- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Is the Conventional Wisdom Wrong About Gold?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

In the wake of last Friday’s U.S. employment report, a growing number of analysts now expect the Federal Reserve to raise interest rates before year-end. The conventional wisdom is that such a move will only add to a bearish outlook for gold. But could this time be different?

There’s no doubt that higher interest rates will make it more expensive to finance holdings of gold other precious metals, which naturally creates pressure on prices as dealers seek to rein in inventories. And with both the European Central Bank and Bank of Japan making it clear that they intend to remain accommodative for the foreseeable future, the betting is that the dollar will continue rallying as money flows away from Europe and Japan, and towards the U.S., to capitalize on the higher relative yields. A stronger U.S. currency makes the price of gold more expensive in foreign currency terms, leading investors and others to either take profits on their holdings or forgo buying until prices are deemed more affordable.

That said, while a more favorable yield differential is one factor that could push the U.S. currency higher, it is not the only one. Perhaps a more compelling reason for the dollar to rise is a sudden unwinding of a massive structural short position in the currency. This mismatch has largely come about as a result of the Fed’s aggressive policy machinations since the financial crisis. Over the past seven years, record low U.S. rates have encouraged corporations, governments and speculators around the world to go on a massive dollar borrowing spree, in many cases to satisfy yield-starved U.S. (and other) investors’ demands for higher-yielding dollar assets.

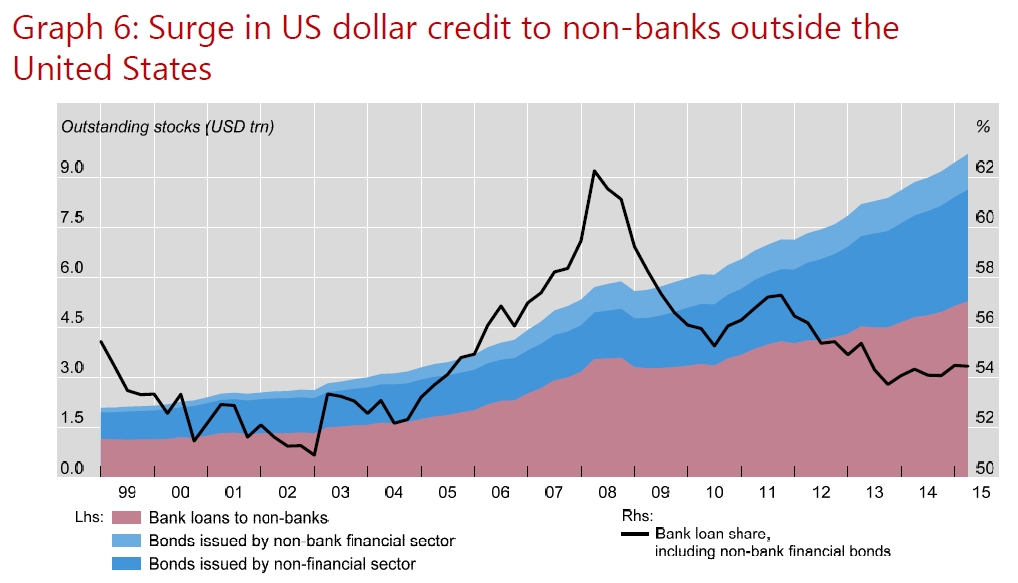

A record $9 trillion in borrowings

According to data from the Bank for International Settlements, detailed in April by Bloomberg, “sovereign and corporate borrowers outside America owe a record $9 trillion in the U.S. currency, much of which will need repaying in coming years.” The article also noted that “central banks that had reduced their holdings of the greenback [were] starting to reverse course, creating more demand. The dollar’s share of global foreign reserves shrank to a record 60 percent in 2011 from 73 percent a decade earlier, though it’s since climbed back to 63 percent.”

While it does not seem to have caused major problems so far, an imbalance of this scale, spurred by the catalyst of a Fed-induced hike in rates, seems like just the set-up for disruptions that could destabilize global financial markets and boost demand for safe haven assets, including gold, for years to come.

For one thing, it is likely that at least some of the banks, hedge funds, and speculators who have been borrowing the U.S. currency to capitalize on the so-called “carry” trade might suddenly find themselves in a difficult situation. Some have used short-term dollar financing to acquire illiquid or otherwise risky assets; others have exchanged the dollars they borrowed into other currencies to purchase foreign assets. An uptick in interest rates or value of the greenback will adversely impact such trades, leading some of those involved to try to reverse their positions. Any sign that this might be occurring on a decent scale could trigger a major scramble for the exits.

Big losses and heightened uncertainty

The tremors wouldn’t only be felt in markets. There would likely also be concerns about the health of many banks and other intermediaries, who tend to “borrow short and lend long.” That is, they finance the longer-term loans they make to individuals and businesses with short-term borrowing. While a rise in U.S. interest rates isn’t necessarily problematic, especially for domestic institutions–indeed, investors bought U.S. bank shares on the heels of the aforementioned jobs report–the fact that many of those who have borrowed in dollars are based overseas suggests that at least some have balance sheets lumbered with unstable maturity and currency mismatches. This could lead to big losses and heighten uncertainty about the affected parties’ financial well-being as they try to cut losses and reduce exposures.

Both situations could cause investors to seek safer havens. But such dislocations are not necessarily required to see the demand for gold and other precious metals increase amid a rise in interest rates. After years of extraordinary monetary interventions, analysts and investors around the world have come to depend on the Fed (and other central banks) for guidance about future economic trends, and many seem convinced that policymakers know just what they are doing. If and when the Fed makes the move that the majority seems to be expecting, it is possible-perhaps, probable–that it will be interpreted as a sign that conditions really are getting better.

In other words, a hike in rates will lead at least some investors to start thinking that the Fed has achieved its long-stated goals of boosting growth and inflation. While the near term data won’t necessarily support such a view, investors probably won’t hang around waiting for the consumer price index to begin perking up. As has been the case in the past, rising inflationary expectations could begin to play a significant role in driving up prices. If that happens, it probably won’t be long before investors get serious about hedging themselves–by investing in gold.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81

[…] there are two reasons to be negative on gold: rising interest rates (an issue I discussed in “Is the Conventional Wisdom Wrong About Gold?”), which will make the price of the metal more expensive for non-dollar buyers; and low […]

[…] dollar rally means the news is largely priced in. Perhaps that is true, but as I noted in “Is the Conventional Wisdom Wrong About Gold?” there are reasons to believe that the world is structurally short of dollars, which suggests […]

[…] and have warned that further strength will be similarly negative. Moreover, as I argued in “Is the Conventional Wisdom Wrong About Gold?” the risk is that a destabilizing global bear squeeze will play a key role in sending the […]

[…] noted last week in “The U.S. Stock Market Is Set for a Fall” and, previously, in “Is the Conventional Wisdom Wrong About Gold?” there is likely a dollar-supportive structural issue at play. Since the Federal Reserve […]

[…] sum, there are myriad reasons why it might be wrong to be long the dollar and commodities (including gold and other precious metals), and short bonds and equities, including some that no one, including me, has even considered. […]

[…] fact that the dollar has recently flat-lined can also be seen as a positive. I argued in “Is the Conventional Wisdom Wrong About Gold?” that a rising U.S. currency wasn’t necessarily bad news for prices, because such a […]