24K Gold: How Much Is Your Gold Worth?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Have you ever wondered how much your gold is worth? You may have some gold jewelry, but is it made with 24k gold? The question is particularly important when it comes to selling unwanted gold jewelry. Let's have a look at the difference between 24k, 18k, or other karats of gold.

Table of Contents

What Are Karats?

The terminology karat comes from gold coins made in medieval times. The gold coins made in those times were weighed in carats. A carat (spelled with a C) was a measure of weight, and a coin weighed 24 carats.

Now, due to the softness of pure gold coins, they would add an alloy like copper. The use of an alloy would make the metal harder and more durable. However, this also changed the amount of gold in the 24-carat coin.

So, the weight of gold was measured as a fraction of the weight of the coin in pure gold. If the coin had 22 parts out of 24 of gold it was called 22-carat gold.

24k Gold Price

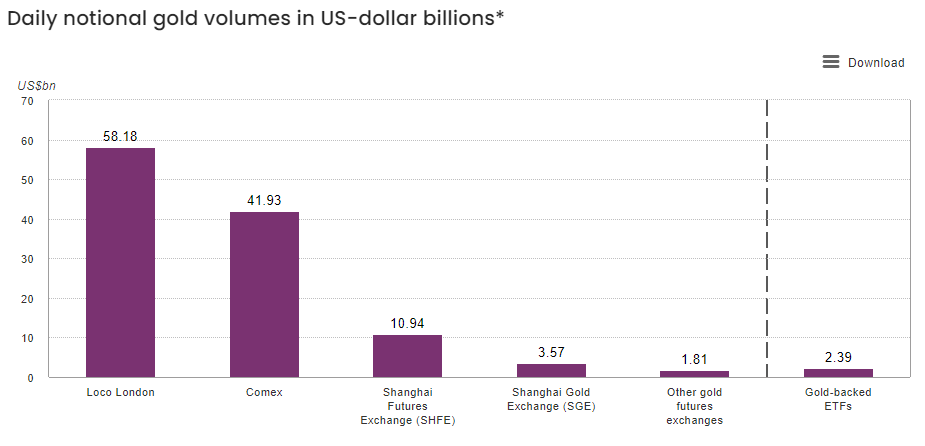

Many exchanges around the world quote the price of 24k spot gold. The word spot refers to immediate delivery, as opposed to delivery at a forward date when trading in futures. Although the largest percentage of spot 24k gold is exchanged over the counter (OTC) in London. OTC trading happens outside of a centralized exchange.

The price of gold is updated continuously throughout the day. Since there are various centers around the world the price of gold is updated almost 24 hours a day.

The price of gold reflects, to some extent, extraction costs known as all-in-sustaining costs. However, the largest part of the value of 24k gold comes from the laws of supply and demand. Gold has many uses from jewelry and industrial, to investment needs.

Where Is 24k Gold Traded?

Physical 24k gold is traded in the financial markets, just like many other assets. The center with the highest trading volumes is in London. Trading 24k gold in London is conducted over the counter (OTC) as opposed to trading on an exchange.

Proponents of OTC trading state the flexibility, as counterparties in the trade can tailor-make their transactions to fit their requirements as and when needed. However, this type of trading lacks the transparency offered by exchanges.

The most well-known 24k gold trading centers and exchanges include:

- OTC London

- Shanghai Gold Exchange

Investors and traders also exchange large amounts of gold futures. Each contract gives you the right to take delivery of a specified amount of gold at a future date. However, most contracts are closed before the delivery date.

- COMEX Exchange, New York

- Shanghai Futures Exchange

Source: WorldGoldCouncil

What Affects the Price of 24k Gold?

Apart from the factors of demand and supply mentioned earlier, other aspects also determine the cost of gold.

Melt Cost

This is the cost of melting the gold ore into 24k gold that refiners bear. The cost varies with the price of labor, energy, and alloys. Some countries have higher melting costs than others driven mostly by regulatory costs together with energy and labor costs.

The Shape of 24k Gold

24k gold can come in various shapes or forms, each one may shift the value of the precious metal.

