Lexi Capital Review: Is This IRA-Approved Gold and Silver Bullion Provider Worth the Money?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 23rd September 2024, 09:30 pm

- Phone : (800) 473-1213

- URL :

- Global Rating

- Good

User Rating

- 1 Reviews

Based in North Carolina, Lexi Capital is a provider of gold IRAs and IRA-compatible bullion. If you are nervous about making a mistake when you buy gold for your IRAs, Lexi Capital offers the perfect antidote with its returns and exchange policy. And what makes the company stand out is its Gold Assurance Program, which protects gold investors from dips in the price of gold for up to six months after purchase. Nonetheless, a lack of transparency around pricing and selection makes us hesitant to fully endorse it.

Pros:

- Over a decade in business

- Low $1,500 minimum investment requirement

- Partners with reputable STRATA Trust Company for custodianship

- Offers comingled or segregated storage in a Delaware-based repository

- Includes some rare and collectible non-IRA coins for sale

- Offers live chat support on website

Cons:

- Low transparency; no products or prices displayed on website

- Social media presence is inactive and out of date

- Small selection of non-IRA bullion

- Customer support phone line does not have set, guaranteed hours

Lexi Capital is a provider of gold and silver IRAs and bullion products based in Raleigh, North Carolina. The firm provides IRA custodianship and vault storage via third parties and offers a special guarantee to buyers of bullion with its unique Gold Assurance Plan. For six months after purchase, this plan protects the price of purchased gold against drops in value.

Table of Contents

- Company Background and Philosophy

- Lexi Capital 2022 Reviews, Ratings, and Complaints

- Lexi Capital Management Team

- Lexi Capital Sign-Up Process

- Lexi Capital Coins and Bars

- Lexi Capital Gold Assurance Plan

- Lexi Capital IRS-Approved Vault Storage

- Lexi Capital Fees

- Lexi Capital Account Minimum

- Lexi Capital IRA Custodian

- Lexi Capital IRA Rollovers and Transfers

- Lexi Capital Website

- Lexi Capital Customer Education

- Why Get a Gold IRA with Lexi Capital?

- Contact Us If You Represent Lexi Capital

Company Background and Philosophy

Lexi Capital Background

It is no coincidence that Lexi Capital was founded in 2010, just two years after the 2008 financial crisis that crippled traditional IRAs and 401(k) accounts with big holdings in conventional stocks. The founders of Lexi Capital saw that the reliability of precious metals offered American investors a better deal by offering protection when the stock market crumbles.

The price of gold tends to go up when the price of other assets goes down. The technical term for this behavior is ‘inverse correlation’. It happens because gold is seen as a safe haven in times of inflation and market crisis and so investors flock to gold. There is thus more demand for gold and the price rises. Investors holding gold in their IRAs benefit. In practice, this means that a gold IRA is designed to keep your retirement savings safe even if financial markets crash.

At one time, Lexi Capital had an office in Westlake, California, registered with the Better Business Bureau.

Lexi Capital Philosophy

The idea for Lexi Capital’s unique offering came out of a final year project by two graduates of UCLA. The idea was to bring to market a business that allowed retail buyers to buy gold and silver with the same protections given to big Wall Street investment houses. Funding was secured from friends and family and the company was launched with the Gold Assurance Plan offering 6 months of protection against price fluctuations on newly-bought gold.

Lexi Capital 2022 Reviews, Ratings, and Complaints

Lexi Capital has gained excellent ratings with the Better Business Bureau (A+) and the Business Consumer Alliance (AAA). The firm has received no reviews or complaints elsewhere.

Reviews & Ratings

- Better Business Bureau: A+

- Business Consumer Alliance: AAA

- Trustpilot: Unrated

- Yelp: Unrated

Complaints

- Better Business Bureau: None

- Business Consumer Alliance: None

Lexi Capital Management Team

Chris Mitchell (Chief Executive Officer)

Chris has served as CEO of Lexi Capital since 2020. Chris says that at Lexi Capital he is continuing a ‘tradition of excellence to ensure our clients are supported and satisfied with our services.’ His public social media profiles indicate that he feels passionate about helping Americans add alternative assets, such as Bitcoin, gold, and silver bullion to their IRAs and tax-advantaged retirement accounts.

Chris began his career in real estate sales with Realtor.com. He then earned a hefty 11 years of experience in precious metals in his role as a Senior Portfolio Manager at Lear Capital before taking up the helm at Lexi Capital. In 2018, Chris founded Bitcoin Advizers LLC which offers cryptocurrency IRAs, a company that he operates in tandem with Lexi Capital.

Check out Lexi Capital CEO Chris Mitchell’s LinkedIn profile here.

Lexi Capital Sign-Up Process

The IRA sign-up process with Lexi Capital involves four basic steps:

- Begin your application by downloading their online IRA form from their website.

- Supply your Social Security details and relevant retirement account data.

- Phone Lexi Capital (800-473-1213) and discuss your IRA and bullion options with an advisor.

- Stock your IRA with bullion assets.

Lexi Capital Coins and Bars

Unfortunately, Lexi Capital does not publicize which coins and bars it has on offer. In our view, this is a major blow against its credibility because most of its competitors (such as Noble Gold, for instance) publicly list the assets that they help their clients invest in.

Note that not all bullion or coin products are eligible for IRA inclusion, including those offered by firms such as Lexi Capital. Remember that, for your gold IRA to be valid, you must invest in IRS-approved bullion only. Check out our guide to IRS-approved precious metals.

Lexi Capital Gold Assurance Plan

What makes Lexi Capital stand out amongst precious metal IRA providers is its Gold Assurance Plan. This aims to protect regular Americans buying gold in the same way that big institutions are sometimes protected by bullion providers. The Gold Assurance Plan gives some protection against the price of gold falling after gold is purchased.

For example, you might buy coins when gold is priced at $2000 per oz. A month later, the price of gold may have fallen to $1800 per oz. In this case, your investment would have lost 10% of its value within a month. The Gold Assurance Plan aims to support the buyer in this situation. Lexi Capital explains that:

“Coins eligible for The Gold Assurance Plan have six months of protection of up to $500 per ounce. Your portfolio’s eligibility is communicated during purchase.”

Lexi Capital IRS-Approved Vault Storage

To comply with IRS regulations, any bullion you put into your IRA must be stored with a vault approved by the IRS. Lexi Capital does not arrange this service directly. Rather, storage can be arranged by the firm’s partner custodian STRATA Trust at the IRS-approved Delaware Depository.

There are two vaults available: one in Wilmington, Delaware, and another in Boulder City, Nevada. Delaware Depository facilities are fully-authorized for IRA storage (as well as used for CME & ICE gold derivatives). Insurance up to $1bn is provided by Lloyds of London.

Source: Delaware Depository.

Most importantly for discerning investors, Delaware Depository offers commingled and segregated storage options:

- Commingled storage means your bullion is stored on a nominal basis. If you put in an American Gold Eagle, for example, you will receive one when you withdraw your assets — but it will not necessarily be the same coin.

- Segregated storage means your bullion is stored separately from other coins and bars. This means that, when it comes to withdrawal, you will definitely receive exactly the same items that you stored. With all vaults, segregated storage is more expensive than commingled storage.

Lexi Capital Fees

| Lexi Capital Service | Lexi Capital Fee |

|---|---|

| IRA management | Investment less than $50k: $285 for the first year, then $180 per year Investment over $50k: no fee |

| Bullion storage in an IRS-approved vault | Commingled: $100 per year Segregated: $150 per year |

| Shipping fee for non-IRA precious metals | $14.95 |

| Shipping fee discount | 3% off shipping orders paid with checks, wire payments or cash |

Lexi Capital offers a return/exchange policy if you get in touch by phone within 3 days of your purchase. If you cancel your order, the firm will charge you $45 as well as any ‘market loss’ it has incurred.

Lexi Capital Account Minimum

The minimum you can invest with Lexi Capital is $1,500. This is close to competitor Noble Gold’s minimum of $2,000. Both minimums compare very favorably to competitor Goldco’s minimum investment threshold of $25,000. For low-income or younger investors without a lot of capital with which to invest, Lexi Capital may, therefore, be a suitable option.

IRS rules stipulate that you can invest a maximum sum of $6,000 per year into your portfolio of IRAs if aged under 50 years old and a maximum of $7,000 if aged over 50 years old.

Lexi Capital IRA Custodian

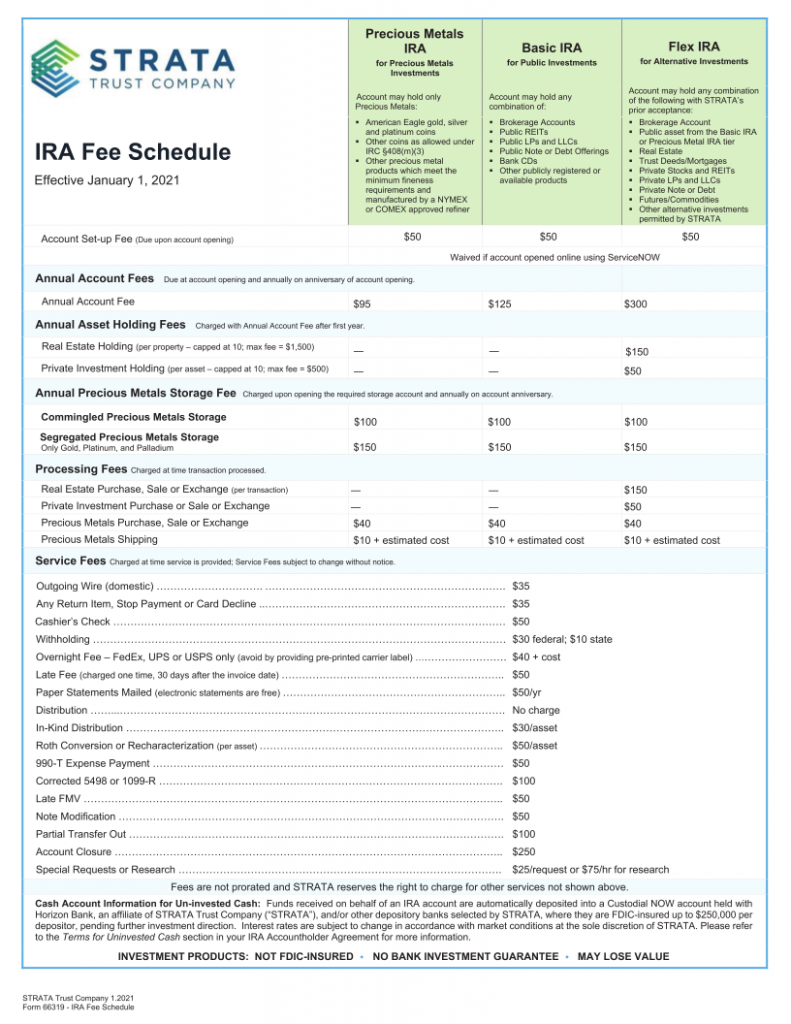

Unlike some competitors, Lexi Capital does not act as custodian for your gold IRA. It is a legal requirement for precious metal IRAs to have an authorized company act as custodians. You cannot be a custodian yourself — nor would you want to be, as the IRA custodian is responsible for keeping all the IRS reporting and paperwork up-to-date!

Lexi Capital offers custodianship through partner STRATA Trust Company, based in Austin, Texas. STRATA was founded in 2008 as a subsidiary of Horizon Bank and was formerly known as Self Directed IRA Services Inc. STRATA has 46 employees and has served 40k customers. The firm has $3bn in assets under management.

(Fee list from STRATA Trust)

Get more info on Lexi Capital’s preferred IRA custodian by checking out STRATA Trust’s LinkedIn profile here. Or dive deeper with STRATA TRUST’s page on precious metals IRAs, which contains all the information you need to know about Lexi Capital's custodial partner.

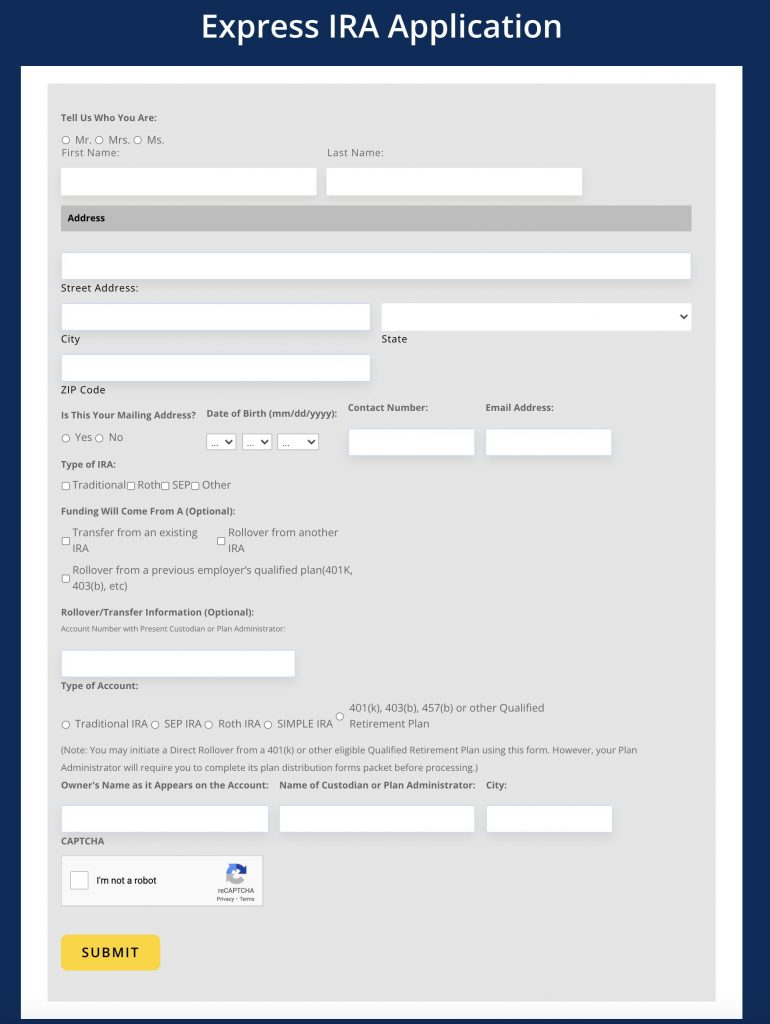

Lexi Capital IRA Rollovers and Transfers

If you already have an IRA or 401(k) account, Lexi Capital will arrange for a transfer or rollover of your funds. You can set up either a traditional or Roth IRA. You can use the Express IRA application form online to apply for either account type.

(Application form from Lexi Capital)

Lexi Capital Website

The Lexi Capital website is smart and easy to read. The information provided is very basic, but it does include a helpful FAQ section that covers essential information such as the sign-up and cancellation processes. Best of all, there's a live chat feature to help you contact a support agent, which gives it a leg up on competitors such as Noble Gold who are sorely lacking in live online chat support. However, you will need to phone 800-473-1213 to drill down to details of products and pricing because they vary with time.

(Screenshot from Lexi Capital's homepage)

Lexi Capital Customer Education

Free Guide Mailed to your Home

Lexi Capital offers a free investor kit. But the link on the website to apply for this does not currently work. This constitutes yet another strike against the service's credibility, especially since IRS compliance is such a vital part of the IRA investing experience. Without adequate client education, Lexi Capital clients can expose themselves to regulatory risk unwittingly.

Why Get a Gold IRA with Lexi Capital?

With its low minimum investment threshold of $1,500, an IRA with Lexi Capital would suit the cautious investor who may not have much money with which to invest. With no review activity and sparse information provided online, it is difficult to gauge the level of service quality provided. Therefore, consumers should proceed with caution before choosing this gold and silver IRA provider.

With that said, the IRA custodian which Lexi Capital uses, STRATA Trust, is certainly a reputable provider. Lexi Capital’s appointed vault, the Delaware Depository, is also a reputable provider. Even if information about Lexi is sparse, it certainly gives us confidence knowing that they partner with reputable third-party custodians and vaults.

Remember that, to guard your retirement funds best, you should not just invest in a gold IRA. Ensure that you have a diversified portfolio, with exposure to other assets like stocks, ETFs, commodities, and real estate. As an investment, gold is seen to be a hedge against inflation as well as an asset that has historically risen over time as well as weathered stock market crashes. But to be prudent, you must balance your gold IRA with other investments.

With so many reputable and transparent gold IRA companies on the market, we can't enthusiastically endorse Lexi Capital. However, those looking for low exposure to gold in their IRA without spending more than $1,500 may be enticed by the company's low capital requirements. We recommend inquiring with several other companies before making a final decision. To do so, check out our review list of 2023's top gold IRA providers.

Contact Us If You Represent Lexi Capital

At Gold IRA Guide, we want to deliver 100% accuracy in our reviews. If you are a representative of Lexi Capital and would like to provide updates on your company, please contact us using this secure online form.

- Phone : (800) 473-1213

- URL :

- Global Rating

- Good

User Rating

- 1 Reviews

Based in North Carolina, Lexi Capital is a provider of gold IRAs and IRA-compatible bullion. If you are nervous about making a mistake when you buy gold for your IRAs, Lexi Capital offers the perfect antidote with its returns and exchange policy. And what makes the company stand out is its Gold Assurance Program, which protects gold investors from dips in the price of gold for up to six months after purchase. Nonetheless, a lack of transparency around pricing and selection makes us hesitant to fully endorse it.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,330.67

Gold: $3,330.67

Silver: $36.82

Silver: $36.82

Platinum: $1,384.05

Platinum: $1,384.05

Palladium: $1,126.20

Palladium: $1,126.20

Bitcoin: $108,174.39

Bitcoin: $108,174.39

Ethereum: $2,550.40

Ethereum: $2,550.40