The Best Dave Ramsey Retirement Investing Advice (2025 Compilation)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 13th June 2025, 01:51 am

In a world filled with get-rich-quick gurus and questionable investment mentors, Dave Ramsey is refreshingly dull. As the host of the popular financial talk show “The Ramsey Show” (previously known as the “The Dave Ramsey Show”), Dave has built a cult following of listeners dedicated to paying off their debts and setting themselves up for a secure retirement.

Much of Dave Ramsey’s rules of investing are run of the mill. Tackle your debts from smallest to largest, build an emergency fund, invest in diversified mutual funds, and keep a trusted advisor at arm’s length. These are the pillars of Dave’s retirement preparation strategy.

Many of my customers are fans of Dave’s show and, over the years, I’ve come to appreciate his hard-nosed, no-nonsense approach to personal finance. That’s why I’ve put together a quick guide to the Dave Ramsey retirement investing strategy.

Table of Contents

Dave’s Retirement Investing Strategy: The Basics

Let’s break down the basic elements of the Dave Ramsey investing strategy.

It starts with setting aside the right percentage of your income for your retirement savings. Dave recommends dedicating no less than 15 percent of your household income to a tax-advantaged retirement account like a 401(k) or Roth IRA. Of course, if your employer offers a contribution match, always take them up on the offer and maximize the eligible contribution amount.

You’re probably not going to fit all 15% of your gross income into your self-directed 401(k) plan. That’s why Dave advises contributing up to the maximum employer contribution match in your 401(k) before switching to your Roth IRA—allowing your money to grow tax-free in two accounts.

Although I have some reservations about this, Dave cautions against investing if you have non-mortgage debt. Before you start investing, he advises that you should knock out your debts one-by-one (from smallest to largest) and build an emergency fund that covers at least three months of your monthly expenses.

The Real Estate Method

Dave recommends buying your home outright in cash. If this sounds far-fetched to you, you aren’t alone. For many, a 100% down payment is unfeasible. At the very least, however, Dave insists that you meet the following base criteria before becoming a homeowner:

- You’re debt-free and have an emergency fund

- You’ve saved at least 20% toward a down payment to skip out on Private Mortgage Insurance

- You’ve been married for no less than one year or are buying property on your own

When it comes to renting, Dave’s all on board. Whereas some financial authors view rent payments as throwing away money, Dave knows that paying rent can save you a lot of headaches if you aren’t ready to purchase real estate. So, don’t be afraid to rent if it makes more sense for your financial situation.

The Mutual Fund Game Plan

Dave recommends splitting your mutual fund investments into four categories that are weighted evenly in your portfolio:

- International

- Growth (i.e., large-cap)

- Aggressive growth (small-cap)

- Growth and income (mid-cap)

These funds can be purchased from any mainstream brokerages or investment providers such as Vanguard or Fidelity. Your mutual funds are the backbone of your retirement investment portfolio, they’re the money-makers that will provide you with compound interest and long-term growth.

As each fund grows over time, its 25% weighting will fall out of sync. Periodically, recalibrate your holdings across each account so that the value of each mutual fund is equal. The goal is to sell assets from your best-performing funds and add them to your worst-performing funds so that they’re more or less equalized.

