- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

BitcoinIRA Review: Can You Trust This Company in 2024?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 22nd January 2024, 11:19 pm

BitcoinIRA

- Phone : (877)-936-7175

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

A pioneer in its field, BitcoinIRA is America’s first IRA company specializing in Bitcoin and cryptocurrency investing. Founded in 2015, BitcoinIRA grew from humble beginnings to become one of the country’s premier investing and trading platforms for digital assets. Known for its diverse range of digital assets on offer, the California-based company has recently expanded its lineup to include physical gold bullion as well as a best-in-class 6% interest-earning program for select holdings.

Pros:

- Global pioneer of both Bitcoin IRAs

- Widest selection of digital assets available to account holders

- Free Bitcoin IRA information guide

- 24/7 trading platform available in-app or desktop

- Gold eligible for purchase and trading

- Responsive customer support phone lines

- 2-6% Interest Earning Program for select investments

Cons:

- May not offer as many altcoins as some rival companies (subject to change)

- Administration fees and storage charges are not transparent

- Fee structure is higher than some competitors'

Quick Facts about BitcoinIRA

Year Founded:2015

Location:USA

Annual Fees:$240 Annual fee + flat 10-15% fee levied on initial investment, then 1% per trade/swap and 1% per sale. (Call to verify).

Supports Roth IRA?:Yes

Custodian:BitGo Trust

Assets Offered:Bitcoin, Bitcoin Cash, Gold (Bullion), Ethereum, Ethereum Classic, Ripple (XRP), Litecoin, Stellar Lumens, Zcash, Cardano, Chainlink, Dogecoin, and more.

Offers Other Assets?:Yes

Current Promotion:N/A

Insurance Offered?:$100 million

Have you purchased products from BitcoinIRA? Leave a review!

At the time of its founding in March 2015, BitcoinIRA (or “Bitcoin IRA”) was America’s first online cryptocurrency investing platform for individual retirement account (IRA) holders. As such, it received widespread media coverage in outlets such as CNBC, Forbes, and The Wall Street Journal. Although originally exclusive to Bitcoin investors, the company has diversified its product lineup with “altcoins” such as Ethereum, Litecoin, Zcash, and even physical assets such as gold.

However, the jury’s still out as to whether BitcoinIRA is worth the cost in today’s competitive market. BitcoinIRA is no longer the only game in town, as it now faces stiff competition from rivals such as Noble Bitcoin, and BitIRA. To help you decide whether BitcoinIRA is right for you, we reviewed their cryptocurrency IRA service below.

Table of Contents

- Company Background & Philosophy

- Bitcoin IRA Management Team

- Free Investor Guide: A Wealth of Bitcoin IRA Information

- BitcoinIRA Calculator

- BitcoinIRA Account Sign-up and Opening Process

- BitcoinIRA Fees and Account Minimums

- BitcoinIRA Storage and Security

- BitcoinIRA Products

- BitcoinIRA Blog and Resources

- BitcoinIRA Reviews, Ratings, and Complaints

- Review All Bitcoin IRA Options Before Investing

Company Background & Philosophy

Many industries experience what’s called the “first-mover advantage”, and the Bitcoin investing space is no different. As the first occupant of the market, BitcoinIRA brings with it a wealth of experience and consumer trust that other companies simply do not.

In March 2015, BitcoinIRA was founded by investment entrepreneur Chris Kline (now Chief Operating Officer) in collaboration with Edmund “Ed” Moy, the former Director of the United States Mint. BitcoinIRA began offering Bitcoin investment services to American retirement investors within Traditional and Roth IRA accounts, at a time when Bitcoin investing was not only seen by many as a “fringe” asset, but also when no online service was available to make Bitcoin investing accessible to the average American investor.

The following year, BitcoinIRA expanded to include Ether (ETH), the cryptocurrency token of Ethereum. Today, Ether is the world’s second-largest cryptocurrency by market capitalization. Regarding their inclusion of Ethereum in their product line, COO Chris Kline had this to say:

“Cryptocurrency as an industry is on a new wave of mainstream adoption. As a business, it made sense to listen to our clients. They wanted Ethereum, so we delivered.”

BitcoinIRA is a firm believer in the power of Bitcoin and other cryptocurrencies as a stabilizing force in retirement portfolios. In a volatile stock market and inflation-prone monetary environment, cryptocurrencies such as Bitcoin hedge against the instability of dollar-denominated assets like U.S. equities, bonds, and real estate. Unlike conventional assets, cryptocurrency prices move independently of the U.S. dollar, which makes them a useful tool for protecting one’s wealth during retirement.

