- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

SeedInvest Review

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2023, 12:25 am

SeedInvest

- Phone : (646) 291-2161

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

SeedInvest has been highly successful in attracting some of the best business startups and an active large network of investors to their platform. This gives them a greater percentage of startups that actually meet their minimum fundraising goals, and allows for a higher percentage of success stories for their investors.

Pros:

- This model encourages and facilitates reaching out to friends, family, and customers with the inclusion of its social media marketing tools.

- Paperwork has been vastly reduced through their streamlining and standardization of documents efforts, saving startups money and time.

- The network that SeedInvest has fostered for providing funding to small businesses and companies with viable products on the market is interesting and rewarding to investors and very helpful to startups and still newer businesses.

- Their team is a pleasure to work with and takes a hands on interest and approach in each of their fundraising outfits listed on the platform.

- The platform's network of both angel investors and individual investors is active and extensive.

Cons:

- Only 1% of startup applicants are accepted into the program and listed on the platform.

- The fees for startups and small businesses are quite higher than what the majority of their rivals charge.

- The fundraising type of All or Nothing means that many businesses get nothing at all.

Quick Facts about SeedInvest

Company Headquarters:New York, NY

Reviewed By:David Crowder

Have you purchased products from SeedInvest? Leave a review!

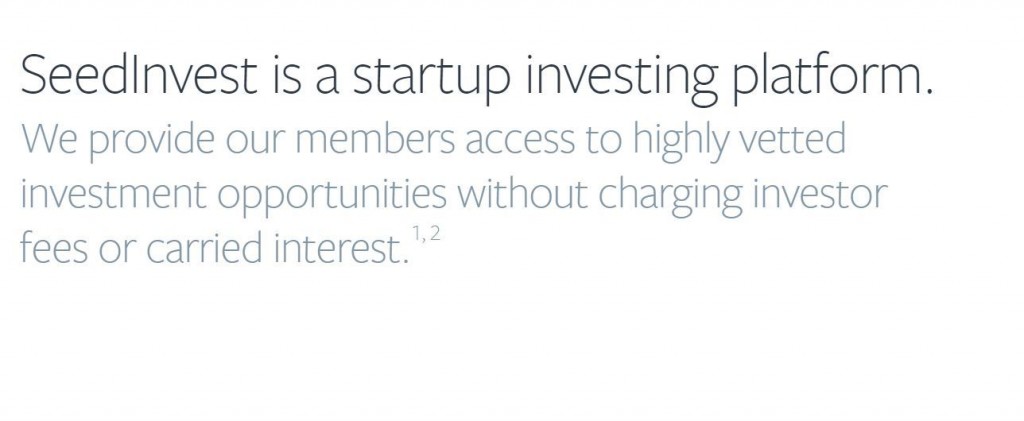

When you look at the amount of money that early investing in Venture Capital has made over the last 30 years, it will sicken you if you missed out like the overwhelming majority of investors. At an astonishing 21.29% average return per year over three full decades, Venture Capital has crushed stocks and bonds combined easily. SeedInvest is a crowdfunding platform that brings you this rewarding method of investing in business opportunities, through giving you a means to invest in vetted and transparent startup companies throughout the United States.

