- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Everything You Need to Know About Taxes and Your Gold IRA

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 16th September 2021, 06:33 pm

Many retirement investors add gold to their individual retirement account (IRA) specifically because they don't want to think about tax implications. They'd rather let their assets sit in a tax-deferred account, like a Traditional IRA, without paying a dime to Uncle Sam until the day they choose to retire.

Even then, gold IRAs are still taxable. Regular marginal tax rates (and not the 28% collectible tax rate) apply to the gains on assets held in your gold IRA. Plus, there are early withdrawal penalties if you take a distribution from your IRA too early.

If you're not careful, you might be on the hook for more taxes, fees, and penalties incurred by misusing your IRA. Fortunately, we’ve got you covered. In this guide, we'll cover what to know about taxes and gold IRAs—this way, you can keep more of your wealth in your own hands rather than the IRS'.

Table of Contents

Gold IRAs 101: Roth vs. Traditional

The tax implications vary widely between the two main types of gold IRAs: Roth and Traditional. Let's go over the key differentiating factors between Roth and Traditional IRAs when it comes to their respective tax requirements.

First, note that both types of accounts are tax-advantaged retirement vehicles, meaning they are designed to allow individuals to build wealth intended for their retirement via tax benefits. However, the Roth IRA allows for tax-free growth and the Traditional IRA provides tax deferment.

Therefore, Roth IRAs are made up of after-tax income whereas Traditional IRAs are pre-tax. When you withdraw from a Roth IRA, there is no tax owed on the distributions, but Traditional IRA withdrawals are subject to ordinary income tax rates. Below, I've summarized the key differences between these two account types.

Traditional IRA

- Contributions are tax-deductible in the year made

- Taxes on all earnings are deferred until the funds are withdrawn

- Distributions and withdrawals are taxed as ordinary income

- Eligible for precious metals inclusion (physical and paper)

- $6,000 annual contribution limit ($7,000 if you’re 50 or older)

Roth IRA

- No tax deductions available for year of contribution

- Taxes on all earnings are deferred while funds are inside the account

- Distributions and withdrawals are completely tax-free

- Eligible for precious metals inclusion (physical and paper)

- $6,000 annual contribution limit ($7,000 if you're 50 or older)

Therefore, both the Traditional IRA and Roth IRA offer tax advantages to investors looking to invest in gold, silver, platinum, palladium, or other physical precious metals. However, they vary in the type of advantages they present and investors should choose an account that best suits their financial situation.

Which Gold IRA Type Is Best For Me?

It's not always easy to decide on the best retirement type for one's needs. However, there’s a general rule of thumb that can help investors choose between Roth and Traditional IRAs. I've outlined this basic heuristic below:

- Roth IRAs: Better suited for investors who expect to have a higher income during retirement than what they currently earn

- Traditional IRAs: Better suited for those who expect to have a lower taxable income during retirement than right now

It's also worth noting that Roth IRAs may be better for risk-averse investors. Roth IRAs eliminate some degree of uncertainty since the account holder won't have to wonder what marginal tax rate their withdrawals will be subject to in retirement. Therefore, it’s easier to plan and financially forecast with a gold Roth IRA as opposed to a traditional gold IRA.

To be sure, always consult with a qualified and licensed financial advisor before opening an investment account. Everyone's financial circumstances are different, and there may be unique reasons why one account type better fits your goals and not another.

Is Gold Taxable in an IRA?

It depends. If you've chosen a Traditional IRA, then the gains on gold investments will be taxable once the account holder cashes out. These gains are taxed as ordinary income at marginal tax rates identical to cash savings (e.g., 24%, 32%, 35%, etc.).

A common misunderstanding about gold IRAs is that physical gold is sometimes mistaken as a collectible and, therefore, falsely assumed to be taxable at the 28% collectible tax rate. This is untrue since collectible items are expressly prohibited from being included in tax-advantaged retirement accounts per IRC Section 401(a).

If you're wondering what to know about taxes and gold IRAs, perhaps it's most important to understand that gold withdrawals are taxed at marginal rates identical to cash. However, gold withdrawals from a Roth IRA are entirely tax-free.

Tax Implications of Selling A Coin Collection

Numismatics and rare coin enthusiasts often ask us, “What are the tax implications of selling a coin collection?” Since these coins are often made of silver or gold, they can be worth a considerable amount in the collector's aftermarket.

You must only pay taxes on the profits gleaned from the coin sale in the form of a capital gains tax. In the U.S., short-term capital gains are capped at 37% and long-term capital gains are capped at 20%. There are no taxes owed on coin sales that do not generate a profit or even result in a net loss.

Note that silver or gold coins cannot be included in an IRA or 401(k) employer-sponsored retirement account. If you sell precious metals coins, these transactions are independent of any tax advantages offered by an IRA.

(By the way: If you're looking to calculate the melt value of your gold coinage or scraps, check out our handy gold calculator to see what it's worth in the aftermarket.)

