- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Anything But Positive for Bond Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 30th November 2015, 05:28 pm

In theory, the fact that copper and other commodity prices are hovering near multi-year lows (as I noted here), while the Baltic Dry Index, a gauge of global shipping rates, has just hit its lowest level in three decades (suggesting that global growth is mediocre at best), should be good news for fixed-income markets. Bond prices tend to do well when economic conditions are soft and inflation is subdued.

In reality, a variety of crosscurrents suggest that the outlook for the sector is anything but positive. In part, this reflects the growing belief that the Federal Reserve is set to move towards interest-rate “normalization,” perhaps as soon as the next Federal Open Market Committee meeting in mid-December. By raising the federal funds target rate–which helps determine the level at which banks lend balances to each other overnight–above the 0.00%-0.25% range that has prevailed since December 2008, the Fed is ostensibly seeking to transition the economy back to some level of “normalcy.”

The Next Leg Down

Unfortunately, the result may not be what policymakers want or intend. That is because fixed-income markets have become severely distorted in the wake of an era dominated by two acronyms: ZIRP and QE. Aside from encouraging malinvestment and excessive lending to the riskiest sectors of the economy, the Fed's long-running zero interest-rate policy and multiple rounds of quantitative easing (where the central bank bought substantial quantities of bonds in the hope of driving down long-term yields) have created what amounts to a substantial increase in potential supply, setting the stage for a big leg down.

Specifically, aggressive monetary accommodation encouraged a dramatic increase in borrowing by many companies and individuals that will have a hard time paying back what they owe when financing costs rise. Given the numbers involved, this could undermine confidence–and prices–in all but the highest-rated sectors. In addition, a sizable share of the borrowings that have occurred in junk bond, corporate bond and bank-loan markets will need to be rolled over during the next few years, which means that no small number of borrowers may hit the wall–and the market–sooner rather than later.

Meanwhile, the flood of issuance since 2008 has led many investors to acquire positions that have significantly greater risk than many might be comfortable with during more “normal” times. It has been clear from the outset that one of the Fed's goals during the past several years has been to force investors to move away from traditional safe havens such as Treasurys, and it appears that they have succeeded.

Deteriorating Conditions

Other developments have also weakened the underpinnings of fixed-income markets, which means that trading conditions could deteriorate quickly. Liquidity, in particular, has been undermined by regulatory changes such as the Volker Rule, which “prohibits banks from conducting certain investment activities with their own accounts, and limits their ownership of and relationship with hedge funds and private equity funds.” In other words, various bond markets, including the Treasury market, no longer have the backstop of deep-pocketed financial institutions that can absorb a sudden jump in supply.

The explosion of interest in and ownership of exchange-traded and mutual funds that invest in fixed-income securities, including many which are thinly or rarely traded, has likely also sown the seeds of future instability. While individual retail investors, among others, may believe they can trade out of their positions whenever they like, the reality is that a widespread run for the exits will be akin to elephants stampeding through a revolving door, putting considerable pressure on prices.

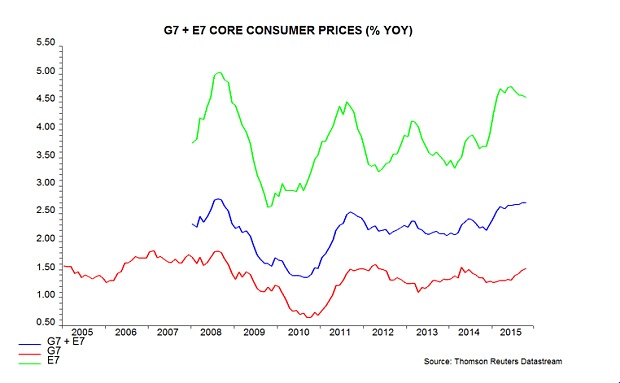

Even supposedly supportive fundamentals may be less than what they seem. As I noted in “Has Inflation Finally Arrived,” there are various indicators that suggest inflation is near an inflection point. Indeed, a growing number of institutional investors are reportedly looking beyond currently weak commodity markets and seeing “an end to the deflationary supercycle.” According to The Daily Telegraph's Ambrose Evans-Pritchard, “nobody wants to be caught flat-footed if the latest surge in the global money supply finally catches fire and ignites reflation, closing the chapter on our strange Lost Decade of secular stagnation.” He notes that $17 trillion of bonds worldwide are trading at yields below 1%, which is “remarkable” given that “global core inflation–as measured by Henderson Global Investor's G7 and E7 composite–has been rising since late 2014 and is now at a seven-year high of 2.7%.

Interestingly, weakness in global commodity markets is unsettling supply-demand imbalances in bond markets, but not necessarily in a way that some might have expected. Between 2000 and mid-2014, Evans-Pritchard notes, China, various OPEC member countries and other commodity-rich emerging countries “led a sixfold increase in foreign reserves to $12 trillion,” which “flooded global bond markets with capital. The process has now “gone into reverse,” he adds, as “capital flight and the commodity bust [have] forced a string of countries to defend their currencies,” drawing funds away from fixed-income markets and into the real economy.

Signs of Trouble

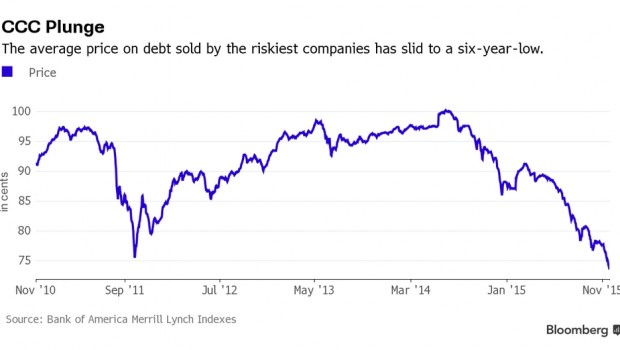

In fact, various fixed-income markets are already facing difficulties. Reports indicate that distressed debt, leveraged loan and junk bond markets have been under a great deal of pressure, especially in recent months. As Bloomberg notes,

investors in the debt of junk-rated companies are showing little patience for even the slightest whiff of bad news as they seek to shield themselves from the market’s first annual loss since 2008. With the Federal Reserve poised to lift interest rates next month and a deepening commodities slump stirring fears that earnings growth will be squeezed, price swings in the market are intensifying. To Wasserstein & Co. [money manager Ray] Bagaria, it’s creating a combustible environment that’s starting to remind him of the last credit crisis.

In the end, of course, the recent jitters may prove fleeting–especially if, as some think is possible, they spur the Fed to delay making changes to its policies until sometime next year or beyond. Still, while bond markets have proved to be remarkably resilient over the course of the past several decades, it’s a truism on Wall Street–and in life–that all good things come to an end. Given recent developments, it would appear that such a point might have been reached.

In the end, of course, the recent jitters may prove fleeting–especially if, as some think is possible, they spur the Fed to delay making changes to its policies until sometime next year or beyond. Still, while bond markets have proved to be remarkably resilient over the course of the past several decades, it’s a truism on Wall Street–and in life–that all good things come to an end. Given recent developments, it would appear that such a point might have been reached.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68