Inflation & Gold: A Historical Analysis

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 21st October 2022, 08:15 am

We continue to see inflation data on the rise and concerns are more entrenched about a sustained period of high inflation. So, the debate has resurfaced once again regarding inflation and gold, and whether the latter can act as an inflation hedge.

When considering the relationship between inflation and gold at a historical level we can only really go as far back as 1971. In August of the year president Nixon ended the convertibility of gold. This meant that the price of gold was no longer pegged to a dollar value and was allowed to float freely.

Before 1971, gold has had a long history of being considered as the ultimate store of value. We know that civilizations from the Incas to the ancient Egyptians have used gold as a measure of wealth and a means of exchange to transfer goods and services.

However, the concept of inflation and possible hedges are more attuned to modern portfolio theory and more recent history. It seems more appropriate then, that we consider the relationship between gold and inflation from more recent times, especially from the moment gold price is free to float.

Whether gold does act as an inflation hedge or not it certainly should be part of a diversified portfolio. Gold, and other physical assets, have very little correlation to the returns on stocks and bonds. This feature reduces the overall risk of a portfolio.

Table of Contents

Correlation Between Inflation and Gold

The media, financial educational institutes, and academia have covered the relationship between inflation and gold on many occasions. Often, these analyses fail to give the perception that gold is a good hedge against high and rising inflation.

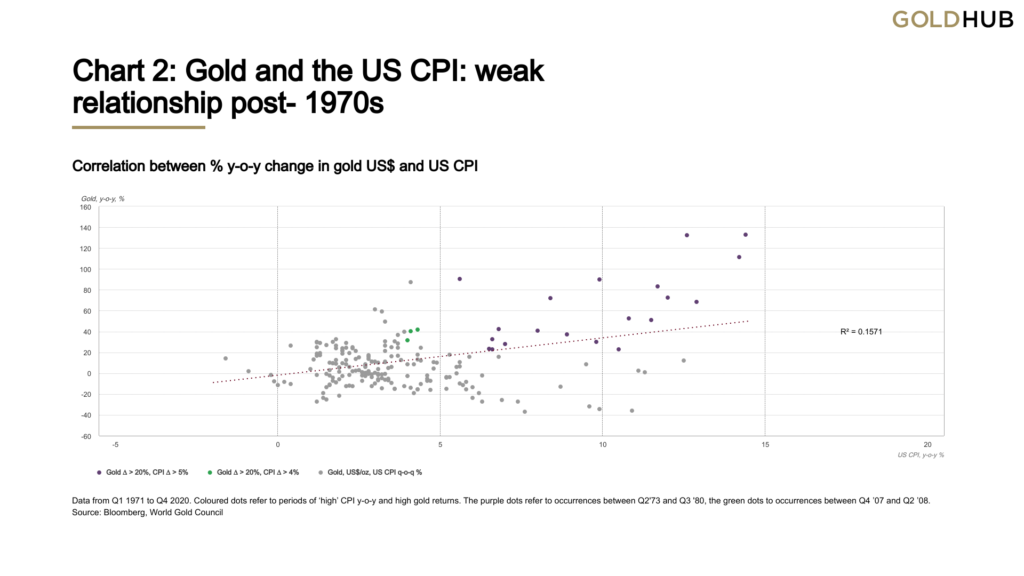

For example, an article published by the CAIA (Chartered Alternative Investment Analyst) foundation, shows that gold may not act as a strong hedge against inflation. The article states that the data they analyzed from 1971 showed that only 16% of changes in gold's price can be explained by changes in inflation.

In an article by CNBC, Amy Arnott, portfolio strategist at Morning Star, said that “Gold is not really a perfect hedge” The strategist analyzed the returns of various assets over three periods of high inflation. She found that gold outperformed all other assets only once. For the other two periods, gold had negative returns. In the same article, Michael McClary, chief investment officer at Valmark Financial Group, said “I wouldn't buy it [gold] purely because you think inflation is coming”. He then goes on to list other alternative assets that can perform well in times of rising inflation.

Where’s the Catch?

Well, it’s certainly true the assets McClary mentions may do well also, but as part of a well-diversified portfolio gold may also have a role. So why do the pundits mentioned above give gold a fail as an inflation hedge?

My reading is that in the CAIA article, the analysis is based on all periods from 1971, not just ones with high and rising inflation. Also, they do not mention the time period of the correlation. It’s highly likely daily price moves may not have any correlation and quarterly or yearly returns may have a stronger relationship.

