Silver Coin Melt Value: What Your Silver Coin is Really Worth (2025 Update)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 5th March 2025, 04:15 am

Since 1792, the U.S. Mint has produced silver coinage. However, Since the 1960s, silver coins have been removed from general circulation, but the U.S. Mint continues to produce silver bullion coins, such as the American Silver Eagle, as well as commemorative silver coins for collectors..

If you’re the lucky owner of a genuine silver coin, you can bet that it’s worth more than its face value. At the time of writing, The value of silver coins varies based on their silver content, rarity, and current market conditions. For example, a 90% silver Roosevelt dime may be worth a few dollars in melt value, while rare collector coins can fetch hundreds or even thousands. The value of your silver coin varies according to the condition of the piece, as well as the market value of the metal.

In this article, I’ll touch on the basics of investing in silver coinage and will walk you through the process of finding your silver coin melt value. This way, you can liquidate your silver assets with confidence knowing that you won’t get short-changed for your coins.

Table of Contents

History of Silver Coinage

Shortly after the establishment of the U.S. Mint, the United States Government started issuing silver coins in the form of half dimes, half dollars, and dollars. In 1796, the Mint introduced the silver quarter and dime. Since then, silver coins have entered circulation in various forms and have undergone many designs, and each features distinctive numismatic elements that are desirable to collectors and enthusiasts.

In 1964, the U.S. Mint halted all production of silver coinage with the exception of commemorative items “Not Issued for Circulation” (NIFC). These modern coins are produced for the collectors’ aftermarket and are not intended to be used as everyday money.

The change came about because post-war industrial society recognized the need to preserve silver for its widespread use in manufacturing and to prevent hoarding from investors. Consequently, dimes and quarters switched to a copper-nickel alloy in 1965, while half dollars retained some silver until 1970. However, nickels remained mostly unchanged, except for the wartime silver nickels (1942–1945), which contained 35% silver.

Some of the rarest silver coinage from the United States includes the following pieces:

-

Mercury dime (1916–1945) (“D, S, or no mint mark” hallmarks, as Philadelphia did not use a mint mark).”

Standing Liberty quarter (1916-1930) (“D, S.” hallmarks) - Barber half dollar (1892-1915) (“D, O, S.” hallmarks)

- Peace dollar (1921-1935), (“D, S.” hallmark)

- Morgan dollar (1878–1904) (“CC, S, O, D, and no mint mark for Philadelphia” hallmarks).

Benefits of Investing in Silver Coins

Silver coins share many of the same benefits as investing in physical silver bullion. Below, I’ve listed some of the main reasons why you should consider acquiring commemorative silver coins as part of a diversified investment portfolio.

- Reliable store of value: Silver can be used as money and historically retains its value during times of economic downturn or financial crisis.

- Tangible, secure asset: Silver is a tangible, physical asset that you can store in your own home and cannot be printed on-demand like fiat currency.

- No counterparty risk: There is no trusted third-party with silver coinage, since you are the owner and curator of the asset.

- Liquid asset: Silver is an in-demand asset that can be bought or sold virtually anywhere in the world.

- Private and immutable: As a physical asset, silver can be kept private and out of the reach of banks and other third-parties. Similarly, your silver cannot be hacked or compromised via digital means.

Whether you invest in silver bullion, paper-backed silver (e.g., ETFs and silver mining stocks), or silver coins, the benefits are largely the same. Adding silver to your precious metals IRA or 401(k) retirement savings account can help diversify your portfolio and insulate your wealth from market risk and other systemic risks. You can learn more about how to rollover an existing retirement account on this page.

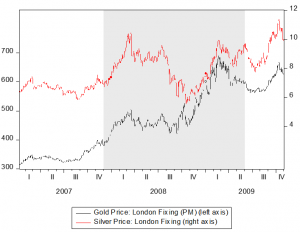

Plus, silver retains its value during recessions and other periods of economic turmoil. The chart below depicts how silver and gold performed well during the 2007-2009 global financial crisis.

Source: Suisse Gold

How to Calculate Silver Melt Value

Calculating your silver coin’s melt value is a simple two-step process. First, use our up-to-the-hour chart to find the current spot price of silver. Then, multiple the spot price of silver by the weight of pure silver in your coin. To find the weight of the silver in your coin, multiply the weight of the coin overall by the total percentage of silver found in the coin.

As of March 4, 2025, the spot price of silver is approximately $31.98 per troy ounce. Given that there are 31.1035 grams in a troy ounce, this translates to about $1.03 per gram.

A 1946 Roosevelt Dime weighs 2.5 grams and contains 90% silver, equating to 2.25 grams of pure silver. At the current rate of $1.03 per gram, the melt value of the silver content in the dime is approximately $2.32.

.

Keep in mind that a coin’s melt value considers the economic value of the metal only. Many collectors’ coins are worth more than their melt value because they are antiques that carry nostalgic or sentimental value. For instance, a 1932 Washington Quarter often sells for more than $200 despite having a melt value of only a few dollars. What’s more, the 1916-D Mercury Dime sometimes sells above $1,000 if kept in good condition.

You can use silver melt value calculators to find the exact value of the material found in your silver coin. However, it may be in your interest to hang onto your silver coinage as its value as a collectors’ item may exceed its value in metal.

The Bottom Line

The melt value of a silver coin is based on its silver content and the current spot price of silver, which fluctuates daily. While face value remains constant, older silver coins often hold a significantly higher intrinsic value due to their metal content.

The most reliable way of calculating your silver coin melt value is to find the silver content of your coin measured in troy ounces and multiply the figure by the current spot price of silver. Investors should consider both melt value and numismatic (collector) value when selling silver coins. While some coins are worth only their silver content, rare or high-grade pieces may command a premium from collectors. Ask the precious metal company you plan to buy from if they sell bullion or premium coins. For instance, popular American companies like Noble Gold Investments or Birch Gold are known to focus mostly on bullion products, while companies like Augusta Precious Metals, GoldCo or American Hartford Gold Group focus on selling premium coins.

If you want to add silver to your retirement savings account, note that only select IRS-approved metals and coins are eligible for inclusion. Check out this list of IRA silver bullion and coinage to see whether your silver coins can grow your wealth in a tax-advantaged account.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,724.05

Gold: $4,724.05

Silver: $95.37

Silver: $95.37

Platinum: $2,408.53

Platinum: $2,408.53

Palladium: $1,883.49

Palladium: $1,883.49

Bitcoin: $91,189.85

Bitcoin: $91,189.85

Ethereum: $3,107.31

Ethereum: $3,107.31