Top 10 Best Gold IRA Companies (With Fees!) + Reviews (2025)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Edited by: Liam Hunt | Financial Writer

Reviewed by: Kelly Kennedy | CPA, CMA, MBA

In today's uncertain economic landscape, many American retirees are looking for ways to add physical precious metals such as gold and silver to their retirement portfolios as a way to diversify and protect their wealth.

Now, whether you have an employer-sponsored 401(k), a TSP, a Roth IRA or any other type of account, you can roll it over into a new Precious Metals IRA, which is essentially a special type of SDIRA containing physical bullion gold, silver, or a variety of investment-grade precious metals. All you need is to select a gold IRA provider to work with, like the ones reviewed on this page.

Given the wide variety of companies out there, as an investor, your job is to do your due diligence and choose a trusted company before opening your gold IRA account. We have reviewed and ranked over 60 companies in the space to help you make a decision. We highly recommend contacting 2 or 3 top-rated service providers before making a decision.

Table of Contents

- Detailed Breakdown & Reviews

- #1. Best Rated Overall

- #2. Best for High Net Worth

- #3. Best for Gold Bars

- #6. Advantage Gold

- #7. Gold Alliance

- #8. American Bullion

- #9. Goldco

- 5 Questions You Need to Answer Before Calling a Gold IRA Company

- 8 Things to Look For in a Gold IRA Company

- Top 3 Gold IRA Companies in 2025

- Gold IRA Reviews: Frequently Asked Questions (FAQs)

Detailed Breakdown & Reviews

#1. Best Rated Overall

PROS

✅ Lowest fees out of any company we reviewed

✅ Perfect Global Rating of 5/5

✅ Low IRA account minimum of $5,000

✅ Collin Plume puts a lot of emphasis on education

✅ Exclusive IRS-approved storage in Texas

✅ “No-quibble” buyback policy, easiest in the business

CONS

❌ Young brand (only 6 years old)

❌ Key founding partner left in 2020

❌ Higher premium on exclusive coins

See Reviews & Ratings

Reviews

- Better Business Bureau: ⭐⭐⭐⭐⭐ (4.98 Stars averaged from 188 Customer Reviews)

- Business Consumer Alliance: ⭐⭐⭐⭐ (4 Stars and “AA” from 4 reviews)

- Consumer Affairs: ⭐⭐⭐⭐⭐ (5 Stars averaged from 785 reviews)

- Trustlink: ⭐⭐⭐⭐⭐ (5 Stars averaged from 124 reviews)

- Yelp: ⭐⭐⭐⭐⭐ (5 Stars from 1 review)

Ratings

- Better Business Bureau: A+ (Accredited since January 23, 2017)

- Business Consumer Alliance: AA

Complaints

- Better Business Bureau: 5 complaints in 3 years

- Business Consumer Alliance: 1 complaint in 3 years

#2. Best for High Net Worth

PROS

✅ Non-Commissioned Sales floor (Rare in the industry)

✅ Only gold IRA provider with in-house compliance department

✅ Best customer reviews across the board

✅ Harvard-educated Economist on staff

✅ Perks for High Net Worth customers

CONS

❌ High investment minimum ($50,000)

❌ High premium on exclusive coins

❌ No offerings in platinum or palladium

See Reviews & Ratings

Reviews

- Better Business Bureau: ⭐⭐⭐⭐⭐ (4.94 Stars based on 103 reviews)

- Business Consumer Alliance: ⭐⭐⭐⭐⭐ (5 Stars based on 100 reviews)

- Consumer Affairs: ⭐⭐⭐⭐⭐ (5 Stars from 142 reviews)

- Google My Business: ⭐⭐⭐⭐⭐ (4.9 Stars from 499 reviews)

- Trustlink: ⭐⭐⭐⭐⭐ (5 Stars from 288 reviews)

- Yelp: ⭐⭐⭐⭐⭐ (5 Stars from 5 reviews)

Ratings

- Better Business Bureau: A+ (accredited since 2015)

- Business Consumer Alliance: AAA (accredited since 2013)

Complaints

- Better Business Bureau: N/A (zero complaint)

- Business Consumer Alliance: N/A

#3. Best for Gold Bars

PROS

✅ Good selection of gold & silver bullion products

✅ Great customer reviews

✅ Competitive fees on bullion (similar to Noble)

✅ No first year fees on $50,000+ transfers

CONS

❌ Higher premium on exclusive coins

❌ No offerings in platinum or palladium

See Reviews & Ratings

- BBB Rating: ⭐️⭐️⭐️⭐️⭐️ (“A+” and 4.26 Star Rating based on 104 Customer Reviews)

- BBB Complaints: 11 complaints closed in the last 3 years (Details)

- BCA Rating: ⭐️⭐️⭐️⭐️⭐️ (“AAA” and 5 Star Rating based on 7 Customer Reviews)

