Goldco Review: Is This Precious Metals IRA Service Worth It in 2025?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 31st March 2025, 07:12 pm

- Phone : (855)-481-3206

- URL :

- Global Rating

- Spectacular

User Rating

- 0 No reviews yet!

Outstanding for the positive customer reviews it receives, Goldco is a provider of precious metal IRAs based in Woodland Hills, California. Hailed as one of the fastest-growing companies in the Los Angeles area, Goldco’s success is based on a history going back over 15 years. Goldco hosts a strong collection of key gold and silver coins for IRA use, as well as a clear website and great support for IRA newcomers.

Pros:

- Excellent scores from 1000+ verified reviews

- Highly-rated customer service

- Flat annual fee structure without any surprises

- Competitive $80 annual fee

- Worthwhile promotions on offer

- Segregated and non-segregated storage options

Cons:

- Minimum investment of $25,000

- Higher premium on exclusive coins

- No offerings in platinum or palladium

Goldco is a California-based gold and precious metals investing service. Their online investment platform is split into two parts:

- Management of precious metal IRAs: The firm acts as a central point of organization for gold and silver IRAs, arranging IRA set-up and handling IRA rollovers. IRA custodianship and bullion storage are outsourced to partner providers. Goldco hosts an accessible collection of gold and silver bullion coins and bars for use in your IRA.

- Non-IRA precious metal sales: Goldco also sells bullion items for use outside of IRAs.

Goldco is no stranger to accolades. In 2021, Goldco was named the 22nd fastest-growing company in the LA area by the Los Angeles Business Journal. It was also named Company of the Year in the Stevie Awards (Category: Large, Financial Services). At present, Goldco is listed 317 in the Inc. 500 list of the top American companies.

Ratings

Below is a list of ratings from popular consumer reporting agencies and review aggregators as of January 2024.

- Better Business Bureau: ⭐⭐⭐⭐⭐ (“A+” and 4.8 Stars based on 1,179 Customer Reviews)

- Business Consumer Alliance: ⭐⭐⭐⭐⭐ (“AAA” and 5 Stars based on 1 Customer Review)

- Sitejabber: ⭐ (1 Star based on 1 Customer Review)

- Trustlink: ⭐⭐⭐⭐⭐ (5 Stars based on 254 Customer Reviews)

