New 401(k) Catch-Up Rules Start Next Year: Investors Flocking to IRAs in 2024?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 3rd November 2023, 06:56 pm

Starting next year, the SECURE 2.0 Act will change how Americans save for their retirement. The bill was signed into law on January 3, 2022, as part of an omnibus budget bill. Thanks to certain provisions contained within it, higher-income individuals approaching retirement might soon find themselves losing a tax break due to changes in 401(k) regulations.

Under SECURE 2.0, those aged 50 or older can make additional “catch-up contributions” to their 401(k) plans, allowing them to save an extra $7,500 for 2024, surpassing the regular $23,000 employee deferral limit.

However, starting in 2024, higher earners will only be allowed to make catch-up contributions to after-tax Roth accounts. While Roth contributions do not provide an upfront tax break, they offer the advantage of tax-free growth on funds over time.

Below, we will touch on the various ways that SECURE 2.0 will impact high-earning retirement investors, including their tax planning and diversification strategies in the years ahead.

Key Points:

- Savers aged 50 or older can make catch-up contributions of up to $7,500 for 2023, beyond regular 401(k) contribution limits

- From 2024, higher earners making over $145,000 can only make after-tax Roth catch-up contributions, foregoing upfront tax breaks but enjoying levy-free growth

- The change may offer tax diversification benefits, but experts suggest considering individual financial goals and tax brackets

- Under SECURE 2.0 Act, it may make more financial sense for high-income earners to roll over their existing Roth 401(k) accounts to a self-directed IRA

Table of Contents

The SECURE 2.0 Act: More Details Than You Asked For

The 401(k) provisions under the SECURE 2.0 Act will affect workers earning more than $145,000 from a single employer in 2023. As this change unfolds, experts anticipate administrative turbulence for employers while preparing for its January 1, 2024, implementation date.

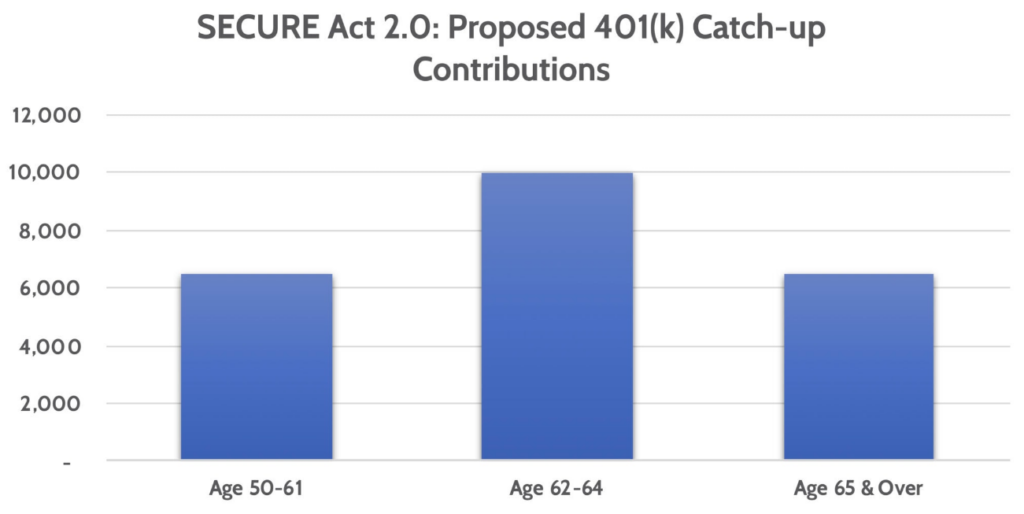

According to a recent Vanguard report based on approximately 1,700 retirement plans, about 16% of eligible employees took advantage of catch-up contributions in 2022. Additionally, a separate SECURE 2.0 change, set to begin in 2025, will increase catch-up contributions by 50% for employees aged 60 to 63.

Figure 1: Catch-Up Contributions Under SECURE Act 2.0 (Source: Financial Design Studio)

Certified financial planner Jim Guarino from Baker Newman Noyes urges higher earners to make pretax catch-up contributions in 2023 to maximize tax benefits. This strategy allows individuals to take advantage of lower tax brackets during retirement, resulting in significant tax savings.

Guarino emphasizes that, while Roth retirement accounts have several advantages, being in a lower tax bracket during retirement may not be one of them. Each option presents unique opportunities for tax diversification and should be carefully considered based on individual circumstances.

In light of the impending change, some experts advise that higher-earning clients consider setting up Roth individual retirement accounts (IRAs) in advance. Investors with Roth 401(k) funds may want to transfer the money to a Roth IRA via a Roth IRA rollover during retirement to avoid dealing with the “pro-rata rule.” This rule requires individuals to withdraw both pretax and after-tax money when taking 401(k) withdrawals.