Beginning in 2019, BitcoinIRA began offering gold bullion to their customers, which can be bought, sold, and traded within the same portfolio as cryptocurrencies. In collaboration with the Virginia-based Brink’s Company, BitcoinIRA provides gold investing, vaulting, and storage services for investors looking to add additional diversification to their retirement portfolios.

Bitcoin IRA Management Team

What sets BitcoinIRA apart from many of its competitors is that they are fully transparent about the individuals who comprise their executive team. BitcoinIRA publicly discloses the personnel on its all-American management team, and proudly puts a human being to their brand, which is more than many companies in the alternative investing space can say.

Ed Moy (Chief Strategist)

Ed Moy served as the 38th Director of the U.S. Mint from 2006 until 2011 after being appointed by then-President George W. Bush.

Mr. Moy’s 5-year tenure as the head of the U.S. Mint was a definitive success. He oversaw the last days of the “50 State Quarter Program”, and the launching of both the National Park Quarters Program and Presidential Dollar Program. He also oversaw the relaunch of the Saint Gaudens Double Eagle coin. All of these programs were so wildly successful that Moy's Mint contributed over a billion dollars in surplus funds back to the General Fund of the U.S. Treasury.

As Mint Director, Ed Moy dedicated a great percentage of his professional career to considering and penning opinion pieces on monetary policy and the ways in which they hinder or improve global economic conditions. Moy has been a big believer in the liberating power of precious metals and Bitcoin throughout his career. Regarding Bitcoin, Mr. Moy once wrote:

“[Bitcoin is a] technological leap that puts the creation of money and the determination of its value back into the hands of individuals and the private sector…The free market determines the value of a bitcoin through competition, not by government fiat…The promise of digital currency is a new financial transaction system: cheaper, more efficient, and secure transactions. No currency wars, exchange rates, and arbitrage. There could be less friction and more transparency for every transaction.”

Ed Moy brings to the job his educational background in economics, political science, and international relations. While heading the U.S. Mint, he supervised operations in the challenging years of the global financial crisis (2007-2010) and the Great Recession, at a time of historically unparalleled demand for both silver and gold bullion.

Besides his Chief Strategist position at BitcoinIRA, Ed serves as the Chief Strategist for Fortress Gold Group. This is a major provider of physical gold IRAs. He has offered them his expert and experienced analysis of fiscal and monetary policy, precious metals markets, and digital currencies. In 2013, Mr. Moy became the bestselling author of American Gold & Platinum Eagles: A Guide to the U.S. Bullion Coin Programs, which is available on Amazon.

Chris Kline (Chief Operating Officer)

Investment entrepreneur Chris Kline co-founded BitcoinIRA in March 2015 to help bring cryptocurrency investment services to more American retirement investors than ever before. Like Chief Strategist Ed Moy, Chris Kline has a professional background in the precious metals industry as an executive of Fortress Gold Group.

Mr. Kline is chiefly responsible for overseeing the day-to-day affairs of BitcoinIRA, as well as its products and partnerships. He is a graduate of The University of Colorado, Boulder, with a degree in international finance. Under his leadership, BitcoinIRA has grown into a turnkey solution for retirement investors looking to diversify with cryptocurrencies and precious metals, and now has over $100 million in assets under its custodianship. He is a long-time member of the Forbes Finance Council.

Camilo Concha (Executive & Board Member)

The Los Angeles-based Camilo Concha is the chief executive of BitcoinIRA, a position he has held for several years. Mr. Concha joined BitcoinIRA’s Board of Directors upon the company’s founding. He brings to the team his executive experience as the CEO of LendingUSA, a point-of-sale lending solution that has processed over $2 billion in loan requests.

Other key personnel on BitcoinIRA’s management team include Johannes Haze (CMO and Co-Founder), Robert Broomandan (CTO), and Maryann Bullion (General Counsel).

Free Investor Guide: A Wealth of Bitcoin IRA Information

Self-directed IRA investing can be complicated, especially when it includes alternative assets such as cryptocurrencies and precious metals. Since these assets cannot be included in typical brokerage retirement accounts, it’s entirely up to investors themselves to handle regulatory compliance issues.

Fortunately, BitcoinIRA makes it easy to stay in the IRS’ good books by providing a free Investor Guide that is available upon request. Delivered in PDF format via email, the Investor Guide contains all of the need-to-know details about managing your cryptocurrency IRA. If you follow the rules outlined in this document, you can rest assured that you won’t run into compliance issues.