- BCA Complaints: 0 complaints in the last 3 years (Details)

- TrustLink: ⭐️⭐️⭐️⭐️⭐️ (5 Star Rating based on 135 Customer Reviews)

- Trustpilot: ⭐️⭐️⭐️⭐️⭐️ (4.2 Star Rating based on 180 Customer Reviews)

- Yelp: ⭐️⭐️⭐️ (3.0 Star Rating based on 6 Customer Reviews)

- Facebook: 41,000 “Likes” (Details)

#4. Silver Gold Bull

PROS

✅ Best Price Guarantee on gold bars

✅ 365,000+ five-star customer reviews

✅ Low <5% markups on premium metal products

✅ Huge selection of gold and silver investment items (IRA and TFSA approved)

✅ No additional fees when selling back

CONS

❌ Not fully transparent about the management team

❌ Not rated by the BCA

See Reviews & Ratings

- BBB Rating: ⭐⭐⭐⭐, (“A+” and 4.36 Star Rating based on 14 Customer Reviews)

- BBB Complaints: 7 complaints closed in the last 3 years (Details)

- Trustpilot: ⭐⭐⭐⭐⭐ (4.8 Star Rating based on 4,364 Customer Reviews)

- Yelp: ⭐⭐⭐⭐ (3.7 Star Rating based on 3 Customer Reviews)

- ShopperApproved: ⭐⭐⭐⭐ (5 Stars based on 417,406 Reviews)

#5. American Hartford Gold

www.americanhartfordgold.com

(800) 462-0071

Los Angeles, CA

PROS

✅ Great customer reviews

✅ Offers price match guarantee

✅ Buyback program

CONS

❌ Higher premium on exclusive coins

❌ No offerings in platinum or palladium

See Reviews & Ratings

- BBB Rating: ⭐️⭐️⭐️⭐️⭐️ (“A+” and 4.89 Star Review based on 504 Customer Reviews)

- BBB Complaints: 23 complaints closed in last 3 years (Details)

- BCA Rating: ⭐️⭐️⭐️⭐️⭐️ (“AA” and 5 Star Review based on 9 Customer Reviews)

- BCA Complaints: 2 complaints closed in the last 3 years

- Trustpilot: ⭐️⭐️⭐️⭐️⭐️ (4.9 Star Review based on 1,197 Customer Reviews)

- Yelp: ⭐️⭐️⭐️⭐️ (3.6 Star Review based on 26 Customer Reviews)

#6. Advantage Gold

PROS

✅ Great ratings on TrustLink & Trustpilot

✅ The company is a U.S. Mint-listed dealer

✅ They claim to have fast delivery times (to be verified)

✅ Most competitive prices for both bullion & premium coins

✅ CEO is a member of a regulatory body that oversees precious metal compliance

✅ Focus on education

✅ Transparent management team

CONS

❌ Website doesn’t provide pricing information for coins

❌ Higher premium on exclusive coins

See Reviews & Ratings

- BCA rating: “AAA” and 5 Star Rating based on 3 reviews (Details)

- BCA Complaints: 0 over the last 3 years (Details)

- TrustLink:

(5 / 5) based on 488 reviews (Details)

(5 / 5) based on 488 reviews (Details) - Trustpilot:

(4.9 / 5) based on 1,573 reviews (Details)

(4.9 / 5) based on 1,573 reviews (Details) - Facebook:

(4.8 / 5) based on 121 reviews (Details)

(4.8 / 5) based on 121 reviews (Details) - Google My Business:

(5 / 5) based on 756 reviews (Details)

(5 / 5) based on 756 reviews (Details)

#7. Gold Alliance

PROS

✅ Great ratings on BBB, TrustLink, and Trustpilot

✅ Partners with 3 IRA custodians: Equity Trust, Preferred Trust, & GoldStar Trust Companies

✅ Preferred vault facility is the world-renowned Delaware Depository

✅ Segregated or non-segregated storage options

CONS

❌ Higher premium on exclusive coins

❌ No offerings in platinum or palladium

❌ Newer in the industry

See Reviews & Ratings

- BBB Rating: ⭐⭐⭐⭐⭐ (“A+” and 4.98 Star Rating based on 171 Customer Reviews)

- BBB Complaints: 5 complaints closed in the last 3 years (Details)

- BCA Rating: ⭐️⭐️⭐️⭐️⭐️ (“AAA” and 5 Star Rating based on 13 Customer Reviews)

- BCA Complaints: 0 complaints (Details)

- TrustLink: ⭐️⭐️⭐️⭐️⭐️ (Details)

- Trustpilot: ⭐️⭐️⭐️ (3.4 out of 5 based on 1 review) (Details)

- Facebook: ⭐⭐⭐⭐⭐ (5 Star Rating based on 15 reviews + 12,829 “Likes”) (Details)

