- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

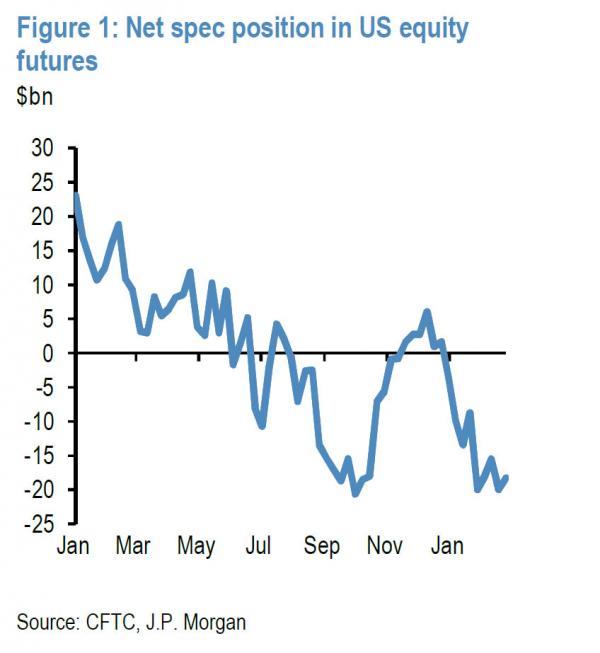

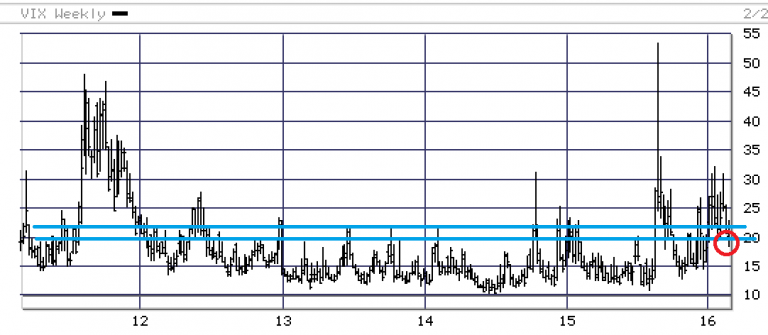

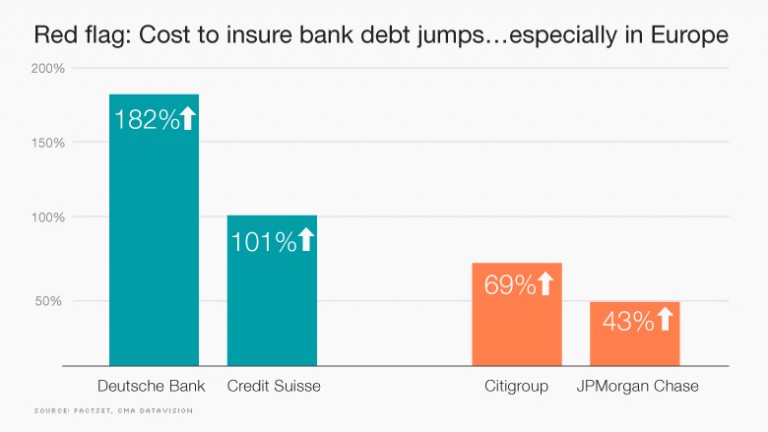

S&P 500 still looking weaker despite strong jobs data

Strength of most recent rally subdued Not all stock market rallies are made the same. Some have incredible momentum, with average daily gains well above 1% and many single day gains above 3%. A strong upward move in a broad…

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,337.49

Bitcoin: $67,337.49

Ethereum: $3,245.06

Ethereum: $3,245.06