Inflation and Stock Market: What Are the Effects of Inflation on Stocks & Economy?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

What is the relationship between inflation and stock market? Let's take a look at how inflation works and what it does to the economy and stock market. Then, we'll look at what you can do to protect your portfolio from the negative effects of inflation.

We all know of these negative effects of inflation on our pockets. We see goods and services get more expensive while our income remains stable. This produces a scissor effect in reducing our purchasing power.

On the one hand, prices rise, but there is no compensation as income remains the same. Inflation bites into your bottom line and also diminishes the confidence consumers have in their money.

Table of Contents

How Inflation Works

Inflation isn't always a bad thing. Some inflation is needed and indicates that the economy is in expansion. The problem with inflation arises when continued price rises are prolonged and at a high pace.

The Federal Reserve considers a low inflation rate of around 2 percent necessary to maintain a buoyant economy. In fact, its main mandate is price stability along with low unemployment. But very rarely can prices remain the same, as there is a natural tendency for costs to rise.

Rising costs happen when there is more money in circulation. If, in general, more people have more cash it's easier to acquire goods and services. This creates upward pressure on prices. Money is created by economic activity. Or, as in the case of various central banks, by quantitative easing.

We are in a period of high money mass, as never seen before, in fact. Plus, the supply constraints of geopolitical factors and increased demand coming out of a pandemic lockdown. All these factors are colliding together causing sustained and sharp price increases.

How Inflation Is Measured

The Federal Reserve and economists watch various economic data that gauge the pace of price increases. Ultimately, it is the Federal Reserve that acts on the data it follows. The economic indicators the central bank follows in the US are the following:

- Personal Consumption Expenditures Price Index (PCE): This is the main economic indicator the Federal Reserve follows to gauge inflation. And is issued by the Department of Commerce

- Consumer Price Index (CPI): This index is issued by the Department of Labor and tracks the rise in prices for consumers.

- Producer Price Index (PPI): Also issued by the Department of Labor and tracks the cost of materials to factories and producers of goods.

The Federal Reserve bank tries to gauge the duration of inflation. In so much as short bursts in price, increases are not a concern. Since central bank policy once implemented needs a few months to be effective. So, it makes sense not to act on interest rates for a short-lived inflationary period.

This means that the Federal Reserve is not only looking at the latest inflation figures. But it is also attempting to establish just how long and how high inflation could continue. In other words, they are also preoccupied with the forecast or expected inflation.

Peak in Inflation

Has inflation reached its peak? That depends on who you ask. However, most nonpartisan economists will agree that it currently does not look like inflation is about to peak anytime soon.

Job data is showing strong demand for labor, which should keep people spending. On a side note, it makes the Federal Reserve’s job easier when balancing low inflation and maximizing employment.

Higher Inflation Leads to Higher Interest Rates

As mentioned before the mandate of the Federal Reserve is to keep inflation around 2 percent. So, when inflation rises to levels we have not seen in decades, the Federal Reserve must take action. And the only action it can take is to raise interest rates.

Of course, if inflation is not prolonged interest rates do not need to match inflation. However, we have seen over the past how the Federal Reserve tends to raise interest rates until inflation begins to fall.