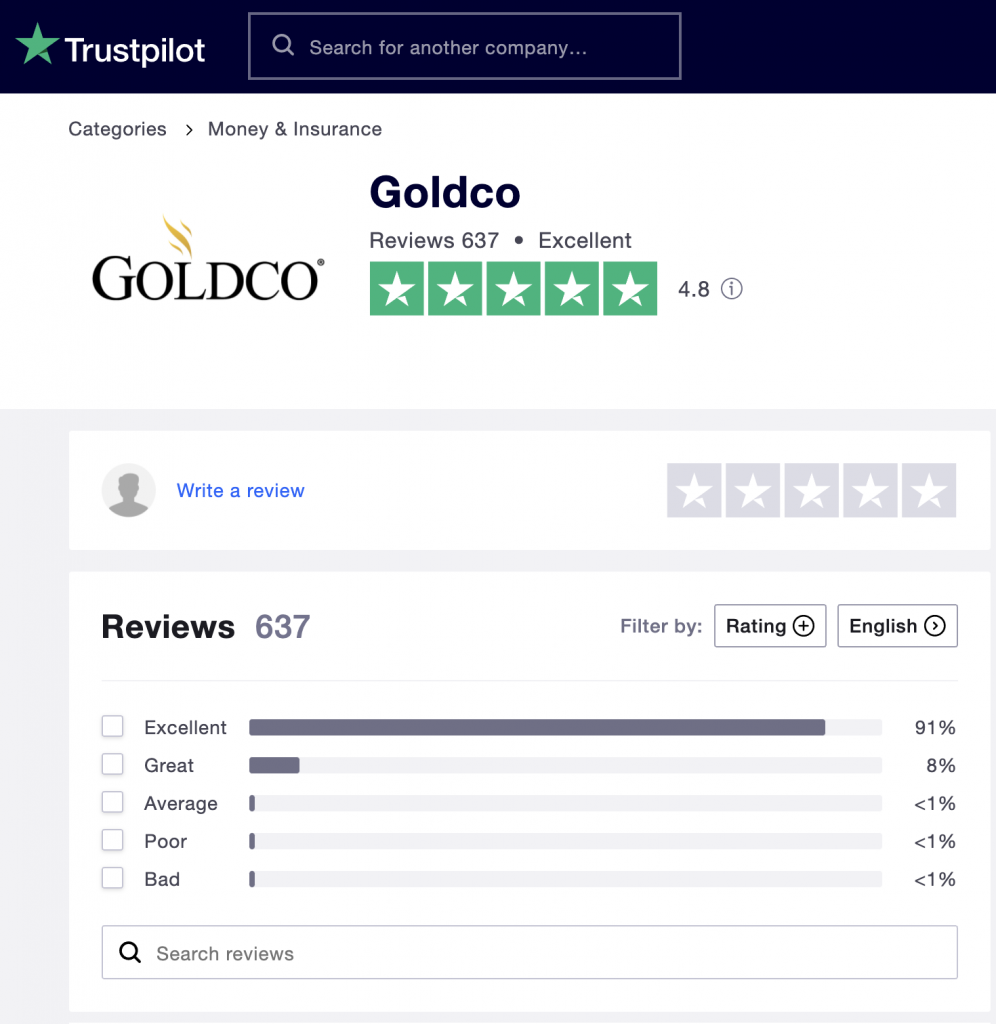

- Trustpilot: ⭐⭐⭐⭐⭐ (4.7 Stars based on 1,257 Customer Reviews)

- Yelp: ⭐ (1 Star based on 1 Customer Review)

Complaints

- Better Business Bureau: 47 complaints closed in last 3 years

- Business Consumer Alliance: 1 complaint closed in last 3 years

Table of Contents

- Company Background and Philosophy

- Goldco Celebrity Endorsement

- Goldco Sign-up Process

- Goldco Featured Products

- Goldco IRA-Approved Gold Products

- Goldco IRA-Approved Silver Products

- Goldco Storage

- Premium Coins vs Standard Bullion Coins – Understanding the Difference

- Goldco Fees, Account Minimums and Promotions

- Goldco Reviews, Ratings and Complaints

- Consider All Options Before Buying Gold for Your IRA

- Contact Us if You Own or Represent Goldco

Company Background and Philosophy

Goldco was founded in 2006. Since its inception, Goldco has also traded under the names Goldco Direct and Goldco Precious Metals. The firm has 50 employees. Headcount has risen by 11% in the last 6 months.

Goldco Management Team

Founder and CEO Trevor Gerszt

Trevor Gerszt, Goldco Founder – Trevor Gerszt grew up in South Africa – home to the largest gold mines on the planet. He came to the US aged six. A keen coin collector as a boy, Gerszt took his passion for bullion into the business world by picking up the reins of Goldco Precious Metals in 2008. He reports that, ‘in looking at where I put a stake in the ground for a career — the finance industry — and more specifically, precious metals was a natural fit for me.’ Gerszt is proud to be a self-made entrepreneur. Check out Trevor Gerszt’s LinkedIn profile here.

Jennifer Levin, Vice President and General Counsel – Jennifer Levin is in charge of all legal affairs at Goldco. In 2021, Levin was awarded the accolade of In-House Counsel of the Year (Fastest-Growing Private Company category) by the LA Business Journal. Having received a Juris Doctor (JD)doctorate in Law at the USC Gould School of Law in 2007, Levin began her career as an intern at 20th Century Fox. Check out Jennifer Levin’s LinkedIn profile here.

Goldco Celebrity Endorsement

Goldco is endorsed by US martial arts and film legend Chuck Norris, as seen in this Goldco testimonial below.