While the strategist and the CIO from the CNBC article may not deal in gold as an asset and probably have no way to recommend gold as part of an alternative investment portfolio. Of course, this is just my speculation. Note, there have been 9 periods of high and rising inflation since 1971.

What about Academia?

Academia has also covered the relationship between inflation and gold prices on numerous occasions. Let’s just take a look at a paper from Vicky Xu at Harvard University. The paper analyzes the effects of the Federal Open Market Committee meetings on gold prices.

However, it also goes into other matters such as inflation and the value of the US dollar against other currencies. Where we see that a strong dollar will weaken the price of gold. This is because gold is traded in US dollars, so as foreign investors and producers of gold can get more local currency for a US dollar, they are willing to sell gold for fewer dollars.

Xu also considers the effect inflation may have on gold prices. Although she recognizes some academics have found gold to be a poor hedge against inflation she concludes:

“Most studies focusing on 10-year inflation rates and 10-year gold returns have found that gold serves as a good hedge against long-run inflation during longer time periods”

You see, she specifically states during long-run inflation and longer time periods. This is the fundamental aspect of understanding whether gold can perform positively and protect your portfolio from the negative effects of inflation on stocks and bonds.

What Happened During Previous High Inflation Periods?

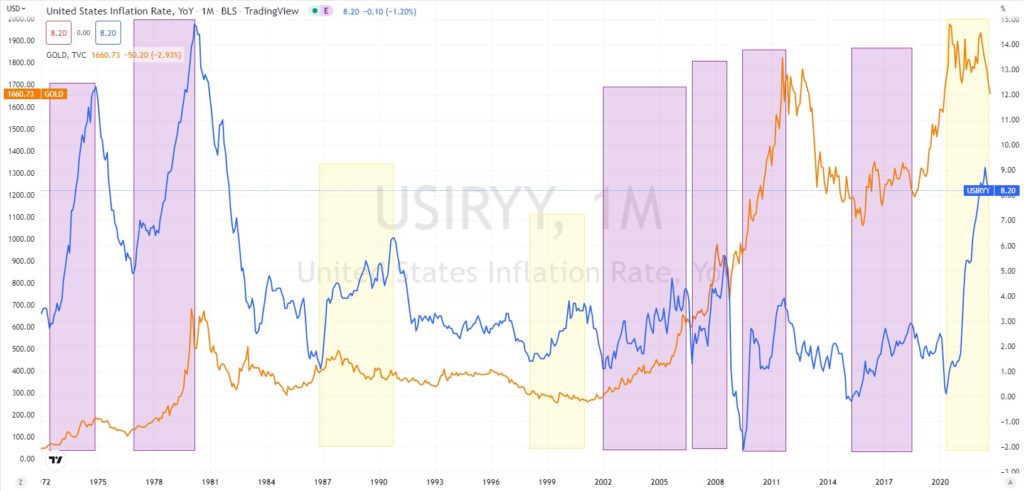

So, let’s have a closer look at what has happened over the past nine inflationary periods from 1971 to 2022. The chart below shows the inflation rate (right axis) and the price of gold (left axis) from 1971 to 2022.

The rectangles highlighted in pink show inflationary periods where gold prices rose. And the rectangles in yellow show inflationary periods where gold prices declined. There were 9 inflationary periods, six saw gold prices rise, and three saw gold prices go down.

So, we definitely have a positive skew to higher gold prices during periods of prolonged inflation. Moreover, from the table below we can see that the periods with declining gold prices show that the declines in gold prices were relatively small compared to the increases.

Inflation and Gold: Number Crunching

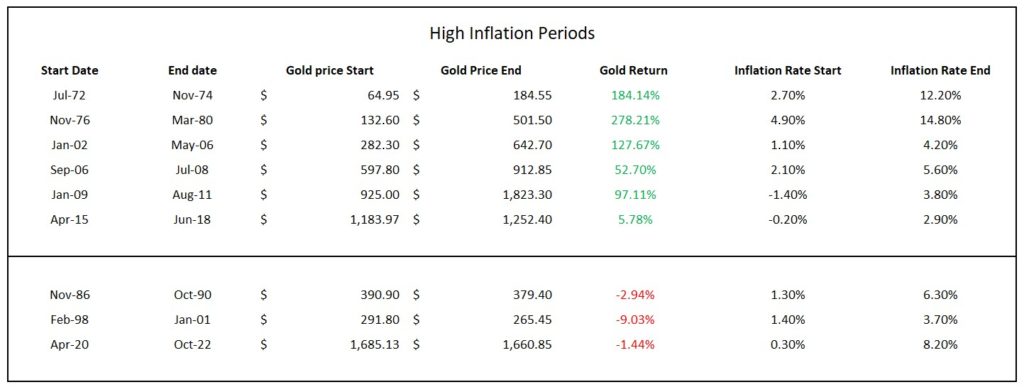

We can see that in the first two inflationary periods there was a very strong correlation between inflation and gold prices. From July 1972 to November 1974 inflation rose from 2.70 percent to 12.20 percent. During the same period, gold prices rose from $64.95 to $184.55, an increase of 184.14 percent.

