- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Noble Gold Investments Review: Good or Bad for Gold IRAs?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 18th December 2023, 03:39 pm

Noble Gold

- Phone : 626-605-3152

- URL :

- Global Rating

- Spectacular

User Rating

- 2 Reviews

Review Summary :

Noble has some of the LOWEST fees on bullion combined with some of the BEST ratings out of any company we reviewed in 2024. Cofounders Charles Thorngren and Collin Plume didn't spend millions of dollars in hiring celebrity ambassadors or running fancy commercials on TV and radio. They decided to run a "lean" company and focus on providing great service to their clients. Overall, the strategy seems to be paying off as the company does have great ratings across the board. We couldn't find anything negative aside from one 2020 complaint on the BBB, which has been resolved.

Pros:

- Lowest fees out of any company we reviewed

- Perfect Global Rating of 5/5

- Low IRA account minimum of $20,000

- Collin Plume puts a lot of emphasis on education

- Exclusive IRS-approved storage in Texas

- "No-quibble" buyback policy, easiest in the business

Cons:

- Young brand (only 6 years old)

- Key founding partner left in 2020

- Higher premium on exclusive coins

Quick Facts about Noble Gold

Year Founded:2017

Company Headquarters:Pasadena, California

Annual Fees:$100 annual maintenance; additional $150 for storage (segregated only)

Supports 401(k)?:Yes

Supports Roth IRA?:Yes

Crypto Offered?:Yes, through its sister company, My Digital Money.

Assets Offered:Gold, Silver, Platinum, Palladium

Offers Other Assets?:No

Custodian:Equity Trust

Current Promotion:FREE 3 oz. Silver American Virtue coin

Supports Home Storage?:Yes

International Storage?:Yes (Canada)

Segregated Storage?:Yes

Preferred Storage Location:Dallas, Texas

Preferred Storage Vault:Texas Depository and Canada (IDS)

Reviewed By:Liam H.

Have you purchased products from Leave Review for Noble? Leave a review!

I give Noble Gold a 100%

I give Noble Gold a 100% for customer support because they have always answered my requests immediately whether it was through email or phone. Other two companies I called took up to 48 hours to respond to me but Noble always responded right away and had a gold IRA specialist available when I needed them during business hours. Colin Plume was very helpful and has a lot of experience in this industry. I was initially tempted to go with a home storage setup but they convinced me to store safely in Texas instead which is not too far from where I live anyways so it worked out. A+ company

September 20, 2019, 7:09 pmNoble answered all of my questions about gold IRA investing

I spoke to a few companies and Noble Gold investments did the best in terms of answering my questions honestly and promptly. Highly recommended.

March 14, 2023, 4:45 pmNoble Gold is what we call a “lean” gold IRA provider, meaning that they haven't spent millions of dollars in hiring celebrity ambassadors, nor have they produced fancy commercials on TV and radio. Company co-founder Collin Plume believes in letting their great service and low fees speak for themselves. So far, the strategy has paid off.

Although the company was founded in 2016, Noble is today one of the well-known providers of Precious Metal IRAs. This is mainly due to their great ratings and competitive fee structure.

The company was founded by Collin Plume and Charles Thorgren, two veterans in the metals industry. When it comes to storage of bullion for IRA purposes, Noble Gold has multiple IRS-approved vaults to offer, including in-country in Delaware and Texas, as well as overseas in Ontario, Canada.

When it comes to IRA-approved bullion, Noble Gold offers coins and bars in gold, silver, platinum, and palladium. A selection of rare coins is also offered for non-IRA use. For smart investors looking to stash physical bullion at home for use in an emergency, Noble Gold offers a range of Royal Survival Packs priced from $10,000 to $500,000+.

Noble Gold boasts a robust media presence. Co-founders Charles Thorngren and Collin Plume have both acted online as pundits for the gold and silver IRA industries. The Noble Gold website and Twitter account are up-to-date and show veteran expertise in precious metals. 400+ online customer reviews for Noble Gold achieve a perfect total score of 5/5.

Precious metals IRAs are one of two main Noble Gold investments available. A sister company, My Digital Money, provides cryptocurrency IRAs.

Table of Contents

- Company Background and Philosophy

- Noble Gold Reviews, Ratings, and Complaints (2024)

- Who Owns Noble Gold?

