Passive Real Estate Investing: How You Can Save for Retirement With Real Estate Investments

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

For those wanting to diversify their investments and enter the real estate sector, one of the first decisions to make is whether you want to be an active or passive investor. Active investing involves managing the property directly, which can include things like choosing tenants and collecting rent.

On the other hand, passive real estate investing is a more hands-off approach to investing in a way that allows others to handle most of the day-to-day tasks related to the investment property.

Since investing using passive income strategies often involves less work, many investors prefer this method. However, depending on your situation, active investing may suit your lifestyle better.

For example, if you wanted real estate investment to be your full-time job, you could pursue active investing to increase your investment returns by doing more hands-on work. For those who have full-time jobs and are okay with sharing the profits with others in return for less time commitment, passive investing is an equally appealing option.

This article will focus on the different methods of passive real estate investing. Examples of passive real estate investing include REITs and real estate syndications. While these may seem like complicated concepts, this article will give a breakdown of both and allow you to make an informed decision.

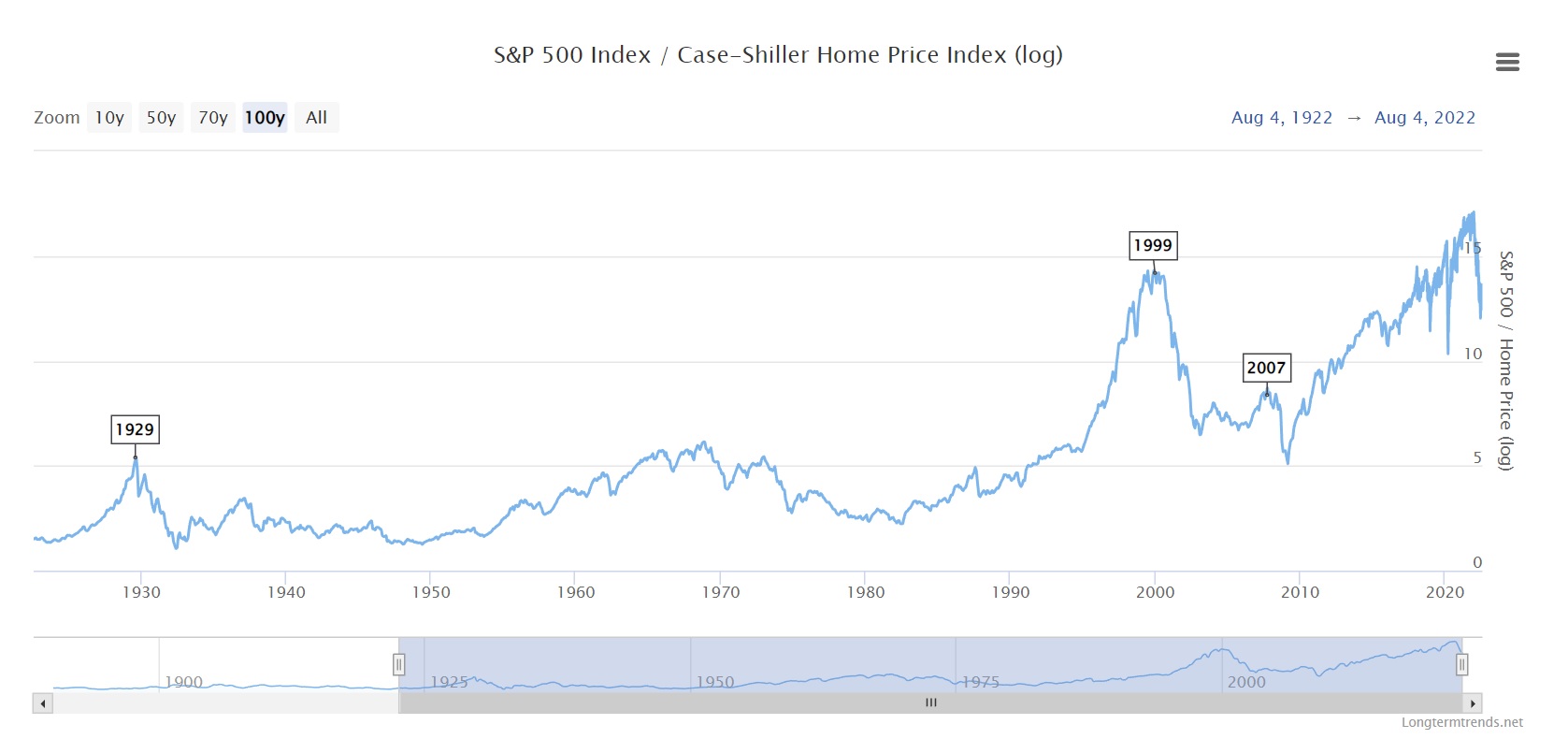

Figure 1: Stocks to Real Estate Ratio. Source: LongtermTrends

Table of Contents

What is Passive Real Estate Investing?

