GoldStar Trust Company Review: Worth Trusting With Your Retirement Savings?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

- Phone : (800) 486-6888

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

GoldStar Trust Company is one of the leading industry self directed IRA custodians. They count more than three decades of experience and over 60,000 IRA accounts with assets over $2.7 billion among their highlights. The firm specializes in a variety of niches in the business, including church finance and church bond investments, custodial accounts of various kinds, Swiss annuities, private investments, and more. Their sliding scale annual fees are a lone detractor from this excellent operation.

Pros:

- Over three decades of experience and $2.7 billion under management

- They boast more than 60,000 IRA accounts

- They offer a wide variety of unusual investments such as Swiss annuities, private investments, and church bond investment opportunities

Cons:

- Sliding scale fees are a lone detractor as the costs for having a growing account similarly increase

GoldStar Trust Company (http://www.goldstartrust.com/) is an industry-leading self-directed IRA custodian with more than three decades of experience and more than 60,000 IRA accounts holding assets worth more than $2.7 billion. The company began as Colonial Trust Company in 1989 and in 2004 entered into negotiations with Happy State Bank to become their trust-only branch. Happy State Bank is one of the biggest banks in the Texas Panhandle. In 2006 GoldStar Trust Company acquired American Church Trust Company and the next year all operations were moved to the current location of their headquarters in Canyon, TX.

Table of Contents

About the Management

Not much information is given about the management staff on the company's official website. However, they have photos and names of the key management staff on their website.

The president of GoldStar Trust since January 2020 is Jeff Kelly, who has been in the IRA Trust industry since 2004. Previously Jeff Kelley was a SVP for Equity Trust for almost 10 years. Kelley earned his bachelor's degree from Baylor University in Economics & Finance in 1988. In our opinion, it's a great sign that the company is transparent about its management team, and it's all the more reason to trust their services, especially considering that many companies in the IRA custodian space aren't public about who is behind them. For more up-to-date information about GoldStar Trust's management team, check out their LinkedIn page.

