Bitcoin IRA Reviews: Top Crypto IRA Companies in 2025

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Edited by: Liam Hunt | Financial Writer

TOP FEATURES

✅ Perfect security track record

✅ Transparent about all fees

✅ Simple and intuitive online platform

www.mydigitalmoney.com

(833) 636-2008

Pasadena, CA

TOP FEATURES

✅ Global pioneer of both Bitcoin IRAs

✅ Widest selection of digital assets

✅ 24/7 trading platform available

www.bitcoinira.com

(877) 430-3546

Nevada, LV

TOP FEATURES

✅ Best in the industry cold storage

✅ Full protection with insurance

✅ Wide choice of digital assets

www.bitira.com

(800) 299-1567

Burbank, CA

If you're considering investing in a Bitcoin IRA (also referred to as a cryptocurrency IRA or crypto IRA), exercising a traditional IRA rollover, or rolling over a Roth IRA, 403b, or 401k to a Bitcoin IRA, then your first step is to choose a Bitcoin IRA company or custodian with successful and verifiable track records with retirement investors.

Below is a comparison chart that will guide you in finding the best crypto IRA company for your needs, and you can see all of the relevant details by clicking on the “Read Review” button beside each of the companies.

Table of Contents

- Top 4 Rated Crypto IRA Companies

- #1. Best Rated Overall

- #2. BitcoinIRA

- #3. BitIRA

- #4. Coin IRA

- The Rise of Bitcoin and Ethereum

- Top 9 Reasons to Consider Investing in Cryptocurrencies in Your IRA

- What To Look For In A Crypto IRA Company

- My Digital Money: The Top ‘All-in-One' Company for Your Bitcoin IRA Investments

- Top 3 Bitcoin & Ethereum IRA Companies in 2025

- Bitcoin IRA: Frequently Asked Questions (FAQs)

Top 4 Rated Crypto IRA Companies

#1. Best Rated Overall

PROS

✅ Military-grade security protocols; perfect security track record

✅ Respect for user privacy, no data sold to third-party advertisers

✅ Transparent about all fees and includes no hidden charges

✅ Partnership with Equity Trust Company for IRA custodian services

✅ Simple and intuitive online platform and dashboard

✅ Access to all major cryptocurrencies

CONS

❌ New company with lots still to prove

❌ Slightly higher per-trade platform fees for Tier 1 users (1.9%)

#2. BitcoinIRA

PROS

✅ Global pioneer of both Bitcoin IRAs

✅ Widest selection of digital assets available to account holders

✅ Free Bitcoin IRA information guide

✅ 24/7 trading platform available in-app or desktop

✅ Gold eligible for purchase and trading

✅ Responsive customer support phone lines

✅ 2-6% Interest Earning Program for select investments

CONS

❌ May not offer as many altcoins as some rival companies (subject to change)

❌ Administration fees and storage charges are not transparent

❌ Fee structure is higher than some competitors'

#3. BitIRA

PROS

✅ Enhanced reporting and account holdings overview that makes tracking all operations and transactions easy

✅ Best in the industry cold storage and full protection with insurance of your digital coins

✅ Wide choice of digital assets with a list of the nine top cryptocurrencies in the market

✅ Perfect physical and cybersecurity track record

✅ Exclusive partnership with Genesis to facilitate trades and an interest-earning crypto loan program

CONS

❌ Lack of transparency of all costs implied in transactions, maintenance, and setup

❌ Smaller choice of cryptocurrencies (9) compared to other digital IRA companies

❌ Higher than average minimum deposit ($5,000)

#4. Coin IRA

PROS

✅ Coin IRA management brings extensive industry-leading experience

✅ They feature an education first, low-pressure approach to investing for their clients

✅ Coin IRA offers a selection of cryptocurrencies including Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin

✅ No maintenance or setup fees

✅ Live customer support

CONS

❌ Smaller selection of cryptocurrencies compared to some of its competitors

The Rise of Bitcoin and Ethereum

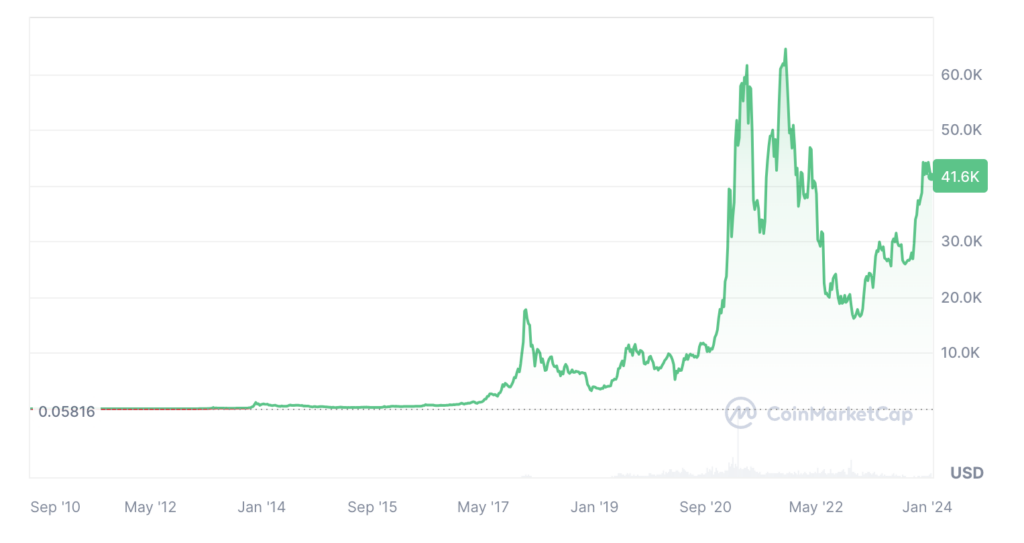

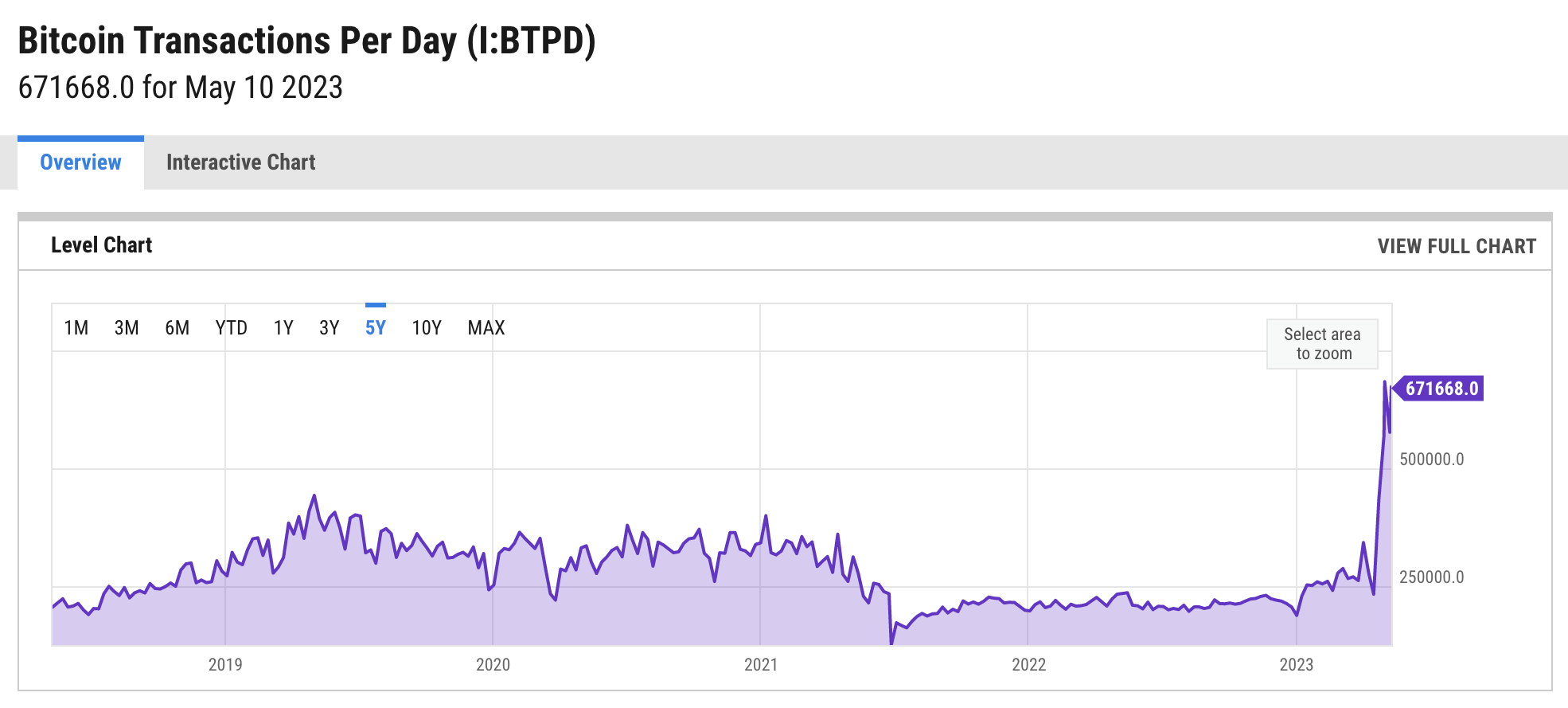

Both Bitcoin (BTC) and the second most popular digital currency, Ethereum (ETH, or Ether), have virtually become household names in recent years. As the chart below indicates, the value of the leading cryptocurrency has risen and fallen dramatically since its inception in the early 2010s.

Some experts predict that the price ceiling for both Bitcoin and Ethereum over the long term could be enormous. The analyst Van-Peterson of Saxo Bank correctly predicted the Bitcoin price move from approximately $750 to $2,000, as did tech guru Kim Dotcom. Now Van-Peterson is forecasting the price of the world's largest cryptocurrency to hit $100,000 within a decade.

In arriving at these dramatic predictions, Van-Peterson assumes that all of the main surviving cryptocurrencies will make up 10 percent of the average daily volumes of the entire Forex market within 10 years. The average daily volume (ADV) of the foreign exchange is presently around $5 trillion per the Bank for International Settlements.

Van-Peterson says that Bitcoin will hold 35 percent of the cryptocurrency market share once at maturity. That would give them $175 billion in average daily volume. As of 2024, the ADV of Bitcoin is about $48.4 billion.

Van-Peterson assumes that the total market cap of Bitcoin will be 10 times its ADV, which would amount to a $5 trillion in market cap for the leading cryptocurrency. At maturity, Bitcoin will have, at maximum, 21 million tokens in circulation. If you take 21 million and divided it by a $5 trillion market cap, you arrive at a per-BTC value of slightly more than $238,000 each. Even if you assume that Van-Peterson’s market cap prediction is off by double, you still arrive at a value of nearly $120,000 per token—a sum about 3 times its current value as of Q1 2024. Van-Petersen stated:

“This is not a fad, cryptocurrencies are here to stay. There will emerge two to three main ones. Bitcoin will be one of those. And the reason is the first-mover advantage, the scale, and the pioneering.”

Ethereum has already proven itself in a number of strong “industrial” types of digital applications in the field of smart contracts, especially pertaining to electricity account management and payment and cash transfer transactions. Thanks to the dozens of companies involved in the EEA Enterprise Ethereum Alliance (including Microsoft, Intel, BP, JP Morgan, and numerous international banks and financial institutions), Ethereum has a strong institutional base of support that makes it a likely contender as a long-term runner-up to Bitcoin.

Even if Van-Peterson's lofty projections on Bitcoin might seem overly optimistic, the rapid growth of Bitcoin helps to explain why many individuals and investors are beginning to think seriously about cryptocurrencies as a substitute for gold in their IRAs and 401(k)s. Remember, however, that these are inherently speculative assets and you should always speak to your financial advisor before investing in Bitcoin or any other cryptocurrency.

Top 9 Reasons to Consider Investing in Cryptocurrencies in Your IRA

Aside from their price potential, there are a number of other compelling reasons to add electronic currencies to a well-diversified retirement portfolio that already includes stocks, bonds, and physical bullion. The so-called digital gold (Bitcoin) and Ether have all of the following significant advantages over government-backed fiat currencies:

#1. Cryptocurrencies are still emerging assets

Given that cryptocurrencies are nascent assets (the first BTC token was mined in 2009), they have long runways for growth. As immature assets, they have the capacity for significant growth and losses, making them risky but potentially rewarding stores of value.

#2. With the world becoming increasingly more digital

technological advances such as cryptocurrencies will almost certainly face wider adoption around the world. As internet infrastructure improves worldwide, cryptocurrency usage is set to become more and more prevalent in the years ahead.

