Using a Self-Directed IRA for Real Estate Investing: A Beginner’s Guide (2024)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 23rd January 2024, 03:33 pm

The value of the U.S. real estate market surpassed $113 trillion in 2023. As property values trend up with time, more and more Americans are opting to invest in physical assets such as real estate to capture the upside potential of this asset class.

Those investing for their retirement may want to consider investing in real estate—or in investment vehicles that track the real estate market—within a tax-advantaged retirement account. Fortunately, the IRS allows for real estate to be included within such accounts as long as the properties are purchased for investment purposes only.

If you've dabbled in retirement planning, you're likely familiar with traditional Individual Retirement Accounts (IRAs) and Roth IRAs. But have you considered a Self-Directed IRA (SDIRA) to shelter your real estate investments?

This account type allows greater flexibility in your retirement portfolio, enabling you to diversify beyond stocks and bonds. Let's take a look at what SDIRAs are, how to open an account, and how you can leverage them to make tax-advantaged real estate investments.

Table of Contents

- What is a Self-Directed IRA (SDIRA)?

- Why Invest in Real Estate with an SDIRA?

- Potential Tax Savings of SDIRA Real Estate Investing

- Steps to Invest in Real Estate with an SDIRA (An Overview)

- Real Estate in an SDIRA Rules & Regulations to Keep in Mind

- ❌ Potential Pitfalls of Real Estate SDIRA Investing

- ✅ Advantages of Investing in Real Estate in an SDIRA

- Benefits of Tax-Deferred Real Estate Growth

- What to Look for in an SDIRA Company

- Our Top Picks for Real Estate SDIRAs

- Real Estate & SDIRAs: A Winning Team?

What is a Self-Directed IRA (SDIRA)?

Approximately 118 million Americans own an IRA, yet only a small percentage of these account types are self-directed. Rather, IRAs tend to be packaged as brokerage accounts offered by the Big Three retail brokerages:

- Charles Schwab

- Fidelity Investments

- Vanguard

The main brokerages restrict the assets eligible for inclusion in their brokered accounts in order to minimize risk on their client’s behalf. While well-intentioned, these restrictions prevent investors from freely exercising control over their money. For instance, brokerage IRA holders cannot invest in real estate or other physical assets.

An SDIRA, however, allows account holders to broadly diversify their portfolios across a wide variety of assets including the following:

- Real estate and real estate trusts (REITs)

- Precious metals such as gold and silver bullion

- Promissory notes

- Private placements

- Cryptocurrencies such as Bitcoin

- Trading accounts and foreign currencies

At its core, an SDIRA functions similarly to traditional or Roth IRAs but offers a wider array of investment opportunities. While regular IRAs are typically limited to standard assets like stocks, bonds, and mutual funds, SDIRAs allow investments in alternative financial assets.

From a tax benefit perspective, IRAs and SDIRAs share the same essential advantages: they both allow for tax-deferred or tax-free growth depending on whether one selects a Roth or Traditional account type. They are also subject to the same contribution limits and regulations.

For 2024, SDIRA and IRA account holders can contribute up to $7,000, which, like 401(k) accounts, have an additional catch-up allowance of $1,000 for those over the age of 50. Required minimum distributions no longer apply to Roth-designated IRA or SDIRA accounts.

Why Invest in Real Estate with an SDIRA?

There are advantages and disadvantages to investing in real estate and rental properties via an SDIRA. It is important to do due diligence and carefully consider these factors in tandem with a qualified financial advisor before making any investment decision.

Some of the primary motivators for investing in real estate within an IRA include the following:

- Diversification: Diversifying your portfolio can reduce risk. Real estate can act as a hedge against stock market volatility.

- Potential Returns: Historically, real estate has offered competitive returns when compared to traditional investments. As of 2024, the average annualized return on commercial real estate is 9.5% and residential real estate is 10.6%.

- Tangible Asset: Unlike stocks or bonds, real estate is a physical asset you can touch, see, and even use similar to gold and silver.

- Tax Advantages: Just like other IRAs, profits within an SDIRA are either tax-deferred or tax-free, depending on whether it's a Traditional or Roth SDIRA.