- Noble Gold Sign-up

- Noble Gold Coins and Bars

- Noble Gold IRS-Approved Vault Storage

- Noble Gold Fees

- Noble Gold IRA Custodians

- Noble Gold Website

- Noble Gold Customer Education

- Why Get a Gold IRA with Noble Gold?

- Contact Us if You Represent Noble Gold

Company Background and Philosophy

Noble Gold Background

Noble Gold was founded in 2016 by Collin Plume and Charles Thorngren in Florida. The company has in the region of 30 employees working out of its new office location in Encino, California, in Los Angeles County.

Noble Gold Philosophy

‘Noble Gold was founded because we were tired of the unsavory practices in our industry. We never hard-sell.’ The company sets a high moral bar. This is easy to do in theory. But in practice? Investors will be pleased to learn that, barring 3 complaints in 3 years, 400+ customer reviews overwhelmingly bear out Noble Gold’s claim to be the good guys in the gold IRA industry. The firm’s no-quibble buyback program is evidence that Noble Gold offers an ethical service.

Source: Noble Gold

Noble Gold Reviews, Ratings, and Complaints (2024)

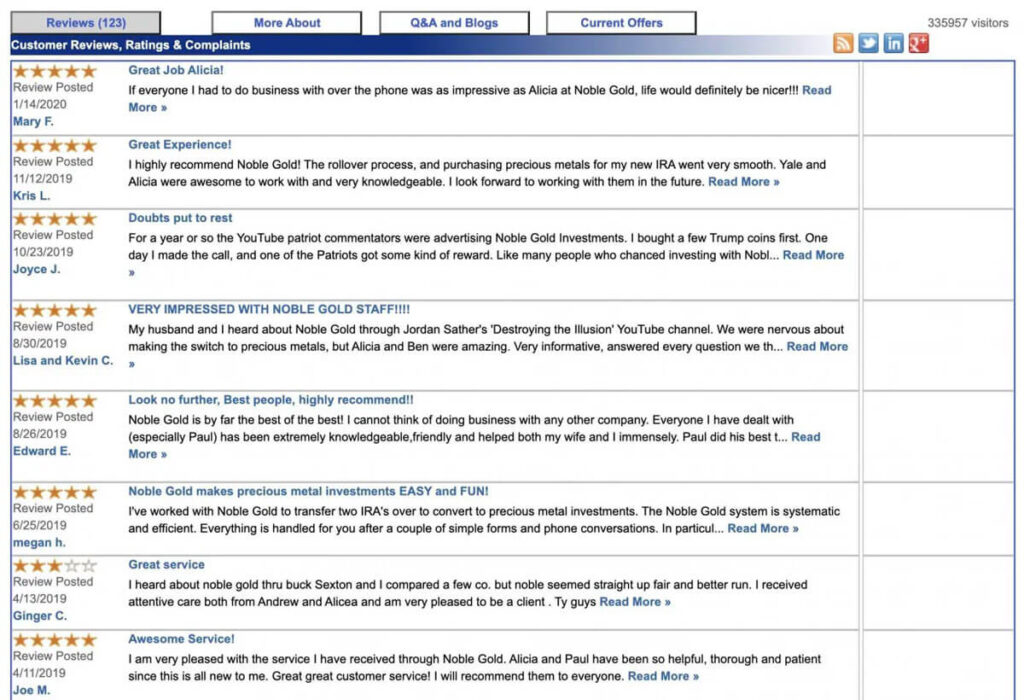

From a total of 931 reviews across five websites, Noble Gold achieves a perfect average rating of five out of five stars.

Reviewers consistently praise the quality of customer service and the ease of setting up a Noble Gold IRA.

Reviews

- Better Business Bureau: ⭐⭐⭐⭐⭐ (4.98 Stars averaged from 139 Customer Reviews)

- Business Consumer Alliance: ⭐⭐⭐⭐ (4 Stars and “AA” from 4 reviews)

- Consumer Affairs: ⭐⭐⭐⭐⭐ (5 Stars averaged from 725 reviews)

- Trustlink: ⭐⭐⭐⭐⭐ (5 Stars averaged from 123 reviews)

- Yelp: ⭐⭐⭐⭐⭐ (5 Stars from 1 review)

Ratings

- Better Business Bureau: A+ (Accredited since January 23, 2017)

- Business Consumer Alliance: AA

Complaints

- Better Business Bureau: 5 complaints in 3 years

- Business Consumer Alliance: 1 complaint in 3 years

Source: Noble Gold profile on Trustlink

Who Owns Noble Gold?

