- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Stock Market Expected Returns Reduced: Gold Looking More Attractive

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Stocks have had an amazing rally since they bottomed out in March 2009 at 735. Over the next 6 years, the S&P 500 reached a new high in May 2015 at 2107, which represented an 186% increase from trough to peak. This sustained rally created a higher level of expected stock market return. Since 1965, expected return had been considered as the historical return experienced, which has been at around 7% adjusted for inflation. The 5 years ending December 2015, however, gave a return of 12.2% per year. This caused some analysts to adjust expected returns also to the upside.

The recent events that have plagued the global stock markets, and which have led to higher volatility and some sharp falls in price, have begun to create a new norm for expected returns from stocks. The current macro narrative is unlike anything we have seen previously. Interest rates have never been so low and for such a sustained period of time. The Fed is aware that interest rates need to increase, and the stock market is very wary of any increases. The concern is that the economy may not be strong enough to maintain its current expansion if the cost of capital rises. The world’s second-largest economy is China, an emerging country, with problems in keeping its growth rate at the kind of levels enjoyed in the recent past.

New normal for expected stock market returns

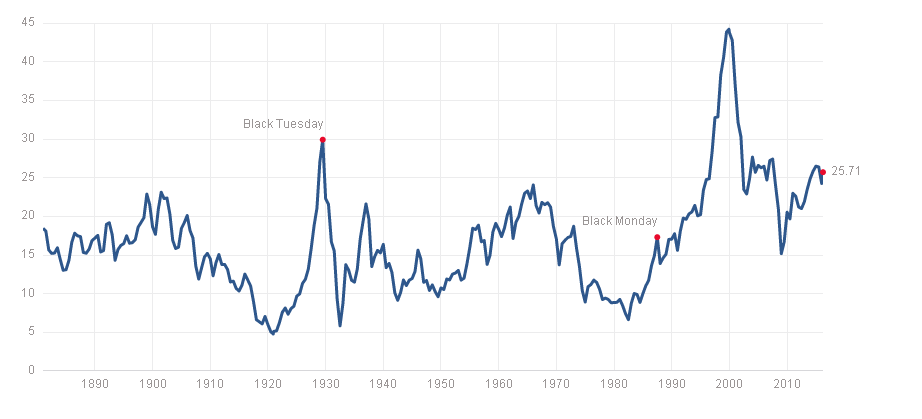

The current economic environment has created the need to readjust stock market expected returns. In the light of the factors coming into play, it would seem unlikely that stock will be able to continue performing at the same level. Price-earnings ratios, as measured by the Schiller P/E ratio, are at the highest levels on a historical basis. They are most likely to retreat from current levels creating a drag on returns.

In January 2007 at the onset of the subprime crisis the Schiller P/E ratio was at 27.21. Currently, the ratio is at 25.71. The chart below shows how the stock market has consistently declined when the P/E ratio is at these current levels. The spike in the P/E ratio during 1999-2000 is due to the technology bubble and has never been repeated. This metric alone could be a warning sign of weaker stock markets.

Jack Bogle, founder of Vanguard Mutual Fund, at his latest conference, stated that he saw current expected returns to be made of two elements: investment return and speculative return. The first is the return from dividends, at around 2% and the second is the return from price growth around 6%. Then he went on to state that the reduction in P/E ratio would reduce expected return by around 3% per year, not adjusted for inflation.

Schiller PE Ratio, Source: multpl.com

Schiller PE Ratio, Source: multpl.com

Precious metals looking more attractive

Gold may have never really lost its long-term attractiveness, but seeing its price plunge by nearly 46% from its highs in 2011would not have felt too good to most people. Silver was hit even harder losing 68% from its highs in 2011. Now it looks like their fortunes may be changing. Despite the fear of interest rate hikes, which have been shrugged off, it would seem precious metals could be heading back to a typical bull market.

Elliot Wave theorists are now joining the many voices that see Gold as an outperformer over the next decade. The Elliot wave theory is based on the principle that markets are made up of cycles, and each cycle can be broken down into a set number of waves. This set number of waves allows for making market predictions. In 1941, Ralph Elliot predicted that the stock market would enter a 70-year bull cycle, which was expected to end in around 2012.

That prediction sounds quite amazing when you consider it was made in the midst of World War II. Using Elliot’s wave theory, some analysts are predicting that buying Gold in 2016 could be similar to buying stocks in 1941. There have been predictions for Gold to retouch previous highs in an attempt to reach $2,000 again, some have even envisioned price reaching $5,000. However, Avi Guilbert an Elliot wave theorist, suggests Elliot Wave forecasts are predicting gold at $25,000 over the next 50 years.

His prediction for silver is even more bullish with a forecast of $1,000.

A more reasoned approach to Gold’s value

Whether you think Elliot wave theory may or not be able to predict future market cycles, Gold is beginning to regain its appeal. The shiny metal holds the characteristic of being a great safe haven against market turmoil and an excellent hedge against inflation. These two factors alone are generating renewed interest in this precious metal given the current scenario. Then there is the limited availability of this metal and the unlimited supply of money. As money mass increases worldwide the value of Gold expressed in terms of an ever increasing unit can only also rise.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81