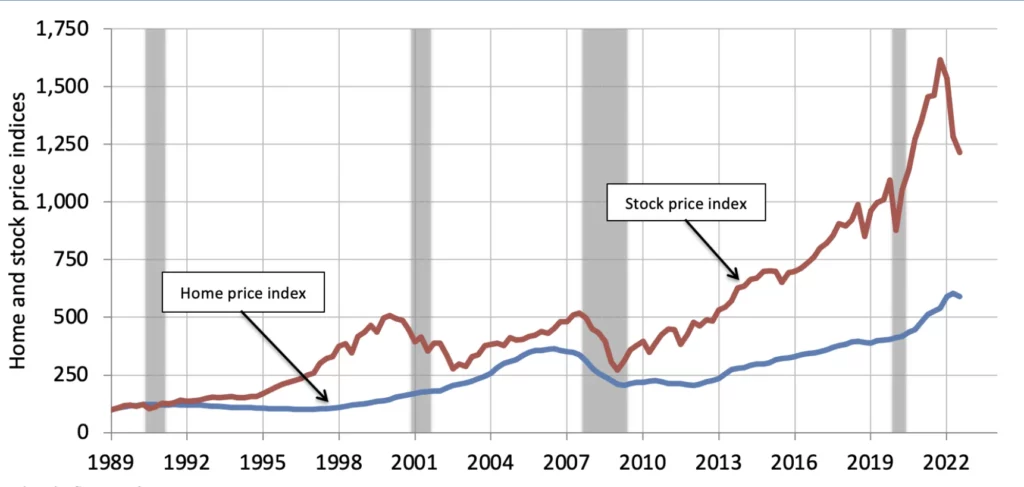

Figure 1: U.S. Real Estate Index vs. Stock Price Index, 1989-22 (Source: First Tuesday)

As seen in Figure 1, pictured above, the U.S. real estate index has trended upward since 1989, with only one notable downturn occurring during the 2007-2009 global financial crisis. While the U.S. equities market has seen more pronounced growth in the same period of time, this market index experienced far greater volatility, notably in 2001 and 2020.

Capturing the upside potential of the U.S. real estate market within a tax-free or tax-deferred investment account could save an investor thousands of dollars in capital gains taxes.

Potential Tax Savings of SDIRA Real Estate Investing

Let’s assume that an individual, John, earns a salary of $200,000 annually and sold his rental property in 2020 for a purchase price of $900,000. John’s rental property was purchased outside of an SDIRA.

John originally purchased the property for $400,000 in 2001. Therefore, his property would have enjoyed a capital gain (before adjustments) of $500,000.

Let’s also assume that the seller deducts $50,000 in home improvement costs and selling costs (like realtor fees), bringing the total capital gain to $450,000.

For an individual earning $200,000 in 2020, the long-term capital gains tax rate would be 15% for capital gains.

- Tax owed: $450,000 x 0.15 = $67,500

Therefore, John’s decision to purchase his rental property outside of an SDIRA would cost him $67,500 in capital gains taxes at the time of sale. If he had sold the rental property held within a Roth SDIRA, he would not have owed capital gains tax on the sale of the property, as the proceeds would remain within the Roth SDIRA.

However, this is a simplification. The actual capital gains tax calculation might differ based on various adjustments, deductions, and specific circumstances. Likewise, other rules and regulations apply to SDIRAs, especially around prohibited transactions and disqualified persons. Always speak to a tax professional before making any real estate investment decision.

Steps to Invest in Real Estate with an SDIRA (An Overview)

Below is a general procedure for investing in real estate with an SDIRA.

1. Choose a Custodian: Regular financial institutions usually don't offer SDIRAs because of their complex nature and exposure to risk. You'll need a specialized SDIRA custodian.

Research and pick a custodian familiar with real estate investments. A good starting point is our list of vetted and highly reputed self-directed IRA companies.

These companies are often branded as “gold IRA” companies because they generally advertise self-directed IRAs containing gold and precious metals to their clients. However, these accounts are capable of holding any IRS-approved asset, including real estate.

