Gold IRA Rollover: Step-by-Step Guide (2025 Update)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

BY J.B. Maverick

- UPDATED: April 24, 2025With gold breaking its all-time highs, surpassing $3,500 per ounce recently, many American investors are looking into ways to add gold to their retirement accounts. Now, investing in gold through an IRA generally involves a gold IRA rollover, a transfer or a cash contribution. In this article, we'll cover the rollover process and how it compares to transfers and cash contributions.

Table of Contents

- Top Rated Gold IRA Rollover/Transfer Companies

- What is a Gold IRA Rollover?

- Gold IRA Rollover vs. Gold IRA Transfer

- 401(k) to Gold IRA Rollover

- Deciding on a Gold IRA Rollover Strategy

- Gold IRA Rollover: Choose IRS-Approved Bullion Bars

- Gold IRA Rules and Contribution Limits

- Physical Gold IRA Rollover vs. “Paper Gold” Rollover

- Finding the Best Gold IRA Custodian

- List of Top Gold IRA Companies

- Eligible Account Types for a Gold IRA Rollover

- Gold IRA Rollover FAQs

- Are You Ready to Start Your Rollover?

Top Rated Gold IRA Rollover/Transfer Companies

To simplify the process, we’ve put together this short guide to gold IRA rollovers. This way, you can easily convert stocks, bonds, ETFs, and other assets into precious metals—all within a tax-advantaged retirement account such as a self-directed Roth or Traditional IRA.

What is a Gold IRA Rollover?

A gold IRA rollover is the technical term we use when describing the process of converting part of an existing retirement account or investment portfolio (i.e., 401(k), Roth IRA, SEP IRA) into gold coins or bullion bars, as a hedge against economic uncertainty and inflation.

In short, a gold IRA allows you to own real physical precious metals in your retirement account on a tax-deferred or tax-free basis. A gold IRA rollover is the process that allows you to easily create and fund such an account by transferring assets or cash from an existing IRA.

During a rollover, funds are withdrawn from the existing account and can be held for no longer than 60 days until they must be redeposited into the new IRA under a different custodian or administrator.

Gold IRA Rollover vs. Gold IRA Transfer

Investors have two options when it comes to funding a gold IRA: a rollover or a transfer. Simply put, a transfer is a more secure and risk-managed strategy for moving assets between retirement savings accounts. There are many gold IRA rollover rules and conditions of which investors must be aware. If an investor breaks these rules, the account holder may be subject to costly IRS-imposed penalties. However, fewer rules apply to transfers than do rollovers.

Below, we’ve listed some of the key differences between gold IRA transfers and rollovers as well as certain core similarities.

Gold IRA Transfer Rules | Gold IRA Rollover Rules |

|---|---|

| No 60-day transfer rule in effect | 60-day transfer rule applies, in which the account holder must transfer the deposited funds from their account into the new gold IRA |

| No early withdrawal penalties | distributed funds are subject to a 10% early withdrawal penalty if the account holder is under the minimum withdrawal age of 59.5 |

| Not taxable | If the 60-day rule is violated, the distributed funds are then deemed taxable as ordinary income |

| No annual limits | IRA holders are strictly limited to one rollover per 365-day calendar year |

| No withholding taxes | There is no tax withholding if a rollover is made from a personal IRA to another IRA |

A gold IRA transfer (sometimes referred to as an “IRA gold transfer”) involves moving funds from custodian to custodian. Therefore, the account holder does not receive any money withdrawn from their account. Rather, the funds are transferred directly between third parties without the account holder's involvement. It's a simplified, no-touch process for the account holder that's handled entirely by the custodians.

The key difference between rollovers and transfers is that, in the case of IRA transfers, the distributed money never touches the IRA holder’s bank account. For more information about how the IRS regulates rollovers, and what the consequences of violating them are, check out this handy IRS-authored guide to general IRA rollovers. Or, consider reading this comprehensive gold IRA FAQ section straight from Uncle Sam himself.

For many, an IRA gold transfer is preferable simply because it minimizes the margin of human error relative to a rollover. In the case of a rollover, it's possible to inadvertently create difficulties by, for example, failing to move the distributed funds into your new account before the IRS-imposed time limit transpires. Failing to do so would incur a significant financial penalty from the IRS; however, gold IRA transfers are not susceptible to this error since the process is handled automatically by your account custodian.