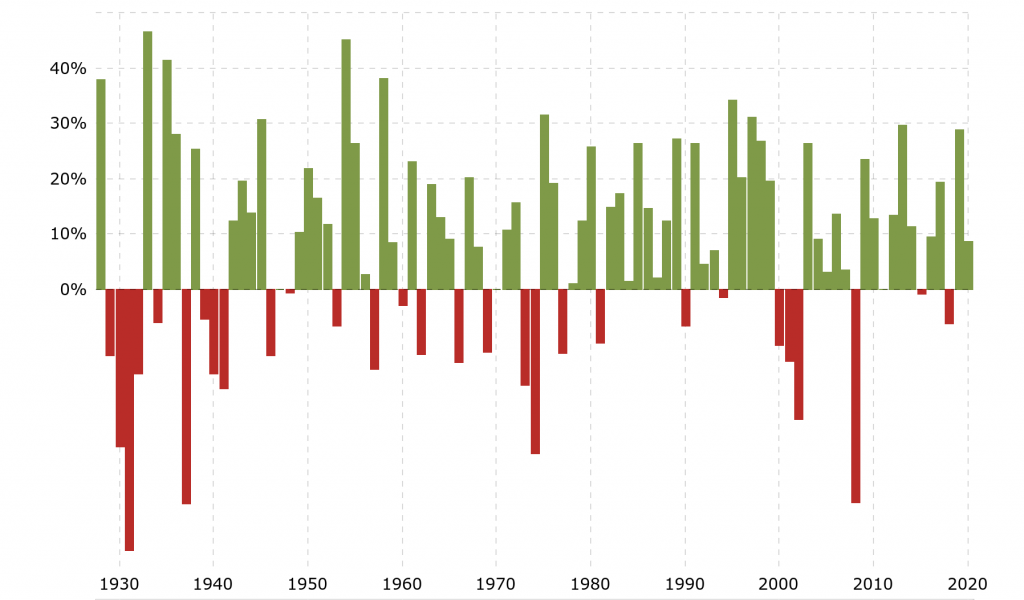

While Dave shoots for a 12% average annual return, I think this is a somewhat unrealistic figure. Over the past 20 years (2005–2024), the S&P 500 Index has delivered an average annual return of approximately 9.8%. While this is still strong, it's lower than the 12% return Dave often promotes. Financial advisors generally recommend using a more conservative return estimate, around 7–8% after accounting for inflation and taxes. (for this, I recommend the Dave Ramsey retirement calculator).

“S&P 500 Historical Annual Returns, 1927-2020” Source: Macrotrends

To get the most out of any retirement calculator in 2025, be sure to account for both taxes and inflation. With U.S. inflation averaging 3.2% annually between 2020 and 2024, and tax policies likely to shift, your retirement projections should reflect more realistic, inflation-adjusted outcomes. As a rule, assume inflation will rise at a rate of about 2-3% per annum, which will result in a doubling of one’s cost of living after about 27 years.

Moreover, Dave warns against chasing promises of a high short-term return. Instead, pick funds that have been on the market for a long time (i.e., 15 years minimum) and are proven performers.

Where Dave Might Be Wrong

While Dave Ramsey’s principles have helped millions achieve financial discipline, his investment advice isn’t without criticism — especially in today’s evolving financial climate.

1. High-Fee Mutual Funds

Dave promotes actively managed mutual funds, which often come with expense ratios of 1% or more. In 2025, most financial advisors favor low-cost index funds or ETFs with fees as low as 0.03%, especially since the majority of actively managed funds still underperform the S&P 500 after fees.

2. Avoiding Bonds Entirely

Dave recommends steering clear of bonds altogether. While this advice may suit young investors with long time horizons, many retirees or those approaching retirement in 2025 are turning to Treasury bills and high-yield savings accounts. With interest rates over 5% in early 2025, these instruments provide safe, predictable income — which Dave’s model doesn’t fully acknowledge.

3. No Crypto Exposure

Dave dismisses cryptocurrency as speculation. While that’s understandable for highly volatile assets, major institutions now hold Bitcoin as part of their long-term portfolios. A small, carefully allocated crypto position (1–5%) may offer long-term upside and diversification. Check out our review of Decentralized Masters to learn more about investing in crypto.

4. Gold & Precious Metals Rejection

Dave’s position that gold is too risky overlooks its role as a hedge against inflation and market volatility. Between 2020 and 2024, gold outperformed many tech stocks during periods of market stress. While gold won’t provide passive income, it can be a valuable portfolio stabilizer.

5. Debt Snowball Over Interest Rate Logic

Dave’s debt snowball method prioritizes small debts first for psychological wins — even if they carry lower interest rates. While this works for motivation, it’s not mathematically optimal. For those confident in their discipline, the debt avalanche (paying high-interest debt first) can lead to faster and cheaper outcomes.

