Rosland Capital Review: Still a Top Precious Metals IRA Provider in 2024?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 23rd September 2024, 09:30 pm

- Phone : (844)-754-1349

- URL :

- Global Rating

User Rating

- 0 No reviews yet!

Founded in 2005, Rosland Capital is a precious metals investment firm. Located in Los Angeles, the company also assists clientele in setting up Gold IRAs. The catalog of inventory includes a wide array of both IRA-eligible coins and bars, coupled with collectible coins. Unfortunately, no product pricing is provided on the website. Customers must contact the company directly for that information.

Pros:

- Good selection of products

- Great customer service

- Delivery in 10 days or less

Cons:

- Higher premium on exclusive coins

- Website doesn't provide pricing information

- Some negative customer reviews

Table of Contents

- Company Info and Background

- Rosland Capital Management Team

- Rosland Capital Custodian and Storage

- Rosland Capital Products

- Premium Coins vs Standard Bullion Coins – Understanding the Difference

- Rosland Capital Precious Metals IRA Info

- Rosland Capital Reviews, Ratings, and Complaints

- Rosland Capital Contact Information

- Review All IRA Options Before Investing

Company Info and Background

Rosland Capital (www.roslandcapital.com) was established in 2005 and is headquartered in Los Angeles, California. The precious metals investment firm offers a myriad of gold, silver, and platinum, products. The company has a selection of some of the most popular IRA-eligible coins for retirement savers. In addition, for collectors, there is a vast selection of collectible coins.

Likewise, the company will help clients establish a Precious Metals IRA. The process is seamless, having the IRA custodian, Equity Trust, providing custodial services for precious metals held in a self-directed IRA. In addition, secure storage is provided by Delaware Depository.

Moreover, Rosland Capital keeps its customers informed with a “News” section on its website, covering a variety of topics pertaining to precious metals and investing. For those inclined, the company also offers a free guide to purchasing gold. Said guide covers numerous subjects including what to look for when buying gold coins, to what to look for in graded coins.

Rosland Capital Management Team

Founder and CEO

Rosland Capital was founded by Marin Aleksov in 2005. He is also listed as the company’s Chief Executive Officer.

Rosland Capital Custodian and Storage

Rosland Capital has partnered with renowned IRA custodian, Equity Trust Company.

Vault storage is provided by Delaware Depository, at its secure facility located in Wilmington, Delaware. Precious metals are fully segregated, and insured with a comprehensive insurance policy from the prestigious Lloyds of London.

Rosland Capital Products

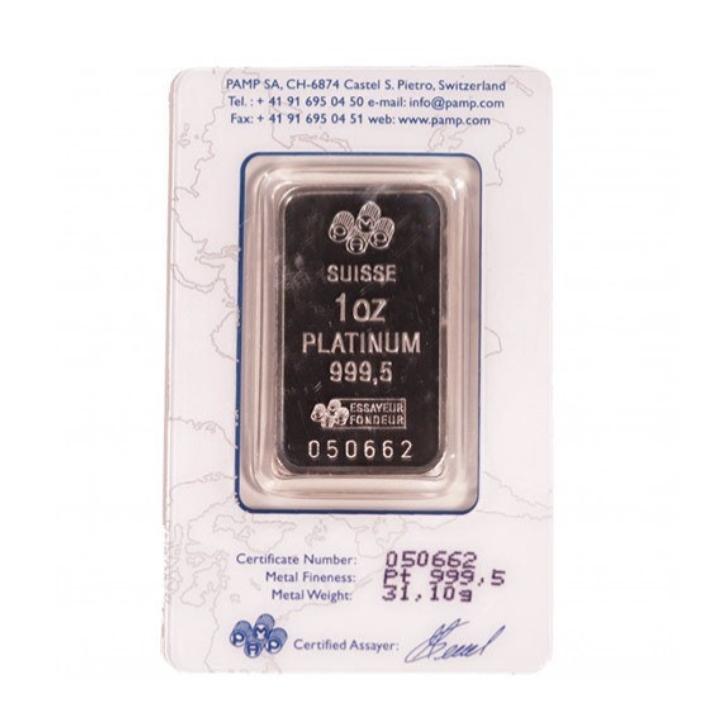

Rosland Capital has a good inventory of some of the most popular IRA-eligible gold, silver, platinum, and palladium coins and bars. Some of the available products include the American Buffalo Gold, American Eagle Gold, American Eagle Silver, Austrian Gold Philharmonic, Canadian Palladium Maple Leaf, and the Silver Canadian Maple Leaf. For those interested in IRA-approved platinum, Rosland Capital offers a one-ounce platinum bar.