401(k) to Gold IRA Rollover

Despite what some investors believe, it is indeed possible to transfer or rollover funds from an existing employer-sponsored or self-directed 401(k) to a gold IRA. However, this process is subject to slightly different rules that must be made clear before proceeding.

Rolling over funds from a 401(k) that was sponsored by a former employer into a new gold IRA shouldn’t present any issues. Simply choose a new gold IRA custodian and have them initiate the 401(k)-to-IRA rollover on their end. However, a 401(k) sponsored by your current employer presents more of a challenge when rolling over into a self-directed IRA.

If you’re rolling over from a 401(k) sponsored by your current employer, check the terms of your policy. Sometimes, employer-sponsored 401(k)s disallow gold investments while you’re still employed. Call your employer and inquire about the rules of your current 401(k) and whether you’re permitted to rollover or transfer to a gold IRA.

Rest assured, it’s entirely possible to rollover a current-employer 401(k) to a new gold IRA. For a more detailed description of the process, check out our article on gold IRA rules and regulations. There you can find a full guide to sorting out employer-sponsored 401(k) rollovers.

Deciding on a Gold IRA Rollover Strategy

There’s no one-size-fits-all approach to investing in a gold IRA. Your financial plans will ultimately shape the kind of rollover strategy you select for funding your account. For instance, we’re commonly asked by our readers: “What percent of my portfolio should be allocated to precious metals?” To this question, there’s no clear-cut answer.

The level of funding dedicated to precious metals, like gold or silver, depends heavily on your personal risk tolerance and proximity to retirement. Investors who prefer not to take on much risk, and who may be within ten years of their target retirement age, may be better off dedicating more of their portfolio (i.e., 15-20%) to precious metals.

In any case, supplementing your investment portfolio with alternative assets such as gold, silver, or cryptocurrencies can help provide a hedge against broader market instability. For instance, recent stock market instability was met by multi-year highs in the spot prices of gold, silver, and palladium. As economy-wide uncertainty has cast doubt on traditional markets, an increasing number of investors are diversifying with uncorrelated assets such as gold.

Still undecided? Luckily for you, we’ve interviewed some of the brightest minds in alternative investments to help you find a gold IRA funding strategy that works for you. Check out our exclusive interview with 10 world-class financial advisors on the topic of gold and silver IRA allocation.

Choosing Your Gold IRA Allocation

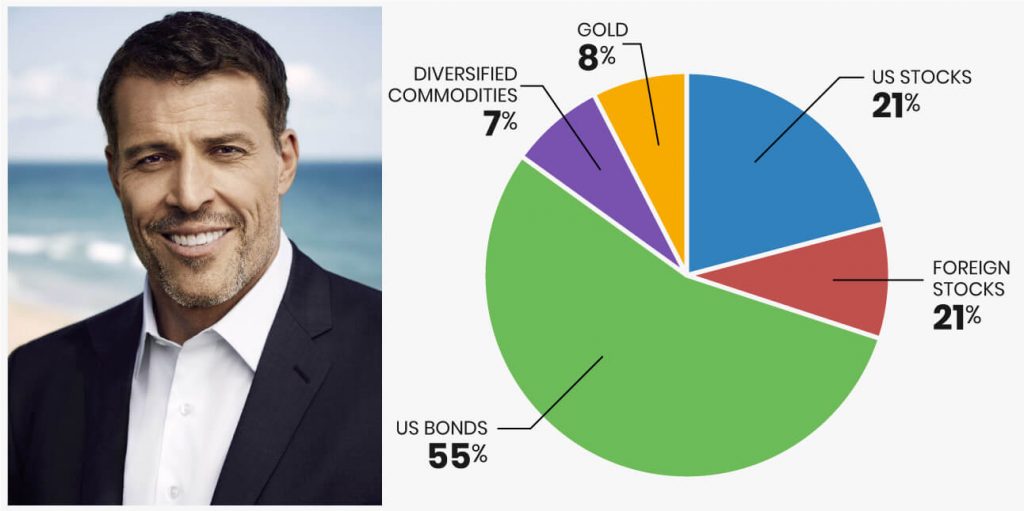

In short, some of the world’s most accomplished investors swear by the 5-10% rule (e.g., NBC Shark Tank’s Kevin O’Leary, Tony Robbins, and Ray Dalio). There are, however, many more market-averse investors who suggest going far beyond that mark. Questions that should guide your decision-making process include the following:

- What’s my outlook on the economy as a whole over the next 5-10 years?