BitcoinIRA’s free Investor Guide is available here in exchange for your email address and basic personal information, including your phone number.

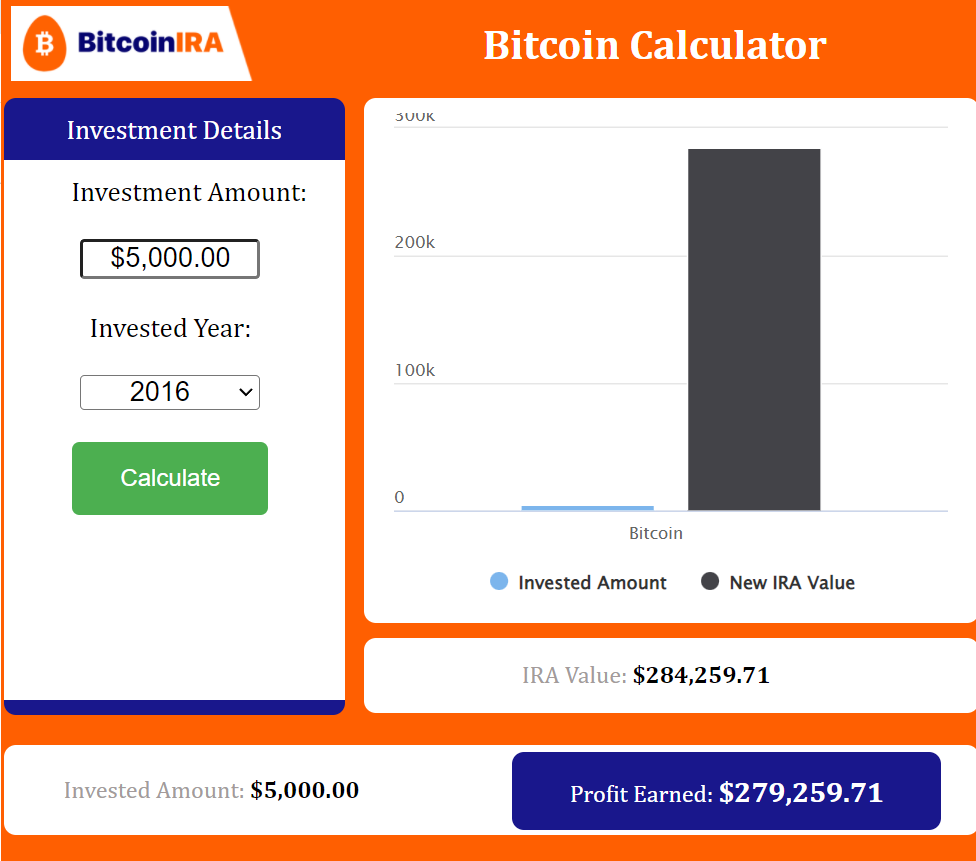

BitcoinIRA Calculator

Something that appears to be unique to BitcoinIRA is their Bitcoin investment calculator, pictured below. To use the calculator, simply input a hypothetical initial investment amount and the year in which you would have invested it. It then tells you what the value of your Bitcoin holdings would be according to its current spot price.

You can see that since 2016, $5,000 invested on January 1st would, as of December 2021, be worth an incredible $284,259—returns over 50x the initial investment.

Obviously, past performance is no guarantee of future returns. However, these gains are demonstrative of Bitcoin’s massive wealth-building potential for those who are still sitting on the sidelines trying to decide whether or not to invest their hard-earned retirement IRA dollars in the world's largest cryptocurrency.