For enhanced control over retirement funds, Galli recommends that retired clients maintain pretax and after-tax money in separate IRAs, providing greater flexibility in managing funds based on their tax implications.

Despite the potential advantages of these changes, some companies are struggling to update their retirement plans before the 2024 deadline. Approximately 200 organizations have petitioned Congress for more time to implement the necessary adjustments.

In recent years, Roth contributions have become increasingly popular in retirement plans, with 80% of plans offering Roth 401(k) options in 2022 compared to 71% in 2018, according to Vanguard.

IRA vs. 401(k) Catch Up & Contribution Limits

The 401(k) catch-up rules allow individuals aged 50 and older to make additional contributions to their 401(k) retirement accounts beyond the regular annual contribution limits.

These catch-up contributions are designed to help older workers boost their retirement savings as they approach their retirement years. The catch-up rules were established to address the fact that individuals closer to retirement may have less time to accumulate sufficient funds for their post-work years.

Below are the current contribution limits for 401(k) accounts as of 2024:

- Regular 401(k) Contribution Limit (Under Age 50): The regular contribution limit for 401(k) plans in 2024 is $23,000.

- 401(k) Catch-Up Contribution Limit (Age 50 and Older): Individuals aged 50 or older are allowed to make catch-up contributions of up to $7,500 in addition to the regular contribution limit. This meant that the total allowable contribution for those 50 and older was $30,500 in 2023.

By contrast, below are the contribution limits for IRA accounts for 2024:

- Traditional and Roth IRA Contribution Limit (Under Age 50): The regular contribution limit for both Roth and Traditional IRA plans is $7,000.

- Traditional and Roth IRA Catch-Up Contribution Limit (Age 50 or Older): Individuals aged 50 or older are allowed to make IRA catch-up contributions of up to $1,000 in addition to the regular contribution limit. This meant that the total allowable contribution for those 50 and older was $8,500 in 2024.

Readers should note that these contribution limits are subject to change over time due to inflation adjustments and changes in tax laws. This article will be updated periodically to reflect these changes as they occur over time.

Figure 2: IRA vs. 401(k) Contribution Limit Growth 2012-20 (Source: Investor’s Business Daily)

Listed above (Figure 2) are the basic contribution limits and catch-up contribution limits for both 401(k) and IRA accounts from 2012 until 2020. The chart demonstrates the rate of growth that both account types have seen in recent years.

Although the 401(k) outpaces the IRA in terms of absolute contribution limit growth, the IRA is unique in that it allows for nonworking spouses to contribute as much as the wage earner. Therefore, the contribution gap between the two account types is significantly lesser for married couples in which one partner does not work.

The significance of the catch-up rules lies in their potential to significantly enhance retirement savings for individuals approaching retirement age. By taking advantage of the catch-up contributions, those aged 50 and older can maximize their retirement nest egg in the final years leading up to retirement. These additional contributions offer an opportunity to make up for any potential gaps in retirement savings and help ensure a more financially secure retirement.

Implications for Retirement Investors and Tax Management

Higher earners who are affected by the 401(k) catch-up contribution changes starting in 2024 may consider switching to Traditional IRA plans for certain tax planning purposes.

The 2024 changes will limit higher earners earning over $145,000 to only make after-tax Roth catch-up contributions to their 401(k) accounts, which means they will forego the upfront tax break on these contributions. This can result in higher tax liabilities in the current year.

In contrast, Traditional IRAs allow individuals to make pre-tax contributions, reducing their taxable income in the current year and providing an immediate tax break. This can be particularly advantageous for higher earners looking to reduce their tax burden during their peak earning years.

Additionally, the ability to make pretax contributions to Traditional IRAs regardless of income level can make them an appealing option for individuals who exceed the income threshold for making Roth contributions directly to a Roth IRA.

Traditional IRAs: A Superior Tax Planning Tool in 2024?

By contributing to a Traditional IRA, investors may effectively lower their taxable income for the year, potentially placing them in a lower tax bracket and saving on current tax liabilities. This is particularly attractive for those aiming to maximize tax deductions while saving for retirement.

However, it's important to note that the decision to switch to a Traditional IRA should not be solely based on the tax implications of the 2024 catch-up contribution changes. Individual financial goals, retirement plans, and long-term tax strategies should all be considered before making any changes to retirement accounts.

Ultimately, the choice between a Traditional IRA and a Roth IRA depends on an investor's individual financial situation, tax planning goals, and long-term retirement objectives. Consulting with a financial advisor or tax professional can help investors make informed decisions based on their specific circumstances.

Rolling Over a 401(k) to an IRA: A Winning Move in 2023?

