- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

New Direction IRA Review: Is This IRA Custodian Worthy of Your Gold IRA?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

New Direction IRA

- Phone : 877-742-1270

- URL :

- Global Rating

- Very Good

User Rating

- 1 Reviews

Review Summary :

New Direction prides themselves on their self directed IRA specialization. Their clients have many choices for investments, including real estate, precious metals, and a number of other attractive alternative assets. The downside to their excellent service is that their fees do not cover storage of precious metals. Plus, they charge termination and setup fees that sometimes pale in comparison to their competitors, such as Equity Trust. The sliding scale fee which increases on accounts over $100,000 is a disadvantage as well.

Pros:

- Choices are many and varied, ranging from real estate to precious metals to other alternative assets

- Their proprietary online account access interface myDirection is powerful and convenient to use

- They offer six different IRA depositories from which clients can choose freely

- Low account setup fee ($50)

Cons:

- The considerable IRA fees do not include the cost of precious metals storage

- Sliding scale fees mean that as account value increases, fees go up as well

- Account termination fees reach as high as $250

Quick Facts about New Direction IRA

Company Headquarters:Louisville, Colorado

Reviewed By:Wesley Crowder

Have you purchased products from New Direction IRA? Leave a review!

Running Scared!

I have been with these guys since 2013. They started out good but, have gotten themselves hooked up with some VERY BAD characters in the precious metals industry and NOW they are running scared afraid of their association with them! Too late folks! NO EXCUSE for your tremendous fall in customer support! If ya wanna stay in business much longer you better start changing your ways!

July 6, 2023, 4:02 pmNew Direction IRA is ranked #3 on our list of the top precious metals IRA custodians of 2024. In the following review, we'll cover the company's history, management, reputation, products/services, and fees.

New Direction Trust Company IRA, Inc. (www.newdirectionira.com) is a leading provider of administrative and custodial services for self-directed precious metals IRAs and other types of retirement accounts. The company has more than a decade of experience in the IRA industry and is based in Louisville, Colorado.

No matter what way you look at it, New Direction is one of the top firms in the business, based on its longevity, fee structure, and track record of excellent security. Although they don't rank as high as their competitor, Equity Trust Company, they are a solid choice for self-directed investors looking for a reputable custodian to handle their assets in a secure environment.

Table of Contents

About the Management

The founders of New Direction IRA are Catherine Wynne and Bill Humphrey. According to the firm's LinkedIn page, the company boasts the following key personnel:

- Bill Humphrey (Chief Executive Officer)

- Aaron Benway (Chief Revenue Officer)

- Kevin Dodson (Chief of Staff)

- Oliver Chung (Director)

- Dan Falardeau (President, Hawaii Division)

- Nikki Sisneros (VP of Trust Accounting)

Bill Humphrey has more than 20 years of experience as a Certified Public Accountant, and obtained his Bachelor of Science in Business from the University of North Carolina. He's since improved his background with a graduate study in Finance, Accounting, and Economics from the University of Colorado in Boulder. By contrast, Catherine Wynne handles customer operations and education, and has a background in teaching at the University of Denver Law School. You can learn more about the company's management on their ‘About Us' page.

Generally, it's a good look when a company like New Direction is public about their management. Whereas some firms are shrouded in secrecy, New Direction isn't afraid to expose the people behind the company. In our opinion, this is a trustworthy signal that shouldn't be taken lightly, as it means they are likely much less prone to scandals than certain other companies.