Frequently Asked Questions (FAQ)

Let’s take a look at some of the most commonly asked questions about Dave Ramsey’s retirement investing strategy.

Who is Dave Ramsey?

Dave Ramsey is an American radio show host, business owner, and author of ten books on topics spanning personal finance, early retirement, and financial independence. He received a Bachelor’s degree in Finance from the University of Tennessee.

By age 26, Dave had built a real estate investment portfolio worth over $4 million. Two years later, Dave filed for bankruptcy after accruing millions in debt to the bank that was financing his investment business. During this time, Dave became a devout Evangelical and married his wife, with whom he’s built a family for nearly four decades.

After working his way out of bankruptcy, Dave started counseling local families and professionals on financial matters. Dave’s advice about getting out of debt derives from his first-hand experiences repaying his debts owed by his first business.

Dave got his start in broadcasting by co-hosting The Money Game beginning in 1992, a radio show that would later go on to become The Dave Ramsey Show. A television spin-off of the radio show, under the same name, aired on Fox Business Network between October 2007 and June 2010. Today, Dave is best known for his radio program and podcast which together garner over 14 million weekly listeners.

What is Dave Ramsey’s net worth?

In 2019, an article published in TheStreet estimated that Dave Ramsey’s net worth is approximately $200 million.

How does the Dave Ramsey retirement calculator work?

There are several retirement calculators available online to help give you an idea of when you can retire at your target per-annum savings rate. Most of these calculators are in real terms, meaning they automatically adjust for inflation at a rate of about 3% per year, but you should check the details of each calculator to make sure of this before trusting its calculation.

The Dave Ramsey retirement calculator works much the same way, by calculating your rate of return in real terms. His proprietary calculator considers the following factors:

- Your current age

- Your target retirement age

- The sum of your assets already saved for retirement

- Your expected monthly contribution

- Your expected annual return

Based on these metrics, Dave’s calculator produces three figures: your estimated retirement savings, the portion consisting of your own contributions (i.e., the principal investment), and the portion attributed to compound interest or yields (i.e., the “growth”).

An important thing to note is that Dave’s calculator notes that the historic 30-year return S&P 500 is 12%. While this technically isn't wrong, it is misleading. This figure is not adjusted for inflation and is an arithmetic mean, which is not a true representation of “annualized” returns.

For instance, if you had an initial investment that rose by 50% one year and then fell by 25% the following year, it wouldn’t make sense to allege that it saw 12.5% returns (50% – 25%)/2, because the value of your investment is right back where it started. So, consider aiming for a truer, more conservative annualized return from the S&P 500, which is around 7%.

What is the Dave Ramsay “snowball method”?

The snowball method is Dave’s strategy for eliminating personal debts. Dave’s approach to paying down one’s debts involves making minimum payments on all open balances and using whatever money is left over every month to pay off the smallest debt principal. Over time, you work from smallest to largest debts until you’re debt-free.

Unlike the “avalanche method”, which is based on interest rates rather than principal amounts, Dave’s snowball method sees quick results because small lingering balances are quickly eliminated under his strategy. In most cases, the snowball method leads to fast debt relief that builds momentum and keeps dedication high over time.

The chart below depicts a basic example of achieving debt freedom within 14 months using Dave’s snowball method. As one debt line is eliminated, the cash previously devoted to the former debt is reallocated to the next-largest debt until all of them are paid off.

Source: BusyBliss

What is a Dave Ramsey ELP?

Dave Ramsey ELPs (or “Endorsed Local Providers”) are vetted financial service providers that specialize in insurance, taxes, estate planning, or financial advisory. Listed ELPs are agents and financial professionals who share Dave’s philosophy regarding debt relief and financial responsibility, and are mentored and held accountable by a member of Dave’s team.

You can find a local Dave Ramsey ELP by downloading Dave’s Smartvestor app and using its interface to connect with a vetted professional in your area.

What’s Dave Ramsey’s mortgage advice?

