How to Profit from Inflation: A Guide to Winning in 2024’s Inflationary Economy

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 22nd January 2024, 11:19 pm

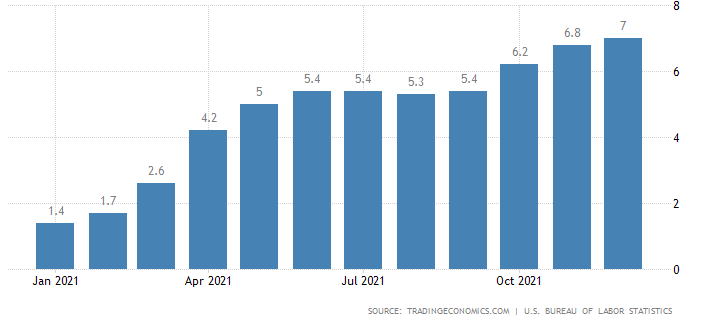

Inflation has started to raise its ugly head again. Data from the past months shows inflation is gaining pace at an alarming rate. Last month’s data showed inflation at 6.8% up 0.6% from the previous month. The chart below shows monthly data for YoY inflation since January 2021.

Source: TradingEconomics

Inflation bites into your wallet by reducing your purchasing power. Goods and services simply become more expensive. Your hard-earned cash goes a shorter and shorter distance. There is some good news, however. There are ways to making money during inflation.

How to Make Money During Inflation

From an investor's point of view, inflation can have its benefits even though it may not be the best thing for the economy. Inflation is a symptom of an expanding economy, which sounds like it must be good. But in the long run, high inflation eats into the efficiency of production and consumption.

Companies and individuals will all be affected by high inflation. For corporations with a high debt to equity ratio, high inflation can be a real concern. As they must pay higher interest on the debt they owe. Inflation also means interest rates will rise, and higher interest rates hurt these companies the most.

One of the best ways to protect your portfolio from high inflation is to invest in assets that perform well in times of rising prices. We are not saying that all your cash should be invested in any one asset. Investing in a broad asset range is a great way to achieve portfolio diversification.

Portfolio diversification is a well-known strategy to access returns from investments whose performances are not correlated. In times of high inflation, this concept is even more current.

Let’s have a look at the following assets, their past performances, and their general characteristics.

- Inflation-Linked Bonds

- Gold

- Real Estate

Inflation-Linked Bonds

A standard bond will suffer greatly in periods of high inflation. The coupon is fixed but interest rates are higher to adjust for high inflation. This dynamic means that the price of the bond will have to go down to compensate investors for receiving a relatively low coupon.

Unlike the typical Treasury Notes or Bonds which pay a fixed coupon every 6 months, inflation-linked bonds reset their coupon periodically. As inflation rises, so too will the coupons paid by these bonds. There are 2 types of inflation-linked bonds issued by the US Treasury. Treasury Inflation Protected Securities (TIPS) & Inflation Linked Savings Bonds (I Bonds).

TIPS

The principal of TIPS is adjusted for inflation or deflation instead of the coupon. The bond pays a fixed coupon every 6 months. However, if inflation has gone up you will receive a higher payment as the principal amount will have been increased. The principal is adjusted according to the change in the Consumer Price Index. At maturity, you will receive the original principal or the adjusted, whichever is higher.

These bonds are issued with maturities of 5, 10, and 30 years. You don't have to wait for the US treasury to auction them as you can buy and sell them in the secondary market. The minimum purchase size is $100, and increments are multiples of $100.

The IRS considers increases in principal as taxable income. So, your best option is to hold these bonds in a Traditional IRA to avoid taxation while your money grows. Or in a Roth IRA to eliminate taxation altogether on your principal income growth when you take distributions.