- Has my portfolio been performing as expected over the past 5 or so years?

- What’s my true purpose for investing in physical precious metals (e.g., diversification, risk management, profit)?

- How close am I to my target retirement date?

- Have I spoken to my financial advisor?

Of particular interest is the third question, which should prompt you to search within yourself for your true intentions. We find that, in most cases, our readers’ responses can fit within three broad orientations that describe the investor’s motives for opening a gold IRA. We've listed each of these below.

Diversification Orientation

The diversification orientation describes those who want to invest in precious metals simply to protect their portfolio from overexposure to stocks, bonds, and other traditional assets. Many risk-conscious investors diversify with gold to limit potential losses in the event of a stock market downturn or recessionary event.

This orientation is well-suited for a 5 to 10% precious metals allocation. In other words, investors should consider dedicating roughly this much of their portfolio’s total value to precious metals holdings such as gold, silver, or platinum. Dedicating more than this percentage to these assets will likely be too conservative for investors with such a risk tolerance.

Inflation and Debasement Orientation

Investors concerned with currency debasement or widespread inflation might want to consider dedicating more of their portfolio to gold or silver. Since gold has long been considered a strategic hedge against inflation, a gold IRA rollover can help investors protect their wealth from an ever-declining U.S. dollar.

In the early 2020s, the U.S. faced a sustained period of generationally high inflation that began in March 2021 and eventually reached a high of 9.1% in June 2022. In April 2021, the country reeled from the highest year-over-year CPI rise (+4.2%) since September 2008. During the 1970s, a notorious era of inflation, the value of gold rose over +600% due to institutional capital fleeing an unstable dollar.

Investors seeking a safe haven from inflation should think about increasing their exposure to precious metals. Many experts agree that being in the range of 5 to 20% in gold or silver may be a suitable option for investors who are bearish on the U.S. dollar. If the dollar continues to backslide, those with holdings in precious metals may fare better than those without.

Systemic Collapse Orientation

Those most concerned about the overall state of the economy and whether it can even be sustained into the future, are better off dedicating more of their wealth to precious metals. Gold and silver are commonly considered “disaster hedges” because they tend to rise in value when the geopolitical or global environment undergoes instability.

In other words, when panic strikes the market, gold tends to benefit. For example, the March 2020 OPEC+ oil crisis saw the price of gold hit a 7-year high. During the infamous January 2020 U.S.-Iran airstrike, which saw a top Iranian general killed, gold prices jumped +1.4% overnight amid a stock market sell-off. Likewise, escalations in the Russo-Ukrainian War, which threatened the global security order, caused gold prices to quickly spike 6% in February and March 2022.

Similarly, gold saw a near-immediate price jump during during the early days of the 2023 Israel-Hamas war. In the three weeks following Hamas' initial attack on Israeli settlements on October 7, 2023, the price of gold skyrocketed 9 percent as worries mounted regarding whether the war would expand beyond the borders of Israel and Palestine.

Investors who want systemic protection against collapse or war should consider diversifying by allocating a portion of their wealth in precious metals. Investors like Kevin O'leary has a 5% gold allocation. Ray Dalio and Tony Robbins talk about an 8-10% allocation in his “All Seasons Portfolio”. At the end of the day, this is a decision that each investor needs to make for themselves, in coordination with their financial advisor.

Disclaimer: The content provided on this page and throughout this website is for informational purposes only. It does not constitute financial advice and should not be taken as such. Always speak to your financial advisor before making an investment decision.

Gold IRA Rollover: Choose IRS-Approved Bullion Bars

The IRS maintains strict standards regarding the type of gold assets that can be held within a tax-advantaged retirement account. For a complete list of authorized holdings, check out this guide to IRS-approved precious metals. These include, but aren’t limited to, the following types of gold assets:

In all cases, collectibles are prohibited from any IRA or 401(k) per IRS regulations. Rare coinage, or any other type of precious metal classified as a “collectible” under IRC Section 401(a), is strictly disallowed from an IRA of any variety. As a rule, gold bullion bars are never classified as collectibles. Regarding coinage, there are three key exceptions that allow for investing in gold coins via a gold IRA rollover:

- Certain coins described under 31 USC Section 5112

- Coins minted and issued under the laws of any sovereign state

- Coins or bullion kept in the possession of a bank or non-bank trustee

Investing in unapproved assets may result in penalties or fines. To play it safe, it helps to simply stick to investing in gold bullion as opposed to rare coinage. If you insist on investing in gold coins, make sure you thoroughly review our list of top IRA-approved gold coins.

