- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Not Yet Time to Pull the Trigger

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 29th February 2016, 02:27 pm

Last week's column, “Is the ‘Crowd' too Bearish?” discussed whether excessive pessimism on Wall Street had set the stage for corrective countertrend moves in various markets. As of now, the question remains open. After a choppy week, equities and Treasury bond yields ended a tad higher, but so did gold and the U.S. dollar.

Regardless, some might be tempted to think that the recent price action has gone some way toward working off the pessimism that has built up since 2016 began, but there are indications that this is probably not the case.

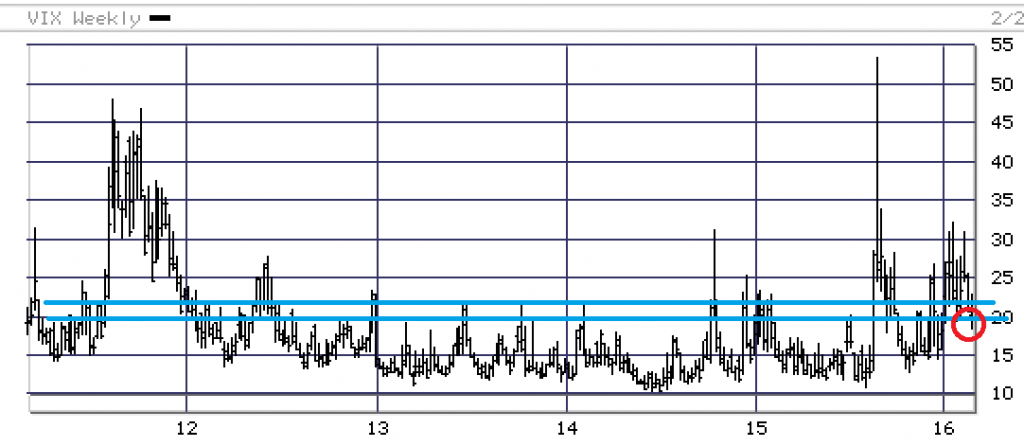

For one thing, traders are reportedly betting that the CBOE Volatility index, or “fear gauge,” a measure of the prices being paid for at-the-money options on the S&P 500 index, has hit bottom. This is despite the fact that the VIX is hovering around the midpoint of its 6-month range, and is near levels that marked interim peaks (i.e., lows in share prices) in the prior five years.

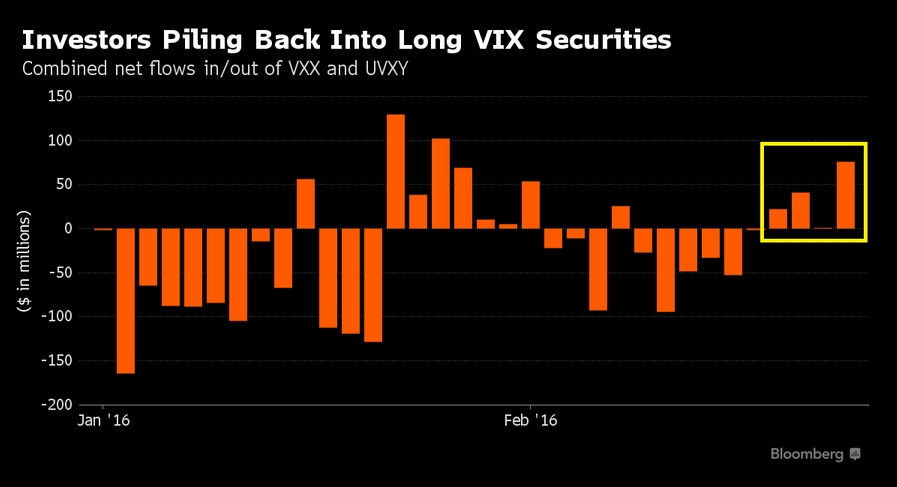

Certain investment flows also suggest that many pessimists have not given up the ghost, which is probably necessary for bearish trends to reassert themselves. According to Bloomberg, “a pair of securities that track the [fear] gauge have seen combined inflows of $140 over the last week after losing almost $1 billion to start 2016.” Meanwhile, “hedge funds hold more long bets on VIX futures than at any time since September,” based on data from the U.S. Commodity Futures Trading Commission.