Goldco Sign-up Process

Potential investors with Goldco can sign up by phone. This gives you the chance to get all your questions answered before you commit to anything. Goldco states that the basic process involves just 3 steps:

- Sign an agreement and open your IRA

- Fund your IRA with an IRA rollover

- Buy coins and bullion bars to stock your IRA

Goldco Featured Products

Goldco offers two ways of doing business. You can buy bullion coins and bars to have at home, outside of your IRA – or you can buy bullion coins and bars to put into IRS-approved storage as part of your Goldco precious metals IRA.

Customers who want bullion mailed to their home can choose from a robust inventory of gold and silver 27 coins – plus bullion bars of different weights. Keep in mind that premium coins carry higher spreads and premiums over spot.

26 of these featured coins are available for IRA investment.

Goldco IRA-Approved Gold Products

For IRAs, Goldco offers gold bars of various weights and 12 different types of coin:

- Gold American Eagle – Type 1

- Gold American Eagle – Type 2

- Gold American Eagle Proof

- Gold Maple Leaf

- American Gold Buffalo

- Gold American Bald Eagle

- Gold Military Guinea

- Gold Freedom Coin

- Gold Freedom and Hope

- Gold Lucky Dragon

- Gold Australian Saltwater Crocodile

- Gold British Lunar Series

The photography of Goldco’s coin inventory is stunning. Full details are provided for a couple of coins below:

Gold American Eagle – Type 1

Perhaps the most famous of all gold coins, the gold American Eagle is the official bullion coin of the USA. Minted in 22 karat gold to a purity of 0.9167 fine, the Eagle is available with Goldco in four weights.

On the front, Lady Liberty takes centre stage, – with the Capitol Building peeping out of the bottom left. On the back, depending on the date of issue, is a group of eagles or a single eagle.

Gold American Buffalo

The Gold American Buffalo boasts a finer purity than the Gold American Eagle. It is minted in 24 karat gold to a purity of 0.9999.

The front features the head of an American Indian. The features are a composite of chiefs Big Tree, Two Moons and Iron Tail. The design is based on James Earle Fraser’s Indian Head Nickel of 1913. The back of the Gold American Buffalo features a bison in profile.

Goldco IRA-Approved Silver Products

For IRAs, Goldco offers silver bars of various weights and 14 different types of coin:

- Silver American Eagle – Type 1

- Silver American Eagle – Type 2

- Silver American Eagle Proof

- Silver American Bald Eagle

- Silver Maple Leaf

- Silver Lucky Dragon

- Silver 20th Anniversary Britannia

- Silver Great Barrier Reef

- Silver Freedom & Hope

- Silver Military Guinea

- Silver Freedom

- Silver Australian Saltwater Crocodile

- Silver World War II Victory

- Silver Britannia Lunar Series

Silver Maple Leaf

Struck from 1 oz. of .9999 purity silver, the Silver Maple Leaf is a popular investment-grade coin. The coin is struck by the Royal Canadian Mint and has a face value of $5 CAD.

The front features a portrait of Queen Elizabeth II. The back features a fine illustration of a maple leaf.

Silver Lucky Dragon

Also struck by the Royal Canadian Mint, the Silver Lucky Dragon features 0.9999 purity silver at a weight of 1 oz. It has a face value of $5 CAD.

The front features a portrait of Queen Elizabeth II. The rear features an exotic and intricate illustration of a dragon.

Goldco Storage

For your IRA to be valid with the IRS, you will need to arrange to have your precious metals stored in an approved vault. You cannot keep your bullion at home. If you do, the IRS will not consider it as part of your IRA and you will face financial charges.

Goldco arranges storage in IRS-approved vaults via third-party providers. You can choose between two types of storage: segregated and non-segregated.

Non-segregated means that the vault does not distinguish between individual coins of the same type: if you put in an American Gold Eagle, for example, you will receive one back when it comes to withdrawal, but it may not be the same example of an American Gold Eagle that you put in. For investment purposes this does not matter. That’s because your deposits are not unique ‘collectible’ coins, but generic items. Their value is based on their bullion weight, not on their individual characteristics.