Fees and Costs Associated With Gold IRAs

Taxes are certainly an important consideration when managing your wealth in a gold IRA. However, there are other fees and costs that also have to be factored into the equation, such as:

- Gold storage fees: Gold IRA providers often charge setup fees and annual storage fees as core aspects of their business model, and some even tack on shipping fees which vary according to the product weight. One-time setup costs between $50 and $200 are not uncommon, followed by annual fees of $50 to $300.

- Account administration fees: Occasionally, you will find gold IRA vendors who also add account administration fees to their slate of annual charges, which range from $100 to $250 dollars per annum.

- Transaction fees: Wire transfers, checks, closing fees, outgoing transfers, and reporting corrections to the IRS can trigger transaction fees that vary greatly in price but typically range between $10 and $175 per transaction.

- Insurance: Gold IRA providers are fully insured against losses, theft, or damages but some vendors may charge a small percentage of your account value (e.g.0.25-1.0%) to cover insurance premiums.

Of course, capital gains tax on gold sales (for collector's coins) or income taxes (for bullion) are other major considerations that we've already covered.

Early Withdrawals and Mandatory Withdrawals

There are fees and penalties that come with taking withdrawals too early or too late. The minimum age threshold for taking a penalty-free distribution from an IRA is 59.5. You must reach 59.5 years of age to withdraw gold or any other asset type from your IRA without incurring a 10% early withdrawal penalty.

Likewise, there are severe penalties for not taking a required minimum distribution (RMD) by the age of 70.5. If you're over the age of 70.5 years and do not take an RMD from your gold IRA you may owe 50% of the value of your RMD to the IRS when you eventually withdraw it.

In sum, to avoid fees and penalties do not take a distribution from your gold IRA before the age of 59.5 and make sure you take your first RMD before the age of 70.5.

Don't Get Burned by Your Gold IRA

Gold IRAs are an excellent tax-advantaged retirement vehicle that can help you diversify responsibly for your later years. But if you're not careful, you might end up footing a hefty bill to the IRS or to a predatory account provider that overcharges for storage fees, administrative costs, and insurance premiums.

Source: GoldIRAGuide

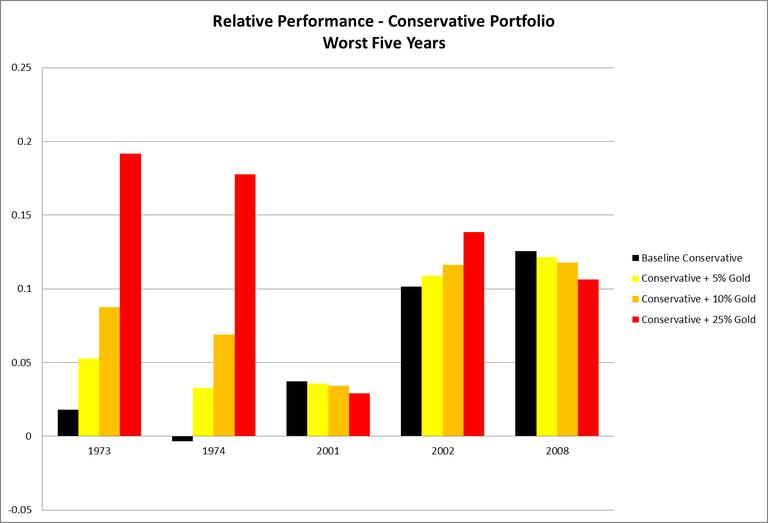

When done correctly, gold IRA investing can provide exceptional stability and growth during times of economic downturn. In the chart above, notice how well gold-heavy investment portfolios performed during the most recent recessions and economic crises, such as the global financial crisis and the bursting of the early-2000s dot-com bubble.

If you're going to invest in a gold IRA, invest safely and with peace of mind. Start with downloading our free gold IRA guide, a how-to manual for responsibly investing in gold and other precious metals within an IRA. Not only will you learn what to know about taxes in a gold IRA, but also how to avoid scams, predatory vendors, and common mistakes.

Gold IRA and Taxes: Frequently Asked Questions (FAQs)

When must an investor pay taxes on an IRA?

Roth IRAs are composed of after-tax money, so the earnings in a gold Roth IRA are completely tax-free. However, earnings from a Traditional IRA are taxed as ordinary income at the moment of withdrawal.

Do you pay taxes if investing in an IRA?

Yes, Traditional IRAs are subject to income taxes as each withdrawal takes the form of ordinary income.

Do you pay tax on gold?

Yes, gold sales that are considered collectibles by the IRS are subject to short-term or long-term capital gains taxes depending on how long the assets were held. Gold held in a Traditional IRA (i.e., non-Roth) is taxed as ordinary income when a distribution is taken from the account.

How much tax do you pay on an IRA withdrawal?

When withdrawing from a Traditional IRA, distributed funds are taxed as ordinary income and are therefore subject to regular marginal tax rates. In the U.S., marginal tax rates scale progressively between 12% and 37% depending on an individual income or married couple's joint income.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81