- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

U.S. Dollar: Last Currency Standing

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

One has to be careful about reading too much into short-term swings in asset prices. This is especially true in December, when markets become increasingly illiquid and occasionally volatile as companies, banks and investors close out their books and wind down market-related activities for the year. That said, the fact that the U.S. currency rose relative to overseas counterparts while share prices fell and fixed-income markets edged higher in the wake of the Federal Reserve's long-anticipated change in policy suggest there is more to the dollar's fortunes than traditional economic drivers alone.

Indeed, logic would suggest that the moves seen in stocks and bonds during the latter part of last week reflected concerns that the Fed had made the wrong move at the wrong time–despite some predictions that the next hike could come as soon as March–and that U.S. growth is set to stumble. Even before the Fed took action, some observers were warning that conditions were nowhere near as good as the central bank was indicating. Billionaire investor Sam Zell said during a Bloomberg Television interview that he believed there was “a high probability that we're looking at a recession in the next 12 months,” while, as Business Insider reported, J.P. Morgan has published research arguing “there is a 76% chance that a recession will take hold within the next three years.”

Normally, such a prospect, which appeared to be the dominant concern among equity and fixed-income investors, would also be seen as bad news for the dollar, reflecting expectations that money would soon flow out of the U.S. in search of greener pastures–that is, higher returns. But the greenback did not react this way. While it is possible that currency traders have a more bullish outlook for the U.S. economy than equity and bond trading counterparts do, that seems less likely than the prospect that other factors are carrying more weight.

Other factors at play

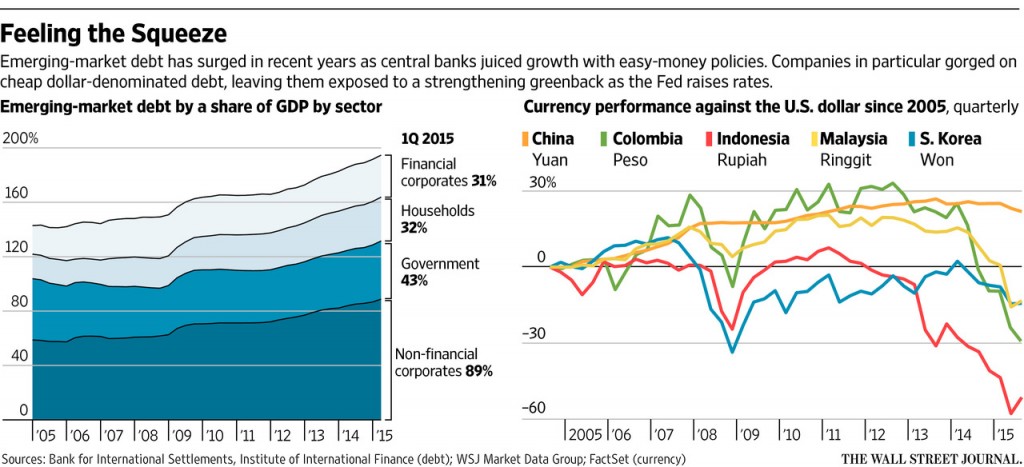

As I noted last week in “The U.S. Stock Market Is Set for a Fall” and, previously, in “Is the Conventional Wisdom Wrong About Gold?” there is likely a dollar-supportive structural issue at play. Since the Federal Reserve first set on its easy-money course roughly seven years ago, non-U.S. companies and other entities have been borrowing dollars like gangbusters. Citing data from the Bank for International Settlements, Bloomberg reported that “sovereign and corporate borrowers outside America owe a record $9 trillion in the U.S. currency, much of which will need repaying in coming years.” As those debts mature, it naturally boosts demand for the U.S. unit from those foreign debtors.

Shifting capital and trade flows are likely also bolstering the dollar. The long-term fallout from the financial crisis and the bursting-bubble collapse in commodity prices has had a severe impact on the economies and financial condition of numerous countries, especially those which are dependent on the sale of raw materials such as oil and metals to keep things going. Many, including South Africa and Brazil, have seen their currencies come under considerable pressure as investors in the U.S., in particular, who poured money into those countries when the times were good, have repatriated their capital. At the same time, some, along with other export-oriented nations, have been devaluing their currencies to ensure they aren't undercut by global competitors offering lower prices.

Even China, which is no longer an emerging economy but which is, in fact, one of the world's largest, has been playing the devaluation game. Data from the latest China Beige Book showed that “economic conditions deteriorated across the board in the fourth quarter,” with national sales revenue, volumes, output, prices, profits, hiring, borrowing, and capital expenditure all weaker than they were in the prior three months. Consequently, despite the fact that the yuan was recently added to the International Monetary Fund's benchmark SDR currency basket, ostensibly reflecting its status as a “freely usable” currency, China has, according to The New York Times, “allowed its currency to depreciate this year against the dollar as its economy weakens and investors move money elsewhere.”

Getting worse, not better

Along with the prospect of rapidly multiplying beggar-thy-neighbor devaluations, geopolitical developments have also bolstered the dollar's appeal, which like gold and other precious metals, has historically been seen as a safe haven in times of trouble. In “A Boiling Point… For Gold,” I noted that “geopolitical, political and social conditions around the world are deteriorating” and that the world was becoming increasingly unstable,” citing developments in various locales. If anything, things have only gotten worse since then.

Last week, for instance, President Vladimir Putin ordered the Russian military to “‘immediately destroy' any threat to Russian forces” in and around Syria,” ratcheting up the rhetoric, Zero Hedge wrote, in what appears to be “one step closer to the potential for direct conflict with The West.” On Saturday, China's Defense Ministry said “that the U.S. committed ‘a serious military provocation' by recently flying two Air Force B-52 bombers over a Chinese-controlled man-made island in the South China Sea, a mission that the U.S. appeared to indicate had strayed off course.” According to the Associated Press, the Asian nation “accused the U.S. of deliberately raising tensions in the disputed region.”

Needless to say, while most, if not all, of these rationales can support a further dollar rally, that doesn't necessarily mean that it will be at the expense of precious metals. While dollar strength has in the past been a negative for gold, silver and platinum, chances are, once the demand for safe havens is in full swing, all members of the safe haven group will stand to benefit.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68