#8. American Bullion

www.americanbulliononline.com

(888) 895-6950

Los Angeles, CA

PROS

✅ Longevity in the industry

✅ Substantial educational resources section

✅ Provides secure storage with Delaware Depository

✅ Segregated or non-segregated storage options

CONS

❌ Some negative reviews and complaints

❌ Higher premium on exclusive coins

❌ No offerings in platinum or palladium

See Reviews & Ratings

- BBB Rating: ⭐️⭐️⭐️⭐️⭐️ (“A+” and 5 Star Rating based on 1 Customer Reviews)

- BBB Complaints: 1 complaint closed in the last 3 years (Details)

- BCA: ⭐️⭐️⭐️⭐️⭐️ (“AAA” and 5 Star Rating based on 8 Customer Review)

- BCA Complaints: 0 complaints closed in last 3 years

- Trustpilot: ⭐️⭐️⭐️⭐️ (4.8 Star Rating based on 194 Customer Reviews)

- TrustLink: ⭐️⭐️⭐️⭐️⭐️ (5 Star Rating based on 57 Customer Reviews)

- Facebook: ⭐️⭐️⭐️⭐️ (4.3 Star Rating based on 271 Reviews & 40,000+ “Likes”)

#9. Goldco

PROS

✅ Excellent scores from 1000+ verified reviews

✅ Highly-rated customer service

✅ Flat annual fee structure without any surprises

✅ Competitive $80 annual fee

✅ Worthwhile promotions on offer

✅ Segregated and non-segregated storage options

CONS

❌ Minimum investment of $25,000

❌ Higher premium on exclusive coins

❌ No offerings in platinum or palladium

See Reviews & Ratings

Ratings

- Better Business Bureau: ⭐⭐⭐⭐⭐ (“A+” and 4.8 Stars based on 753 Customer Reviews)

- Business Consumer Alliance: ⭐⭐⭐⭐⭐ (“AAA” and 5 Stars based on 1 Customer Review)

- Sitejabber: ⭐ (1 Star based on 1 Customer Review)

- Trustlink: ⭐⭐⭐⭐⭐ (5 Stars based on 254 Customer Reviews)

- Trustpilot: ⭐⭐⭐⭐⭐ (4.7 Stars based on 1,257 Customer Reviews)

- Yelp: ⭐ (1 Star based on 1 Customer Review)

Complaints

- Better Business Bureau: 47 complaints closed in last 3 years

- Business Consumer Alliance: 1 complaint closed in last 3 years

#10. Rosland Capital

PROS

✅ Good selection of products

✅ Great customer service

✅ Delivery in 10 days or less

CONS

❌ Higher premium on exclusive coins

❌ Website doesn't provide pricing information

❌ Some negative customer reviews

See Reviews & Ratings

- BBB Rating: ⭐⭐⭐⭐⭐, (“A+” and 4.78 Star Rating based on 338 Customer Reviews)

- BBB Complaints: 22 complaints in last 3 years (Details)

- Google My Business: ⭐⭐⭐⭐⭐ (4.8 Star Rating based on 20 Customer Reviews)

- Trustpilot:⭐⭐⭐⭐ (4.2 Star Rating based on 126 Customer Reviews)

- RipOff Report: 13 reported complaints filed since 2010 (Details)

- Yelp: ⭐ (1 Star Rating based on 3 Customer Reviews)

- Facebook: 4,300+ “Likes” (Details)

Looking for a gold IRA company that isn't here? Some companies like American Hartford Gold Group, RedRock Secured, Goldline and others didn't make the cut due to lawsuits. » See Full Ranking Table of the best gold IRA companies in the business.