Cryptocurrencies also have a long growth runway when it comes to institutional adoption, as many sovereign central banks, including the People's Bank of China, are experimenting with central bank digital currencies (CBDCs) that peg their national cryptocurrency to the value of their fiat currency.

#3. The degree of anonymity

The degree of anonymity of cryptocurrencies is very appealing to many people who value their financial privacy. They allow you to discreetly conduct your transactions and even lower the likelihood of your identity becoming stolen or used fraudulently.

#4. Bitcoin and Ethereum are completely decentralized

Holders of cryptocurrencies are not subject to the whims of the U.S. Federal Reserve and its currency interference. Bitcoin and Ethereum are completely decentralized as they are not issued by any central bank or issuing agency. This gives them the same appeal as gold, silver, and the various other precious metals IRAs and 401(k) assets.

#5. No holding fees

There are no holding fees with most cryptocurrencies, unlike what you're bound to run into with banks and credit unions. With crypto, you can hang onto more of your hard-earned money without third parties eating into your profits.

#6. They provide the safe haven appeal of gold

When economic, financial, and geopolitical crises hit, fixed quantity safe haven currencies like gold, precious metals, and now the main two cryptocurrencies enjoy the benefit of a dramatic flight to safety as geopolitical tensions around the globe increase. World governments may print more paper money in such scenarios, yet neither gold nor cryptocurrencies like Bitcoin and Ethereum can be endlessly reproduced. Their limited nature gives cryptocurrencies huge appeal during periods of economic instability. Therefore, both gold IRAs and cryptocurrency retirement investments make for strong portfolio diversifiers.

#7. Limited supply and growing demand

Limited supply and growing demand may suggest that the price can only rise over time as long as demand continuously increases. There are no more than 21 million total Bitcoins that can ever be produced by the rules of its underlying blockchain system. This means that the world will soon reach the point where Bitcoin (which currently has about 19 million coins in circulation) reaches its hard cap of 21 million. This makes BTC far rarer than even gold and precious metals.

Ethereum is similarly limited in production. The fact that BTC and Ether are scarce resources means that their prices will never be subject to the various types of inflation via mass production.

#8. Effective diversification for your retirement portfolio

It's possible that your retirement portfolio is either stock or bond (or both) heavy. Virtually every successful investor will say the same thing regarding investing: you should never place all of your proverbial eggs in the same basket. Cryptocurrencies provide you with another viable asset class in which to diversify a portion of your retirement holdings in a way that's non-correlated to the equities market. In other words, if your mutual funds and ETFs decline in value, Bitcoin and other cryptocurrencies may provide a much-needed counterweight to the stock market's downtrend.

#9. Reliable hedge against the money-printing-induced declining dollar

As more and more dollars are printed to finance the U.S. Treasury's annual trillion-dollar deficits, the value of the greenback is likely to decline in perpetuity. Major cryptocurrencies like Bitcoin and Ethereum are finite in number and can not simply be inflated away with time. Both gold and altcoin (i.e., non-Bitcoin) cryptocurrencies provide you with an alternative currency hedge against the decline of the dollar and other fiat currencies.

N.B.: Whether you decide to invest or not, if it is important to speak to your financial advisor and do your own due diligence about this new asset class. Again, digital currencies in an IRA are a highly speculative type of investment. Do NOT invest any sum of money that you couldn't afford to lose.

What To Look For In A Crypto IRA Company

The table above is intended to assist you in comparing the reviews and ratings for the best Bitcoin and Ethereum IRA companies. When choosing a firm, we recommend looking closely at the following three characteristics in Bitcoin IRA reviews:

#1. Ratings, Ratings & Ratings!

It's better to go with a firm that boasts as many positive reviews from its customers as possible. Trusted review authorities such as the Better Business Bureau (BBB), Business Consumer Alliance (BCA), Google user reviews, and Trustlink are most important. It is also good to consider whatever feedback is available from reputable websites including Yelp, Complaint Board, and the online version of Yellow Pages. Disregard reviews that appear to be written by bots or paid advertisers.