With segregated storage, your deposits are kept separately from others. In this way, you can guarantee that you can withdraw exactly what items you put in. With all vaults, regardless of the provider, segregated storage costs more than non-segregated storage.

Premium Coins vs Standard Bullion Coins – Understanding the Difference

A gold IRA is an excellent investment option for investors looking to diversify their portfolios and hedge against inflation. Yet, given the large number of IRA-eligible coins available, which ones to include in your retirement account can prove overwhelming. Prior to making any decisions, it’s necessary to understand the primary difference between these two types of coins.

Premium Coins

Regardless of the fact that premium coins are approved by the IRS to be held in gold IRAs, premium coins are considered semi-numismatic. These types of coins are limited circulation because they are part of a collectible series issued by certain mints. They possess the same purity levels as standard bullion coins, yet because of their limited circulation, are often sold at a markup by some companies.

Standard Bullion Coins

Investors interested in getting the most gold for their money would be well served to invest in standard bullion coins. Coins like the Canadian Maple Leaf, the Austrian Philharmonic, and the American Eagle, all have purity levels of 99.99%. Because these types of coins are not part of collectible series with limited circulation, they are sold at a lower price.

Below is a comparison chart to give you a better understanding of the available types of coins.

| Bullion | Proof & Uncirculated coins | Collectibles/Numismatics | |

|---|---|---|---|

| IRA Eligible? | Yes | Some | No |

| Highest Purity Level? | Yes | Yes | No |

| Limited Edition and/or Scarcity Factor? | No | Yes | Yes |

| High Finishing Quality & Detail?* | No | Yes | Some |

| Easy to Sell/Liquidate Anywhere | Yes | No | No |

| Premium Over Spot When Buying? | Low | Medium | High |

| What you can expect to sell them for? | Close to spot price. Usually no or little premium. | Spot price + premium based on rarity/age/demand for your coins | Spot price (if they contain some precious metals) + premium based on rarity/age/demand and other factors |

| Where can you sell them? | Anywhere, since these bullion coins are recognized and trusted worldwide. However they'll probably only give you spot price. | Anywhere, but original dealer would likely be the best place if you want to recoup premium. Others might only give you spot price. Ebay is also a good option if you have rare and highly sought after coins. | Antique stores, coin shops, collectors' markets, eBay. |

Goldco Fees, Account Minimums and Promotions

Goldco Account Minimums

To invest with Goldco, you need to invest at least $25,000. This is a possible downside for many investors. $25,000 is over four times the annual maximum investment you can make in your IRAs if you are under 50 years old. So you would have to not invest in any IRA for over four years to make a start with Goldco.

IRS fact: Aged under 50, the total amount you can invest in your IRAs from 2024 onwards is $7,000. Aged over 50, the total amount comes in at $8,000. Excess contributions are taxed at 6% annually.

Goldco Fees

Goldco charges a flat annual fee of $80 to manage your IRA. For comparison, competitor Noble Gold charges the same.

| Goldco Service | Goldco Fee |

| IRA set up | Free |

| IRA management | $80 flat annual fee |

| Bullion storage in an IRS-approved vault | Depends on provider |

| Custodianship of your IRA | Depends on provider |

Goldco Promotions

At the time of writing, Goldco is offering two promotions. Readers should contact Goldco sales representatives to verify whether these promotions are still available:

- Fees for your first year are waived (subject to confirmation)

- With silver coins, you get 10% back (paid in more silver coins)

Goldco IRA Rollovers

Goldco can help you convert your existing IRA or savings account into a precious metals IRA. The firm says this process usually takes less than two weeks. 401(k), 403(b), TSP, savings and IRA accounts are eligible.