An IRA may allow some investors to lower their taxable income come 2024—especially among higher-earners above $145,000 in annual earnings who are most affected by the 401(k) catch-up limit changes in the SECURE 2.0 Act.

The good news is that retirement investors can easily transfer their existing 401(k) funds into a self-directed IRA for as little as zero dollars in transfer fees. Read more about the IRA rollover process here (often referred to as “gold IRA rollovers” due to the popularity of gold assets held within this account type).

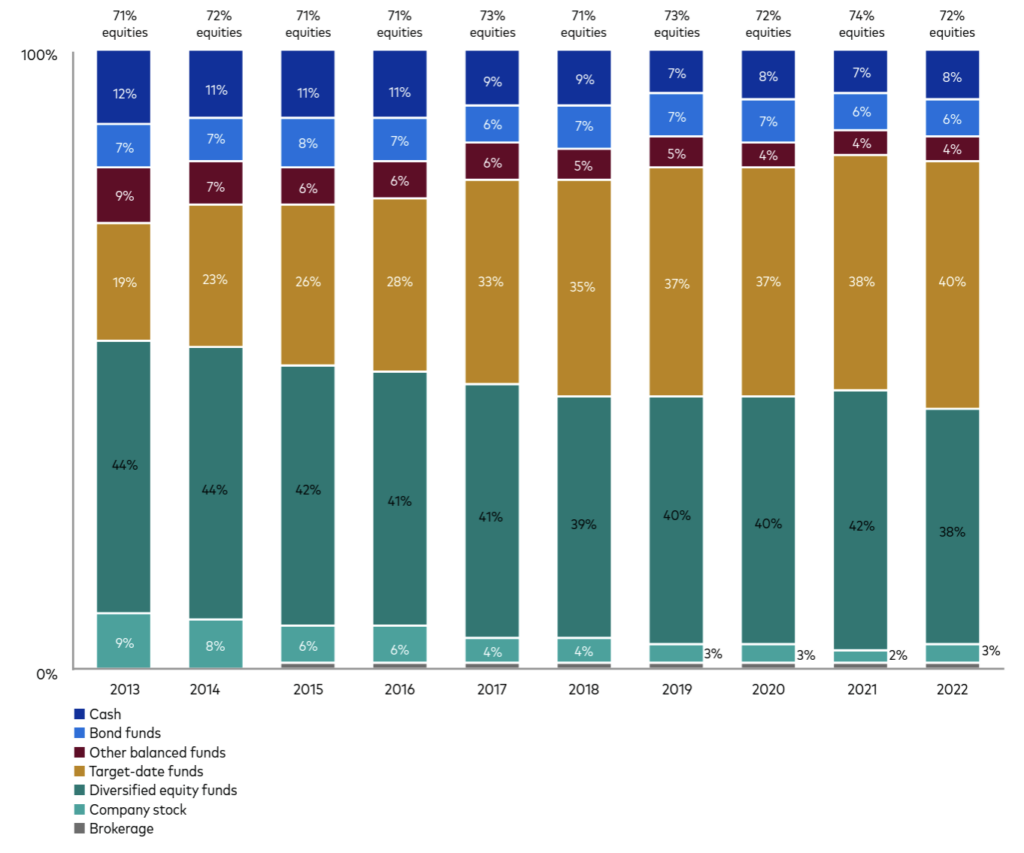

Not only do IRAs often have lower fees and pose unique tax-free growth and withdrawal opportunities, but they also allow for full independence from employer involvement. As seen below, major brokerage 401(k) accounts are highly concentrated in equities and conventional assets.

Figure 3: Asset Allocation of Vanguard 401(K) Plans Over Time (Source: Vanguard)

The chart above (Figure 3) demonstrates the level of asset class diversity seen in standard Vanguard-issued 401(k) plans. As of 2022, approximately 78% of these plans consist of equity funds and fixed-income assets such as bonds and Treasury bills.

By contrast, IRAs allow for much greater asset class diversification. These self-directed plans allow investors to choose the assets in which they want to invest, independent of the preferences of one’s employer or brokerage. For example, IRA investors are free to invest in alternative assets such as gold, silver, cryptocurrencies, annuities, and even real estate.

Retirement investors adversely impacted by the new Roth 401(k) contribution limit changes under the SECURE 2.0 Act may want to consider opening an IRA. To get started, you can browse our exclusive list of America’s top-rated self-directed IRA companies today.

As always, seeking professional advice and understanding the specific rules and regulations governing 401(k) plans are crucial to making informed decisions about retirement planning and catch-up contributions. Speak to your financial advisor before making any investment decision.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.83

Gold: $3,355.83

Silver: $38.43

Silver: $38.43

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,574.14

Bitcoin: $117,574.14

Ethereum: $2,959.38

Ethereum: $2,959.38