Gold and Inflation: Can The Yellow Metal Protect Your Savings In 2023?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 23rd May 2023, 07:38 pm

Gold has long been considered the ideal hedge against inflation. In times of high inflation, the value of paper money erodes, while gold often retains its value. This makes gold an attractive investment for those looking to protect their savings from the ravages of inflation.

But can gold really protect your savings in 2023? Considering the inflation we've seen over the past year and beyond, it's worth looking at the role of gold in your portfolio this year.

Let's take a look.

Table of Contents

Gold and Inflation

Before looking at the 2023 facts and figures, it's important to understand the gold and inflation relationship. Gold is considered an inflation hedge, which means that it tends to hold its value better than other investments when prices are rising.

This is due, in part, to the limited supply of gold in the world. As more and more money is printed, the value of each unit decreases. Gold, on the other hand, is a finite resource, so its value is not affected by inflation in the same way. It’s also not in the same conversation as silver and inflation; gold is by far the rarer metal than silver, making it a more viable investment.

In addition, gold is seen as a safe investment. Unlike stocks or bonds, it is not correlated to the stock market, meaning that its value does not go up and down with the market. This makes it an attractive option during times of economic uncertainty – like during global pandemics, for instance.

Gold in Times of Economic Uncertainty

Let’s talk about the gold and inflation hedge in light of recent events. We are on the other side of an unprecedented few years – not just in terms of our health, but also economy-wise. Last year saw inflation skyrocket, and whether this was due to the economy's volatility or not is still up for debate.

Regardless, gold is a great investment option for those looking to protect their money during times of economic uncertainty. In tumultuous times, investors tend to flock to gold as a safe-haven investment. This was especially true in the lead-up to the 2008 global financial crisis.

Gold isn't a silver-bullet solution, however, and no investment is foolproof. So what are our odds for investing in the yellow metal this year?

Gold in 2023: What You Should Know

There are many reasons to invest in gold, and Q2 2023 is lengthening the list. This year looks to be another winner for gold, as it's already been the front runner asset for Q2 2023. But no value is without its volatility – so what does the year hold for gold?

Stagflation's Influence

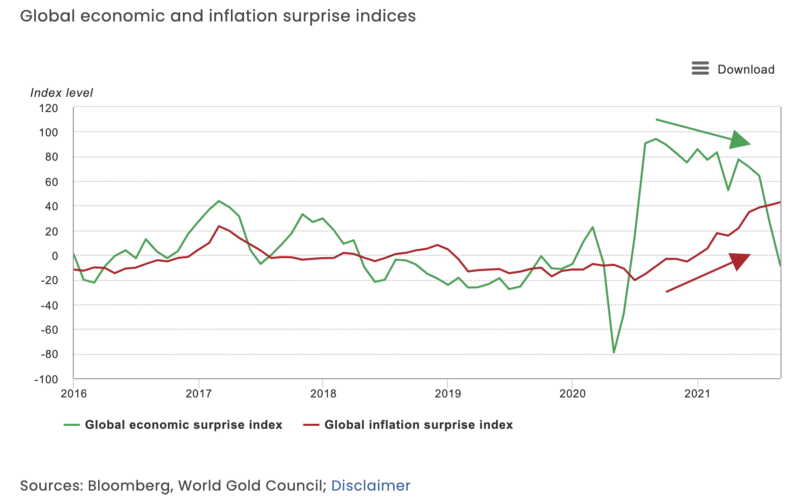

In 2023, stagflation is the word on the economic block. This occurs when there's high unemployment and low economic growth, combined with high inflation. Economists began predicting this shift in 2021, as statistics showed a sharp contrast between rapidly rising inflation and a sharply decreasing global economy (see below graph).

Graph Source: GoldHub

There are many reasons for this inflation, but COVID-19 is arguably one of the main contributors. The European Central Bank increased its money printing by 50% last year in order to scramble back up the steep slope left in the pandemic’s wake, so it was only a matter of time.

We've been experiencing stagflation for some months now – arguably, years – and with new geopolitical tensions on the rise in Ukraine, it's likely that this trend will continue. In that case, gold is only going to get sweeter as a safe-haven investment.

Limited Options

Another factor to consider is that, as the global economy slows down, central banks are going to be less likely to raise interest rates. This is because they don't want to choke off what little growth we have left.

Low interest means that there aren’t a lot of good investment options out there right now. Bonds are not looking attractive, and the stock market is incredibly volatile. Gold, on the other hand, remains a stable investment option even in times of economic turbulence.