Goldco Reviews, Ratings and Complaints

Reviews

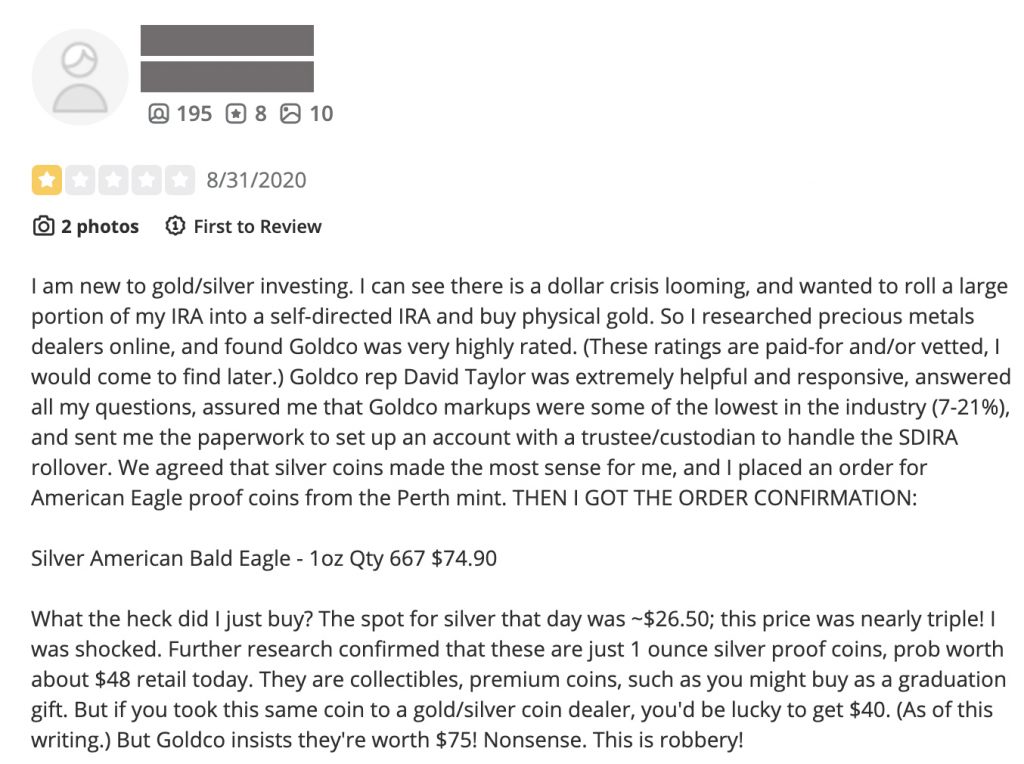

From 1087 reviews across 7 review sites, Goldco achieves an average (mean) score of 3.58/5.

This mediocre score is heavily influenced by one negative review that shows up on two sites (Sitejabber and Yelp). These sites feature no other Goldco reviews. So in neither case is the minimum score representative of a decent sample.

If we discount this single negative review – which appears to be based on an unfortunate misunderstanding – Goldco’s average score from 1085 reviews across 5 review sites is an excellent 4.87/5.

Let’s dig deeper into this negative review. The reviewer rates the Goldco representative as ‘extremely helpful and responsive’. So what was the problem? The issue was that the reviewer ordered a proof silver coin which he then discovered was more expensive than its value in bullion. This difference in price, though, is the market norm for proof coins.

Proof coins are specially-minted for non-circulation. Because of their novelty value, proof coins are generally traded at a premium on their bullion value. In other words, if you buy a proof coin you are paying for more than the silver it is made out of. Whilst permitted for IRAs, proof coins are more suitable as gifts than as precious metal IRA investments. It may be that the reviewer did not understand the difference between proof coins and other bullion coins or confirm the price of the coin at the time of purchase.

Top Tip: The only proof coins accepted by the IRS for IRAs are American Gold and Silver Eagles.