2. Fund Your SDIRA: You can transfer funds from an existing IRA or rollover funds from a previous employer's 401(k). There are annual contribution limits to consider, which, for 2024, is set to $7,000, with an additional $1,000 catch-up addition available for those over the age of 50.

3. Identify Your Investment: Once funded, select the property you wish to invest in. Remember to conduct due diligence and to speak to a qualified investment professional both before and after identifying any potential entry points in the market.

4. Direct Your Custodian: Instruct your SDIRA custodian to purchase the property. All documents, including the deed of the property, will be in the name of your SDIRA and not your personal name. Your SDIRA company has trained staff who know how to facilitate this process properly.

5. Management & Expenses: All costs associated with the property (maintenance, taxes, repairs) must be paid from the SDIRA, and all rental income must flow back into the SDIRA. Violations of this rule would result in a taxable event in addition to applicable IRS penalties.

Real Estate in an SDIRA Rules & Regulations to Keep in Mind

We strongly advise that investors speak to a qualified financial advisor and a licensed attorney with experience advising retirement investors purchasing tax-advantaged real estate. However, a basic overview of some of the main rules to bear in mind are as follows:

- No “Self-Dealing”: You, your spouse, or direct family members can't benefit from the property. This means you can't live in it or use it for personal purposes.

- Unrelated Business Taxable Income (UBTI): If you leverage your property with a mortgage, you may be liable for UBTI. It's wise to consult with a tax professional regarding this.

- Distribution Rules Apply: Like traditional IRAs, you can start taking distributions at age 59½. Early distributions might lead to penalties.

❌ Potential Pitfalls of Real Estate SDIRA Investing

Real estate investing within an SDIRA is not for everyone. Investors must familiarize themselves with the various disadvantages and trade-offs that come with real estate investing within a registered retirement account, including:

- Liquidity: Real estate is less liquid than stocks or bonds. If you need funds, selling a property might take time.

- Due Diligence: Unlike stock investments, real estate requires thorough due diligence. Inadequate research can lead to poor investment choices.

- Management Effort: Managing real estate requires more hands-on attention compared to stocks or bonds.

- Complex Rules: There are specific IRS rules regarding prohibited transactions and disqualified persons. If not adhered to, there could be significant tax penalties.

- Costs and Fees: There can be additional administrative costs associated with maintaining an SDIRA, especially when invested in real estate, which can include property management, maintenance, and other related expenses.

- No Tax Deductions: Unlike real estate investments made outside of an SDIRA, you cannot claim tax deductions related to the property, such as mortgage interest or property taxes, on your personal tax return.

- UDFI: If an investor uses a non-recourse loan to finance a real estate purchase within an SDIRA, they may be subject to Unrelated Debt-Financed Income (UDFI) tax.

Given these advantages and considerations, it's crucial to consult with financial and tax professionals familiar with SDIRAs and real estate investing before making any decisions.

✅ Advantages of Investing in Real Estate in an SDIRA

Here are some advantages of investing in real estate through an SDIRA versus doing so outside of an SDIRA/IRA:

1. Tax-Deferred or Tax-Free Growth: One of the primary advantages of an IRA, including SDIRAs, is the tax-advantaged environment it provides. Earnings from investments within the SDIRA grow tax-deferred, meaning you won't owe taxes on any gains until you take distributions (for traditional SDIRAs).

If you're using a Roth SDIRA, the growth can even be tax-free if you meet the qualifying criteria for tax-free withdrawals.

2. Diversification: Investing in real estate through an SDIRA allows investors to diversify their retirement portfolios beyond the typical stocks, bonds, and mutual funds.

3. Potential for Higher Returns: Real estate is often viewed as a hedge against inflation and, in some cases, can offer returns that outpace more traditional investments. For some, real estate investing is also a form of hands-off passive investing.

4. Leverage: While there are regulations and specific rules to be aware of, it is possible to use non-recourse loans within an SDIRA to finance a real estate purchase. This allows an investor to control a larger asset with a smaller amount of personal capital.

5. Asset Protection: Depending on state laws, assets held within an IRA may be protected from creditors in the event of bankruptcy.