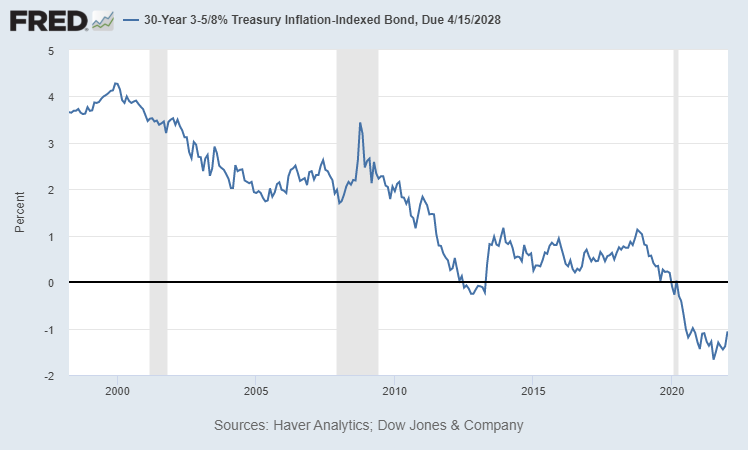

Source: Saint Louis Fed.

The chart above shows the performance of the 30-year inflation-linked bond due April 2028. We can see that its most recent performance is in negative territory due to the extremely low interest rate environment. With interest rates on the rise, the performance of this type should improve considerably.

I-Bonds

The treasury pays coupons every six months that are adjusted for inflation using the change in the CPI. Individuals can only purchase the bonds directly from the US Treasury. You cannot buy or sell these bonds on the secondary market; you will have to hold them till maturity.

I Bonds have a low minimum of $25 for electronic purchase and $50 for paper. Paper purchases are possible only through your IRS tax refund. The maximum amount you can purchase per tax year is $10,000 for electronic purchases and $5,000 for paper.

These bonds should perform well as we enter an inflationary period. The coupon on I Bonds will rise periodically to reflect the rise in inflation. The current coupon in I Bonds sold till April 2022, for example, carries an interest rate of 7.12%.

Interest is not taxable at the state or local level and is at the federal level. You may not be able to include these bonds in your IRA. The US Treasury states these bonds are for individuals and from their website it appears that IRAs don’t make the grade.

Gold

Gold has been known for decades to fight inflation as well as being a non-monetary store of value. It has also had a strong performance over the past 30 years. In certain periods it has even outperformed the broader stock market.

Gold has many characteristics that make it desirable, and we won’t go through them now. But those characteristics have been around for thousands of years. And they certainly look like they are going to stay.

These features make gold a valid option to include in your portfolio. By investing in gold, you aim to achieve the following:

- portfolio diversification

- inflation protection

- store of value outside of the federal reserve.

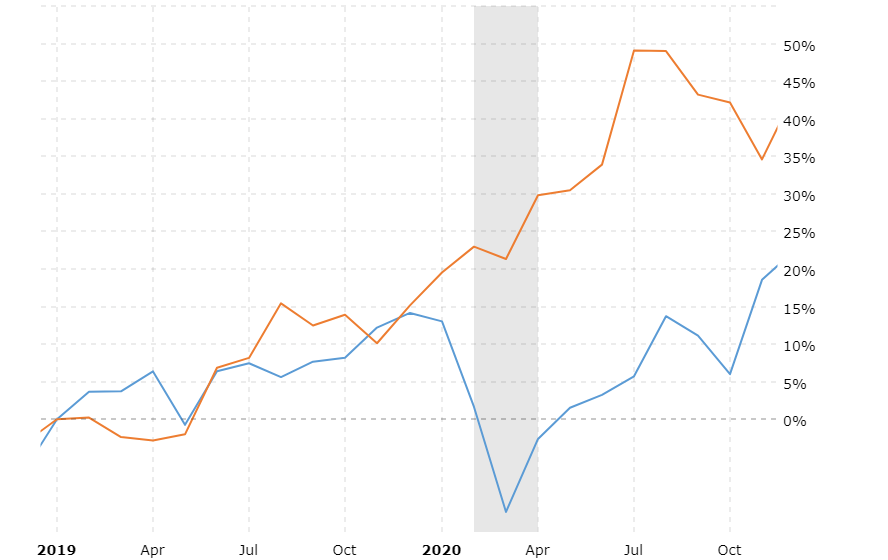

Inflation should always benefit gold which is considered a store of value. If the value of the dollar decreases, owners of gold will want to receive more dollars to maintain the value of the precious metal. The chart below shows the performance of gold since 2019. The shiny metal has nearly doubled the return of the Dow Jones stock index.