Source: Bitcoin IRA Calculator

BitcoinIRA Account Sign-up and Opening Process

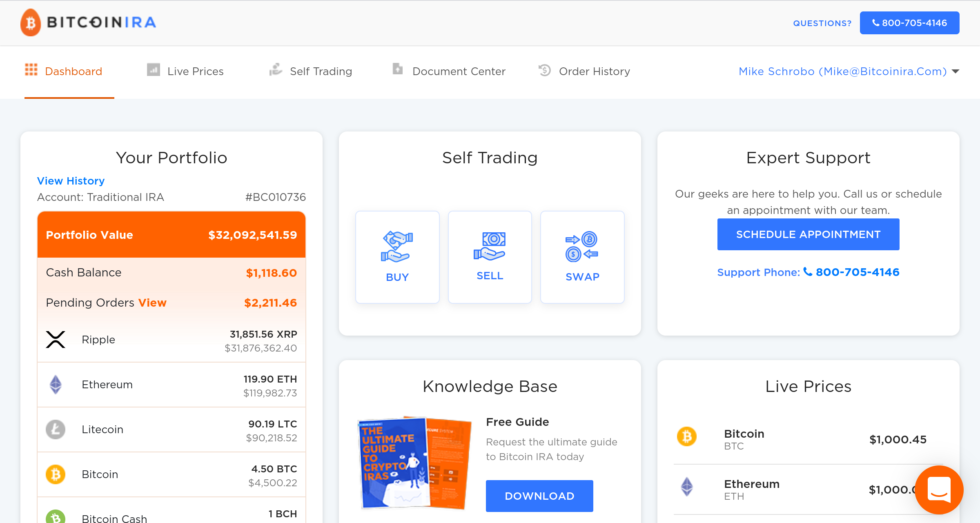

Registering for an account with BitcoinIRA only takes about 30 seconds. Simply visit the company’s homepage and click the blue “Get Started” button in the top-right corner to begin the set-up process. After you’ve inputted your personal information, you will be immediately taken to your dashboard without even needing to verify your email.

The BitcoinIRA dashboard features a host of useful information for a cryptocurrency investor. For example, the right-hand side of the screen features a “Live Prices” section that displays the current trading price of Bitcoin, gold, and several of the leading altcoins.

On the left-hand side is the “Your Portfolio” panel that displays the current value of your IRA holdings.

Also of importance is the “Knowledge Base” panel in the center of the dashboard that serves as an educational resource for investors, including hours’ worth of video walkthroughs.

On the top-right is the “Expert Support” panel that allows users to access telephone support from company representatives or schedule a support appointment.

Signing Up for BitcoinIRA

Once you have accessed your account dashboard, select the panel in the top-left corner that reads “Fund Your Account” (or “Your Progress”, if you’ve already selected this in the past). From there, you will be given two funding options:

- Transfer from an existing account: This process initiates an IRA rollover or a 401(k)-to-IRA transfer using funds distributed from an existing retirement account.

- Transfer from a bank account: This process involves a direct deposit from the user’s bank account into their new BitcoinIRA retirement account.

No matter which option you select, the funding process still takes several business days (typically between 2 and 4) before funding appears in your account. They both entail the same fees, so your decision should ultimately hinge on whether you have contribution room left over to create a new IRA, or if you would rather reinvest funds already contributed to an old IRA.

(Note: Until 2025, the IRS has imposed annual contribution limits on IRAs at $7,000, or $8,000 if the account holder is aged 50 or older. Be mindful of these limitations when selecting an account funding option, as you may not have contribution room available to fund a new account without rolling over funds from an existing IRA.)

After inputting all of your relevant personal information, you will finally be prompted to select your account type. At the time of writing, BitcoinIRA offers the following account types:

- Roth IRA: Accounts that consist of after-tax dollars that appreciate on a tax-free basis; generally preferable for investors who expect to be in a higher marginal tax bracket at the time of withdrawal in retirement.

- Traditional IRA: Accounts that consist of pre-tax dollars that appreciate on a tax-deferred basis; generally preferable for investors who expect to be in a lower tax bracket at the time of withdrawal in retirement.

- 401(k): An employer-sponsored deferred-income plan that operates in collaboration with the account holder’s employer; availability of this account type is subject to the policies of the employer and may not be available to all users.

Regardless of which account type you select, BitcoinIRA handles the process from end to end. This is one of the key benefits of opening an account with BitcoinIRA, since they contact your existing account administrator (in the case of an IRA rollover) and facilitate the entire process without needing any involvement from the end-user.

BitcoinIRA Fees and Account Minimums

In our opinion, BitcoinIRA’s fees are a little steep, at least when compared to some of their competitors. Unfortunately, BitcoinIRA requires you to contact their sales representatives in order to learn about their fees. To save you time, we’ve listed their fees below:

- $240 annual custodial fees

- One-time fee of 10-15% of initial investment value

- $75 asset conversion fee

- ~5% buy order fees

- ~1% sell order fees

- $100 opening position fee (Exclusive to “Interest Earning Program”)

- $100 closing position fee (Exclusive to “Interest Earning Program”)

Although these fees may seem gratuitous at face value, upon closer inspection they aren’t truly as high as they look. In short, the costs have to be measured against the gains. Bitcoin’s year-over-year gains between 2020-2021 were over 100%, which more than doubled their account holder’s gains (tax-free).