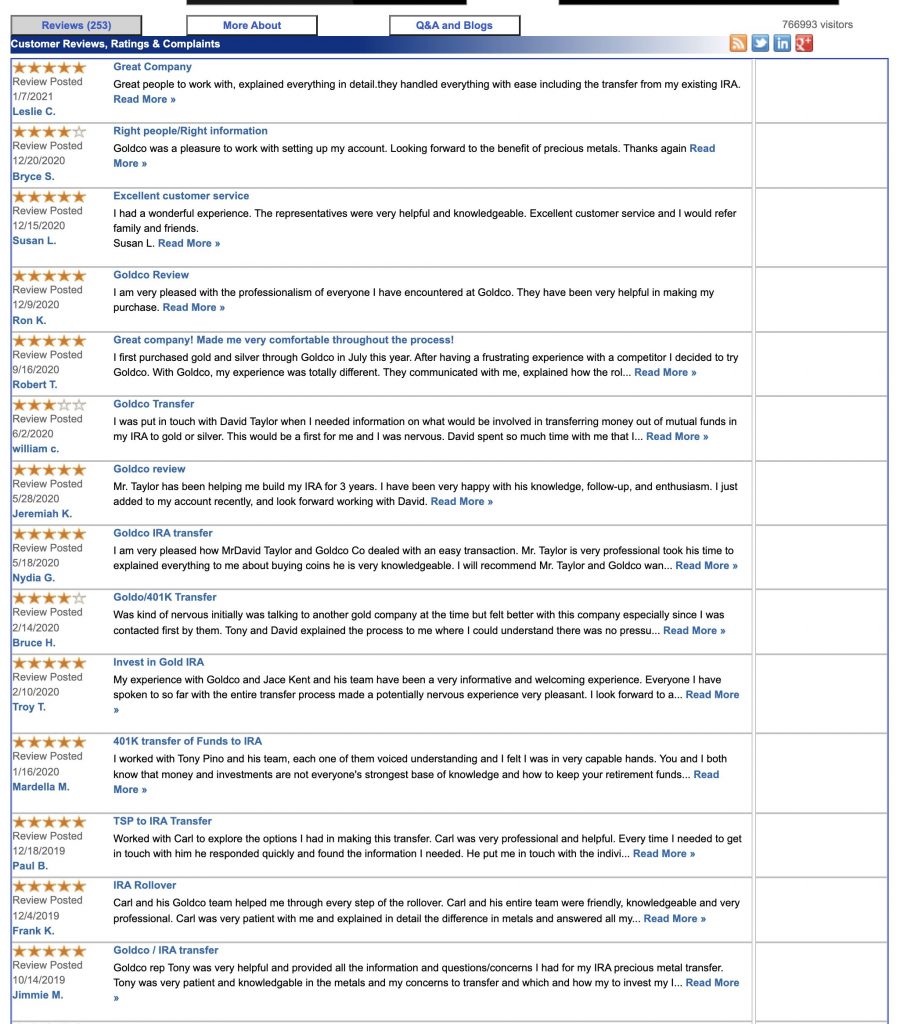

By contrast, check out the blitz of gold stars that Goldco gets on its Trustlink and Trustpilot reviews below.

Consider All Options Before Buying Gold for Your IRA

Newcomers to precious metals IRAs often ask: why don’t I just keep bullion at home?

There are three reasons why this is not a good idea:

- The IRS will not consider your bullion at home to be part of your IRA

- Your bullion could get stolen

- You will have to arrange the sale of your bullion to release its value; how knowledgeable are you about bullion and coin pricing?

A precious metal IRA allows the canny investor to benefit from three features of bullion prices.

- Precious metals are considered to be a safe haven at times of stock market crisis. The value of gold tends to rise when stock market prices fall and go into a ‘bear’ phase. For example, five months after the March 2020 Covid crash, the price of gold hit an all-time high of $2,067 per ounce.

- The limited supply of precious metals means that their value cannot fall because of over-supply. The value of printed currency, on the other hand, can fall when government treasuries print more money. Goldco says that the American dollar has lost 98% of its purchasing power since 1971.