SeedInvest Intro & Background

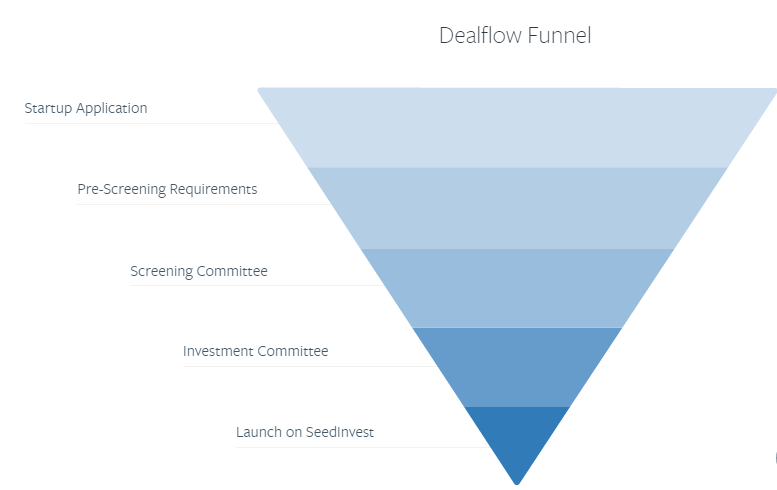

SeedInvest is fairly unique in how exclusive and selective it is with its vetting and narrowing down process. They so thoroughly review and funnel out their applicant startups that only 1% of those who apply are accepted onto the platform. This makes them seven times more selective than the admissions board at Harvard University (which accepts 7% of applicants).

This company also provides another rarity with not charging investors either carried interest or investor management fees. They provide small business investment opportunities in those companies searching for funding that ranges from $100,000 to $5 million, for companies who have demonstrated that they will be successful in their chosen industry. The average funding goal that is achieved is around $40,000.

The team of people who built up SeedInvest hail from a variety of professional investment backgrounds. They have served and worked at such well-known employers as Morgan Stanley, Goldman Sachs, and Wellspring Capital. Besides this, they have also assisted with the management of literally billions of dollars in private investment funds.

SeedInvest Founder and Management Team

CEO AND Co-Founder Ryan Feit understood there was a real need to put together investors and entrepreneurs. Before he started SeedInvest, Ryan worked for Lehman Brothers and Wellspring Capital Management in New York. Here he financed, invested in, and also managed literally dozens of public and private companies. He played an instrumental role in the senate passing the 2012 JOBS Act that eliminated the U.S. securities antiquated laws from 80 years ago which prohibited entrepreneurs from raising money for their businesses via the Internet. He is constantly sourced for startup investing material by The Washington Post, The Wall Street Journal, The Economist, Fortune Magazine, The New York Times, Inc. Magazine, Fox Business Channel, and CNBC the Money channel.

Co-Founder James Han worked as professional investor before he helped to start SeedInvest. At his position at Francisco Partners, he concentrated his efforts on deep technology equity investments. He also served for several years with Morgan Stanley's technology investment banking division, and with Cisco and Riot Games in a variety of capacities.

SeedInvest Loans

SeedInvest utilizes both a personal and an equity model for fundraising. They do not facilitate any loans at this time on their platform.

How SeedInvest Works

We agree that SeedInvest is rightly proud of the way that it brings together a wide range of investors and startups. They count family offices, Venture Capital firms, angel investors, strategic investors, and over 14,400 network investors as participants in their platform. They also are almost unique in the space for allowing international investors to be involved in investing.

Companies that wish to join and fundraise via SeedInvest have an uphill battle ahead of them. They must provide proof of a viable prototype or product, proof of their concept, and also demonstrate that they employ two actual full-time team members in employees. They must also have been legally incorporated within the U.S., and can not be internationally based. This rigorous vetting process only allows 1% of applicant companies to be approved for the platform.

Campaigns are only considered successful when they hit a certain minimum target of fundraising within their campaign efforts. Until and unless their minimum goal is reached, they will not be disbursed any funds. This will disqualify many businesses which are unable to achieve their minimum fundraising goals. Most of the companies on the site are interested in raising in between $100,000 and $5 million. This process that they utilize is known as “all or nothing.” Businesses only receive 60 days in which to achieve their personal fundraising goals, and if they fail to, they receive nothing.

SeedInvest Services

- Legal Standardization – SeedInvest has standardized their legal document paperwork and eliminated the legal review fees for any company who utilizes the documents that they provide without altering them. These are called the Series Seed documents. This should save the startups costs for legal fees.

- Equity Stakes – Any business listed successfully on the platform is allowed to both connect with and appeal to investors for funds by offering to provide equity stakes within their company.