5 Questions You Need to Answer Before Calling a Gold IRA Company

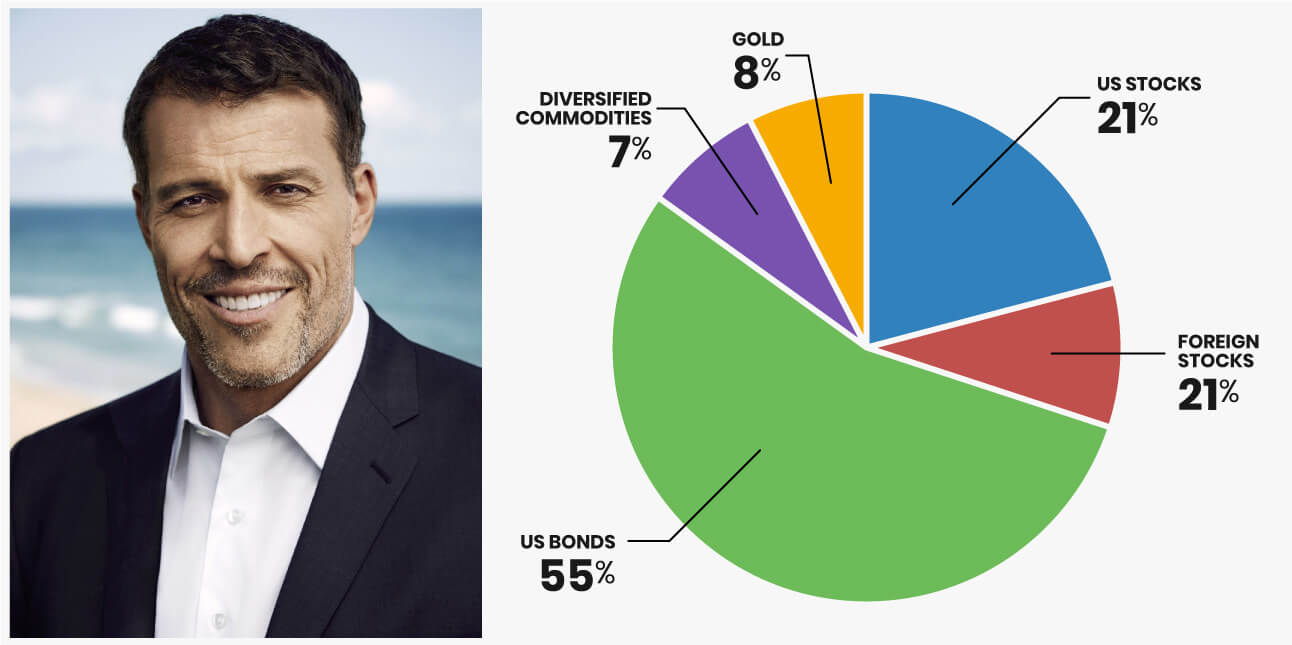

#1. What Percentage of your Portfolio Do You Want to Allocate to Precious Metals?

If you let a company's sales team make that decision for you, you'll end up investing 100% of your savings in precious metals. Do your due diligence and speak to your financial advisor to determine what allocation is best for you based on your objectives, investment time horizon, economic concerns, and general outlook regarding the precious metals asset class.

Gold and silver are generally used as risk management hedges in case all other dollar-bound investments like stocks and real estate go south. In effect, they act like an insurance policy of sorts for a stock-heavy portfolio. Diversifying across a broad array of asset classes is often a good idea for an IRA as it allows your retirement funds to accrue value over a long horizon while being able to sustain periods of economic decline.

#2. Bullion Coins OR Premium/Rare Coins?

← Slide left and right to view more. →

| Bullion | Proof & Uncirculated coins | Collectibles/Numismatics | |

|---|---|---|---|

| IRA Eligible? | ✅ | Some | ❌ |

| Highest Purity Level? | ✅ | ✅ | ❌ |

| Limited Edition and/or Scarcity Factor? | ❌ | ✅ | ✅ |

| High Finishing Quality & Detail?* | ❌ | ✅ | Some |

| Easy to Sell/Liquidate Anywhere | ✅ | ❌ | ❌ |

| Premium Over Spot When Buying? | Low | Medium | High |

| What you can expect to sell them for? | Close to spot price. Usually no or little premium. | Spot price + premium based on rarity/age/demand for your coins. | Spot price (if they contain some precious metals) + premium based on rarity/age/demand and other factors. |

| Where can you sell them? | Anywhere, since these bullion coins are recognized and trusted worldwide. However they'll probably only give you spot price. | Anywhere, but original dealer would likely be the best place if you want to recoup premium. Others might only give you spot price. Ebay is also a good option if you have rare and highly sought after coins. | Antique stores, coin shops, collectors' markets, eBay. |

Higher Quality & Detail?* Bullion coins are struck once. Proof coins are struck twice, giving them more luster, detail and shine. Visually and texturally, proof coins look better as they are meant to attract investors and collectors alike.

The IRS allows only bullion and a limited amount of proof coins to be included within a gold IRA. The question you need to ask yourself is “Do you care about the quality or rarity of the products you're buying?” If the answer is no, then go for the common (non-proof) bullion coins like American Eagles or Canadian Maple Leafs in your IRA account. Gold bars are also a good option, which command lower premiums over spot.

No premium can be added to these since they aren't rare, and the same coins are being sold every year.

If the answer is yes, and you don't mind paying higher premiums for such coins, then go for proof or rare coins. However, be careful, as only certain proof coins are allowed within a gold IRA account (e.g. American Eagle Proofs). Most proof coins aren't eligible for a precious metals IRA.

Selling proof coins is a bit more difficult than bullion. Unless you want to settle for a price close to spot, it's much easier to sell them to the same gold IRA firm you bought them from if you want to get the best prices. That's why it's important that you verify each company's buyback policy before deciding on a gold IRA provider.

#3. Am I Opening a Gold IRA for the Right Reasons?