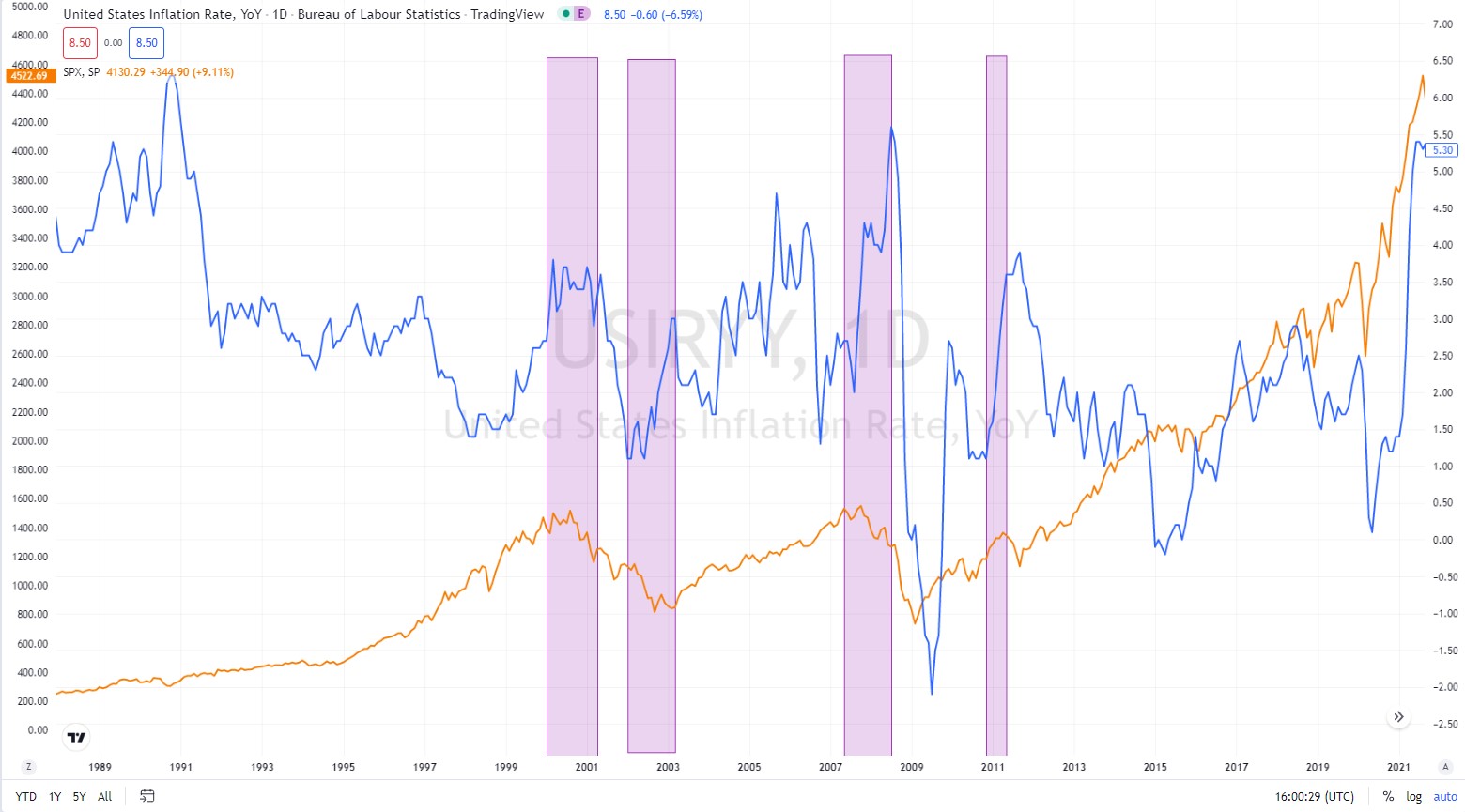

As we can see from the chart below, central bank interest rates have always been above inflation. Usually at least until inflation started falling. From 1967 to 2008 we can see how continuously, a spike in inflation was met with higher interest rates.

In 2008, the financial crisis changed matters a little. And the Federal Reserve adopted a more permissive stance on inflation. However, inflation never reached the levels we are seeing today. So, it remains clear that interest rates must rise further to stem inflation.

Source: TradingView

Source: TradingView

Despite many analysts at top institutions calling for a peak in inflation in the coming months. Fed Chair Powell’s speech after the Jackson Whole meeting gave a very different outlook. Powell offered the view that inflation could prove more resistant and cause the Federal Reserve to keep hiking interest rates for a prolonged period.