Low Interest Rates

In 2023, interest rates aren't looking too hot. This is due to a number of reasons, including the global economic slowdown and the huge public debt in many countries.

What does this mean for gold? In short, it means that gold is going to become more and more attractive as an investment option. This is because investors will be looking for alternatives to the low interest rates being offered on bonds and other investments.

Gold in 2023: the Facts and Figures

In terms of value, 2023 has already been an excellent year for gold. In Q1 2022, gold reached new heights, jumping by 8% to its best performance since 2020. Its inflows reached US$17 billion, which is also the highest since 2020.

Needless to say, gold is doing well thanks to interest rates, economic volatility, and high geopolitical tension – and economists predict a great run moving forward.

Gold Amid Geopolitical Risk

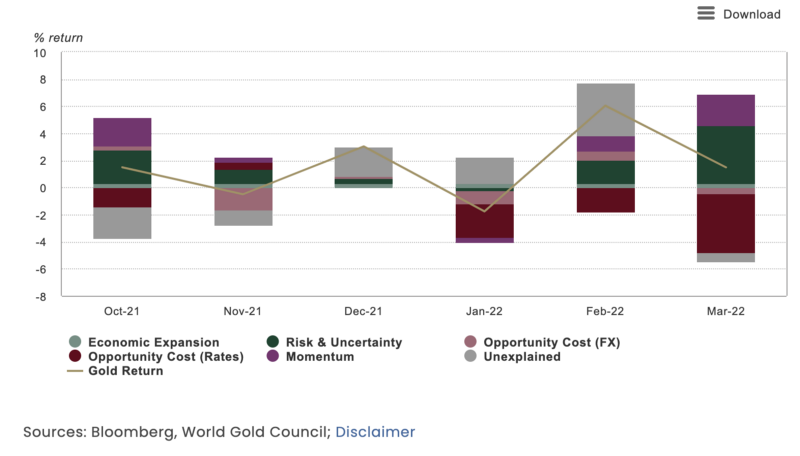

As you can see in the graph below, there are two main causes of gold's Q1 performance – Opportunity Cost and Risk & Uncertainty. We can see that these factors have both been key drivers since the beginning of the year, but never more so than now.

Graph Source: GoldHub

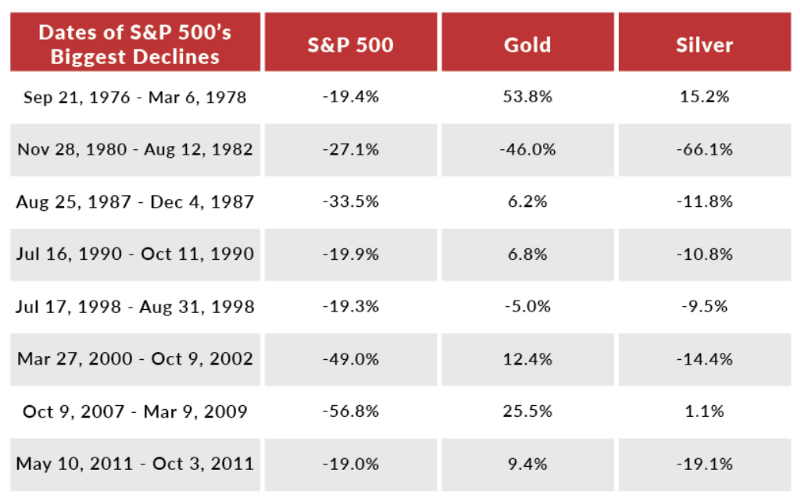

These are conditions under which gold has performed well in the past. In fact, 75% of all recessions have seen gold's value skyrocket, and past wars and conflicts have seen similar trends – so it's fairly safe to place confidence in the yellow metal's ability to strike again.

Graph Source: Suisse Gold

Should You Invest?

History is on your side when it comes to gold. It's worked well as a safe-haven investment in times of volatility and uncertainty, as it hedges against inflation beautifully. And with stagflation on the rise, high interest rates, and limited investment options, it's looking like a good investment option for 2023.

However, always do your own research before investing – no one can predict the future with 100% certainty. Speak to an expert if you're unsure, and remember to diversify your portfolio to mitigate risk.

In the meantime, check out our live tracking page for the latest data and updates on the price of gold. If you are interested in diving deeper, we also have a comprehensive guide to all things gold – you can find it here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24