How Much Is a Pound of Gold Worth? (2024 Pricing)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 22nd January 2024, 11:06 pm

How much is a pound of gold worth? First, we need to understand how gold is priced and the weight used for international transactions of gold. Gold is bought and sold on various exchanges and over-the-counter marketplaces around the globe.

The main exchanges are the COMEX in New York and the Tokyo Commodity Exchange. While the largest over-the-counter marketplace is in London, followed by Shanghai. The price of gold in all marketplaces is by the Troy ounce.

The value of one Troy ounce is determined by the market forces of supply and demand which are influenced by the following factors:

- Interest rates

- Inflation

- Geopolitical Factors

- Government reserves

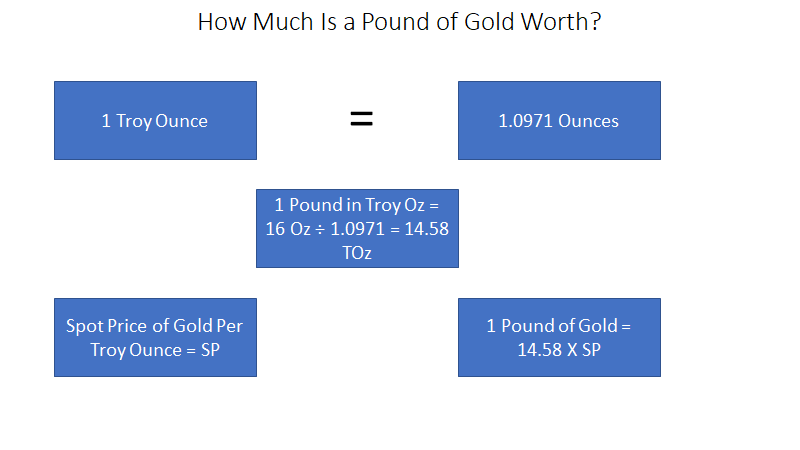

So, once we have the price of one Troy ounce of gold, how do we determine how much a pound of gold is worth? The infographic shows the procedure. Simply multiply the spot price of one Troy ounce of gold by 14.58

In one pound there are 16 ounces, to convert 16 ounces to Troy ounces you must divide by 1.0971, which gives you 14.58 Troy ounces. Finally, you would multiply that number by the current spot price of gold.

Table of Contents

How Much Is a Pound of Gold Worth?

At the time of writing, the spot price of gold is around $2,025 per ounce, which means that a pound of gold is worth about $29,525. However, this is just the base price, and it does not take into account other factors that can affect the value of gold. For example, if there is high demand for gold, the price may be higher, while if there is a surplus of gold on the market, the price may be lower.

A pound of gold is worth a lot of money, but exactly how much it is worth can vary depending on several factors. The value of gold is determined by its market price, which is influenced by a variety of different things, including supply and demand, political and economic conditions, and even the time of year.

One thing to keep in mind is that a pound of gold is a very large amount of precious metal. In fact, a pound of gold is equal to 16 ounces, which is well over half a kilogram. This means that if you were to go to a gold dealer and try to buy a pound of gold, you would need to have a very large amount of money on hand to make the purchase.

Various Factors Influence the Price of Gold

In addition to supply and demand, the value of gold can also be influenced by political and economic conditions. For example, if there is political instability in a country that is a major producer of gold, the price of gold may go up as investors seek a safe haven for their money. On the other hand, if there is a strong economy and low interest rates, the demand for gold may decrease, leading to a lower price.

Finally, the value of gold can also be affected by the time of year. For example, gold is often in higher demand during the holiday season, when it is commonly given as a gift. As a result, the price of gold may go up during this time.

In conclusion, a pound of gold is worth a significant amount of money, but the exact value can vary depending on several factors. The best way to determine the current value of gold is to check the market price and take into account other factors that may be affecting the value of the precious metal.

Spot Price & Commercial Value

The spot price of gold is the current market price of the precious metal as determined by various gold market players. While the commercial value of gold refers to the price at which gold items are bought. These two terms are often used interchangeably, but they do have completely different meanings.

The spot price of gold is determined by various factors, including supply and demand, political and economic conditions, and even the time of year. This price is quoted in U.S. dollars per Troy ounce, and it represents the current value of gold in the market.

The commercial value of gold, on the other hand, is the price at which gold items are exchanged from a bullion dealer or jeweler to the public or investors. This price can vary depending on the specific items of the sale. Factors that can influence the commercial value of gold include:

- Craftsmanship

- Minting costs

- Strike quality for coins

- Production costs

- Markup for refiners

- Markup for dealers and jewelers

How Big Is the Difference Between Spot Price & Commercial Value?

The answer to the above question depends greatly on the type of gold product or item in play. You need to take into account various aspects such as the quantity of gold being traded, and the type of contract involved.

For example, an exchange of thousands of ounces of gold bullion bars might have a relatively low markup over the spot price. The bullion dealer will cut the percentage amount of his markup as the quantity will make it worthwhile.

Whereas the same bullion dealer selling one or two ounces to an individual will need a larger markup to justify the transaction. In general, bullion dealers' markup for gold bars is around 5 percent for small transactions.

Bear in mind, that most bullion dealers offer discounts for bulk orders and that may reduce the cost per ounce. On the other hand, jewelers will apply a much higher markup over the spot price of gold. This extra margin has to take into account the craftsmanship and design, and you will often see jewelry with markups as high as 30 or 40 percent.

That goes for run-of-the-mill gold jewelry, but not for high-end or luxury brand items. In this case, the exclusivity of the design and the pulling power of the brand may carry a markup of 200 or 300 percent. Note, that gold jewelry is rarely made of 24-karat gold.

Conclusion

We have tried to answer the question “How much is a pound of gold worth?” the best we could. And we have seen that the answer can vary greatly. Although there is a market value for 1 pound of gold bullion, your pound of gold may have a completely different value.

Certain gold items like collectible coins have an extra value determined by their numismatic value, coins like the first American Eagles or the Trump gold coin are commonly known examples. Also, consider that when you go to sell your gold, bullion dealers and jewelers alike will mark the value down.

Bottom Line

Investing in gold and precious metals may offer an effective way to diversify your investment portfolio. Gold has little to no correlation to stocks and bonds, this helps reduce your overall risk. You can invest in gold through specialized IRA companies, you can read our reviews of the top companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24