Gold IRA Rules and Contribution Limits

Gold IRAs are subject to the same rules and regulations are regular IRAs that hold conventional assets like stocks and bonds. The only difference between a gold IRA and a regular one is that the former includes gold—that's it!

One of the most important rules that govern gold IRAs is that account holders can only contribute a limited amount of resources to their IRA per year. The Internal Revenue Service (IRS) has introduced new, expanded IRA contribution limits for the 2025 tax year:

- Annual IRA contribution limit for 2025 remains $7,000, with an additional $1,000 catch-up contribution available for individuals aged 50 or older.

- Annual catch-up contribution limit: $1,000 (additional contribution room for those aged 50 or older)

Importantly, there are also “phase-out arrangements” that gold IRA investors must consider. These refer to the income thresholds that determine eligibility to make deductible contributions to IRAs. For 2025, these rules have been updated as follows:

- For single taxpayers covered by a workplace retirement plan, the deduction phases out at a modified adjusted gross income (MAGI) between $79,000 and $89,000.

- For married couples filing jointly where the spouse making the IRA contribution is covered by a workplace retirement plan, the deduction phases out at a MAGI between $126,000 and $146,000.

- For an individual who is not covered by a workplace retirement plan but married to someone who is, the deduction phases out at a MAGI between $236,000 and $246,000

Note that overcontributing to your gold IRA will result in penalties and taxable events. Overcontributed account holders will have to pay a 6% penalty on their overcontributed portion until said portion is absorbed or corrected as new contribution room is generated in subsequent years. (Overcontributed to your gold IRA? Here's an excellent guide on how to respond to the situation.)

Physical Gold IRA Rollover vs. “Paper Gold” Rollover

There exist two primary forms of exposure to gold. First, there’s physical gold bullion. This describes cold, hard metal bars that are kept in secure vaults by trusted, third-party custodians. The second is referred to as “paper” gold, which describes any type of gold-based security, such as a gold mining stock or ETF.

Aside from perhaps convenience, it would be hard to argue the benefits of paper gold over real metal bullion. Although some investors praise gold stocks for their added liquidity, this is a double-edged sword since increased liquidity makes it easier to buy and sell the asset quickly. Therefore, paper gold is known to be more volatile than physical metal commodities.

You need to look into a physical gold IRA rollover if you want true exposure to the benefits of gold investing. In the event of runaway inflation or outright economic collapse, the gold stocks you own might be worth little more than the paper they’re printed on.

Still not sold? Below, we’ve listed some of the top advantages of physical gold investing as compared to securities-based gold exposure.

- Counterparty Risk: Unlike a publicly traded stock, a gold bar cannot declare bankruptcy or fail to honor its contractual obligations—therefore, physical gold investors are free from the same counterparty risks as paper gold investors.

- Safe Haven Store of Value: In an economic crisis, physical gold bullion acts as a last resort store of value if cash and paper assets are rendered worthless.

- Physical Ownership: You own precious metal bars, which make them far more difficult to confiscate or seize as opposed to electronic assets.

- Transferring and Movable: Gold bars are portable and can be withdrawn from your IRA into your own hands or vault in the form of a distribution.

Although these benefits are not exclusive to precious metals, they present some of the most compelling reasons why gold and other metals have a rightful place in many investors' portfolios.

Finding the Best Gold IRA Custodian

When you open a regular Traditional or Roth IRA, you simply drive to your local Vanguard or Fidelity Investments branch and apply on the spot for a new IRA. However, gold IRA rollovers are a little more complicated than that.

Conventional brokerages like Fidelity and Charles Shwab don’t support gold IRAs. To open a gold IRA, you have to research and select a gold IRA custodian. This is the company that will initiate and facilitate your gold IRA rollover with your existing IRA or 401(k) provider. A reputable custodian will work with you to ensure that your holdings are safely vaulted while remaining compliant with IRS protocols and regulations.

Trustworthy gold IRA companies assist with the rollover process from end to end. These companies are fully transparent and provide you with all of the paperwork and documentation necessary to complete the rollover upfront, without any hidden clauses or fees tacked on at the end.

