Top 9 Best Gold Bars to Buy for Investors

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 23rd April 2025, 12:22 am

The gold price broke All-Time-High in 2025, and investors, just like central banks, are once again preparing for this upcoming bull market by stocking up on gold. In this article, we'll be covering some of the most popular gold bars for investors. You can buy these gold bars from your local gold shop, or from a reputable online gold company.

Table of Contents

Most Popular Gold Bar Brands

The world's most trusted producers of gold bars in the world today include Credit Suisse/PAMP, the Perth Mint, the Royal Canadian Mint, Johnson Matthey and Engelhard. Others, including Metalor, Umicore, and various government mints are also reputable bullion manufacturers. There are also gold quarters that are worth a pretty penny if you happen to come across one. Read our exclusive article to find out how much a gold quarter is worth.

The quality of your gold bullion bar is critical, and this is even more important if you are looking to add gold bullion bars to an IRA, 401k or other retirement vehicles. The Internal Revenue Service sets minimum purity requirements for any IRA-approved bullion, meaning that only bars of incredibly high purity are eligible. Therefore, you cannot afford to mess around when adding gold to your IRA or retirement account—they must meet very specific criteria, otherwise they're ineligible for inclusion.

Here is our list of top 5 gold bars (in no particular order) based on their purity, liquidity, fineness, and worldwide recognition. Note that all five are IRS-approved gold for IRAs, so they can be added to your tax-advantaged retirement accounts.

#1 – Credit Suisse Gold Bars

Developed by the international financial conglomerate Credit Suisse Group and manufactured by PAMP (Produits Artistiques et Métaux Précieux or “artistic precious metals products”), these gold bars are among the most popular bullion investments in the world. They boast a simplistic design and unique identifying serial number. In effect, this lowers their premium and makes it easy to guarantee the quality of your investment. At .9999 gold fineness, Credit Suisse Gold Bars are approved for IRA investing. If you had to invest in only one gold bar, make it a Credit Suisse Gold bar.

#2 – Johnson Matthey Gold Bars

Johnson Matthey is a British company with a long history in metals production. They became the official silver coin producer for the United Kingdom in 1946, and have exploded in popularity since. Their gold bars come in wide variety of sizes, designs, shapes and degrees of refinement. Rather than undergo the expensive minting process of many bullion manufacturers, Johnson Matthey bars are usually just a “cast” gold ingot, reducing the premiums to investors. All IRA-approved JM bars are .9999 gold fineness. Just like Credit Suisse gold bars, Johnson Matthey's bars are renowned and trusted worldwide. Another great bar to have in your portfolio!

#3 – PAMP Gold Bars

PAMP (Produits Artistiques Métaux Précieux) Suisse is one of the most renowned names in the gold bar industry. Their gold bars, especially those featuring the “Lady Fortuna” design, are recognized worldwide for their quality and aesthetic appeal. PAMP Suisse bars are manufactured in Switzerland, just like Credit Suisse ones, and are highly sought after by investors for their consistent 99.99% purity and detailed craftsmanship. Each bar comes with an assay card that certifies its authenticity, making it a trusted option for both new and experienced investors.

#4 – Royal Canadian Mint Gold Bars

The Royal Canadian Mint (RCM) is highly respected for producing some of the purest gold bars in the world. These bars, with a purity of 99.99%, are backed by the Canadian government, adding an extra layer of trust and security for investors. RCM gold bars have advanced security features, including a unique serial number and a micro-engraved maple leaf, which helps prevent counterfeiting. These bars are a top choice for North American investors seeking high-quality, government-backed gold from one of the top mints in the world.

#5 – Perth Mint “Gold Minted Bars”

The world-famous Perth Mint in Australia manufactures gold bars ranging from ½ oz to 1,000 oz in gold weight. For most investors, however, it is simply cost-prohibitive to purchase their branded 400 oz or 1,000 oz bars. Their “Gold Minted Bars” series offers weight denominations in 5, 10 and 20 grams as well as 1 oz and 10 oz. These bars also include a hopping kangaroo and are packaged in a “tamper-proof” display card, making them more attractive than many other gold bars. The Perth Mint is a trustworthy and renowned institution that has been producing high-quality gold bars for decades.

As of 2023, Perth Mint is currenty navigating a scandal after the company was caught selling diluted gold bars to Chinese customers. The firm was forced to initiate a $9 billion product recall. However, this remains a one-time incident and Perth Mint is nonetheless one of the most trusted global providers of gold bullion bars.