Passive real estate investing is when you allocate your money to real estate investments without needing to manage properties directly. Real estate investors may prefer the passive approach because they will not have to act as landlords. Instead, these investors can sit back and enjoy a steady stream of passive income.

While other passive income methods such as investing in mutual funds or dividend-paying stocks remain very popular, passive real estate investing presents an exciting alternative to more traditional investment strategies. Alongside income generated from collecting rent, the appreciation of value in properties can also yield high returns.

Through this method, investors can own pieces of high cash-flow properties in real estate sectors such as residential buildings or even commercial properties with small amounts of initial capital. Entering these sectors alone would be very unfeasible, given that the average person likely does not have the capital to purchase apartment complexes or other large-scale property.

Passively investing in large-scale properties allows investors to pool money and take advantage of the most optimal real estate opportunities.

How to Get Started With Passive Real Estate Investing?

If you want to start passively investing in real estate, the first step is to choose your investing method. You can invest in real estate investment trusts (REITs) or real estate syndications are both popular methods. These options all have slight differences, and the best method will depend on your own risk tolerance, time horizon, and other factors.

The most basic method from this list would be investing in REITs. REITs are companies that invest in large-scale real estate investments. You can buy and sell REITs on the stock market through any brokerage account, just like a stock or an ETF. REITs are great because there is tons of liquidity, making it easy to buy and sell easily.

Investing in real estate syndications is another unique way to generate real estate passive income. A real estate syndication is a group of investors pooling their money together to invest in real estate. Investors generally get paid cash distributions each month or quarter, which allows for a steady stream of income.

How Do You Make Money With Passive Real Estate Investing?

When you are a passive real estate investor, you will likely receive cash flow distributions every month or quarter. Depending on your investment method, you may get paid through a brokerage account or directly from a company or individual.

For example, REIT investors will get paid cash flow distributions via dividends every quarter or month depending on the fund. On the other hand, if you are part of a real estate syndication, you can expect to get paid interest each month, depending on your terms.

The return potential for passive real estate investors is lower than for active investors, which is a tradeoff many are willing to accept given the minimal time commitment required. Some of the profits will inevitably go towards costs such as management fees on REITs or property management companies for real estate syndicates. However, making money as a passive investor is much easier and will enable you to generate passive income.

How Does Passive Real Estate Investing Compare to other Investing Methods?

Passive real estate investing has both similarities and differences when compared to alternative investing methods. For example, investing in the stock market or in mutual funds is similar to passive real estate investing since you can generate dividend income and capital appreciation. Investing in REITs is almost identical to investing in the stock market. The only difference is that REITs are solely focused on real estate rather than other sectors of the economy.

Like stocks and ETFs, REITs allow investors to buy and sell almost instantly. On the other hand, real estate syndications have more restrictions that make it harder to take your money out anytime you want. Additionally, you may be required to be an accredited investor if you want to invest in a real estate syndication.

There are various brokerage account types that you can choose to invest in real estate with passively. For example, you can utilize a regular tax account or a tax-advantaged Self Directed IRA.

Is it Risky to Invest in Real Estate?

Investing in any asset type involves risk, including real estate. Depending on the investment method you choose, you may be susceptible to the following risks:

- Bad tenants

- Bad location

- Downturn in specific real estate sectors (commercial, residential, etc.)

As a passive real estate investor, you will not have much control over many of these factors, which is a good thing because it saves you stress. However, just because you are not directly dealing with it does not mean these risks should not be considered when making investment decisions

Bad tenants can be a significant nuisance to your cash flow if you constantly need to repair damages or deal with complaints. As a passive investor, you will not have to deal with these issues directly. However, having these issues arise will likely cut into the cash flow of the investment, thereby reducing the profits that each investor receives.

Final Thoughts

Passive real estate investing is a great way to generate a source of income with a minimal time commitment. If you want to invest in real estate, opening a self-directed IRA (SDIRA) will allow you to receive tax advantages which are especially helpful for dividend income received through REITs. Just as you can invest in gold with an SDIRA, you can also do the same for real estate investing via REITs or rental properties.

Depending on your goals, passive and active investing both have their pros and cons. If you have a lot of time and energy to manage properties yourself, active investing may be a good choice for you. However, if you are busy with other commitments in life and are okay with sharing profits, passive real estate investing may be the better option for you.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.86

Gold: $3,355.86

Silver: $38.41

Silver: $38.41

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,749.21

Bitcoin: $117,749.21

Ethereum: $2,952.91

Ethereum: $2,952.91