If you need a place to start, check out our guide to the world’s most reputable gold IRA rollover companies. Beyond that, there are a couple of basic ground rules that must be kept top of mind when researching for a Gold IRA custodian, including:

1. Reputation and Prestige

It should go without saying that a company with a rock-solid reputation and customer satisfaction profile is paramount when shopping for a gold IRA provider. Unfortunately, there are companies with malicious intentions that prey on unsuspecting customers.

Avoid any precious metals company that is not well-reviewed online. Customer-generated reviews on YouTube, Google My Business, Trustpilot, Reddit, and the Better Business Bureau (BBB) are excellent places to research authentic customer testimonials and reviews.

The operative term is “authentic”. Unfortunately, some companies do publish paid-for reviews on their social media profiles. If the reviews are all similar in length and provide little substantive information that differentiates one from the next, then this should raise a red flag that the reviews are inauthentic.

Please note that only IRS-approved nonbank trustees can operate a precious metals vault. If your custodian does not mention being IRS-approved, then move on to another option. Other vendors slyly try to sell low-purity gold or numismatic coins that aren’t authorized for an IRA. To stay clear of bad actors, review our list of IRA-approved precious metals.

2. Rollover Limitations

Bear in mind that the IRS only allows one penalty-free rollover per 365-day period. Therefore, if you complete a rollover on July 1, 2025, you won’t be able to initiate another rollover tax-free until July 1, 2026. As such, you must choose a custodian carefully. If you decide to change custodians before the 12-month period has elapsed, you’ll be on the hook for an early distribution penalty if you roll the funds over again.

List of Top Gold IRA Companies

With so many precious metals IRA companies in the market, it can be hard to decide on the best one for your needs. That’s why we’ve put together a quick list of the bestselling and most trusted companies in the industry, each of which has been in operation for a decade or longer:

Generally, you should expect to pay between $100 and $325 for gold storage fees from a reputable provider. Some companies charge $0 in rollover or transfer fees, and also waive all administrative and storage fees for the first year.

For a more in-depth analysis of the best custodians on the market, read our reviews of the top 10 gold IRA providers today. There you’ll find a full breakdown of the nation’s best-reviewed gold IRA rollover companies, as well as a list of five essential considerations you need to keep in mind when shopping for a gold rollover.

Eligible Account Types for a Gold IRA Rollover

To complete a gold IRA rollover, you can transfer funds from any existing tax-advantaged retirement account, including the following:

- Traditional or Roth IRA

- Self-directed 401(k)

- Employer-sponsored 401(k)

- SEP IRA

- 403(b)

- 457(b)

- TSP

In the case of employer-sponsored accounts, such as a 401(k) or 457(b), you may need to facilitate the rollover after you have terminated employment at the company. This is because certain employers prohibit rollovers from one account to another. In some cases, you may be able to do a partial rollover while still employed after you’ve reached 59.5 years of age.

Moving funds from an existing account to a new gold IRA is simply a matter of registering a new self-directed IRA through a gold IRA provider. Then, fill out a transfer request form to kickstart the process of rolling over the funds. Usually, it takes no longer than 14 working days for funds to successfully appear in the new IRA.

Gold IRA Rollover FAQs

How does a Gold IRA Rollover Work?

Sometimes any movement of funds from one retirement account to another, is referred to as a “rollover”. However, it’s important to note that the Internal Revenue Service (IRS) makes a clear distinction between a rollover and a “transfer”. In a rollover, the money being moved is paid to you and you then deposit the funds in the other account. With a transfer, the original custodian of the IRA transfers the funds directly to the new IRA custodian you designated to receive the funds. In essence, you never see the money, personally.

Custodian-to-custodian transfers are the most common method of establishing self-directed IRAs like a Gold IRA with exiting qualified funds. A new account is established with an IRS-approved IRA custodian who, with your consent, requests the transfer of IRA assets from your existing retirement account. The custodian will then be able to accept the money and invest the assets according to your instructions.

Additionally, if you choose to go with a rollover, it is highly recommended to elect to perform a “direct rollover” instead of an “indirect rollover”. Indirect rollovers have withholding requirements and run the risk of incurring early distribution penalties.

What are the IRS Rules for a Gold IRA?

The IRS has stringent rules and regulations for Gold IRA accounts. The most important rule pertaining to self-directed IRAs like Gold IRAs, is that by federal law you must use an approved IRA custodian to open this type of retirement account.