Leaning one way

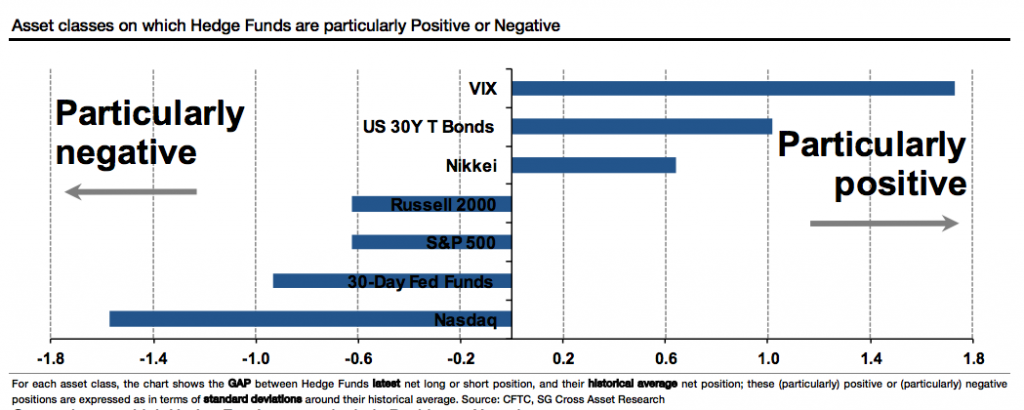

Other developments bolster the notion that large speculators are expecting the worst, including the fact that they have outsized positions in certain assets classes that should benefit if and when the turbulence of the past two months reappears. Citing data from Societe Generale, illustrated in the chart below, Business Insider reports that hedge funds are “battening down the hatches” and “getting ready for Armageddon.”

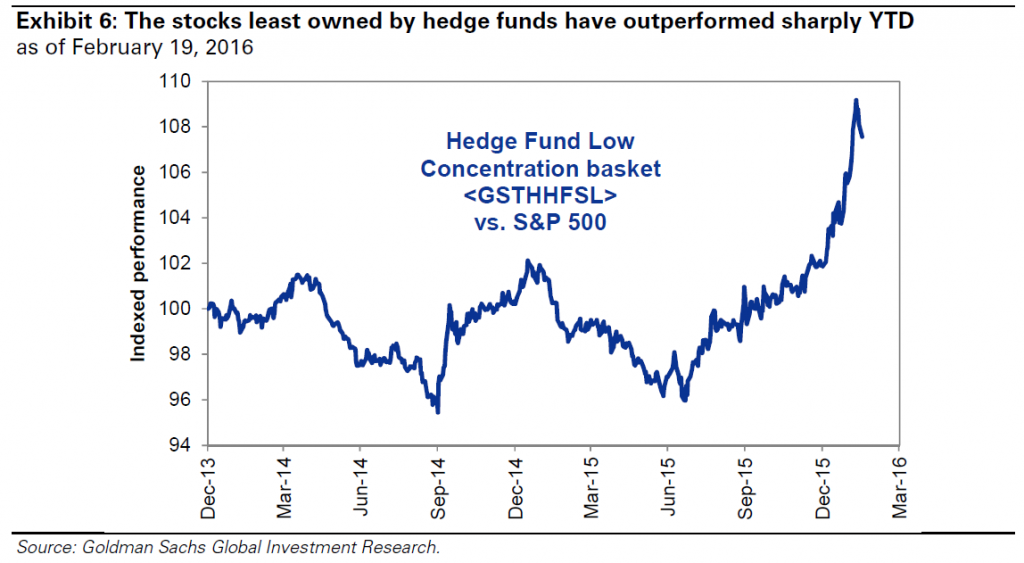

Those who believe this group represents the “smart money” and is therefore worth emulating should keep two recent research commentaries in mind. The first is from Goldman Sachs, which found that stocks with low hedge fund ownership have outperformed the S&P 500 since the third quarter of 2015, contrary to the pattern that had been in effect since June 2015.