In the second inflationary period, from November 1976 to March 1980, inflation increased from 4.90 percent to 14.80 percent and gold prices nearly tripled from $132.60 to $501.50, an increase of 278.21 percent.

It’s possible that because gold prices were free to float only recently, and inflation rates reached such high levels these two factors converged to create a surge in gold prices. The last four inflationary periods see lower inflation highs and smaller increases in gold prices compared to the first two periods.

Still, the period after the dot com bubble saw an increase in gold prices of 127.67 percent, and inflation increased from 1.10 percent to 4.20 percent. While the last three periods show gold prices increasing by 52.70, 97.11, and 5.78%.

Now let’s compare those figures to the inflationary periods when gold prices declined. We see that of the three periods the largest drop in gold prices was 9.03 percent from February 1998 to January 2001.

While the inflationary periods from November 1986 to October 1990 and April 2020 to October 2022 saw gold prices drop 2.94 and 1.44 percent respectively. In my opinion, these decreases in gold prices are negligible compared to the possible surges in gold prices in other inflationary periods.

Why Is Gold Price Not Rising Now?

Why are gold prices not rising now? That's an interesting question. And so is understanding why gold prices underperformed during the periods that went from November 1986 to October 1990 and February 1998 to January 2001.

Analyzing the answer to that question for the first two periods goes beyond the scope of this article. But as we are still in the current inflationary period let's look at what is happening now. As mentioned earlier, gold prices weaken when the US dollar strengthens.

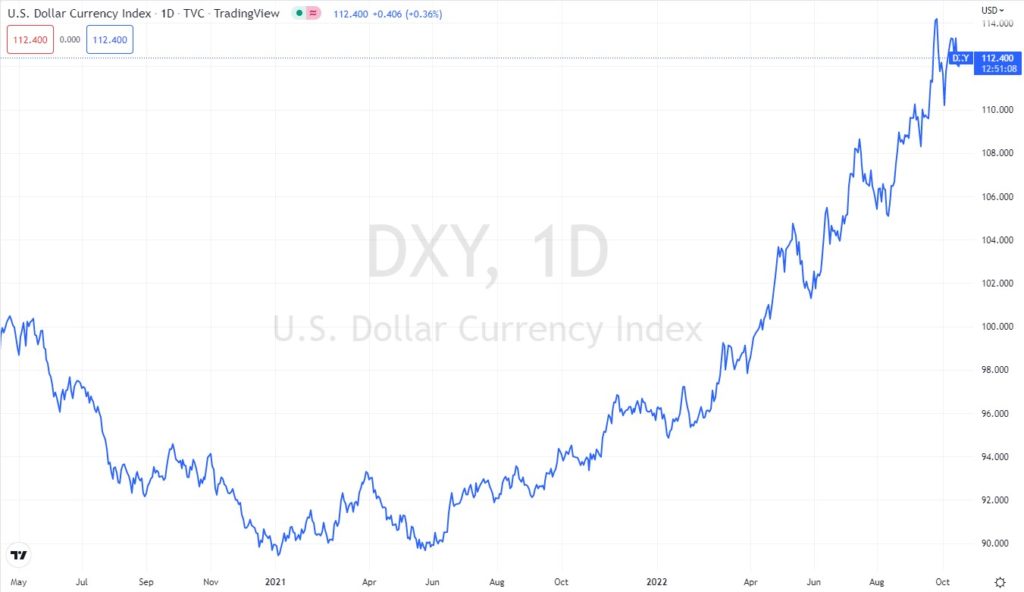

From the chart above, we can see the performance of the US dollar index (DXY) from April 2020 to October 2022. As we can see, the US dollar has risen by 12 percent over this period, and 25.50 percent from its low in January 2021.

To get a better grasp of how strong the dollar is, it’s at levels not seen since May 2002. As mentioned earlier, a strong dollar exchange rate weakens gold prices. Foreign producers and investors can still get the local cash they want for their gold even if gold prices decline, as long as the US dollar rises against their local currency.

What Investors Say About Inflation and Gold

Let's look at what some well-known and successful investors have to say about gold.