New Direction IRA Prices and Products

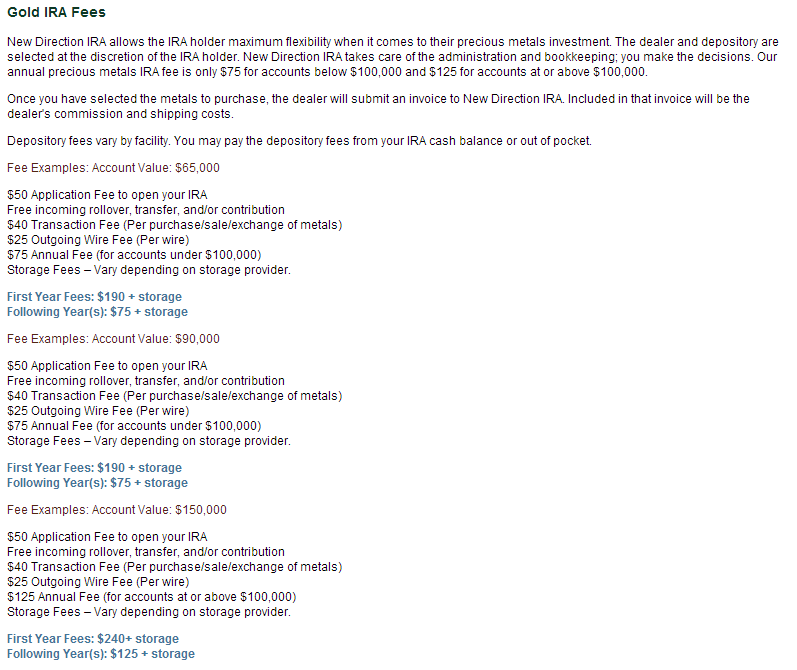

New Direction IRA specializes in self-directed IRAs. They allow their clients to invest in precious metals, real estate, and a variety of other alternative assets within their retirement accounts. They have a proprietary online account access portal called myDirection, which is intended to be used by clients who set up a precious metals IRA with New Direction IRA and choose First State Depository as their preferred depository. The following is a screenshot from New Direction IRA's fee schedule for Gold IRAs:

Most importantly, New Direction IRA's annual fee does not cover the cost of storage. Instead, the account holder has to pay the appropriate annual storage fees to their choice of one of 6 IRS-approved depositories, in addition to the fees paid to New Direction IRA. They also charge a sliding scale annual fee that increases from $75 to $125 if the value of the precious metals in your account goes over $100,000. This is in contrast to some other custodians who charge a low flat-rate annual fee that includes the cost of storage.

While each of New Direction's fees are reasonable, there are a plethora of fees that add up to make a big difference over the lifetime of the account, especially when you factor in account termination and setup fees. In our books, Equity Trust has a superior fee structure that is more streamlined and simplified, without any surprises or hidden fees.

New Direction IRA Contact Details

- Address: 1070 W Century Dr., Ste 101, Louisville, CO 80027

- Toll-Free Phone: 877-742-1270

- Phone:303-546-7930

- Fax: 303-665-5962

- Email: info@ndira.com

Consider All Options Before Investing with New Direction IRA

Most financial advisors recommend allocating about 5%-20% of your retirement portfolio to precious metals. However, this seemingly small portion of your portfolio could actually wind up being the most important, as gold and other precious metals serve as an effective hedge against inflation. Plus, we all know that the value of gold increases as the economy worsens, because that's when investors start to avoid cash-based investments and start looking for ways to protect the value of their savings.

Given the strategic importance of a gold IRA with your overall retirement portfolio, choosing the right gold IRA company or custodian can be a stressful process, especially considering what's at stake. If you're having trouble making a decision, we urge you to start by conducting your own research. We've made it easy for anyone to quickly examine various aspects of each custodian and gold IRA company with our top precious metals IRA custodians of 2024 and top gold IRA companies of 2024 comparison charts.

Contact Us if You Own or Represent New Direction IRA

If you're an owner, associate, or representative of New Direction IRA and you've noticed any information within this review that is misleading, incorrect, or outdated, please do bring it to our attention. We strive to provide the most accurate and useful reviews continually, and will therefore honor any revision or removal requests that are in line with that goal.

Why Equity Institutional is Among Our Top-Ranked IRA Custodians of 2024

We looked at more than three dozen companies while building this year's list of the top precious metals IRA custodians. Our comparison chart makes it easy for anyone to conduct their own research and learn about the background, reputations, features, policies, and fees, of each of the top custodians, which we've researched and ranked based on the following easily observable factors:

- Annual cost and fee structure – are their fees flat-rate or sliding scale?

- Depository used and additional annual cost of storage (if any) – is the storage included in the annual fee?

- Overall reputation and web presence

- Cost of setting up an account

Out of all of the custodians we researched, Equity Institutional averaged the best in all of the above areas, with a reputation spanning three decades, a low flat-rate annual fee, and partnerships with leading Gold IRA companies like Augusta. In fact, Equity Institutional's relationship with Augusta is one of the reasons why they've been able to rank highly among our list of custodians this year.

If you'd like to learn more about the advantages of opening an Equity Institutional precious metals IRA through Augusta, see the full review of Augusta Precious Metals. For more information about our top-ranked self-directed IRA custodian, read our exclusive review of Equity Trust.

New Direction IRA

- Phone : 877-742-1270

- URL :

- Global Rating

- Very Good

User Rating

- 1 Reviews

Review Summary :

New Direction prides themselves on their self directed IRA specialization. Their clients have many choices for investments, including real estate, precious metals, and a number of other attractive alternative assets. The downside to their excellent service is that their fees do not cover storage of precious metals. Plus, they charge termination and setup fees that sometimes pale in comparison to their competitors, such as Equity Trust. The sliding scale fee which increases on accounts over $100,000 is a disadvantage as well.

Have you purchased products from New Direction IRA? Leave a review!

Running Scared!

I have been with these guys since 2013. They started out good but, have gotten themselves hooked up with some VERY BAD characters in the precious metals industry and NOW they are running scared afraid of their association with them! Too late folks! NO EXCUSE for your tremendous fall in customer support! If ya wanna stay in business much longer you better start changing your ways!

July 6, 2023, 4:02 pm

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81