View more Rosland Capital products here.

Premium Coins vs Standard Bullion Coins – Understanding the Difference

At times, the sheer number of available IRA-compatible coins that can be held in a self-directed IRA can prove overwhelming – especially for novice investors. Yet, before making any selection, first, understand that there is a differentiation between these two types of coins.

Premium Coins

Premium coins are considered IRA-eligible by the IRS because they contain identical purity levels to standard bullion coins. However, the major difference is that premium coins are semi-numismatic because they have limited circulation being part of a collectible series. Oftentimes, some companies charge a higher markup for premium coins because of their limited circulation status.

Standard Bullion Coins

Standard bullion coins like the Austrian Philharmonic, the American Eagle, and the Canadian Maple Leaf, make an excellent investment option to include in a self-directed IRA. These types of coins have purity levels of 99.99% but are sold at lower price points due to the fact that they are not semi-numismatic. Therefore, investors get the most gold for their money with these types of coins.

Below is a comparison chart to give you a better understanding of the available types of coins.

| Bullion | Proof & Uncirculated coins | Collectibles/Numismatics | |

|---|---|---|---|

| IRA Eligible? | Yes | Some | No |

| Highest Purity Level? | Yes | Yes | No |

| Limited Edition and/or Scarcity Factor? | No | Yes | Yes |

| High Finishing Quality & Detail?* | No | Yes | Some |

| Easy to Sell/Liquidate Anywhere | Yes | No | No |

| Premium Over Spot When Buying? | Low | Medium | High |

| What you can expect to sell them for? | Close to spot price. Usually no or little premium. | Spot price + premium based on rarity/age/demand for your coins | Spot price (if they contain some precious metals) + premium based on rarity/age/demand and other factors |

| Where can you sell them? | Anywhere, since these bullion coins are recognized and trusted worldwide. However they'll probably only give you spot price. | Anywhere, but original dealer would likely be the best place if you want to recoup premium. Others might only give you spot price. Ebay is also a good option if you have rare and highly sought after coins. | Antique stores, coin shops, collectors' markets, eBay. |

Rosland Capital Precious Metals IRA Info

| Company | Rosland Capital |

|---|---|

| Annual Cost | Variable |

| Scaled or Flat Fees? | Flat Fees |

| Partnered Storage Vault | Delaware Depository |

| Partnered Custodian | Equity Trust Company |

| Metals Available | Gold, silver, platinum, palladium |

| Years in Business | 13 years (2008) |

Rosland Capital Reviews, Ratings, and Complaints

Below we offer a diverse selection of reviews, ratings, and complaints pertaining to Rosland Capital from trusted consumer reporting and rating agencies sites. Simply click on the links provided to study the reviews in greater detail.

- BBB Rating: ⭐⭐⭐⭐⭐, (“A+” and 4.78 Star Rating based on 338 Customer Reviews)

- BBB Complaints: 22 complaints in last 3 years (Details)

- Google My Business: ⭐⭐⭐⭐⭐ (4.8 Star Rating based on 20 Customer Reviews)

- Trustpilot:⭐⭐⭐⭐ (4.2 Star Rating based on 126 Customer Reviews)

- RipOff Report: 13 reported complaints filed since 2010 (Details)

- Yelp: ⭐ (1 Star Rating based on 3 Customer Reviews)

- Facebook: 4,300+ “Likes” (Details)

Rosland Capital Contact Information

- Address: 11766 Wilshire Blvd, #1200, Los Angeles, CA 90025-6557

- Phone: (800) 967-5151

- Email: services@roslandcapital.com

- Website: www.roslandcapital.com

Review All IRA Options Before Investing

It is essential to carefully consider the different precious metals companies available, prior to making any purchases as part of your IRA investment strategy. In addition to its overall reputation, be mindful of a company’s bullion prices, policies, practices, and most importantly, storage fees for precious metals.

- Phone : (844)-754-1349

- URL :

- Global Rating

User Rating

- 0 No reviews yet!

Founded in 2005, Rosland Capital is a precious metals investment firm. Located in Los Angeles, the company also assists clientele in setting up Gold IRAs. The catalog of inventory includes a wide array of both IRA-eligible coins and bars, coupled with collectible coins. Unfortunately, no product pricing is provided on the website. Customers must contact the company directly for that information.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,346.73

Gold: $3,346.73

Silver: $36.44

Silver: $36.44

Platinum: $1,419.54

Platinum: $1,419.54

Palladium: $1,158.22

Palladium: $1,158.22

Bitcoin: $109,361.56

Bitcoin: $109,361.56

Ethereum: $2,588.40

Ethereum: $2,588.40