Gold Manipulation: How Precious Metals Price Fixing Led to Fraud

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 27th June 2023, 08:54 pm

After the 2008 financial crisis, we started hearing about various financial market price manipulations. Forex manipulation, gold manipulation, silver manipulation, and possibly the most famous, Libor manipulation.

However, gold and silver prices are set by market forces of supply and demand. So, investors should not be worried about the price of precious metals. The gold and silver manipulation was more to do with investors, their contracts with financial institutions, and the daily price fixing.

Let’s take a look at how market participants played a role in gold manipulation and silver manipulation, and how they made profits for themselves and their institutions.

Table of Contents

Gold Manipulation: How It’s Executed

Gold manipulation and silver manipulation consist of major market players acting in a way that pushes gold and silver prices in their favor just before the fixing. The gold and silver price fixings are used to establish a profit and loss quantity for traders’ positions in the precious metals markets.

What these traders do is spoof the market. So, they will give the market the appearance that there is a large buying or selling interest. Usually, these orders would go to market just before gold and silver price fixings.

By spoofing the market, precious metals traders could benefit from the small change in the market price at the time of fixing. This small change may not seem important, but with the sizes many institutional precious metals traders have, the difference in their profit and loss would have been substantial.

Court Cases for Gold Manipulation & Silver Manipulation

The process of gold manipulation and silver manipulation was fairly widespread, and the truth of the matter is that many investors and traders have known how this has been happening in the past. We found various lawsuits have been filed against a number of financial institutions including:

- JP Morgan Chase

- Deutsche Banks

- Barclays Bank

- Bank of Nova Scotia

- HSBC Plc

In September 2020, JP Morgan was fined $960 million for gold manipulation by U.S. authorities. The claims brought against JPM were for manipulating the price of gold futures during an 8-year period. From 2008 to 2016, according to the prosecution JP Morgan employees had manipulated gold and silver prices.

The fine is the biggest so far ever awarded for a case of gold manipulation or silver manipulation. In the past, smaller fines had been the result of lawsuits brought against financial institutions for spoofing. In 2014, Barclays Bank was fined $44 million over gold manipulation in the fixing of the spot gold price.

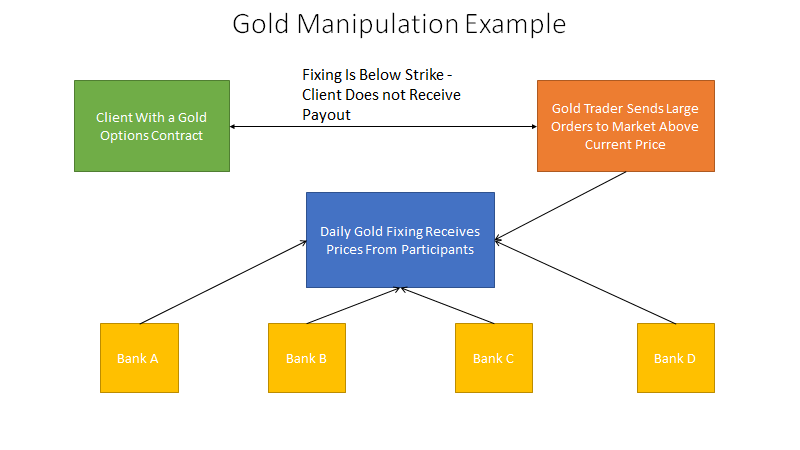

A client of Barclays had bought options on gold with the strike price linked to the spot gold fixing. The contract was a digital option, meaning that the gold fixing was needed to simply settle above the strike for the customer to receive a $3.9 million payout.

On the day of the option contract expiry, a Barclays director of precious metals submitted large sell orders above the market price. The price for gold fell and the fixing for gold came in just below the strike of the client’s options contract.

Today, notable cases of spoofing by major banks have garnered public outcry—with some commentators demanding prison time for those responsible.

A Case of Silver Manipulation

Prosecutors have brought other lawsuits against various top-tier banks for silver manipulation. In 2014, lawsuits were brought against Deutsche Bank, Banks of Nova Scotia, and HSBC for silver fixing fraud. The banks had been accused of taking out positions in silver prior to the fixing and using their position to generate illicit profits after the fixing.

Later in 2016, Deutsch Bank settled in a Manhattan Court a fine of $38 million. Investors also claimed that the aforementioned banks’ traders colluded in secret meetings to determine the silver price fixing to benefit themselves and their banks.

Spoofing: Definition & How It Leads to Gold Manipulation

We mentioned the terminology “spoofing” above, let's briefly explain what it is. The video below gives a great example of how it's done. Spoofing is what some unethical financial market players do to manipulate the price of an asset they are trading.

Spoofing: Definition & How It Leads to Gold Manipulation

Spoofing usually occurs just before the price-fixing of the assets these nefarious market players trade. And what they do is place extremely large orders to buy below or sell above the current market price.

So, they might want the gold price fix to come out slightly higher, or as high as possible to benefit the profit and loss. In this case, close to the fixing time they would place large buy orders below the current market price.

In reality, they have no intention of buying, and if the price of gold were to decline they would simply pull the buy orders. However, many market investors and day traders, seeing the large buy orders may feel enticed to buy.

Their actions could send the market higher if only by a few dollars. But that’s more than enough for the traders that are spoofing to see a much higher profit on their positions.

Bottom Line

Despite investors' ongoing concerns as to the transparency and legitimacy of gold and silver price fixings these price manipulations only occurred at the fixing and were short-lived. As mentioned above precious metals prices are set by the forces of demand and supply.

When investing in precious metals you can diversify your portfolio and create a hedge against inflation. You may want to take advantage of a retirement savings account such as a gold IRA. We have compiled a list of the top gold IRA companies, you can read our reviews on them here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,328.02

Gold: $3,328.02

Silver: $37.77

Silver: $37.77

Platinum: $1,404.65

Platinum: $1,404.65

Palladium: $1,226.98

Palladium: $1,226.98

Bitcoin: $117,368.41

Bitcoin: $117,368.41

Ethereum: $3,090.52

Ethereum: $3,090.52