- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

The Fallout from a Change in the Interest-Rate Cycle

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Following last week's better-than-expected U.S. November nonfarm payroll data and remarks by Federal Reserve Chair Janet Yellen–which essentially confirmed that short-term interest rates are headed higher–all eyes are on the December 15-16 Federal Open Market Committee meeting. Expectations are that the Fed will raise the federal funds target rate by 25 basis points from the 0.0%-0.25% level that has been in effect for seven years. I already argued in “Anything But Positive for Bond Markets” that the move will be negative for bonds, but the effects are likely to be far-reaching, though not necessarily completely predictable.

A good bet

That said, there is one historical pattern that will likely repeat itself. According to strategist Robert Doll, “rising interest rates tend to be associated with periods of market volatility.” More specifically, that means prices will, on balance, swing more erratically and in wider intraday ranges than has generally been the case in recent years. Odds are as well that correlations will fall and dispersion will rise, which could lead to more challenges or opportunities for investors, depending on their vantage point.

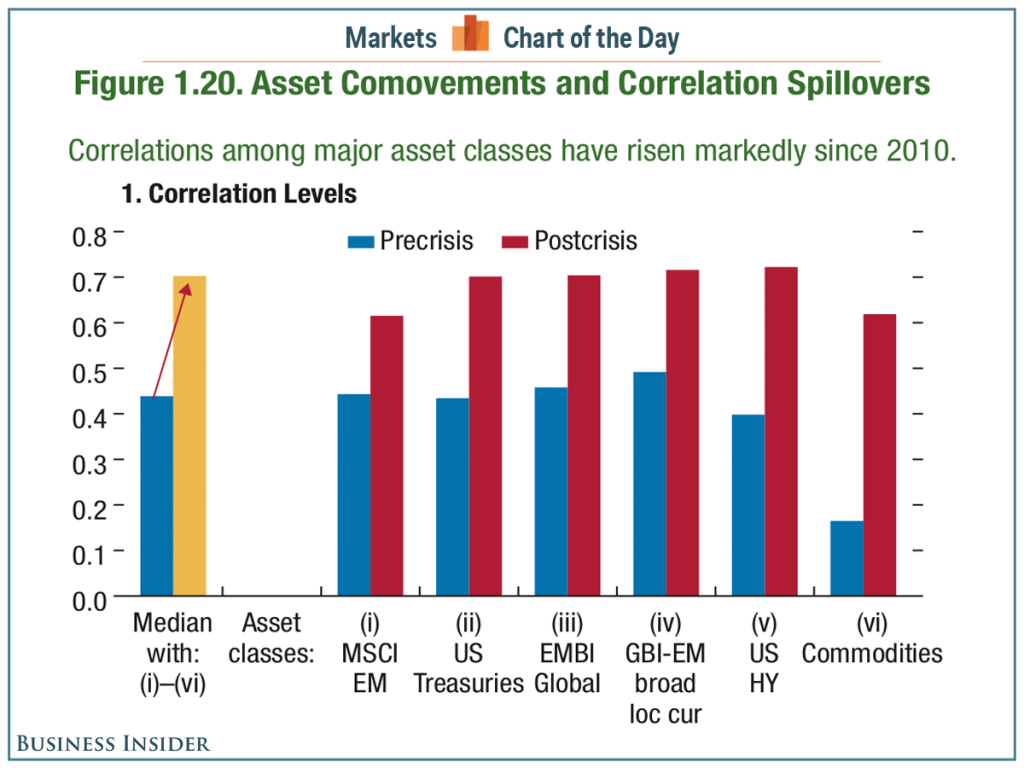

As detailed in the following chart, data from the International Monetary Fund shows that asset prices have in the years since the global financial crisis become more correlated–that is, they have increasingly moved in sync–than they were prior to that event.

Along the same lines, data from strategist Michael Mauboussin reveals that returns have been more “clustered” in the last few years than previously, meaning that differences in performance among securities within an index or universe have been less varied than has been the case at various times before now.

Will the past repeat itself?

Historically, certain stocks and sectors, including financials and small cap stocks, have fared better than others in a rising interest rate environment. However, things may be different this time. While many investors and analysts have, for example, been betting that U.S. financial stocks will gain from tighter monetary policy, other factors might put pad to this notion. Undoubtedly, banks and other lenders benefit when they can charge more for the loans they make. But if, as I suggested in earlier articles, the monetary policy turnabout destabilizes markets and raise concerns about the creditworthiness of borrowers who have been kept alive by artificially low rates, then the financial sector might not do as well as many expect.

A rise in U.S. interest rates, especially at a time when central banks in Europe, Japan and in other parts of the world seem intent on maintaining accommodative policies, will likely also affect cross-border capital flows and the exchange value of the U.S. currency. Some might argue that since markets have been anticipating the Fed's impending move for some time, the recent dollar rally means the news is largely priced in. Perhaps that is true, but as I noted in “Is the Conventional Wisdom Wrong About Gold?” there are reasons to believe that the world is structurally short of dollars, which suggests that the path of least resistance is still up.

Scramble for safe havens

If money flows into U.S. assets and the dollar rises, that could cause problems in numerous markets, especially in emerging countries, and trigger a widespread scramble for safe haven assets. Needless to say, many analysts are convinced that the traditional inverse relationship between the dollar's value relative to other currencies and the price of gold (and other precious metals) will remain intact, but the sort of instability that a broad-based dollar and credit squeeze could provoke could prove them very wrong.

Of course, a higher dollar doesn't only impact asset prices. While it is true that if the currency strengthens it will cost foreigners more to buy U.S.-denominated securities, such a development will also have other effects. For example, U.S. export-oriented companies might find it harder to sell their products in overseas markets because local-currency-equivalent prices will rise with the dollar. Alternatively, foreign companies that largely sell to domestic customers and who buy raw materials priced in dollars, such as oil, may see margins squeezed.

Unexpected consequences

More broadly, a rise in the U.S. dollar would have the unintended effect of reducing U.S. inflation because imported goods would be that much cheaper. This could play havoc with central bank policymaking, leading to confusion or even confrontation between policymakers and interested parties. There is also the risk that higher rates and a stronger dollar will land a one-two punch on an economy that does not seem as robust as the Fed and others claim it is. If so, conditions could deteriorate quickly, and the Fed could be forced into an abrupt about-face that leads to a widespread loss of faith Yellen & Co. Alternatively, the U.S. central bank may need to alter the pace and eventual magnitude of its rate-tightening cycle, spurring greater uncertainty and exacerbating already heightened market volatility.

In light of all of this, anyone who is expecting a rising-rate cycle to play out just as it has before may be in for a rude awakening. Arguably, this largely stems from the fact that the past decade has not been “typical” in any real sense of the word. The only thing that one can probably say for sure is that plenty of experts are going to be surprised or startled by what happens next. In such an environment, the best option may be to batten down the hatches and acquire some insurance.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81