GoldStar Trust Company Prices & Products

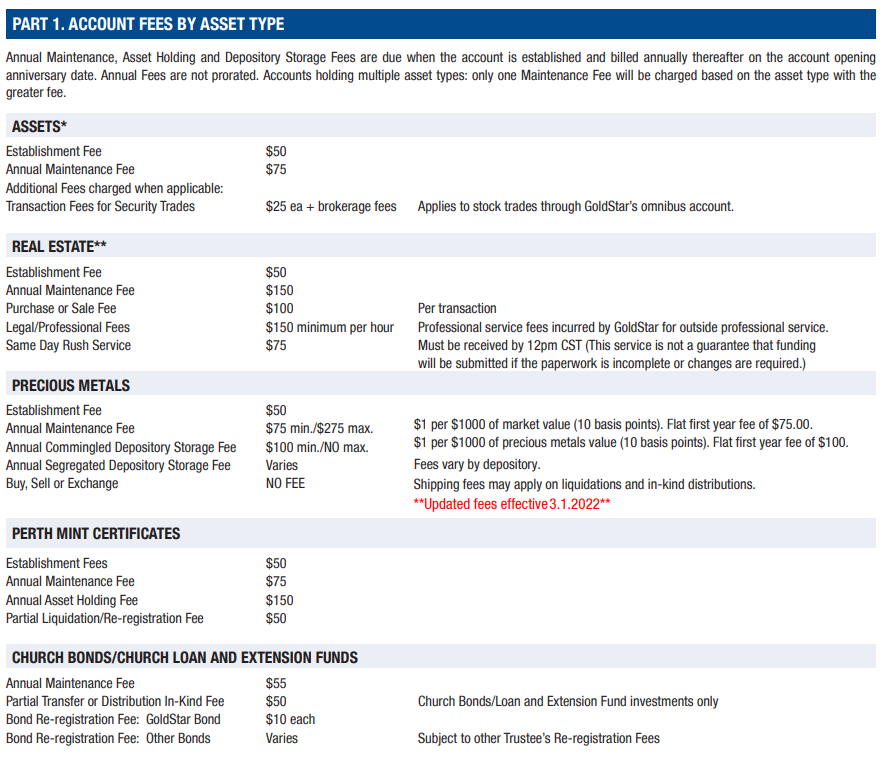

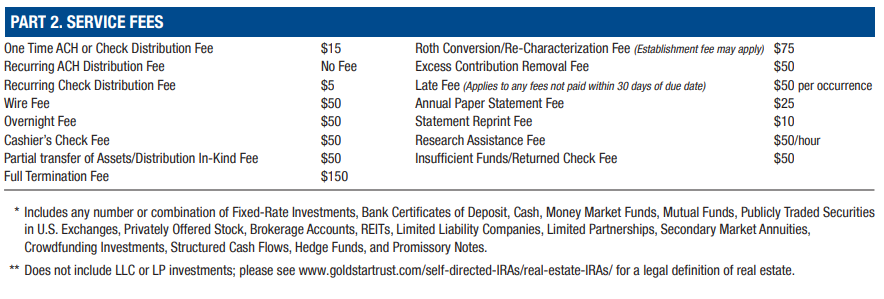

GoldStar Trust Company specializes in providing various kinds of custodial accounts, self-directed IRAs, precious metals IRAs, church bond investments, church finance, publicly traded securities, privately offered investments, Swiss annuities. As well as other types of custodial and investment-related services. The following are screenshots of GoldStar Trust Company's fee schedules for precious metals and other assets IRAs:

Note that GoldStar Trust Company charges sliding scale annual fees, which increase along with the market value of the assets held within the account. This fluctuating fee structure is typically less preferable than the flat-rate annual fees that some other custodians charge.

GoldStar Trust Ratings & Complaints

- Better Business Bureau: Rating A (Details)

- BBB: Customer Rating ⭐ Out of 8 Reviews

- BBB: Complaints Closed 10

- Business Consumer Alliance: Rating BB (Details)

- Yelp: Rating ⭐ Based on 20 Reviews (Details)

- Birdeye: Rating ⭐⭐⭐ Based on 46 Reviews (Details)

- Trustpilot: Rating ⭐⭐⭐⭐ Based on 101 Reviews (Details)

- Facebook: 365+ “Likes”

GoldStar Trust Company Contact Details

- Address: 1401 4th Avenue, Canyon, TX 79015

- Phone: (800)-486-6888

- Fax: (806) 655-2530

- Email: info@goldstartrust.com

- Website: http://www.goldstartrust.com/

Always Review the Competition Before You Buy

The general consensus is that investors should be looking to allocate about 5%-20% of their overall retirement portfolio towards precious metals. This portion of your portfolio is intended to fulfill two primary purposes. It acts as a rather predictable and effective hedge against inflation. When the inflated dollar's value decreases, the value of gold typically rises. And it provides the opportunity to boost the value of your retirement savings multiple times over in the event of another recession or depression. Which could dramatically increase the demand for and price of gold.

What does all this ultimately mean? It means you should be extra careful about how you invest that seemingly small portion of your portfolio, as it could wind up becoming the most important investment you can make for your retirement in the long-term.

Fortunately, we've made it easy for anyone to conduct their own research and compare the leading gold IRA companies and top IRA custodians. Our guides and comparison charts provide convenient resources from which to research how Gold IRAs work and which companies are the most trusted and cost-effective service providers and bullion dealers.

Contact Us if You Own or Represent GoldStar Trust Company

If you're an owner, representative, or associate of GoldStar Trust Company and you've found any of the details in this review to be erroneous, misleading, or outdated, please do contact us with your concerns. With the intent of providing the most accurate reviews on an ongoing basis, we will gladly revise or remove any content that you see as outdated or incorrect.

How We Rank IRA Custodians

While building this year's list of the top Gold IRA custodians, we considered numerous different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research. You'll find information regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. Moreover, each company has been thoroughly researched and ranked based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale fees vs. flat-rate annual fees

- company reputation and industry presence

Next Step

You may have found GoldStar Trust a perfect match or you may still want to compare other companies before making a final decision. You can check out the reviews of another 9 top trusts on our list here. Then you may need an IRA company that specializes in bullion. To get started, we recommend you read the review of our top pick for IRA precious metal companies, Noble Gold.

- Phone : (800) 486-6888

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

GoldStar Trust Company is one of the leading industry self directed IRA custodians. They count more than three decades of experience and over 60,000 IRA accounts with assets over $2.7 billion among their highlights. The firm specializes in a variety of niches in the business, including church finance and church bond investments, custodial accounts of various kinds, Swiss annuities, private investments, and more. Their sliding scale annual fees are a lone detractor from this excellent operation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,347.59

Gold: $3,347.59

Silver: $38.15

Silver: $38.15

Platinum: $1,411.19

Platinum: $1,411.19

Palladium: $1,235.08

Palladium: $1,235.08

Bitcoin: $119,780.03

Bitcoin: $119,780.03

Ethereum: $3,007.65

Ethereum: $3,007.65