6. Disciplined, Long-Term Investing: Since the primary purpose of an IRA is for retirement, there are penalties for early withdrawal. This can encourage a long-term investment perspective, which many argue is beneficial for real estate investing.

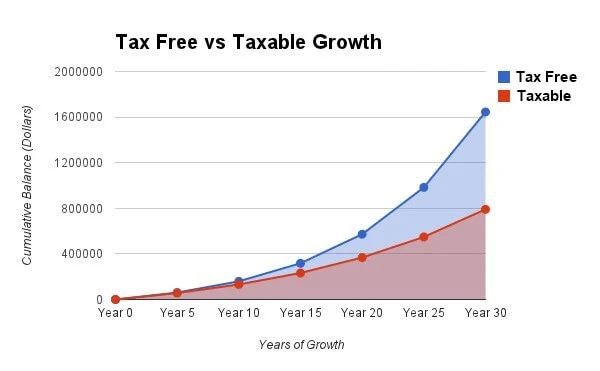

Figure 2: Roth SDIRA Tax-Free Growth vs. Taxable Growth (Source: Coach Carson)

Figure 2, pictured above, demonstrates the wealth-building potential of real estate rental revenues within a tax-free Roth SDIRA. Rental income held within a Roth SDIRA is not taxable and therefore subject to far greater growth potential over a long time horizon.

In the example above, which assumes a compound growth rate of about 10%, one’s tax-free cumulative balance would double a taxed balance over 30 years of growth. Therefore, one’s rental income, if properly vested, could greatly exceed taxable revenues held outside of a tax-sheltered environment.

Benefits of Tax-Deferred Real Estate Growth

If you invest in real estate in a Roth IRA or SDIRA, you benefit from tax-free gains on your real estate investments. In other words, you won’t have to pay 15 or 20 percent capital gains taxes on the appreciated value of your property during any future sale. These accounts consist of assets purchased with after-tax dollars.

On the other hand, Traditional IRA or SDIRA accounts have the benefit of tax-deferred growth. This means that accounts of this kind hold assets purchased with pre-tax dollars. They accumulate in value on a tax-free basis until a distribution is taken, which triggers a taxable event.

| Feature/Aspect | Roth IRA | Traditional IRA |

|---|---|---|

| Tax Treatment on Contributions | Contributions are made with after-tax dollars. | Contributions are often tax-deductible. |

| Tax Treatment on Withdrawals | Qualified distributions are tax-free. | Withdrawals are taxed as ordinary income. |

| Required Minimum Distributions (RMDs) | No RMDs during the account holder's lifetime. | RMDs start at age 72 (or 70½ if born before July 1, 1949). |

| Contribution Age Limit | No age limit, as long as the individual has earned income. | Cannot contribute for the year you turn 72 and onwards. |

| Income Limits for Contributions | There are income limits to be eligible to contribute. | No income limits for contributions, but limits for deductions may apply. |

| Early Withdrawal Penalty | Contributions can be withdrawn any time without penalty. Earnings have specific criteria to avoid penalties. | Withdrawals before age 59½ usually incur a 10% penalty, with certain exceptions. |

| Best Suited For | Investors who expect to be in a higher tax bracket in retirement or want flexibility without RMDs. Also suitable for those who value tax-free withdrawals in retirement. | Investors who expect to be in a lower tax bracket in retirement and would benefit from the tax deduction now. Suitable for those who might want to convert to a Roth IRA later. |

Whether you invest with a Roth or Traditional SDIRA will depend on your unique financial situation and personal goals. Consult a qualified financial advisor to decide which account type best suits your needs.

What to Look for in an SDIRA Company

Arguably, the most important element of investing in real estate in an SDIRA is identifying a trustworthy account custodian to help you set up, fund, and administer your SDIRA.

Fortunately, there are specialized companies that offer these services to investors, many of which have decades of experience in the industry.

Below, we’ve listed a few crucial considerations to bear in mind when searching for a real estate IRA company:

- Longevity: Trustworthiness is everything in the self-directed IRA industry. In an industry with a lot of turnover, it is advisable to work with a company that has at least 10 years of experience under its belt.

- Transparent Management: Similar to longevity, a transparent management team is a trust-building gesture that signals that the company is confident enough in its service quality that it can put names and faces to its brand.

