Peter Schiff vs. Spencer Schiff: The Father-Son Debate Over Bitcoin, Gold, and What Makes Money Valuable

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 18th April 2025, 10:04 pm

2025 UPDATE: Years after their now-legendary Twitter feud, Peter and Spencer Schiff's debate over gold vs. bitcoin continues to symbolize a deeper generational divide in how we define and defend our money. While Peter clings to physical gold, Spencer remains a proud digital-native contrarian, betting on bitcoin’s long-term dominance. However, given that Peter was complaining about his son's involvement in Bitcoin back in 2020, do you think he feels the same way in 2025 given the meteoric rise of Bitcoin in the last five years? Probably not.

Peter Schiff, longtime gold bug and founder of SchiffGold and former CEO of the now-defunct Euro Pacific Capital, a hedge fund with $228M in assets under management, is caught up in a Twitter spat with his son Spencer, an 18-year-old college freshman.

Unlike more common father-son disagreements over football games or whether one's grades are up to snuff, Schiff senior and junior are at odds over the very essence of our monetary system. The crux of the debate is whether gold and bitcoin, respectively, constitute sound money or reliable mediums of exchange.

Spencer, a devotee of the Austrian School, is outspoken in his support of bitcoin. His father, Peter, is one of cryptocurrency's loudest critics. For over a decade, Schiff senior has refused to touch cryptocurrency and refuses to recognize its value as a legitimate store of wealth. His son, meanwhile, is all-in on bitcoin.

A discerning onlooker might assume that Spencer was adopted. All jokes aside, the debate between Spencer and Peter is a serious one. Although precious metals and cryptocurrencies have a lot in common, gold bugs and bitcoin enthusiasts have often, though not always, failed to see eye-to-eye for over a decade.

But it's also a false debate. As I'll explain, theirs is not a true dilemma—rather than an either/or situation, gold and cryptocurrencies are both valuable diversification tools depending on one's risk tolerance.

Table of Contents

The Debate at a Glance

What makes money valuable? On one side, we have Peter Schiff who believes that money requires tangibility to be a valid unit of account. As such, he thinks that bitcoin is a medium of exchange, but that it falls short of the requirements necessary to count as a real store of value.

On the other side of the aisle is Spencer Schiff, a libertarian, who's committed to the belief that valid stores of value are anything that a free and open market treats as such. Against this backdrop is the now-infamous Schiff father-son Twitter debate, which has divided crypto enthusiasts and gold bugs alike.

Peter's Side

Schiff senior believes that bitcoin is little more than fool's gold, and that it doesn't provide anything of inherent utility that would confer its value. According to him, sound stores of value are physical objects that can be utilized by market participants as an exchange medium.

For Peter, bitcoin enthusiasts have no basis on which to believe that the cryptocurrency will ever constitute genuine money. Rather, speculators who buy bitcoin or other cryptocurrencies are just that—speculators—who sell, or hope to sell, the asset to other speculators at a higher price.

Peter claims that bitcoin doesn't fit the definition of money because, unlike fiat cash or gold, he alleges that cryptocurrency is not a commodity with value unto itself. That bitcoin is neither “legally recognized,” according to Peter, nor backed by a centralized guarantor, renders the asset useless as a medium of exchange.

This proposition holds that palpable physical properties are necessary for any asset to register as money. Without tangible properties, it lacks the fundamental criterion to qualify as money—according to Peter Schiff, at least.

‘There's always a use for gold,” Peter reminds us. “It's not like no one's going to want it.”

Spencer's Side

Peter's teenage son couldn't be more unlike him, at least regarding their monetary philosophies. Like any contrarian child, Spencer scoffs at his father's demand that bitcoin, or any store of value for that matter, require tangible properties for it to hold value.

Rather, for Spencer, the differentiation between “sound” and “fiat” money is whether it emerged spontaneously on the free market or was thrust upon us by the dictates of the state.

But why, then, should we stop at bitcoin? If we take Spencer's logic at face value, wouldn't baseball cards, fine art, or antique furniture—all of which are traded on free markets—also qualify as sound money? At least in the first case, trading cards are divisible, tangible, finite, in-demand, and spontaneous products of a free market.