Source: Macrotrends ———— DJIA ———- Gold

Past performance is not a guarantee of future performance. However, Gold has continued to have strong returns for decades. It is also humanity’s oldest form of storing wealth, with qualities that have kept their own for millennia.

Investors can easily hold gold in a Self-Directed IRA and various companies help make that process straightforward. You may only hold gold bullion in an IRA, whether you prefer gold bars or coins. You can learn more about investing in gold and gaining some protection from inflation in our guide here.

Real Estate

Owning real estate that you are renting can be effective at keeping inflation away. Most rental contracts are linked to some kind of inflation index, often the CPI. As inflation rises, so too will the rental amount paid by the tenant.

True, rental contracts are not revised very often, typically years go by before rentals are adjusted for inflation. However, if in the succeeding period inflation declines you will still be cashing in on the adjusted rental.

Real estate also acts as a portfolio diversifier. Often the returns of this real asset have a low correlation to the broader stock market and bonds. General recession is not good for real estate in the same way it is not for stocks.

But an inflationary period is particularly bad for fixed coupon bonds and can adversely affect the stock market. Real estate, on the other hand, will continue to generate higher revenues as the inflationary period extends. The longer the inflationary phase the more your rental contracts will be adjusted higher.

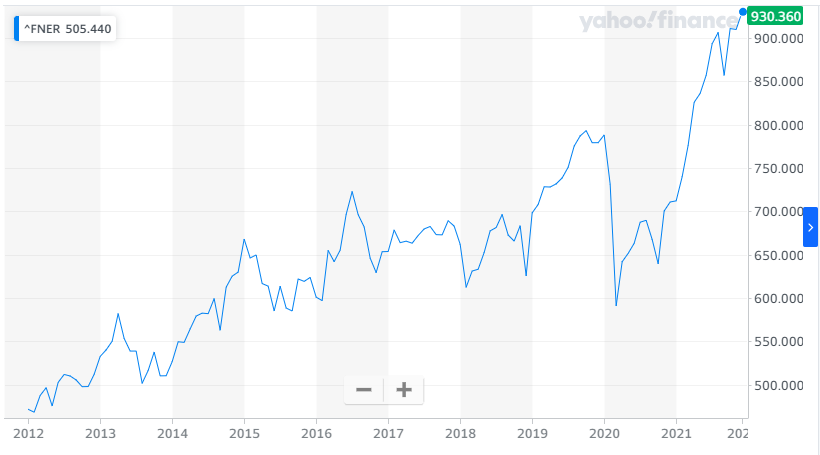

The chart below shows the performance of the FTSE NAREIT All US Equity REIT index. We can see that since January 2012 the broad REIT market has increased by 96%. More noticeably, the index has risen by 56% from its low in March 2020.

Source: YahooFinance

ETFs

An effective way to gain access to real estate returns is through a Real Estate Investment Trust (REIT). These trusts invest their cash in all types of real estate, from commercial to residential, as well as infrastructure.

You can buy shares in many REITs offered through your bank or broker. There is also a list of ETFs that invest in real estate. ETFs have the benefit of a highly liquid marketplace, making selling and buying your shares easy.

REITs offer a special tax advantage to shareholders when they distribute at least 90% of their income. In this scenario, shareholders receive their dividends gross of corporate tax, avoiding double taxation.

You can hold REITs in your Self-Directed IRA; in which case you will receive two-fold protection from taxation. If you hold the REIT shares in a Roth IRA you will receive your dividends untaxed, and they won’t be taxed when you take distributions either.

Bottom Line

Adding these assets to your portfolio will help in diversifying risk, creating alternative revenue streams, and fighting inflation. You can hold all 3 assets in an IRA, and thanks to their small minimum investment sizes you can add them easily. Yearly contributions are currently at $6,000 giving you enough room to diversify across all assets.

source: tradingeconomics.com

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24