- Coins: Coins that are made of 24k gold have a higher value than the price of gold alone. The higher the quality of the coin the higher its value. To get the best detail stamped into the coin the minter must press the coins multiple times, elevating its cost. Other factors also come into play such as rarity or beauty.

- Jewelry: When 24k gold is shaped into a piece of jewelry such as a bracelet, ring, or necklace the value can increase greatly. This is due to the craftsmanship costs, the beauty of the piece, and even the brand of the seller.

- Ingot or Bar: These are often called bullion and are made of 24k gold. The cost of these ingots or bars varies very little from the price of spot 24k gold. The refining process of gold bars is much easier than that of coins or jewelry. Usually, their cost does not vary over the spot price of 24k gold by more than 10%.

Extraction Costs

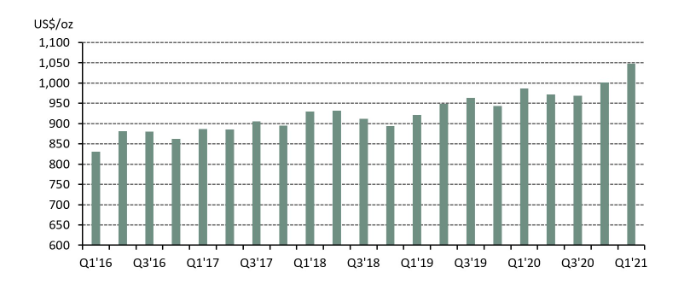

The biggest base factor for the price of 24k gold is its extraction cost. As we mentioned earlier, the all-in-sustaining cost is the cost to miners including, regulatory, licensing, labor, and so on. Over the years this cost has continued to rise.

However, it also acts as a minimum to which the value of 24k gold could fall. As producers of gold will not be willing to extract the precious metal if they cannot at least cover their cost plus a margin. And holders of gold would feel the price of their shiny metal cannot be worth less than it costs to extract.

All-In-Sustaining Costs per quarter

Source: WorlGoldCouncil

Source: WorlGoldCouncil

Melting Value

You can calculate the melt value of 24k gold by multiplying the weight of the coin, or jewelry, by the price of spot 24k gold. The melting value may differ greatly from the price you paid for your coins or jewelry given the factors mentioned above. The melt value is only the value of the gold content in the items.

Also, note that the melt value of gold changes if the purity is not 24k. Most gold jewelry is not made of 24k gold, as it is too soft and malleable. Other karats are more common such as 22k, 18k, or lower. Most gold jewelry carries a stamp where the karats are visible.

So, if you have a gold ring for example with an 18k stamp, this is equal to 18 parts out of 24 of gold, or 75%. You can then multiply the weight of the ring by 0.75 and then multiply by the spot price for gold to determine the melt value.

If you are thinking of selling some unwanted jewelry for scrap you should bear in mind a few things.

- Weigh your gold with an electronic balance. Get the current spot price of gold, so you know how much you should get for the weight of gold.

- Sometimes, the stamp with the karats is missing from some items of jewelry, especially the ones with lower karats.

- Make sure you are going to a trusted and reputable appraiser or gold dealer, as they are the ones that will determine how many karats your gold has.

Wrapping Up

From the dawn of civilizations, societies have always bestowed value on gold. It has been used for centuries as a store of value and a method of payment. For even longer it has been used to make objects of value and jewelry.

24k gold is of the finest purity and is, therefore, the most valuable. It is also the type of gold that investors buy to protect themselves against inflation, market crises, and portfolio diversification. 24k gold is also considered an alternative investment and may enhance overall portfolio performance with other assets such as cryptocurrencies.

When you invest in 24k gold you are placing your money outside of conventional regulatory, corporate, or economic risk. Gold has the capability to maintain its value over time. You can invest in 24k gold through your IRA, and you can learn more about investing in these tax-advantaged retirement accounts by reading our full free guide.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,330.67

Gold: $3,330.67

Silver: $36.82

Silver: $36.82

Platinum: $1,384.05

Platinum: $1,384.05

Palladium: $1,126.20

Palladium: $1,126.20

Bitcoin: $108,795.73

Bitcoin: $108,795.73

Ethereum: $2,575.98

Ethereum: $2,575.98