Ray Dalio

On July 18, 2019, Ray Dalio, founder of Bridgewater Associates, a multi-billion-dollar hedge fund, said

“I believe it would be both risk-reducing and return-enhancing to consider adding gold to one’s portfolio”

At the time, interest rates were extremely low, so the cost of holding gold was very low. But the analysis made by a Bloomberg analyst in the video above states that they found the relationship between gold and interest rates as real and strong.

That was a pretty good call, at the time of Ray Dalio's statement gold was trading at around $1452 per ounce.

Jim Cramer

Jim Cramer is also an investor in gold. Among his many appearances on CNBC, he often makes his case for gold.

“As an investment, gold won’t offer the same returns as stocks, but it can offer some relief from rising inflation” Jim Crammer.

On January 11, 2019, Jim Crammer also stated on his Mad Money show that if you are concerned about stocks, you should invest in gold.

Peter Thiel

PayPal co-founder Peter Thiel is a long-term investor in gold. In his speech at the Bitcoin 2022 conference, he claims that high inflation will continue, and ultimately stocks are going to be a bad investment. So, it doesn’t come as a surprise that one of his companies, Palantir, a data research company funded also by the CIA, bought $50 million of gold in August 2021. The company also said it would accept payment in gold for its services.

Inflation Expectations

Why are investors concerned about inflation? Inflation decreases the value of cash So, to avoid seeing purchasing power diminish, you need to offset inflation with a higher growth rate for your money. Clearly, holding cash in a bank account for a few percentage points of return will only reduce the real amount of cash you have.

At the same time, inflation can cause other securities to decrease in value if the economy can't keep pace with inflation. So, it's important for investors to protect their portfolios and find alternative investments to traditional stocks and bonds.

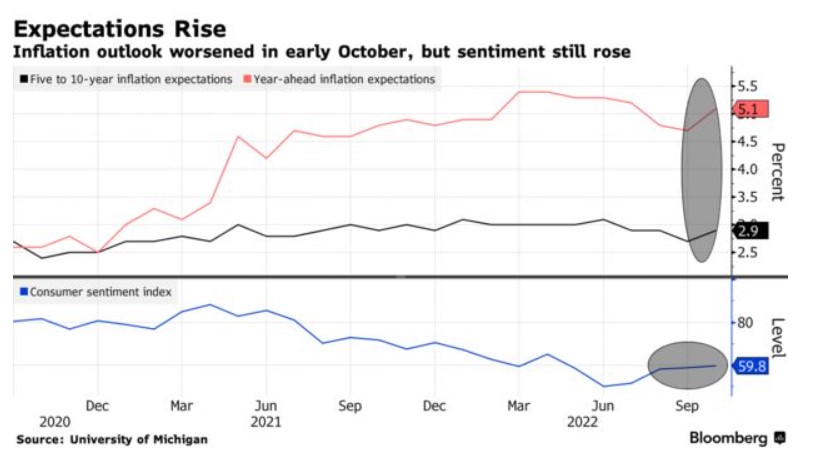

The current inflation expectations for 5 to 10 years are on the rise. Data compiled by Bloomberg shows that 5 to 10 years inflation expectations are on the rise again. After falling to 4.7% in September 2022, they are now back up to 5.1%.

Inflation and Gold: Conclusion

When considering gold within your portfolio you should be looking at the beneficial factors derived from portfolio diversification. True that gold is a volatile asset, but in the long-term, its price has constantly risen.

However, the greatest benefit of holding gold comes from the very low correlation of gold price to the price of stocks. This aspect alone greatly reduces the riskiness of your portfolio. And we have seen how in times of rising and high inflation, gold tends to perform positively on most occasions.

Also, many countries continue hoarding gold and they seem to have it clear that the shiny metal has an intrinsic value. And that it is an asset of significance when holding reserves for a nation. If gold was of little value or a risky bet, then perhaps it wouldn’t be such an attractive way for nations to build reserves.

Gold has no income streams, growth in this investment only comes from price appreciation. Yet, gold also holds no corporate risk. There is little economic pressure, and no management issues tied to the value of gold. These features also set it apart from traditional assets like stocks and bonds.

Bottom Line

If you are looking to invest in gold, you can take advantage of a tax-enhanced environment by investing in a gold IRA. Many companies offer their specialized services that allow you to store, transport, and manage your gold investment within an IRA. You can read our reviews on the top gold IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $117,538.42

Bitcoin: $117,538.42

Ethereum: $3,591.21

Ethereum: $3,591.21