It is most critical to note that you never buy gold or other precious metals with your IRA account funds personally. The IRS requires that your IRA account administrator do the actual transactions on your behalf. You will simply give directions to your custodian in order for them to start purchasing precious metals. They will make all arrangements for shipping and insurance when they conclude the transaction.

The IRS has stringent rules and regulations for Gold IRA accounts. The most important rule pertaining to self-directed IRAs like Gold IRAs, is that by federal law you must use an approved IRA custodian to open this type of retirement account.

It is most critical to note that you never buy gold or other precious metals with your IRA account funds personally. The IRS requires that your IRA account administrator do the actual transactions on your behalf. You will simply give directions to your custodian in order for them to start purchasing precious metals. They will make all arrangements for shipping and insurance when they conclude the transaction.

Once your gold has been purchased, it must be stored according to IRS regulations for precious metals IRAs like a Gold IRA. The custodian of your new Gold IRA will receive your precious metals and then hand them over to an IRS sanctioned third-party, off-site depository. You are allowed to select the depository which is used, or conversely, you can utilize the one with which the account administrator already has an established pre-existing relationship. They will inventory and safeguard your gold holdings all the way to the point when you give explicit orders to your account administrator to either sell your gold or distribute it to you. At this point in time, distributions would be sent by insured delivery to your home address.

What are the IRS Rules for a Gold IRA Rollover?

The IRS has stringent rules pertaining to an IRA Rollover. As per the IRS regulations if you were to do a Gold IRA rollover, you would have 60 days from the date you receive the funds to deposit the money in the Gold IRA company or Custodian you have chosen. If you do not complete the transaction within this period, the money becomes a taxable withdrawal and you will face the 10% early withdrawal penalty if you are under 59 1/2. If you are withdrawing from a personal IRA for a rollover to another IRA, there is no tax withholding. But you can do only one rollover per year.

What are the IRS Rules for a Gold IRA Transfer?

In a direct custodian-to-custodian IRA transfer, you do not have to worry about the 60 day transfer rule since you never receive the money. The transfer is usually accomplished by wire transfer directly between the respective IRA custodians. The original IRA custodian can also accomplish the transfer by issuing a check made out to the custodian of the receiving IRA and mailing it out. This is the easiest way to invest in gold through your IRA since it is all handled in the background by your existing and new custodian.

What are the Fees Involved in a Gold IRA Rollover?

There are no government sanctioned rollover or transfer fees to move over an existing traditional IRA to a precious metals IRA account like a Gold IRA. However, that being said, there may be account application fees involved. Those sanctioned custodians and administrators of the precious metals IRAs often charge a processing fee in order to start the account opening for these self-directed IRAs like a Gold IRA. Different administrators will charge different amounts, but the average is approximately $50 for this particular category of fee.

How does a 401k to Gold IRA Rollover Work?

If you have a 401(k), you can roll it into an Individual Retirement Account (IRA) or another qualified plan without incurring any tax penalties. Here is an overview of some 401(k) rollover rules:

- When you receive funds from your 401(k) for a rollover, you have 60 days to complete the process. If you fail to do this, the IRS will treat your money as a taxable distribution. Additionally, if you are not yet 59 ½ years old, the IRS will also impose a 10% penalty on the withdrawal on top of the normal income taxation.

- You are limited to one rollover per year from a 401(k) into an IRA. This one-year period begins on the date that you receive your 401(k) distribution. This applies separately to each IRA that you own.

- You cannot use the cash from your distribution to purchase investments in the period in between receiving your 401(k) distribution and establishing your IRA.

It is advised that you select the option to perform a “direct rollover” with your 401(k) funds. In a direct rollover, you never receive a check for your distribution; rather, your 401(k) plan provider will transfer the money directly into your new IRA plan.

What Physical Gold is allowed in a Gold IRA Rollover?

The IRS has strict regulations pertaining to the types of gold and other precious metals allowed in an IRA. An investor can hold gold bullion, gold coins and bars as long as they meet two basic standards. The gold must be the official currency of a recognized public entity and it must meet a certain purity standard. In the United States, the purity must be 0.995. This standard is different for different countries, so research is necessary to determine the exact purity level that is necessary. The types of physical gold you can hold in a self-directed IRA like a Gold IRA include:

- The American Gold Eagle coin

- The Canadian Gold Maple Leaf coin

- The Austrian Philharmonic gold coin

- The American Gold Buffalo coin

- Gold Kilo Bars

- Certain Gold Bullion Bars

- Credit Suisse Gold Bars

- Swiss PAMP Gold Bars

What is the Best Gold IRA Rollover Company?