#6 – Valcambi Gold CombiBar

For investors looking for a completely unique gold bar design, look no further than the CombiBar. Introduced in 2011 by the Swiss company Valcambi, these 50-gram bullion bars were designed to fit into a wallet much like a credit card. Each bar divisible into 50 individual 1 gram bars and is easily broken apart, making it a portable, divisible and universally accepted currency option. At .9999 gold fineness, the Valcambi CombiBar is IRA-approved. This is truly a unique gold bar that makes spending gold much easier. In an apocalyptic scenario, you definitely want to have this bar in your pocket instead of a credit card.

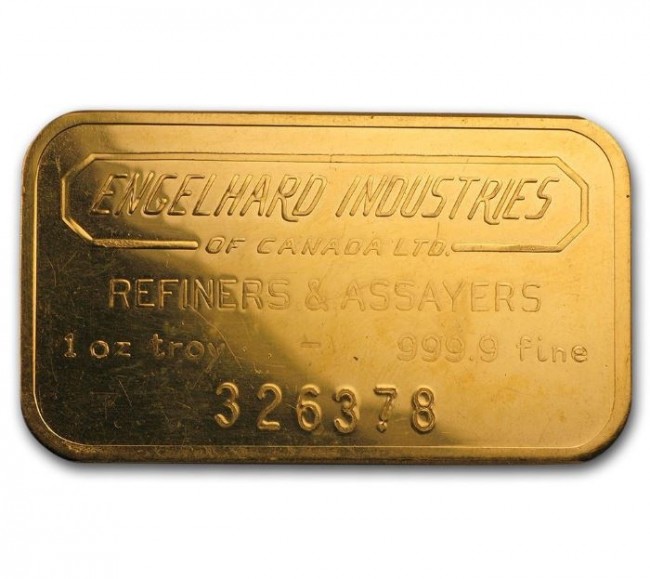

#7 – Engelhard Gold Bars

American-based metals company Engelhard has been around for more than 100 years and is renowned for its gold and silver bullion. Engelhard bars are not produced at the levels of other forms of bullion, and their increasing rarity – and occasional odd shape – can be attractive to some investors (although this does tend to increase premiums). Most Engelhard bars are marked with a unique serial number and come in both “cast” and minted form. If you want to buy gold bars online, Engelhard is an excellent option that's worth considering.

#8 – Valcambi Gold CombiBar

For investors looking for a completely unique gold bar design, look no further than the CombiBar. Introduced by Swiss precious metals manufacturer Valcambi, the CombiBar is a 50-gram gold bar that resembles a credit card in size but can be easily snapped apart into 50 individual 1-gram gold pieces.

Each 1-gram segment is stamped with its own purity, weight, and Valcambi logo—effectively turning one bar into 50 mini-bars. This makes it an incredibly flexible option for those concerned with liquidity, barter potential, or emergency preparedness.

At .9999 gold fineness, Valcambi’s CombiBar is fully eligible for IRA investing and is gaining popularity among investors who want the convenience of smaller denominations without sacrificing purity or brand trust.

Whether you're prepping for economic turbulence or just want a versatile bullion product that fits in your wallet, the CombiBar is one of the most innovative gold bars available today.

#9 – Engelhard Gold Bars

Engelhard Corporation was one of the most respected names in the precious metals world throughout the 20th century. Though Engelhard no longer produces gold bars today, their products remain extremely sought after by collectors and seasoned investors alike.

Most Engelhard bars were produced in the United States and come in both minted and cast formats. They feature unique serial numbers and typically have a purity of .999 or .9999 fine gold, depending on the year and batch of production.

Because Engelhard bars are no longer being made, they often carry a slight premium over newly minted bars. That said, their rarity and historical value make them an attractive addition to any diversified gold portfolio.

If you're looking for bullion with both intrinsic and collectible value, Engelhard gold bars are a time-tested choice worth considering.

Why Invest in Gold Bars?

When central banks hold precious metals – especially gold – in reserves, they hold gold bars. Why? Gold bars are simply more suited for storage and bulk investing than are gold coins. Gold bars take significantly less work to refine, are easier to stack, and can be easier to secure.

The most basic gold bar is essentially a brick (or ingot) that has been refined and stamped with important information such as the weight, gold purity, year of mintage and/or manufacturer’s name and logo. While some gold bullion is more complicated and difficult to produce, the simplicity of design and cheap production process of bars can be a sizeable advantage for investors.

Premiums on gold bars are typically very low, only marginally above the spot price of gold. For investors who have no interest in the design, collectability or other “numismatic” considerations of their bullion, gold bars are often the best option. Per ounce, you are probably going to pay less for your investments through bars instead of coins. This is especially impactful for large-scale investors.

Gold bars can be less liquid (i.e. more difficult to buy and sell) than gold coins. In this light, bars make more sense for those willing to hold on to their bullion for long periods of time than for an investor looking to flip their investment when gold prices spike.

Gold Bars or Coins?

If you're in the market for investment-grade gold bullion, you have two categories of products to choose from: gold coins or traditional gold bars. Before deciding to buy gold bars or incorporate another type of precious metal into your portfolio, you should be aware that:

- There are real, substantive differences between investing in bars vs. coins

- Not all gold bar investments are created equal

Ultimately, you are looking for gold bars for sale because you recognize the myriad financial benefits of owning precious metals. Your next step is to decide which gold product to buy. Bullion bars and bullion coins both share characteristics that make them a superior investment hedge against more volatile assets (e.g., U.S. equities and ETFs) and are much more reliable than holding national currencies. That isn’t going to change regardless of which type of gold you choose to invest in.

When You Buy Gold Bars, You Buy Portfolio Insurance

You insurance your home and your car, why wouldn't you do the same with your retirement savings? After all, your life savings is just as, if not more, important than your real assets, isn't it? In effect, gold bullion bars are a kind of insurance for your portfolio. They aren't tools for getting rich. Rather, they're tools for staying rich by insuring (or insulating) your portfolio from market shocks.

During the 2020 stock market crash, equity values in petroleum, real estate, entertainment, and hospitality sectors precipitated a massive market-wide sell-off. Investor sentiment plummeted, as recession fears rose as retail and institutional investors alike liquidated their assets. The result? The S&P500 lost 34% of its value between March 5 and March 23, 2020.

Imagine if you had been one of the millions of investors who panic-sold during the depths of the March 2020 bear market? Your retirement could've been put in jeopardy, and your sense of financial security could've been ruined for life.

Fortunately, the gold market is highly illiquid (i.e., it takes time to buy and sell gold since it's not listed as a security on an exchange). Therefore, it's resistant to knee-jerk investor reactions and isn't nearly as volatile as the stock market. In 2020, while the stock market was taking investors for a ride, gold prices stood stable with a year open of $1,520 per ounce, a year-low of $1,472, and a year high of $2,058 for an average of $1,773. The relative stability of gold makes it desirable for investors who want to manage risk and hang onto more of their wealth during market downturns.

Buying Gold Bars and Gold Bars as an Investment FAQs

What is the price of a gold bar?

The price of a gold bullion bar varies according to the live spot price on the COMEX market, which fluctuates throughout the day. At the time of writing, gold bars range between $77 (1 gram) and $64,350 (1 kilogram). These prices are based on a spot price of $1,705 per troy ounce.

Where can I learn how to buy gold bars online?

There are plenty of free resources offered by Gold IRA Guide to help you invest in gold bars or coins within your retirement savings accounts. For a starting point, read the latest version of our precious metals IRA investor's guide.

Are gold bars a good investment?

Many investors dedicate a small portion of their portfolio to gold and precious metals as a risk management tool. The price data over the past 5 years indicates that gold is trending upward in the short-to-medium term and has generally risen in value for several decades.

Can I buy gold bars from a bank?

In the United States, you can't simply buy physical gold bullion from your local Bank of America or Walls Fargo branch. Although in some European countries you can order gold bars and coins from central banks via retail banks (e.g., Raiffeisenbank), North American customers have to order through specialized IRS-approved vendors such as Augusta Precious Metals or Noble Gold.

What is a good amount to invest in gold bars?

Your portfolio's exposure to precious metals, including gold bars, should reflect your risk tolerance and time horizon until retirement. Generally, investors tend to dedicate between 5 and 20 percent of their wealth to precious metals in the form of gold. More risk-conscious investors typically devote more of their portfolio to gold and precious metals holdings.

Investing in Gold Bullion Bars Through an IRA

Did you know that you could invest in gold bullion bars through your IRA or self-directed gold 401k? This offers you a tax-advantaged way to own pure bullion bars and protect your portfolio from financial risk and political turmoil.

You can't buy gold bars from bank vendors like you could in the olden days. Instead, you've got to invest in gold bars through qualified, IRS-approved vendors.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.83

Gold: $3,355.83

Silver: $38.43

Silver: $38.43

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,574.14

Bitcoin: $117,574.14

Ethereum: $2,959.38

Ethereum: $2,959.38

[…] December 26, 2015 Gold IRA Guide […]