Despite what gold IRA marketing teams might tell you, precious metals aren't for everyone. Most notably, your risk tolerance and time horizon are the two predominant factors that will determine whether this account type suits your investment goals. As with all major financial decisions, it's always a good idea to first speak to your financial advisor to see if gold IRAs are the right call for you.

You need to ask yourself why you want to own gold or other precious metals in your IRA. Is it for the right reasons (e.g. portfolio diversification, wealth preservation over the long term), or is it for the wrong ones (e.g. getting rich overnight, conspiracy theories, etc.)? Don't let the decision to add precious metals to your IRA be an emotional one, but rather one made with impartial consideration of your financial circumstance.

Dispel any false belief about getting rich quickly or having a store of value if the U.S. dollar suddenly collapses at the drop of a dime. These are not credible reasons why you should invest in precious metals. Rather, the decision to diversify your IRA with precious metals should be borne out of a desire to manage risk and protect your savings over multiple decades.

#4. Am I Looking for Short or Long-Term Growth?

Investors looking for short-term investments (i.e., <5 years before cashing out) are likely not well-suited for precious metals investments. Rather, precious metals like gold, silver, platinum, and palladium are typically added to portfolios with notably long time horizons (i.e., 10 years or more) or for those who are nearing retirement age.

While gold and other precious metals are indeed useful hedges against broader market volatility and economic decline, they are also considerable growth assets. In fact, recent reports indicate that the precious metals catalyzer industry, of which 70 U.S.-based gold IRA companies are a part, is estimated to grow to $22.6 billion in value by 2027. As demand for precious metals continues to increase from developing economies such as China, India, and Brazil, we should expect to see the value of precious metals increase in step.

Precious metals, and especially gold, are considered long-term holds in order to stabilize the value of one's portfolio. Central banks are also adding to their gold stockpiles. In Q3 2022, central banks added a record 399 tonnes of gold bullion to their reserves (valued at US$20 billion) in order to stabilize the value of their reserves amid high inflation in the post-pandemic economy.

#5. When Am I Retiring, and What Will My Retirement Income Look Like?

Generally speaking, gold is a better buy for those with longer time horizons. Because gold, silver, and other precious metal assets tend to move in the opposite direction of paper assets like stocks and ETFs, precious metals are safe hedges against market instability. They essentially act as a bulwark against the ups and downs of the stock market. Therefore, older investors have historically favored them, just as they have bonds and Treasury bills.

The type of IRA account you select (Roth or Traditional) will depend on what kind of retirement you intend to have. While this guide is a helpful resource for choosing your IRA subtype, a rule of thumb is that you should consider a Roth IRA if your income tax bracket at the point of withdrawal will be higher than what it is now. Roth IRAs consist of after-tax funds, so choosing a Roth IRA usually makes sound financial sense if you expect to pay more taxes in the future.

8 Things to Look For in a Gold IRA Company

Before making an investment decision, you'll probably want to contact at least two or three firms from our best gold IRA companies comparison table. We recommend requesting their free gold IRA kits, which usually contain information about their products and fees. You can also simply get on the phone with a few precious metals IRA firms and inquire about their rates directly.

Once you've contacted them, let them know that you're actively shopping around for the best deal available—this might be enough to convince them to lower their fees or otherwise sweeten the deal.

However, your first step is to choose a precious metals IRA company to contact. When choosing between the best gold IRA companies, we recommend looking for the following elements:

#1. Ratings, Ratings & Ratings!

The more positive reviews a company has from its existing client base, the better. Additionally, ratings from authority bureaus are paramount, especially those like the BBB (Better Business Bureau), BCA (Business Consumer Alliance), BirdEye (a review aggregator), and Trustlink.

Feedback from previous clients on websites like Complaint Board and Yelp are also great indicators of the company's professionalism and service level. Reputable gold IRA providers will have near-flawless reviews across these rating sites.

You want a company that cares about you and your investment without feeling pushy and without using fearmongering. This is about diversification and protecting your retirement. Do your due diligence. Speak to your financial advisor, and most importantly don't fall for aggressive salespeople who want to push precious metals investments on you at any cost.

#2. Premiums You're Paying for the Coins

Again, some people are strictly interested in bullion for its high purity, while others like proof coins (also called premium or rare coins) for their rarity and superior craftsmanship (see comparison table below). With bullion, you get the common well-known coins like the American Eagle or Canadian Maple Leaf and other gold and silver coins which are recognized everywhere, and you are generally paying lower premiums over the spot price of gold.

Premium gold and silver coins and proof coins are definitely more attractive visually as they are minted under higher quality standards, but they command much higher premiums, mainly due to their rarity (they are limited editions) and superior craftsmanship (they are struck twice and with a higher level of detail). Depending on which gold IRA company you are calling, they will most likely try to sway you one way or another, yet the best gold IRA companies usually aren't too pushy.

Don't be pressured by their sales teams. You and only you should decide on what type of coins to add to your gold IRA.