Aside from his debt relief method, Dave is best known for his advice on home buying and mortgages. The Dave Ramsey mortgage strategy follows a few basic rules to maximize your buying power and make the most of your wealth in the long-term, including the following:

- Pay for your home outright with cash

- If you can’t pay with cash, put at least 20% to avoid Private Mortgage Insurance

- Be completely debt-free before taking out a mortgage

- Have an emergency fund with at least 3 months of expenses saved

- Get a conventional, fixed-rate mortgage with a term no longer than 15 years

- Make sure your mortgage doesn’t exceed 25% of your tax-home income

Although checking all of the boxes above might seem far-fetched, it’s far from impossible. Following the Dave Ramsey mortgage method requires patience and a significant amount of saving before finally closing a deal on real estate.

Which Dave Ramsey retirement books do you recommend for investing?

There are several Dave Ramsey books that are a wealth of knowledge on investing, debt relief, personal finance, and self-help. In fact, there are currently 10 books available online published in Dave’s name. Below is a complete list of published Dave Ramsey books, as well as the three texts that I would personally recommend to aspiring investors.

- The Total Money Makeover

- The Money Answer Book

- The Total Money Makeover Workbook

- How to Have More Than Enough: A Step-by-Step Guide to Creating Abundance

- Dave Ramsey’s Complete Guide to Money

- Financial Peace Revisited: New Chapters on Marriage, Singles, Kids and Families

- EntreLeadership: 20 Years of Practical Business Wisdom from the Trenches

- The Legacy Journey

- The Financial Peace Planner

- Smart Money, Smart Kids

If you don’t have the time to work through all ten titles in Dave’s oeuvre, then I’d stick to the following three classics that he’s best known for: “Total Money Makeover”, “Dave Ramsey’s Complete Guide to Money”, and “Smart Money, Smart Kids”. These texts will cover everything you need to know about building an emergency fund, living debt-free, buying a home, and much more. For those of you who have a growing family, the third book is especially important as it teaches a common-sense approach to passing down financial wisdom to your children.

Best Dave Ramsey Quotes on Retirement Investing

The Ramsey Show is a wellspring of quotables that pack a lot of hard-nosed financial wisdom into a few terse words. Below, I’ve listed a handful of Dave Ramsey quotes that I find enlightening, inspiring, and wise.

- “A budget is telling your money where to go instead of wondering where it went.”

- “Money is not good or evil. It has no morals or intentions on its own. Money reflects the character of the user.”

- “Sacrifice means spending less time on entertainment and more time on improving your life and family.”

- “Those who don’t manage their money will always work for those who do.”

- “Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.”

- “Change is painful. Few people have the courage to seek out change. Most people won’t change until the pain of where they exceed the pain of change.

The Bottom Line

Dave and I have our share of differences. For instance, I’m a big advocate of diversifying your retirement portfolio with precious metals such as gold and silver bullion. Dave thinks they pose too high of a risk, or that they pose too great of an opportunity cost.

His retirement investing strategy is a bit less risk-averse than mine and tends to favor high-yield asset classes, especially mutual funds comprised primarily of tech stocks. We also differ in our opinion about whether actively-managed funds are worth their expense ratios, and about whether bonds have a place in your retirement portfolio.

However, there’s no doubt that Dave Ramsey’s retirement investing advice is sound for the vast majority of investors. For younger investors (i.e., at least 10 years from retirement), following Dave’s advice outlined above will set you on the path toward financial freedom and an early, wealthy retirement.

Ready to take charge of your retirement? Whether you follow Dave’s traditional mutual fund advice or prefer a more diversified approach that includes gold or crypto, your first step is choosing the right self-directed IRA provider. Compare top IRA companies here and invest in your future with confidence.

Want to follow in Dave's footsteps? Consider opening a self-directed IRA or 401(k) today and invest in your retirement through a diversified, tax-advantaged savings account.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,347.59

Gold: $3,347.59

Silver: $38.15

Silver: $38.15

Platinum: $1,411.19

Platinum: $1,411.19

Palladium: $1,235.08

Palladium: $1,235.08

Bitcoin: $119,780.03

Bitcoin: $119,780.03

Ethereum: $3,007.65

Ethereum: $3,007.65