Currently, the minimum capital requirement for a BitcoinIRA account is $3,000. However, the Interest Earning Program requires a minimum deposit of $10,000.

BitcoinIRA Storage and Security

Bitcoin storage is a critical issue no matter which self-directed IRA firm you choose to partner with. This is because if they are not properly stored and cared for, they can be hacked, stolen, or wiped out in a natural disaster or a computer virus that can destroy the computers on which the assets are stored.

BitcoinIRA maintains the highest security protocols in the industry, including 256-bit SSL encryption to secure their online trading platform. Additionally, BitcoinIRA provides up to $100 million in FDIC insurance to guarantee their customers’ custodial assets.

In order to maximize the security of their customers’ assets, BitcoinIRA partners with BitGo Trust and Lloyd’s of London to securely store all investor funds. In addition, BitcoinIRA only works with U.S.-based cryptocurrency exchanges subject to SEC regulations.

Neither BitGo nor BitcoinIRA elaborates on their exact method of storage, whether it is offline, cold storage, or a sensible combination of the two. However, BitGo does provide the following graphic below which demonstrates a clear competency and expertise in handling, processing, and storing cryptocurrencies.

Source: BitGo Trust

Regarding their physical gold holdings, BitcoinIRA partners with U.S.-based Brink’s in order to vault and store the metals safely in IRS-approved storage facilities. To date, BitcoinIRA’s third-party storage providers (Brink’s and BitGo) have never experienced a security breach that jeopardized their clients’ assets.

BitcoinIRA Products

In addition to Bitcoin and gold, BitcoinIRA also offers a host of major altcoin products that can be purchased and stored on their trading platform, including:

- Ethereum (ETH)

- Ripple (XRP)

- Polkadot (DOT)

- Cardano (ADA)

- Dogecoin (DOGE)

- Chainlink (LINK)

In total BitcoinIRA offers a selection of 60 crypto coins for you to choose from for your crypto IRA.

As previously stated, BitcoinIRA’s account types include Roth IRAs, traditional IRAs, and 401(k) accounts.

BitcoinIRA Blog and Resources

BitcoinIRA’s content team publishes a monthly blog that has grown into a reputable outlet within the cryptocurrency infosphere. Below you see their #40 ranking in the top 100 most important Bitcoin blogs per Feedspot:

Source: Feedspot “Top 100 Bitcoin Blogs”

BitcoinIRA Reviews, Ratings, and Complaints

To help you decide whether BitcoinIRA is right for you, we’ve provided a list of the company’s public ratings and reviews from reputable online review aggregators below.

- BCA Rating: “AA” Company Rating

- BCA Complaints: 0 Complaints (Details)

- BBB Rating: ⭐⭐⭐, (“A+” and 2.6 Star Rating based on 5 Customer Reviews)

- BBB Complaints: 3 cases closed in the last 3 year

BitcoinIRA Company Contact Information

- Address: 15303 Ventura Blvd, Suite 1060, Sherman Oaks, CA 91403

- Phone: 877-430-3546

- Website: www.bitcoinira.com

- Opening Hours: Monday-Friday from 8 am-5:30 pm PST

Review All Bitcoin IRA Options Before Investing

In sum, BitcoinIRA has a diverse product lineup that investors can’t find anywhere else, including a unique Earn program that allows account holders to rake in between 2% and 6% APY on their holdings in addition to natural asset appreciation over time. When combined with their excellent customer support and intuitive interface, there’s no reason not to try BitcoinIRA services if you’re interested in gold or crypto investment within a tax-free retirement account.

Although BitcoinIRA offers an excellent cryptocurrency IRA investing service, you should do your homework before you make a final decision. We recommend contacting several similar self-directed IRA services to find a company that offers the perfect product for your needs. You can read more of our Bitcoin IRA company reviews here.

(Note: Do you own or represent BitcoinIRA? If you would like to get in touch with our reviewers in order to speak about the ratings and reviews provided in this article, or any comment provided herein, please use this secure contact form.)

BitcoinIRA

- Phone : (877)-936-7175

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

A pioneer in its field, BitcoinIRA is America’s first IRA company specializing in Bitcoin and cryptocurrency investing. Founded in 2015, BitcoinIRA grew from humble beginnings to become one of the country’s premier investing and trading platforms for digital assets. Known for its diverse range of digital assets on offer, the California-based company has recently expanded its lineup to include physical gold bullion as well as a best-in-class 6% interest-earning program for select holdings.

Have you purchased products from BitcoinIRA? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum