My Digital Money Review (2025): Is This Crypto IRA Newcomer Worth Your Business?

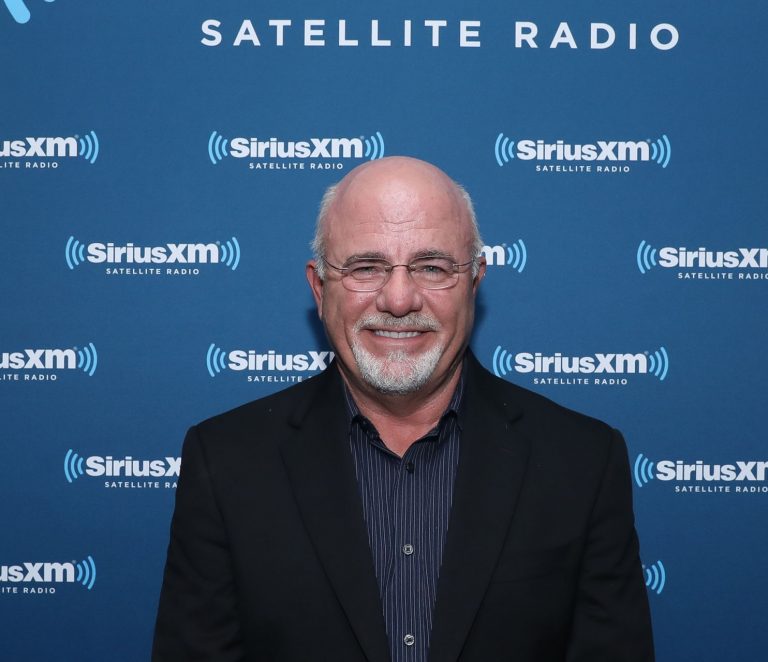

My Digital Money (MDM) is a cryptocurrency IRA solution that brings cutting-edge security and hassle-free simplicity to retirement investors looking to invest in Bitcoin and altcoins. The brainchild of founder Collin Plume, My Digital Money was founded in April 2021…

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24