#3. Company Longevity

In this industry, new gold IRA providers constantly come and go. One of the main reasons it's important to consider longevity before investing in a gold IRA, in our opinion, is because of the buyback program. When you're interested in liquidating, it's much easier to sell your coins/bars back to the same company you bought them from. You'll generally get better prices than going to other dealers. This is especially important for those buying proof coins and limited edition coins for their gold IRA account.

Many of the best gold IRA companies have exclusive precious metals coin deals with national mints like the US Mint or Royal Canadian Mint, meaning that they get exclusive rights to sell specific proof silver or gold coins (that includes setting the price). If you buy those precious metals coins and want to sell them back a few years later, you'll likely have to sell them back to the same company. The good news is that a reputable gold IRA company will buy the investment back at nearly the full price you bought it at.

If the company doesn't exist anymore, you'll have to go to other precious metals dealers or post them on eBay or pawn them off. As you can imagine, this involves a lot more work and it can take you a lot longer to find buyers that want to give you a decent price for them.

#4. Gold IRA Fee Structure

Always choose a company with flat annual fees, as opposed to companies that have a scaled fee model that grows with the account size. This is especially true for medium and large investors (e.g., $50,000+) and those planning to grow their precious metals account size over time. If your fees go up significantly with your account value, your gains are going to be eroded. This is why we caution against the scaled fee model and avoid gold IRA companies that use this model.

Some of the gold retirement companies we reviewed can charge thousands of dollars per year for large gold IRA accounts. We'll reiterate: always seek out flat-fee gold IRA investment companies that won't scale up your fees as your account grows with time. Otherwise, you might find yourself in a situation where you owe many thousands of dollars in fees per year just for the privilege of having the gold IRA company store your metals.

#5. Efficiency & Delivery Time

Some clients reported that they waited up to 90 days for their gold IRA accounts to be set up and their physical gold and other precious metals to be delivered. This is simply unacceptable in today's uncertain economic landscape. If you want to protect your wealth today, you can't let months pass before you can acquire the gold you paid for.

While silver and gold investments take time to materialize, the best gold investment companies or best gold IRA companies typically have same-day or next-day account setup processes. After the setup is complete, they generally let you fund your account within 3-7 business days, at which point you're free to buy and sell gold and other metals in your gold IRA at your leisure.

Executing a gold IRA rollover is perhaps the best way to fund your gold IRA account quickly. Simply put, a gold IRA rollover involves the transfer of existing funds from an IRA (either Roth or Traditional), or a 401(k), into a new gold IRA account. Usually, the gold IRA rollover process is handled by the representatives of a gold IRA company, with little involvement necessary on your end.

#6. Pushy Salesmen or Unfriendly Customer Support

Some agents will try to push you to invest in collectibles and numismatic precious metal coins simply because these will yield much higher profits for them. This is a major red flag and we strongly recommend that you stay away from gold IRA companies with such nefarious practices. Collectibles are not recommended for investors, and they are not approved by the IRS for gold IRAs or any other precious metals IRA account.

When you contact a precious metals or gold IRA company, ask them as many questions as you can to see how knowledgeable and helpful they are. If you feel rushed or pushed into collectibles, move on to the next one.

The only gold or silver eligible for IRA inclusion is physical bullion and certain proof coins made by the US Mint. Any other asset type is unqualified for a precious metals IRA and, if their inclusion in an IRA is caught by the IRS, will result in significant penalties and fines that can evaporate your gains.

#7. Transparent Management Team & Staff

Always seek out a service provider that is fully transparent about their management team and founders. You don't want to go with a company that's shrouded in secrecy and not open about the location of its headquarters or who its team consists of. As a rule, if the founder is not named on the company's website, move along and find another service provider that isn't afraid to show their face.

Trust is everything in the alternative investment space. Without mutual trust, a financial partnership is never going to work. After all, if anything goes wrong or the company goes defunct while you have potentially thousands of dollars in assets invested with them, you're going to want to know the names of the team members to pursue legal action.

A good place to start when it comes to researching a company's management team is LinkedIn and Crunchbase. If you can find the company's details listed on these sites, as well as the names of verified employees and team members, then that should serve as a major confidence boost.

#8. Other Alternative Investment Options Available?

You can read third-party gold IRA reviews for a closer look at which gold IRA companies you should trust in the gold investment space with your gold IRA. There you will find out full reviews of some of the top-rated providers in the gold IRA investing space, such as August Precious Metals and Noble Gold Investments, both of which are revered in the precious metals market. Alternatively, you could open a precious metals 401(k), SEP IRA, Keogh Plan, or a host of other self-directed retirement accounts that offer unique tax advantages.

Inquire with your employer to see if you're eligible for an employer-sponsored retirement account. If so, rolling over your existing employer-sponsored account (e.g., 401k) into a new gold or silver IRA could put you in a better financial position for your retirement. Speak to your financial advisor to see if this is the right move for you.