A Gold IRA company is a firm that specializes in the process of setting up Gold IRAs from beginning to end - including an IRA rollover/transfer. Other components that these companies deal with include IRA account setup, the purchase of IRS-approved precious metals, and storing them with an accredited IRS-approved depository. Reputable Gold IRA companies should be able to handle the entire process for you and answer any questions you may have at any point in the process. Gold IRA Companies typically form strategic alliances with traditional IRA custodians, accredited depositories, and wholesale metal dealers.

Choosing the best Gold IRA company completely depends on what factors are most important to you. Be it ratings, customer support, availability of other alternative asset options, physical location, storage options? Once you decide which factors are most important to you, make a shortlist of a few companies that meet your criteria, and either give them a call, or request their free gold kits to learn more about the specific company and products. Below are our reviews of some of the top Gold IRA companies to give you an idea of your options available.

Note: It is highly recommended that do your due diligence and call a few different companies before making an investment decision. Also, speak to your financial advisor before investing in any asset class.

← Slide left and right to view more. →

| Our Ranking | Company |  |  |  | Fraud / Lawsuits | Total Annual Fees | Full Review |

|---|---|---|---|---|---|---|---|

1 | NIL | $230+ per year | » Read Review | ||||

| 2 | NIL | Variable | » Read Review | ||||

| 3 | NIL | Variable | » Read Review | ||||

| 4 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 5 | No Rating | NIL | Variable | » Read Review | |||

| 6 | NIL | $95-$250 per year | » Read Review | ||||

| 7 | NIL | Variable | » Read Review | ||||

| 8 | NIL | $75-$290 per year | » Read Review | ||||

| 9 | NIL | $175-$225 per year | » Read Review | ||||

| 10 | NIL | $225 per year flat-rate | » Read Review | ||||

| 11 | NIL | $195 + initial setup fees | » Read Review | ||||

| 12 | NIL | Dynamic pricing | » Read Review | ||||

| 13 | Variable | » Read Review | |||||

| 14 | NIL | Variable | » Read Review | ||||

| 15 | NIL | Variable | » Read Review | ||||

| 16 | NIL | Variable | » Read Review | ||||

| 17 | NIL | Variable | » Read Review | ||||

| 18 | NIL | Variable | » Read Review | ||||

| 19 | NIL | Variable | » Read Review | ||||

| 20 | NIL | Variable | » Read Review | ||||

| 21 | No Rating | NIL | Variable | » Read Review | |||

| 22 | NIL | Variable | » Read Review | ||||

| 23 | No Rating | NIL | Variable | » Read Review | |||

| 24 | No Rating | NIL | Variable | » Read Review | |||

| 25 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 26 | No Rating | NIL | Variable | » Read Review | |||

| 27 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 28 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 29 | No Rating | NIL | Variable | » Read Review | |||

| 30 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 31 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 32 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 33 | No Rating | No Rating | No Rating | NIL | Variable | » Read Review | |

| 34 | No Rating | NIL | Variable | » Read Review | |||

| 35 | No Rating | NIL | Variable | » Read Review | |||

| 36 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 37 | No Rating | NIL | Variable | » Read Review | |||

| 38 | No Rating | NIL | Variable | » Read Review | |||

| 39 | No Rating | NIL | Variable | » Read Review | |||

| 40 | No Rating | Variable | » Read Review | ||||

| 41 | NIL | Variable | » Read Review | ||||

| 42 | No Rating | NIL | Variable | » Read Review | |||

| 43 | AA 0 Complaints | No Rating | NIL | $60 per year flat-rate | » Read Review | ||

| 44 | No Rating | NIL | Variable | » Read Review | |||

| 45 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 46 | No Rating | NIL | Variable | » Read Review | |||

| 47 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 48 | No Rating | No Rating | NIL | $150 per year flat-rate | » Read Review | ||

| 49 | No Rating | NIL | Variable | » Read Review | |||

| 50 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 51 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 52 | NIL | Variable | » Read Review | ||||