#2. Process Safety

The #1 risk when it comes to investing in an intangible digital asset like Bitcoin is the threat of hackers, fraud, and theft. Ask your provider how they plan to mitigate hacking and malware risks. These questions are good starting points:

1. Do they print your private key using an offline machine?

2. Do they use cold storage vaults to protect their customers' keys?

3. Do they use the multi-sig security protocol?

Ask each company's customer service representatives about all the ways they are protecting their client's assets and see if they have all their bases covered.

#3. Account Set-Up Efficiency

We've heard of clients who have waited several months just to have their IRA accounts established and ready for first purchases. You want a Bitcoin or Ethereum IRA company that has a fast (ideally same-day) account setup process. With the explosive speed of the crypto market, waiting weeks before you can purchase your BTC or Ethereum might mean paying hundreds of dollars more or less per token, as demonstrated below:

Source: CoinMarketCap

Therefore, if you want price security, you may want to consider acting sooner than later as the price of cryptocurrencies are known to change at the drop of a dime.

My Digital Money: The Top ‘All-in-One' Company for Your Bitcoin IRA Investments

When you consider all the criteria covered above, My Digital Money (formerly Noble Bitcoin) comes out on top due to its high user ratings, excellent reputation within the industry, and how expediently they handle the end-to-end setup process. Other providers like Broad Financial do not handle the entire process and rely on third parties, meaning you have to find your own custodian, coin exchange, and wallet, all while ensuring IRS compliance the whole time.

The main issue with taking the fully self-directed approach (like with Broad Financial) is that many wallets are not accepting business customers, and those that will either take weeks to effectively set up an account or will place limitations that will restrict the assets available for purchase. Coinbase, for instance, will limit new accounts to $150 per day. Broad Financial is a great company if you're an expert and already have a wallet with high limits. But if you're a beginner, it might be better to choose a simple all-in-one service like Bitcoin IRA.

» Read our full review of My Digital Money

» Open a cryptocurrency IRA with My Digital Money

About My Digital Money

My Digital Money (sometimes referred to as “MyDigitalMoney”) is also a great company to consider if you want to include cryptocurrencies in your IRA or 401k. They were the first company in the industry to offer digital currencies to retirement investors, and currently supports Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin Cash, and Ethereum Classic in retirement accounts. The company promised to add more IRA-approved digital currencies and altcoins in the near future.

We strongly recommend that you request My Digital Money's free Bitcoin investment kit that explains everything you need to know to get started. Better yet, all deposits are insured by up to $700 million in comprehensive custody insurance.

One of the best aspects of My Digital Money is that you have full access to their interface directly from your phone or web browser thanks to their proprietary UI/UX dashboard that makes it easy to execute trades directly within a streamlined interface. You can easily make intra-day swing trades and follow price movements using this app, through which you can enable push notifications for up-to-the-minute price data.

Get started investing with My Digital Money below:

Read our full review of My Digital Money

Open a cryptocurrency IRA with My Digital Money

Top 3 Bitcoin & Ethereum IRA Companies in 2025

We recommend that you contact a few companies before making a decision on a Bitcoin IRA provider. Compare their services, products, and fees using our crypto IRA reviews, and do your own homework on each company reviewed—don't merely take our word for it.

Bitcoin IRA: Frequently Asked Questions (FAQs)

What is a Bitcoin IRA?

A Bitcoin IRA is essentially a special type of Self-Directed IRA used to invest in cryptocurrency like Bitcoin and others. Only certain custodians in the US are allowed to open Bitcoin IRA accounts, so please make sure you are working with an authorized and accredited company with a proven track record.

The last thing you want is to invest with a non-compliant company and end up paying large penalty fees, or worse: lose your entire investment. If done wrong, your cryptocurrency IRA can end up costing thousands of dollars in penalties and even get you in trouble with the IRS, which is why it is imperative that you work with a company that has mastered the process and is able to provide 24/7 support regarding any questions or concerns you might have. Also, the best Bitcoin IRA companies have flawless IRS compliance records so you don't end up on the hook for violating federal regulations.

How safe is a Bitcoin IRA?

Bitcoin is a risky investment. While gold is generally considered a safe investment that has proven the test of time, Bitcoin is relatively new. Although a lot of people like to compare Bitcoin to gold, it's too early to tell whether Bitcoin will follow the same path and become a trusted hedge against economic instability and inflation.