Inflation and Stock Market Impact

To assess the effect of high inflation on the stock market we need to first establish what may happen to the general economy in times of high sustained inflationary periods. The first factor that comes into play is that families have less money to spend as goods and services cost more.

And less money to spend for families means that consumers will be more cautious and spend more prudently. Now, that might not sound like too much of a deal, but it also reduces people’s buying power when it comes to real estate.

We have already seen that high prolonged inflation leads to higher interest rates. So, that in turn leads to higher interest rates on mortgage loans. When mortgages become more expensive it diminishes the demand for real estate.

New houses begin to be too expensive and property builders start halting new projects as demand fades. But it just so happens to be that home building is one of the largest segments of the US economy. In fact, the National Association of Home Builders reports that the housing industry contributes between 15 and 18 percent to GDP each year.

In general, high inflation can create a drag on the economy and higher interest rates lead to fewer personal loans, mortgages, and higher financing costs for businesses.

Source: TradingView

Source: TradingView

The chart above shows the inflation rate compared to the S&P 500 performance since 1967. We can see in the pink areas periods of high inflation have often been followed by large drops in the broad stock market.

As the economy cools down then inflation also begins to drop. This means interest rates will fall again and the economy tends to pick itself up again.

How to Protect Your Portfolio from Inflation

To protect your portfolio of stocks and bonds from the impact of inflation you must look at assets that might be positively affected by high inflation or that are resilient to it. Here is a list of assets that can outperform the broad stock market in times of high inflation:

- Inflation Linked Bonds

- Precious Metals

TIPS & I Bonds

These are bonds issued by the Treasury that are adjusted periodically for inflation. So, in a high inflation environment, they will have a positive performance as their income streams are adjusted upwards.

This is in complete contrast to standard notes and bonds which have a fixed coupon. So, as interest rates rise you will see the price of your bond fall to compensate for higher interest rates.

TIPS, or Treasury Inflation Protected Securities, pays a fixed coupon every 6 months. However, the principal amount is adjusted for rising inflation according to the consumer price index. At maturity, you will receive the initial principal or the adjusted amount, whichever is higher.

I Bonds, or Inflation Linked Savings Bonds, are also issued by the Treasury. However, these bonds have a coupon that is adjusted every six months according to the consumer price index. As inflation continues to rise so too will the coupon payments on these bonds.

Precious Metals

Precious metals are known for their capacity to protect against inflation and the adverse effects on the stock market. Gold is the top precious metal for its desirability, but also for its ever-increasing industrial use.

Gold has several characteristics that make it a great inflation hedge and a form of insurance against stock market routs. The main ones include portfolio diversification, high-demand asset, and independence from the banking system.

The performance of gold is not linked in any way to those of stocks and bonds. Since gold has a very low correlation to these assets in times of financial turmoil gold can see its price unaffected or even perform positively. This feature creates diversification of returns for your portfolio and reduces the overall risk.

Gold is a desirable asset, and it has been that way for millennia. So, we know that factor is not going to change. Demand will remain high for jewelry and as a commodity, but in modern times there is a new demand factor. We now see more and more use of gold in various industrial uses.

Gold is a store of value that is independent of any central bank or government. No matter how much money the central bank prints, there is no quantitative easing of gold. Gold is a finite resource, and its high demand is a guarantee of its continued value.

Bottom Line

Investing in gold and inflation linked bonds may be a good idea to protect your portfolio from the negative effects of inflation and a possible recession. For the long-term investor holding gold is a way to create some protection for their portfolio.

You can invest in gold and inflation linked bonds through a self-directed IRA. In this way, you get to see your investments grow in a tax-free environment. Several IRA companies offer specialized services for gold investors.

We have created a list of some of the best in the industry. You can read our reviews on the top gold IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.83

Gold: $3,355.83

Silver: $38.43

Silver: $38.43

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,574.14

Bitcoin: $117,574.14

Ethereum: $2,959.38

Ethereum: $2,959.38