I don't think Spencer launches a rock-solid argument to justify his theory of money. Still, this doesn't obviate his broader argument that physicality might be a trivial component of what makes money money. Instead, units can serve as money merely by virtue of properties that are mathematical (transferability, divisibility, fungibility, scarcity) rather than physical or statutory.

What Twitter Thinks

It would seem that rather than siding with his father, the Twittersphere is strictly backing Team Spencer. In a poll taken back in September, 67,403 survey respondents, representing 81.3% of the total vote share, said that they would rather take Spencer's advice over Peter's when it comes to Bitcoin ownership.

Source: Twitter

Bear in mind, however, that most Twitter users are aged 34 or under (59.6%). According to a recent survey, young Americans overwhelmingly do not own gold. On the other hand, the median age of bitcoin owners is about 33 years. Therefore, the results of the Twitter survey could've been skewed by Twitter's younger gold-foregoing, bitcoin-embracing demographic.

Still, it's worth noting where the internet's opinion lies regardless of potential sample biases. The fact that the 18-year-old Spencer has such earnest support behind him speaks volumes about the veracity of his monetary philosophy and lends some credibility to the notion that money is constituted by reliability and mass consensus rather than decree or physicality.

Bitcoin as a Global Medium: The Value Proposition

With both sides weighed, I'll add that there are several elements missing from the present discussion.