| 53 | No Rating | NIL | Variable | » Read Review | |||

| 54 | No Rating | NIL | Variable | » Read Review | |||

| 55 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 56 | No Rating | No Rating | $50 + per year (scaled) | » Read Review | |||

| 57 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 58 | No Rating | No Rating | NIL | $180 + per year (scaled) | » Read Review | ||

| 59 | NIL | Variable | » Read Review | ||||

| 60 | No Rating | NIL | Variable | » Read Review | |||

| 61 | No Rating | No Rating | No Rating | NIL | Variable | » Read Review | |

| 62 | No Rating | NIL | Variable | » Read Review | |||

| 63 | No Rating | No Rating | No Rating | NIL | Variable | » Read Review | |

| 64 | No Rating | $250 per year flat-rate | » Read Review | ||||

| 65 | No Rating | NIL | $260 per year flat-rate | » Read Review | |||

| 66 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 67 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 68 | No Rating | NIL | Variable | » Read Review | |||

| 69 | No Rating | NIL | Variable | » Read Review | |||

| 70 | No Rating | NIL | Variable | » Read Review | |||

| 71 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 72 | No Rating | NIL | Variable | » Read Review | |||

| 73 | No Rating | NIL | Variable | » Read Review | |||

| 74 | No Rating | No Rating | No Rating | NIL | Variable | » Read Review | |

| 75 | NIL | Variable | » Read Review | ||||

| 76 | No Rating | NIL | Variable | » Read Review | |||

| 77 | NIL | Variable | » Read Review | ||||

| 78 | NIL | Variable | » Read Review | ||||

| 79 | NIL | Variable | » Read Review | ||||

| 80 | NIL | Variable | » Read Review | ||||

| 81 | No Rating | NIL | Variable | » Read Review | |||

| 82 | No Rating | NIL | Variable | » Read Review | |||

| 83 | NIL | Variable | » Read Review | ||||

| 84 | No Rating | NIL | Variable | » Read Review | |||

| 85 | No Rating | NIL | Variable | » Read Review | |||

| 86 | No Rating | NIL | Variable | » Read Review | |||

| 87 | No Rating | NIL | Variable | » Read Review | |||

| 88 | No Rating | NIL | Variable | » Read Review | |||

| 89 | No Rating | NIL | Variable | » Read Review | |||

| 90 | NIL | Variable | » Read Review | ||||

| 91 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 92 | NIL | Variable | » Read Review | ||||

| 93 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 94 | No Rating | NIL | $65/year | » Read Review | |||

| 95 | No Rating | NIL | Variable | » Read Review | |||

| 96 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 97 | NIL | Variable | » Read Review | ||||

| 98 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 99 | No Rating | NIL | Variable | » Read Review | |||

| 100 | NIL | Variable | » Read Review | ||||

| 101 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 102 | No Rating | NIL | Variable | » Read Review | |||

| 103 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 104 | No Rating | NIL | Variable | » Read Review | |||

| 105 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 106 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 107 | NIL | Variable | » Read Review | ||||

| 108 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 109 | No Rating | NIL | Variable | » Read Review | |||

| 110 | NIL | Variable | » Read Review | ||||

| 111 | No Rating | NIL | Variable | » Read Review | |||

| 112 | No Rating | NIL | Variable | » Read Review | |||

| 113 | No Rating | No Rating | NIL | Variable | » Read Review | ||

| 114 | NIL | Variable | » Read Review | ||||

| 115 | No Rating | NIL | Variable | » Read Review | |||

| 116 | No Rating | NIL | Variable | » Read Review |

Are You Ready to Start Your Rollover?

If you’re sure that a gold IRA rollover is right for you, you can get started by browsing our list of the best gold IRA companies. There you’ll find all the information you need to kickstart your rollover and enjoy the wealth-building benefits of true diversification.

While you’re at it, consider taking your investment strategy a step further by investing in other risk-managed alternative assets. For deep diversification, you can add a Bitcoin IRA to your investment portfolio, or add other cryptocurrencies to your self-directed IRA or 401(k).

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,316.03

Gold: $3,316.03

Silver: $36.41

Silver: $36.41

Platinum: $1,367.82

Platinum: $1,367.82

Palladium: $1,142.11

Palladium: $1,142.11

Bitcoin: $111,339.83

Bitcoin: $111,339.83

Ethereum: $2,773.71

Ethereum: $2,773.71