Noble Gold CEO and Founder Collin Plume

Collin Plume is the Chief Executive Officer and founder of Noble Gold, thereby making him the primary owner of Noble Gold. Collin began his career in real estate sales. After almost 6 years as an advisor with another leading gold IRA provider, Collin had a brief spell in digital marketing before taking up the position of CEO at Noble Gold in 2016. Since April 2021, Collin is also CEO of My Digital Money.

As something of a thought leader in the gold and crypto IRA industries, Collin has 13,000 followers on LinkedIn. His name crops up on the internet giving interviews and opinion pieces, like this Investing News video in which he talks about 2021 silver prices. Collin has previously remarked:

“As I finally settled in on my true passion of precious metals investments I realized the key to financial freedom is having diversification with tangible investments.”

Noble Gold Co-Founder Charles Thorngren

Charles Thorngren co-founded Noble Gold in 2016 with Collin Plume. Like Collin, he has a robust presence online as a precious metals expert. Charles left Noble Gold and took the helm of Legacy Precious Metals Investments as CEO in November 2020. See Charles’ LinkedIn page here.

Mr. Thorngren brought to the company more than two decades' worth of professional experience in the investing space, with particular expertise in precious metals. Based on our research, Charles appears to be something of a thought leader within his field. To date, he has published dozens of articles in his name on the precious metals economy and investing space, many of which can be found on Noble Gold's blog.

Noble Gold Sign-up

You can sign up with Noble Gold online straight away by filling out a simple online form. Noble Gold will get back to you by phone to confirm your details. The firm pledges to begin setting up your IRA account with a partner custodian within 24hrs.

You will be emailed your new self-directed IRA account number. You can then choose from Noble Gold’s selection which coins and bars you want to buy for your IRA. IRS-approved storage will then be arranged via the Noble Gold Fortress program at whichever vault you prefer.

Noble Gold Coins and Bars

Bullion is sold in three formats by Noble Gold:

- IRA-approved coins and bars struck from gold, silver, platinum, and palladium

- Non-IRA Royal Survival Packs of bullion for home use or vault storage

- Non-IRA rare coins

Noble Gold IRA-Approved Gold

As well as providing high-quality photographs of the front and back of their coins, Noble Gold illustrates online how the coins are packaged for storage and distribution. With each coin, you can click on the brief description to access a whole page of background information.

There are four types of gold coins available, with the American Eagle available in proof versions as well.

- American Gold Eagle

American Gold Eagle (Proof)

American Gold Eagle (4 Piece Set Proof ) - Canadian Gold Maple Leaf

- Austrian Gold Philharmonic

- Australian Gold Kangaroo

Additionally, four types of gold bars are available:

- Pamp Suisse Lady Fortuna Gold Bar

- Pamp Suisse 100gm Gold Bar

- Perth Mint 1oz Gold Bar

- Johnson Mattey Gold Bar (1 kg.)

(American Gold Eagle available from Noble Gold)

Struck in 22 karat gold, Noble Gold suggests that the American Gold Eagle, shown above, is “America’s most beautiful in the history of the country.” The head (front) of the coin features an engraving of Lady Liberty holding a torch and an olive branch. The tail (back) of the coin shows an eagle with an olive branch in its beak. The American Gold Eagle is available from Noble Gold in various face values ($5, $10, $25, and $50).

Coin collectors might favor the proof versions of the American Eagle available. Proof coins are specially minted for non-circulation and are generally more expensive than normal bullion coins. IRA investors should stick to the bullion versions, as the amount of bullion is the same in bullion and proof versions. Want to learn more? Check out our guide to IRA-approved gold coins and bars.

(American Gold Eagles available from Noble Gold)

Noble Gold IRA-Approved Silver

A small selection of IRA-approved silver and other silver coins is available:

- 1oz American Silver Eagle

- 1oz Canadian Silver Maple Leaf

- 1oz Australian Silver Kangaroo

- 1oz Austrian Silver Philharmonic

- 5oz America The Beautiful Silver

- 1kg Australian Silver

- 1oz Highland Mint Silver Round

A single silver bar is also available:

- 5oz Highland Mint Silver Bar

(Silver Maple Leaf available from Noble Gold)

A popular choice of IRA-approved silver coin, the silver Maple Leaf is minted by the Royal Canadian Mint to a level of 99.99% purity. The front features a portrait of Queen Elizabeth II. The back features a beautiful maple leaf design, with coins struck post-2014 also having microscopic security engravings. This coin is available with Noble Gold at a face value of $5 CAD, which equates to 1oz of pure silver.

There are plenty of other silver investment products available to IRA account holders. Check out our guide to IRA-approved silver coins and bars.

Noble Gold IRA-Approved Platinum

Two platinum coins and one type of platinum bar are available:

- American Platinum Eagle coin

- 1oz Canadian Platinum Maple Leaf coin

- Baird & Co Platinum Bars (1oz and 10oz)

Noble Gold IRA-Approved Palladium

One palladium coin and one type of palladium bar are available:

- Canadian Palladium Maple Leaf Coin

- 1oz Credit Suisse Palladium Bar

Premium Coins vs Standard Bullion Coins – Understanding the Difference

Having a self-directed IRA is an excellent retirement strategy. That being said, which IRA-eligible coins to include in your IRA account can prove a difficult decision given the number of available coins on the market. Before making any decisions, it’s helpful to understand the main difference between these two types of coins.

Premium Coins

Premium coins are deemed semi-numismatic because although being IRA-approved, these types of coins are part of a collectible series issued by mints. Because of their limited circulation, often some companies choose to charge a much higher premium. However, it’s important to note that premium coins contain the same purity as standard bullion coins.

Standard Bullion Coins

The American Eagle, the Canadian Maple Leaf, and the Austrian Philharmonic are all examples of standard bullion coins. Ultimately, standard bullion coins are the better investment because are 99.99% pure and are sold at lower prices than premium coins that often have a mark-up because of limited circulation. For many investors, these types of coins prove the perfect fit for a gold IRA.

Below is a comparison chart to give you a better understanding of the available types of coins.

| Bullion | Proof & Uncirculated coins | Collectibles/Numismatics | |

|---|---|---|---|

| IRA Eligible? | Yes | Some | No |

| Highest Purity Level? | Yes | Yes | No |

| Limited Edition and/or Scarcity Factor? | No | Yes | Yes |

| High Finishing Quality & Detail?* | No | Yes | Some |

| Easy to Sell/Liquidate Anywhere | Yes | No | No |

| Premium Over Spot When Buying? | Low | Medium | High |

| What you can expect to sell them for? | Close to spot price. Usually no or little premium. | Spot price + premium based on rarity/age/demand for your coins | Spot price (if they contain some precious metals) + premium based on rarity/age/demand and other factors |

| Where can you sell them? | Anywhere, since these bullion coins are recognized and trusted worldwide. However they'll probably only give you spot price. | Anywhere, but original dealer would likely be the best place if you want to recoup premium. Others might only give you spot price. Ebay is also a good option if you have rare and highly sought after coins. | Antique stores, coin shops, collectors' markets, eBay. |

Noble Gold Royal Survival Packs

You may already have your IRA strategy fixed up. However, you may rather want to get your hands on some additional bullion to give you and your family greater security in the event of a national disaster. In that case, Noble Gold has got your back with its unique Royal Survival Packs.

There are 7 distinct bullion packs available. Each features a different level of investment, ranging from Knight ($10,000) to Ambassador ($500,000+). Personally, we find these to be worthwhile, beginner-friendly additions to precious metals IRAs as they include various protections to customers.

Source: Noble Gold

Noble Gold makes it fairly easy to manage your Royal Survival Pack with two options:

- With the Noble Express service, you can have your pack mailed to your door fully insured and under plain cover. It is then yours to stash away as you see fit.

- With the Noble Fortress service, you can have your pack stored in a secure vault. Noble Gold offers storage with reputable firm International Depository Services (IDS). In-country, you can have your Royal Survival Pack stored at the IDS vault in New Castle, Delaware. Or you can opt for overseas storage in Mississauga, Ontario, Canada.

Noble Gold Rare Coins

Gold and silver rare coins are available from Noble Gold. The IRS considers rare coins to be ‘collectibles’. Along with fine art, antiques, gems, and stamps, rare coins are therefore not permitted for use in IRAs. However, this is certainly a huge selling point for fans of unique or rare coins because many of Noble Gold's top competitors do not have these coins on offer.

Noble Gold IRS-Approved Vault Storage

Noble Gold offers in-country and overseas IRS-approved storage. Via a partnership with International Depository Services (IDS), you can have your Noble Gold bullion stored:

- In-country: New Castle, Delaware

- In-country: Dallas, Texas

- Overseas: Mississauga, Canada (Greater Toronto)

Noble Gold says it is the only company to offer IRS-approved precious metals storage in Texas.

Source: Noble Gold

All Noble Gold storage facilities are:

- Segregated rather than co-mingled. This means you get back exactly what bullion items you put into a vault, rather than identical examples of your coin/bar.

- Approved by COMEX/CME, LBMA, and ICE.

- Insured by Lloyds of London.

Noble Gold Fees

| Noble Gold Service | Noble Gold Fee |

| IRA Set Up | Free |

| IRA Management | $80 per year |

| Bullion Storage in an IRS-approved Vault | $150 for segregated storage in Texas, Canada, or Delaware |

| Custodianship of your IRA | Depends on provider |

Noble Gold Account Minimum

You will need to invest at least $20,000 to open a precious metals IRA with Noble Gold. This low investment threshold compares favorably to the high $25,000 account minimum stipulated by rival Goldco, for example. (Under IRS rules, the maximum you can invest per year in your IRAs is $6,000 if you are under 50 years of age and $7,000 if you are over 50 years old.)

Noble Gold’s Royal Survival Packs, which feature non-IRA precious metals for emergency purposes, start at $5,000. In our books, this is a huge selling point since virtually all other vendors have higher capital requirements.

For cash deals, the purchase minimum with Noble Gold is $10,000.

Noble Gold IRA Custodians

Noble Gold works with partners Equity International/New Direction IRA to provide custodianship of all customer metals. Note that separate fees may apply to these partners.

Having a custodian for your IRA is a legal requirement. ‘Custodianship’ means that a company is responsible for administering the IRA so that it stays within IRS rules.

Noble Gold IRA Rollovers and Transfers

As with most gold IRA providers, Noble Gold will manage the rollover or transfer of funds from your existing retirement planning account. Noble Gold can help you decide which of a rollover or a transfer is suitable for your individual tax position. No fee is charged for this service. Learn more about IRA rollovers with our in-depth guide to funding your IRA.

Noble Gold Website

The Noble Gold website is easy to navigate and easy on the eye. It offers plenty of relevant information on the bullion available as well as how the IRA process works. There is an insightful blog dedicated to precious metals topics, as well as helpful FAQs.

Noble Gold Blog

A blog that is up-to-date is a sure sign of a company that is on the ball. In this regard, Noble Gold does not disappoint. A post is published on the Noble Gold blog each week. The company covers topics relevant to gold IRAs like government financial policy, the impact of the pandemic, the economy, and the global precious metals markets. The articles are short and to-the-point, making them easy to read.

Source: Noble Gold

Noble Gold in the News

It is always reassuring for an investor when a company has a high media profile. Noble Gold has been asked to comment on precious metals, crypto, and IRAs by a number of prestigious media outlets. Below, we’ve provided links to media sources profiling Noble Gold.

- Founder and ex-CEO Charles Thorgren writes about gold prices (FX Empire)

- Thorgren is interviewed by Lisa Haven news

- Thorgren comments in Forbes on the new breed of Bitcoin investors

Source: Noble Gold

Much of this material dates to pre-2019. But we're still quite impressed by the authority shown here. The management and staff behind Noble Gold seem to have a strong command of knowledge when it comes to the gold and crypto markets.

On the whole, we're impressed with what Noble Gold offers on its website. With that said, we're a little disappointed in the lack of a live chat facility, and the price of their bullion is, unfortunately, only available on request.

Noble Gold Customer Education

Free Noble Gold Gold and Silver Guide Mailed to your Home

Self-directed IRAs can be daunting to the newcomer. So, like many responsible IRA providers, Noble Gold provides a free guide to precious metals investing. In fact, this is a key pillar of Noble Gold's customer experience. With Noble Gold, you truly feel as though you're being “shown the ropes” so to speak, so that you not only invest in an IRA-compliant manner, but also responsibly and safely.

Free educational kits are mailed directly to your home. In applying for this freebie, there is no obligation to sign up with Noble Gold — but you will have to supply some personal contact details.

Source: Noble Gold

Noble Gold Frequently Asked Questions (FAQs)

Some FAQs from IRA providers can be sketchy on the details. But Noble Gold provides clear and detailed information without getting too complicated. Below, we've shown an example of the kinds of questions that Noble Gold answers in their FAQ section.

Source: Noble Gold

Why Get a Gold IRA with Noble Gold?

A gold IRA is right for investors who want to steer clear of traditional investment options. Gold IRA investors value the security of owning real physical precious metals in uncertain economic times whilst still gaining tax advantages: you don’t pay tax on profits when it comes to selling your gold, and you don’t pay tax on the money you invest in your gold IRA. With Noble Gold, you can do all of this within a low-risk, easy-to-use investment system. Noble Gold invests in your education, and ensures that all the Ts are crossed and Is are dotted, so to speak. Plus, they offer rare coins that other companies don't.

Remember that a diversified portfolio is the best way to keep your retirement income safe. A gold IRA should only form one part of your IRA holdings, so make sure you don't put all of your eggs in the same basket. You may want to ensure that gold is one of the many asset classes you cover.

Fortunately, Noble Gold IRAs allow you to invest in stocks, ETFs, real estate, start-ups, and foreign currency in order to diversify your holdings and protect your wealth. A well-diversified IRA, such as those offered by Noble Gold, is also a great way to anchor your retirement in proven hedges against inflation. All cryptocurrency investments, such as in Bitcoin and Ethereum, are handled by a separate company, My Digital Money.

Is Noble Gold Right for You?

Noble Gold is not alone in the industry in providing a fairly small selection of IRA coins and bars. Having said that, the most popular choices of IRA gold and silver coins are covered (and there are not that many IRS-approved coins anyway). The firm also has a selection of rare, non-IRA coins for sale that makes this company particularly unique in its field. But investors seeking a massive range of non-IRA bullion options might want to consider going elsewhere, since Noble's selection of rare coins is somewhat limited.

In my opinion, Noble Gold is suitable for five types of investors in particular:

- If you're a beginner who needs clear, succinct information on precious metals IRA investing. Noble Gold’s candid approach gives it to you straight. The website features up-front information about fees and in-depth FAQs. The firm’s no-nonsense buyback program confirms its commitment to fair dealings, and its staff is friendly and helpful.

- If you are on a low-to-medium budget, Noble Gold’s minimum investment requirement of $20,000 is perfect. This is among the lowest minimums available in the industry and may appeal to younger investors.

- If you have a high investment budget, Noble Gold’s flat fee structure makes sense too. With annual fees of $230 including storage – regardless of how much you invest – higher investments are penalized relatively less.

- For investors wanting to get their hands on a stash of real bullion for use in emergencies, Noble Gold’s Royal Survival Packs make for a convenient innovation.

- Based in Texas and want your bullion stored close to home? Noble Gold is the only IRA provider with access to the IRS-approved vault in Dallas, Texas.

Before you sign up with any gold IRA provider, be sure to review the competition with our review list of top providers for 2024. Always contact multiple IRA providers before settling on a company. Personally, I recommend giving three or four different companies a call and seeing which one aligns best with your goals and values.

Contact Us if You Represent Noble Gold

At Gold IRA Guide, we strive to give our readers the most accurate and up-to-date information possible. Please contact us here if you are a representative of Noble Gold and would like to provide updates on your service.

Noble Gold

- Phone : 626-605-3152

- URL :

- Global Rating

- Spectacular

User Rating

- 2 Reviews

Review Summary :

Noble has some of the LOWEST fees on bullion combined with some of the BEST ratings out of any company we reviewed in 2024. Cofounders Charles Thorngren and Collin Plume didn't spend millions of dollars in hiring celebrity ambassadors or running fancy commercials on TV and radio. They decided to run a "lean" company and focus on providing great service to their clients. Overall, the strategy seems to be paying off as the company does have great ratings across the board. We couldn't find anything negative aside from one 2020 complaint on the BBB, which has been resolved.

Have you purchased products from Leave Review for Noble? Leave a review!

I give Noble Gold a 100%

I give Noble Gold a 100% for customer support because they have always answered my requests immediately whether it was through email or phone. Other two companies I called took up to 48 hours to respond to me but Noble always responded right away and had a gold IRA specialist available when I needed them during business hours. Colin Plume was very helpful and has a lot of experience in this industry. I was initially tempted to go with a home storage setup but they convinced me to store safely in Texas instead which is not too far from where I live anyways so it worked out. A+ company

September 20, 2019, 7:09 pmNoble answered all of my questions about gold IRA investing

I spoke to a few companies and Noble Gold investments did the best in terms of answering my questions honestly and promptly. Highly recommended.

March 14, 2023, 4:45 pm

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81