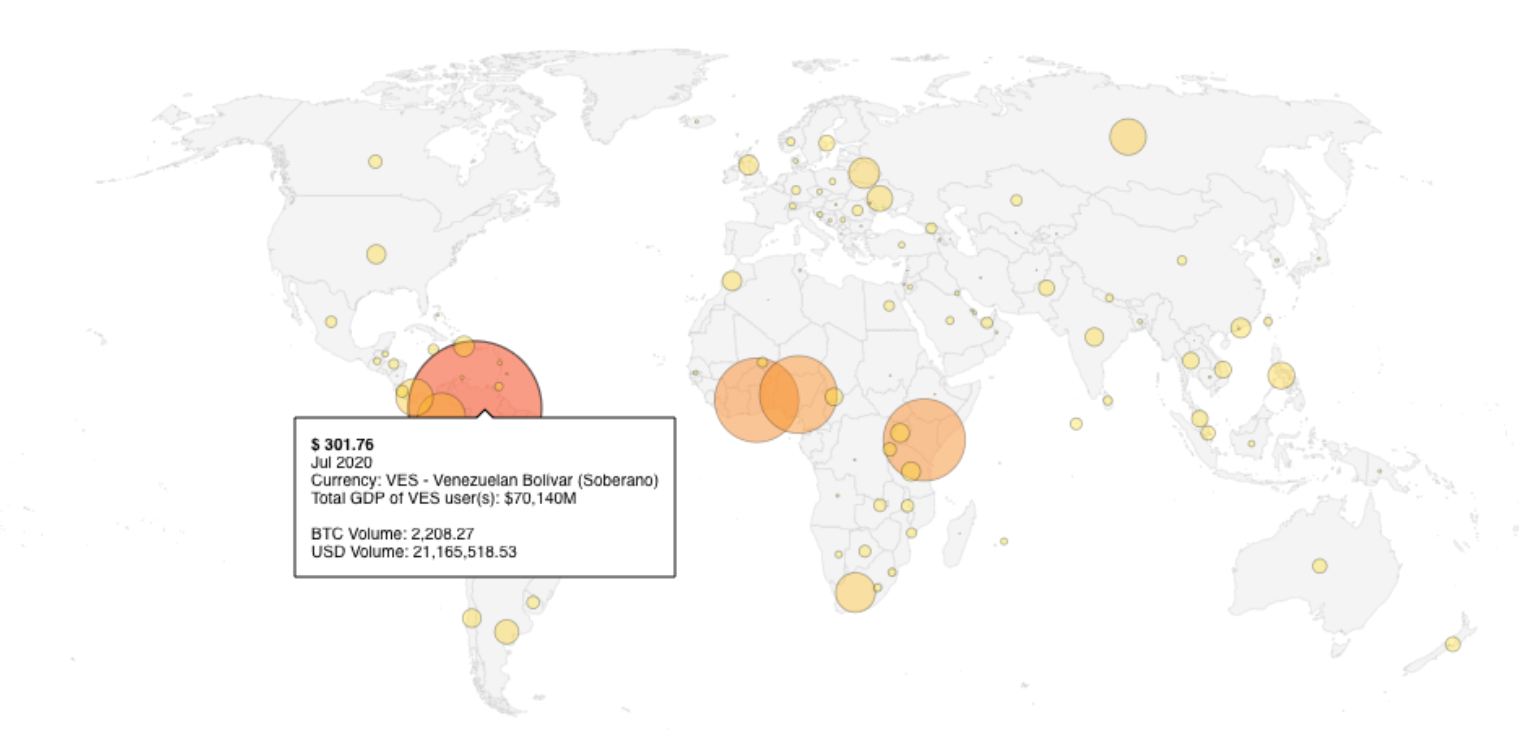

First, Peter either ignores or downplays the utility of bitcoin as a truly global, frictionless store of value. For a man who has built a career of warning against the threat of hyperinflation, Peter disregards the circumstantial reality of those who have actually lived through it in states such as Venezuela and Zimbabwe.

As an economist, Peter knows that money is not merely an economic object of exchange, unit of account, and reliable store of value. It's also a symbolic byproduct of a sovereign state's ability to affirm public confidence in its institutions. When a sovereign government loses public confidence and can no longer sustain a nation's economic machinery, what happens?

In this scenario, as we've seen in Venezuela and Zimbabwe, one's legal tender can become worthless and one's ability to purchase gold in an open market can be made impossible simply by government decree. If you had asked a Venezuelan in 2018, when hyperinflation eclipsed 130,000%, where or how they could acquire gold, they would have laughed you out of the pueblo.

Bitcoin and stablecoins have become vital financial tools for many Venezuelans and Argentinians facing economic instability. In Venezuela, despite governmental crackdowns and the discontinuation of the state-backed Petro cryptocurrency, crypto adoption surged by 110% year-over-year in 2024, reaching a transaction volume of $20 billion. Citizens increasingly turned to cryptocurrencies as a hedge against the plummeting bolívar, with stablecoins like USDT facilitating daily transactions and remittances.

Similarly, Argentina experienced significant growth in crypto usage amid triple-digit inflation and currency devaluation. Between July 2023 and June 2024, Argentinians conducted $91 billion in crypto transactions, surpassing Brazil in total crypto inflows. Stablecoins accounted for 61.8% of these transactions, indicating a strong preference for digital assets pegged to more stable currencies.

These trends underscore how cryptocurrencies are serving as accessible financial lifelines in regions grappling with economic crises, offering alternatives to traditional financial systems and preserving wealth amid volatility.

Source: Coindesk

Despite crackdowns from state authorities and threats of asset seizures, Venezuelans purchased more cryptocurrencies in July 2020 than any other country on earth relative to their GDP. At this time, Venezuelans in mass sought refuge in hard currencies as the bolivar, the nation's debased currency, was rendered practically valueless.

Viewed in this relief, it becomes clear that bitcoin can serve many of gold's practical functions, only, perhaps, even better. It's significantly more accessible and liquid and is ensnared by fewer barriers to entry no matter one's geographical location or political environment.

Further, bitcoin does, in fact, have a central value proposition: it represents a decentralized and transparent alternative to central bank-controlled fiat money. It's also instantly and irrevocably verifiable. That's the value proposition and use case, which, on both counts, present a stark improvement over physical or paper gold.

Crypto vs. Gold: Who's the Winner?

What's lost in the noise between Peter and Spencer is that the debate is falsely framed as binary. There's no need to subscribe to either Peter's fundamentalism or Spencer's naivete regarding the utility of precious metals. Indeed, there's a rightful place for gold, cryptocurrencies, and traditional asset classes in the same portfolio.