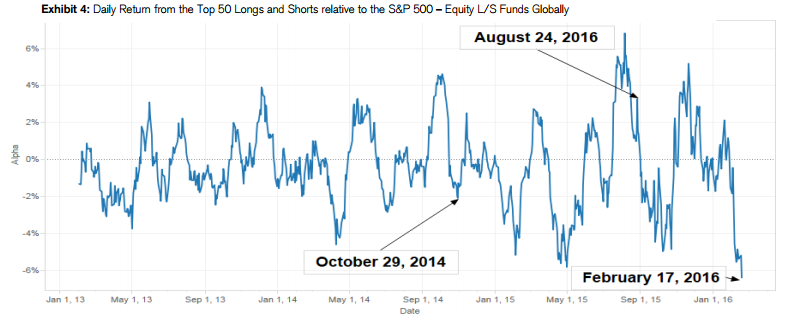

Another assessment by Credit Suisse, highlighted below, shows that equity long/short hedge funds' bullish and bearish bets have been faltering. So far this month, both their longs and shorts are lagging the S&P 500, which hasn't happened since January 2013.

The little guy is also negative

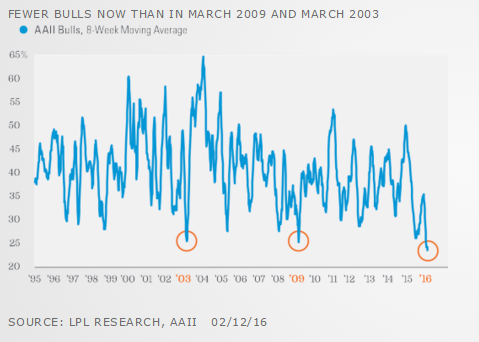

It's worth noting that it isn't just larger players who are convinced that the situation remains dire. Based on one sentiment indicator, individual investors are less optimistic about equities than they have been at any time during the past 23 years. This includes 2003 and 2009, which, as it turned out, proved to be major lows for equity and other risky asset prices.

Nonetheless, there are still plenty of reasons to believe that the longer-term outlook remains negative. Perhaps the most compelling is growing evidence that the U.S. and global economies are heading south, a development that will almost certainly rattle equity and credit markets and reverberate across asset classes around the world.

Indeed, since I noted in “The U.S. Stock Market Is Set for a Fall” that numerous indicators were signaling trouble ahead, other, more recent data has only reinforced this point. Last year, for instance, the “value of goods that crossed international borders fell 13.8%,…the first contraction since 2009.” The Financial Times writes that “weaker demand from emerging markets made 2015 the worst year for world trade since the aftermath of the global financial crisis, highlighting rising fears about the health of the global economy.”

The drop in corporate profits since mid-2015 is also an ominous sign. Over the past 115 years, JPMorgan Chase has found, “recessions have followed consecutive quarters of earnings declines 81% of the time”; of the remaining 19%, a downturn “was only avoided through either monetary or fiscal stimulus,” CNBC notes, both of which seem unlikely prospects in light of current circumstances.

‘Already high and only going up'

Finally, a growing number of analysts are increasingly convinced that an economic downturn is on the cards. For example, Bloomberg recently reported that “after a few years of reasonably calm markets and stable growth around the world, Citigroup Inc. says the chances of a global recession are already high and only going up.” According to the bank's economic team,

“the long-standing fragilities in the world economy relate to the structural and cyclical slowdowns in China and its unsustainable exchange rate regime, the excessive level of debt across many countries and sectors and ongoing regional and geopolitical uncertainty.”

The newswire added that “the economists have accordingly revised their forecast for growth this year in advanced economies, from a 2.4 percent in January 2015 to 1.6 percent currently, and warned that the 2016 figure ‘could well be lower.'”

If history is any guide, the fact that sentiment is fairly pessimistic while the fundamental picture remains poor, to say the least, probably points to the need for more time, grinding but relatively small countertrend moves, and a (false) sense of confidence that the worst is behind us, before bearish forces reassert themselves.

With that in mind, the message remains the same: wait for better entry points to buy gold and sell stocks in preparation for the challenging times ahead.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81