- Social Media Advertising – Companies participating on the platform in fundraising are provided with an integrated set of social media tools to go along with the traditional advertising tools in promoting their fundraising campaign. This way they can also appeal to customers, friends, and family in their fundraising efforts.

- Help with Closing Investment Funding – The platform assists companies in getting their due diligence docs online, completing their legal documents, and processing their investment offerings so that they are able to quickly close on investment offers.

- Investor Verification Tools – The platform provides all investors with the use of some really helpful automated tools for confirming the identification of accredited investors so that your privacy is discreetly maintained on and off the platform.

- Online Due Diligence Listings – The company puts up all of the due diligence documents and materials on the platform so that it is simple to access and appropriately review them before investing in the startups concerned.

- Collaborate and Partner – Platform facilitates easy partnering and collaboration with colleague investors on the site.

- Investor Dashboard – It is so easy to monitor and manage your investment holdings in the equity positions using their investment dashboard to follow your portfolio.

- SeedInvest Academy –We love this good educational service and sub-site that SeedInvest provides its investors and startup people with on the site. There is a section on capital raising and introduction to the finances of startups, as well as how to create equity campaigns, and manage investor relations. Investors can learn the ins and outs of investing properly and profitably in the early stage startup companies and how it actually works. There is also a glossary of terms to help with those tricky investor words and concepts that are not always so intuitive.

SeedInvest Locations

SeedInvest maintains a single office in New York City. It is located at SeedInvest, LLC, 222 Broadway, 19th Floor, New York, NY 10038.

SeedInvest Interface Screenshots

SeedInvest Safety

The company recognizes that you trusting in their security of all of your data and financial information is critical to the ongoing success of their business model. This is why they encrypt all communications and data exchanges between them and you using the 128 bit industry standard SSL encryption protocols. All of their servers are behind firewalls. They do not store any sensitive information like bank account numbers or social security numbers on their servers at all. We feel like this is a major effort towards dependable data security.

SeedInvest Complaints and Ratings

The Better Business Bureau and other online ratings agencies does not maintain a file on SeedInvest as of time of publication. It may be that they company is still too new to have one. We did not turn up any complaints online when we conducted a search for any ratings or complaints on SeedInvest.

SeedInvest Customer Support

Customers or potential clients who feel the need to get in touch with their customer support are invited to email them with their complaints, concerns, comments, and questions. They do not give out their phone number, but the platform does offer a very good Live Chat help and support, along with their educational site SeedInvest Academy, a good glossary, and a helpful Frequently Asked Questions section. The live chat support all by itself is fairly unusual in this industry.

SeedInvest Costs & Fees

This platform is very proud of its no cost fees for investors. They do not even charge management or carried interest fees with their managed features that every investor account includes.

For startups, the story is different. Their costs are high as compared to rival crowdfunding equity platforms. All funds raised are docked fully 7.5% as a completion of campaign charge. Besides this, every campaign pays in between $3,000 and $5,000 for due diligence, escrow, legal, and marketing reimbursement. These charges are quite a bit higher than the more typical 5% completion fees that the majority of their crowdfunding rivals get. Startups that do not reach their minimum fundraising goals do not pay any campaign completion fees, but they also do not get any money.

Final Words on SeedInvest

This is a well-respected and highly successful equity crowdfunding platform for those small businesses who need to reach the investors directly. Startup founders have to bring a highly qualified and appealing concept that has already demonstrated some success on the market in order to be allowed to fundraise here. The fees for startups are quite high, but the platform does provide effective and easy to utilize tools to help the campaigns be more successful in reaching their ultimate minimum fundraising goals. Their stated average of $40,000 raised by their on-platform startups is not at all bad.

SeedInvest

- Phone : (646) 291-2161

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

SeedInvest has been highly successful in attracting some of the best business startups and an active large network of investors to their platform. This gives them a greater percentage of startups that actually meet their minimum fundraising goals, and allows for a higher percentage of success stories for their investors.

Have you purchased products from SeedInvest? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68