Contrary to Peter's claims, bitcoin, like other cryptocurrencies, are commodities. It's a finite reserve asset that serves as a store of value. And though it's not tangible, it's immutable, divisible, scarce, and interchangeable with other goods of the same type. That it's not used as an input in the production of goods of another type, doesn't make it less of a commodity.

I don't buy Peter's claim that gold and bitcoin have nothing in common. Despite what Peter might allege, both gold and cryptocurrencies are speculative investments. Their price mechanisms are complex and not fully understood by anyone; neither are based on fundamental factors such as interest, earnings, or revenue.

Institutional Inflation Hedge: A New Gold Standard?

Historically, gold has been used as an inflation hedge to ease investors’ fears of a weakened dollar. However, there are signs that tomorrow's capital will flow more toward bitcoin rather than gold as the new standard source of protection against the decreased purchasing power of a currency.

Despite his assertions to the contrary, there's a non-negligible chance that institutional money does, in fact, divest from gold and precious metals in favor of bitcoin. In the past year, major industry players have converted cash reserves into bitcoin, including:

- Square, Inc. ($425 million)

- MassMutual ($100 million)

- ARK Investment Management ($20 million)

- Kinetics Portfolios Trust ($17 million)

- Mode Global Holdings ($10 million)

A recent survey of 50 U.K. and U.S. institutional investors with a combined $78 billion in assets under management found that 26% believe that hedge funds, pensions, sovereign wealth funds, and family offices will “drastically” move into cryptocurrency. A further 64% believe that these funds will see a “slight rise” in their cryptoassets holdings.

Already we're seeing a wave of institutional money seeking exposure to bitcoin, ether, and other altcoins.

By mid-2024, institutional crypto holdings surpassed $100 billion globally, according to CoinShares, with major players like BlackRock and Fidelity launching or expanding Bitcoin ETF offerings.

However, it's crucial to note that many prudent, risk-conscious investors incorporate both assets into their retirement investing strategies to hedge against broader economic downturn. There's no reason to be fully committed to one asset class at the expense of the other.

Don't Take Sides; Hedge Your Bets

As of 2025, Peter Schiff continues to mock Bitcoin publicly on X (formerly Twitter), despite its meteoric rise. Meanwhile, Spencer—still all-in on BTC—has seen returns many times over since his early purchases in 2020.

Perhaps this is a ploy, and that both father and son are hedging their bets. If gold goes up, the Schiff family benefits. If crypto takes off, the Schiff's also win. For Schiff senior, this might be a creative charade designed to make him and his family “long” on both assets without conceding his personal faith in gold. To do otherwise would be a blow to his credibility, seeing as he's built a successful career over decades as gold's biggest public acolyte.

But, to keep things fun, let's give them the benefit of the doubt and assume that there's a legitimate Peter Schiff vs. Spencer Schiff philosophical divide that they feel compelled to air out publicly over the internet rather than the dinner table.

The fact is, Peter Schiff's bets against bitcoin have lost him money, whereas Spencer is currently up over 300% on his BTC play since he most recently purchased in September.

Will Spencer end up beating his dad at his own game? Only time will tell. There's no crystal ball that can foresee the longevity of bitcoin. In the meantime, it's crucial to understand that you can, in fact, like both apples and oranges. The real question is one of allocation and the specific amount of each that one should hold in accordance with their risk tolerance.

Smart money chooses both. It's not gold or BTC, it's a matter of how much to allocate to either and being flexible and adaptive in your investment strategy. To get started investing in precious metals in a tax-advantaged retirement account, check out our list of the best gold bullion investment companies. For exposure to cryptocurrency, speak with your financial advisor about opening a crypto IRA today.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,329.45

Gold: $3,329.45

Silver: $36.82

Silver: $36.82

Platinum: $1,388.07

Platinum: $1,388.07

Palladium: $1,153.30

Palladium: $1,153.30

Bitcoin: $109,622.77

Bitcoin: $109,622.77

Ethereum: $2,590.46

Ethereum: $2,590.46