- Market Rates: It is generally inadvisable to work with companies whose pricing structures fall on either extreme end of the spectrum. Companies that advertise having no annual fees or transaction fees tend to be unscrupulous, whereas those with high fees (i.e., above $300 annually) often take advantage of their clientele.

- Third-Party Reviews: Review aggregator websites such as Yelp, Trustpilot, TrustLink, the Better Business Bureau, and the Business Consumer Alliance are excellent resources for learning more about the service quality and overall integrity of each company.

Our Top Picks for Real Estate SDIRAs

Let’s take a look at our top-rated SDIRA custodians for investing in real estate.

Note that Gold IRA Guide is an independent financial education resource that is not employed by any company we review. Our reviews are the product of independent testing, aggregation of consumer reports, and security analyses.

1. Broad Financial

At the top of our list is Broad Financial, an industry veteran with some of the lowest fees paired with top-tier customer ratings. Although they don’t have the celebrity backing of some of their competitors, their track record speaks to their value. With state-of-the-art storage facilities and a perfect security history, it’s hard to go wrong with Broad Financial whether you’re investing in gold, stocks, or real estate.

Global Rating: ⭐⭐⭐⭐⭐ (5/5 Stars)

Quick Facts:

- Lowest fees in the industry

- Minimum account value of just $2,000

- No middleman involved

- Can facilitate a highly diverse range of alternative asset purchases

1. Equity Trust Company

Next up is Equity Trust, a company that has recently garnered significant attention for now having $12 billion in assets under management, has recently started partnering with companies such as August Precious Metals to provide more direct alternative asset investment assistance to their clients. With Equity Trust, a wide variety of alternative assets are eligible for account inclusion, from real estate to precious metals to cryptocurrencies.

Global Rating: ⭐⭐⭐⭐⭐ (5/5 Stars)

Quick Facts:

- Account minimum of only $5,000

- Partnership with top-rated Augusta Precious Metals

- Huge catalog of eligible assets

- Flat storage fees (no sliding scale)

3. New Direction IRA

This Colorado-based self-directed IRA company is an excellent source for low-cost IRAs diversified across alternative assets. While they are best known for their precious metals items, this company has made an excellent name for itself as a leader in the alternative asset space—helping thousands of customers invest in real estate in tax-advantaged accounts.

Global Rating: ⭐⭐⭐⭐⭐ (5/5 Stars)

Quick Facts:

- Low account setup fee of $50

- myDirection online interface is an industry leader

- Excellent catalog of RRSP and IRA-qualified assets

- Average markups

- Account termination fee of $250

4. GoldStar Trust Company

GoldStar Trust Company is undeniably among the best IRA providers in America. They offer leading-edge IRA solutions to alternative investors, with over 6,000 IRAs to its name holding $2.7 billion in assets. They are also among the few top-ranked firms to offer sliding scale fees.

Global Rating: ⭐⭐⭐⭐ (4/5 Stars)

Quick Facts:

- Three decades of wealth management experience

- Offer a huge range of eligible assets, including Swiss annuities

- Sliding scale can raise fees for large accounts

- Headquartered in Canyon, Texas

Real Estate & SDIRAs: A Winning Team?

Investing in real estate through an SDIRA can be an excellent way to diversify your retirement portfolio, potentially offer better returns, and provide unique tax advantages. However, like any investment, it comes with risks. It's crucial to understand the intricacies, rules, and potential pitfalls before diving in.

For those willing to put in the effort and due diligence, an SDIRA real estate investment can be a rewarding component of a comprehensive retirement strategy. But, as always, be sure to consult with financial advisors and tax professionals before making investment decisions.

For those interested in taking the next step in their retirement investing journey, consider reading our exclusive hands-on reviews of the best alternative IRA custodians in America. Each of these companies has been pre-vetted and has the capabilities and expertise to help investors purchase real estate within tax-advantaged retirement accounts.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.83

Gold: $3,355.83

Silver: $38.43

Silver: $38.43

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,574.14

Bitcoin: $117,574.14

Ethereum: $2,959.38

Ethereum: $2,959.38