We have seen Bitcoin drop 30%+ in a matter of hours. Unlike gold and silver, cryptocurrencies are not backed by anything tangible (a point of controversy in the gold vs. Bitcoin debate). As such, they're a unique asset class with no historical precedent. Therefore, invest with caution and, again, do not invest any sum of money that you could not afford to lose.

Many experts, like Mark Cuban, recommend that no more than 10% of one's savings should be allocated to crypto assets. The exact percentage of your portfolio you decide to allocate to cryptocurrencies should vary according to your individual time horizon, risk tolerance, and proximity to retirement. Speak to your financial advisor before making any investment decision.

What are the costs and fees involved in a Bitcoin IRA?

Bitcoin IRA companies and custodians reviewed on this page will usually charge a percentage markup on the value of the Bitcoin IRA investment. We recommend that you call a few of them to obtain the best price. Compare not only their price but also their security, their reputation, and their hidden fees. Some companies charge for selling or trading, have a live trading platform, and offer cold storage, while others don't. Shop around. In addition to the percentage markup, you will also pay an annual fee which is usually between $100 and $350, depending on the custodian.

How do I transfer or rollover an IRA or 401k to Bitcoin?

You first have to determine if your current IRA or 401k is eligible to be rolled over. Many employers are strict when it comes to allowing transfers and rollovers.

Now, if you currently have a self-directed IRA, you should be able to roll it over or transfer it to Bitcoin and other cryptocurrencies without any issue. A Bitcoin IRA rollover means that your current retirement account's custodian will write you a check for the full value of your account. You then have a period of 60 days to send the funds to your new Bitcoin IRA custodian. If you are late, you will pay a hefty distribution fee. A Bitcoin IRA transfer means the custodian will wire the money to your new custodian immediately. This is the preferred option since you don't need to be the medium between both. You also avoid any chance of missing the deadline and paying a penalty fee.

What are the IRS rules when it comes to setting up a crypto IRA or Bitcoin IRA?

The IRS rules are very similar to when you invest in gold and silver. You basically need to work with an accredited custodian that will hold your investment on your behalf. You cannot personally hold your crypto. On this page, all the companies we reviewed are authorized to own Bitcoin, Ethereum, and other cryptos within an IRA, and they can help you through the entire process.

Can I invest in other cryptocurrencies in a Bitcoin IRA?

Yes. Ethereum, XRP, and several other cryptos are allowed by most companies reviewed here. However, the list changes quite often, so please make sure you check in with each company to see which cryptos they allow.

At the end of the day, we recommend sticking to the top cryptos and not venturing into the lesser-known ones, unless you have a very high tolerance for risk and have done your research on those altcoins.

Do I need a self-directed IRA for Bitcoin?

Yes, most likely. Crypto IRA custodians on this page are all experienced in setting up SDIRAs that they use to invest in Bitcoin and other cryptos. Most other investment accounts do NOT allow alternative assets.

How do I find the best Bitcoin IRA?

We recommend you call a few of them. Request their free kits. Compare their security, fees, and reputation, and make sure you know about all the hidden fees. These companies change their fee structure quite often to stay competitive.

Do traditional investment companies like Fidelity, Vanguard, Charles Schwab offer a Bitcoin IRA?

No. Brokerage firms such as these offer ETFs that invest in Bitcoin or other cryptos, but not Bitcoin itself.

Can I open a Roth Bitcoin IRA?

Yes, most custodians on this page will allow a traditional or Roth IRA for your Bitcoin, Ethereum, or other cryptocurrency investments. Call them and ask them about the different types of accounts they can set up for you.

Disclosure: we would like to remind you that we are a 100% independent reviewer and that we are not employed by any of the companies reviewed on this page, including My Digital Money. Always do your due diligence when choosing a company to work with. Call a few, and request their free kits to get a better idea of their offerings. Digital currencies are volatile and risky investments. Do not invest any amount that you cannot afford to lose.

Liam Hunt

Liam Hunt, M.A., is a financial writer and analyst covering global finance, commodities, and millennial investing. His coverage has been featured in publications such as the New York Post, Forbes, and Barron's.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,335.81

Gold: $3,335.81

Silver: $36.93

Silver: $36.93

Platinum: $1,394.91

Platinum: $1,394.91

Palladium: $1,141.81

Palladium: $1,141.81

Bitcoin: $108,104.05

Bitcoin: $108,104.05

Ethereum: $2,503.64

Ethereum: $2,503.64