Top 3 Gold IRA Companies in 2025

As always, we recommend that you contact a few companies before making a decision. Compare their service, products, and fees—don't merely take our word for it. Also, as always, this content isn't financial advice. Speak to your financial advisor before making any investment decision.

Gold IRA Reviews: Frequently Asked Questions (FAQs)

What is a gold IRA?

A gold IRA, or a precious metals IRA, is essentially a self-directed IRA used to invest in physical metals. Only certain custodians offer such investment products. You will not find it at Vanguard, Charles Schwab, or any other standard financial/brokerage firm, as those tend to specialize in paper investments like stocks, bonds, and ETFs. It is also worth noting that not all physical metals are eligible to be held in a gold IRA. Only high-purity bullion products like the American Eagle, American Buffalo, and the Canadian Maple Leaf products are IRS-approved to be held in a gold IRA. Beware of a company that tries to convince you to invest in numismatic or collectibles.

What are the advantages of gold IRA companies?

You may be thinking of adding gold to your investment portfolio for a number of reasons, such as hedging against inflation, deflation, or general economic uncertainty. The benefits of investing in gold are well-established. However, holding gold specifically within a self-directed gold IRA allows you to invest in a tax-enhanced environment. With a traditional IRA, you can deduct your contributions, and your investments grow tax-free.

Investing in gold through specialized gold IRA companies means that you will be dealing with experts in both retirement investing and gold investing. Investing in physical precious metals has many caveats that only a specialized company can take the best care of. You want a gold IRA company that can handle all aspects of the investment process, from regulatory compliance to choosing the coins or bars, understanding rollover procedures, securing storage, and transportation.

What are the benefits of allocating a portion of portfolio in precious metals?

Hedge against the declining dollar and money printing policies

Again, history has shown that any decline in the value of the dollar correlates with a rise in the price of gold. While all other assets tend to follow the health of the dollar, gold gives your portfolio additional protection in case the dollar goes south.

Safe haven in times of geopolitical, economical, and financial turmoil

Gold is often called the “crisis commodity” because people worldwide flee to its relative safety when world tensions rise. While governments and central banks respond to crises by printing more money, gold cannot be produced and the limited supplies make it a hot commodity during those times.

A strong case in point is the global financial crisis, which saw the price of gold rise +27.4% between October 9, 2007, and March 6, 2009. While during the same time the S&P 500 fell by -54%. Similarly, the Dot Com Crash saw gold prices rise +18% (October 2, 2000 to October 2, 2002) and the Iraq-Kuwait war coincided with a +11.1% gain in gold prices between August 1 and August 14, 1990.

Hedge against inflation AND deflation

History has shown that gold not only responds positively to inflation but holds up against deflation as well. During inflationary periods, the price of gold tends to exhibit upward price movement, although there's no direct correlation between the rate of currency inflation and gold prices.

Essentially, when investors notice that the value of their currency is experiencing volatility, they look to sound money, such as physical gold. Gold is a tested way to store wealth as a risk-mitigating measure.

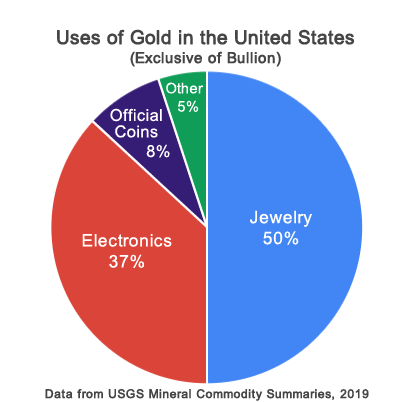

Supply and demand fundamentals

Gold is not just a beautiful shiny metal, it has real-life commercial uses in various industries such as electronics, architecture, high technology, medicine, and more. In particular, gold is used widely in the production of consumer electronics, an ever-growing industry in our modern times. According to Geology.com, 37% of gold, excluding bullion, is used for electronics in America.

Source: Geology.com

In fact, about $21 billion worth of gold is used every year in commercial electronics like smartphones and tablets. Since there are a limited amount of gold mines, and fewer mines are being discovered each year, this bodes well for those bullish on the price of gold in the long run.

Store of Value

As mentioned initially, you don’t necessarily get rich by owning gold. That is not the point of investing in physical metals. However, unlike stocks and bonds, the value of gold can never be zero as there is inherent material value in the substance itself for manufacturing and industrial usage. At no point in its millennia-long history has the price of gold gone to zero.

Portfolio Diversification and Protection

As pointed out previously, at various points in its history gold has had a negative correlation to stocks, bonds, and the dollar. Is your portfolio stock-heavy? Most successful investors will tell you that when it comes to investing: you don't want to put all your eggs in the same basket. Investing in gold and other precious metals such as silver, palladium, platinum, and rhodium offers deep diversification that can protect your wealth during market crashes.