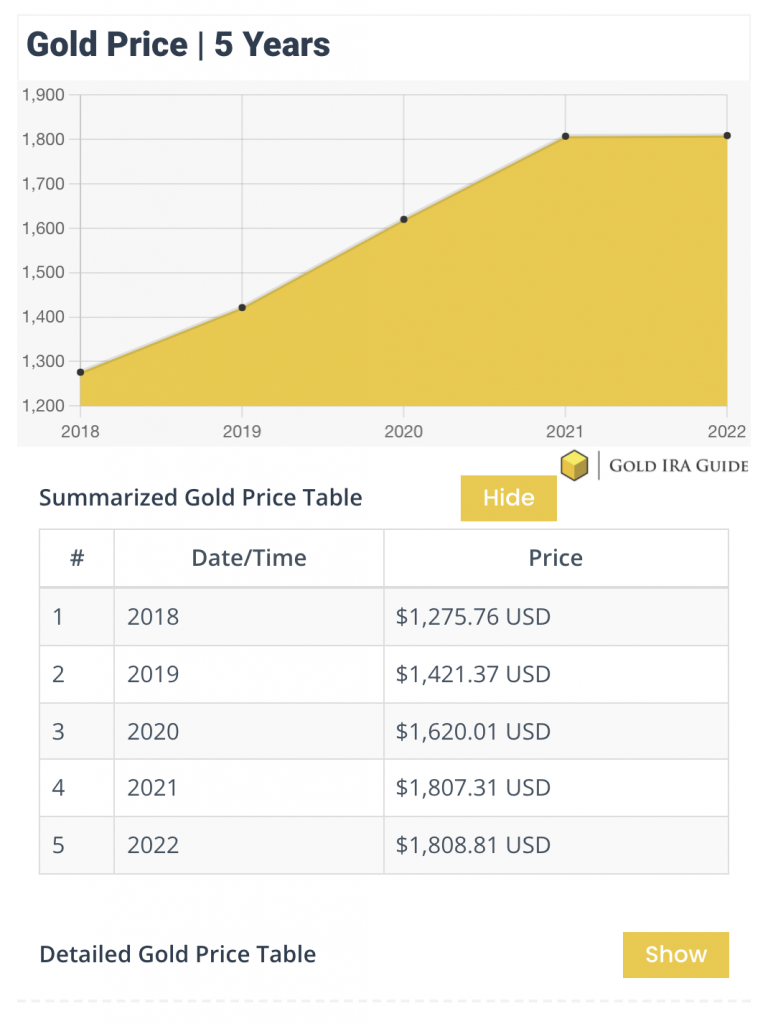

The price of gold in particular has risen over the long-term. Check out gold prices here. Below, we've displayed the 5-year gold spot price chart for the years 2018-2022.

Consumers are currently facing the highest price inflation for thirty years combined with low interest rates. This means that money held in the bank as cash actually goes down in value as time goes on. Investors tend to turn to gold when inflation is high.

Remember that you can benefit from the positives of precious metals investment without using a precious metals IRA. To enjoy similar tax advantages, you can use another self-directed IRA to invest in gold on the stock market. You can invest directly in the price of gold as a commodity. You can invest in gold mining companies individually, or invest in a bunch of them at once using an Exchange Traded Fund (ETF). You can also use an ETF to trade off the gold price. Investing in an ETF is recognised to be a low-risk investment option, but you will have to pay ETF expenses.

To strike an appropriate balance between safety and asset growth, a precious metal IRA should only form part of your total IRA allocation.

Contact Us if You Own or Represent Goldco

Here at Gold IRA Guide, we want our provider profiles to be as accurate as possible. If you are a Goldco representative and have revision requests relevant to this Goldco profile, please contact us using this secure form.

- Phone : (855)-481-3206

- URL :

- Global Rating

- Spectacular

User Rating

- 0 No reviews yet!

Outstanding for the positive customer reviews it receives, Goldco is a provider of precious metal IRAs based in Woodland Hills, California. Hailed as one of the fastest-growing companies in the Los Angeles area, Goldco’s success is based on a history going back over 15 years. Goldco hosts a strong collection of key gold and silver coins for IRA use, as well as a clear website and great support for IRA newcomers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,328.02

Gold: $3,328.02

Silver: $37.77

Silver: $37.77

Platinum: $1,404.65

Platinum: $1,404.65

Palladium: $1,226.98

Palladium: $1,226.98

Bitcoin: $117,368.41

Bitcoin: $117,368.41

Ethereum: $3,090.52

Ethereum: $3,090.52