What is IRA approved gold and silver?

Only certain bullion coin and bars are approved by the IRS for investment within an IRA. This has to do with purity level and issuing mint. The American eagles, Canadian maple leafs, Austrian Philharmonic are examples of bullion coins of high purity levels that are issued by recognized governments. Collectible coins and numismatics are NOT approved for IRA investments. Be careful when you shop around for Gold IRA companies because many of them are known to push collectibles and numismatics to their clients to raise their profit margins. A reputable and trustworthy IRA company should only recommend bullion coins that are IRA approved.

What is a gold IRA company?

A gold IRA Company or custodian is a company that specializes in setting up gold IRAs from beginning to end, including account setup, IRA rollover/transfer, purchase of qualified metals, and storing them with an accredited depository. A gold IRA company should be able to handle the entire process for you and answer any question you may have at any step of the process. Gold IRA companies tend to form strategic alliances with traditional IRA custodians, accredited depositories, and wholesale metal dealers.

Are these gold IRA reviews legit and unbiased?

These reviews are unbiased since we simply extract reviews from external review bureaus like the BBB, TrustLink, the BCA and others. We are an independent gold IRA online magazine with a mission to provide you with all your options. However, as we disclosed on other pages, we do get compensated when you fill out forms or click on certain links on this page. This doesn't affect the quality of the reviews since we are rating these gold IRA companies based on what their own customers are saying about them, and based on their fees and other important criteria. We encourage you to do your due diligence and contact several companies before making an investment decision. Also, speak to your financial advisor and ask for their advice.

What are the top gold IRA scams I should watch out for?

The #1 scam in this industry is companies trying to sell you numismatics and unqualified gold coins in your IRA. Why? Because these coins yield much higher profits for them. 30%-50%+ profit margins on numismatic coins are very attractive margins for some brokers. Buying such coins can end up costing you thousands in penalties as they are NOT eligible to be held in IRAs.

Unfortunately, not all precious metals IRA companies follow industry standards regarding transparency and ethics. Some have even been accused of fraud, something which is unfortunately not unheard of in the precious metals industry. That's why it's imperative that you do your homework and research the most trusted, IRS-approved precious metals vendors for your retirement savings accounts.

If you want a lower-risk experience, I recommend choosing a top-rated gold IRA company that handles the process from end to end. This way, you can rest assured that your holdings are compliant with IRS regulations. Note: we strongly recommend that do your due diligence and call a few different companies before making an investment decision. Also, speak to your financial advisor before investing in any asset class.

Should all companies offer home storage for my gold IRA?

Recent court cases have found that IRAs do not qualify for home storage. Proceed with extreme caution if you plan to take this route. If you decide to choose home storage for your gold IRA, make sure you ask the company for all the details and legalities involved in such a decision. We recommend a safe depository, either in the US or offshore. Doing otherwise can put you in big legal trouble with the IRS if they find out, and there's also the risk of theft and loss. Depositories are insured against all these risks.

Why do gold IRA companies offer free kits?

Just like in any industry, companies want to get your contact information so they can have you in their database and be able to contact you. This space is no different than any other industry. However, you should request a gold IRA kit before investing any sum of money with them or doing any rollover. The kits are usually 100% free and have no obligation, so you don't risk much. Sure, they can email you and call you, but you can opt out of emails and tell their brokers to stop calling you after the first phone call if you aren't interested. They won't be able to pester you after that.

How do I choose the best company to invest with?

It depends on many factors. What do you care about most? Ratings? Storage options? Availability of other alternative investment options? Physical location? Customer support? Once you decide which factors matter the most to you, make a shortlist of a few companies that meet your criteria, and either give them a call, or request their free gold kits to learn more about their company and products.

Amid global economic and geopolitical instability, now might be a good entry point for diversifying your IRA or 401k with precious metals, the only asset class to have consistently performed well in times of crisis. As always, we recommend that you do your due diligence and speak to your financial advisor before making any investment decision.

Liam Hunt

Liam Hunt, M.A., is a financial writer and analyst covering global finance, commodities, and millennial investing. His coverage has been featured in publications such as the New York Post, Forbes, and Barron's.

Reviewed by: Kelly Kennedy, CPA, CMA, MBA.

Kelly Kennedy, CMA, CPA, MBA, earned his MBA from Queens University and currently teaches finance and accounting at college. Apart from his teaching duties, he contributes to numerous publications and blogs, providing insights on a range of financial and investment topics. You can learn more about Kelly's experience and academics on his LinkedIn profile.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.86

Gold: $3,355.86

Silver: $38.42

Silver: $38.42

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,243.37

Palladium: $1,243.37

Bitcoin: $117,714.11

Bitcoin: $117,714.11

Ethereum: $2,956.39

Ethereum: $2,956.39