War in Ukraine: How Gold Prices May Be Impacted After Russian Invasion

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 10th February 2023, 09:07 pm

The war in Ukraine has captured the world’s attention for the worse. However, as a preoccupied investor, you should consider what the consequences of this conflict are on your investments.

We have already seen an increase in volatility in the stock market, with stocks across the globe being hit by a double specter. At first, stock markets roiled on threats of higher interest rates fuelled by inflation. Now war has hit Europe, adding negative effects to global trade, deep economic sanctions targeting the Russian regime that will have worldwide ripple effects, and inflation looks set to jump even higher.

Although no sound investing strategy ever contemplates holding just a few types of assets, still many investors only hold stocks and bonds. You may be thinking of gold as a safe refuge for your savings and investments. It could be the right moment to add some gold to your portfolio or increase the percentage you already hold.

What Makes Gold Resilient?

Gold has been known for millennia as a store of value and wealth. Since its very first discovery, societies throughout history have appreciated the shiny metal for its indestructibility, industrial applicability, malleability, and its shiny color.

The precious metal is not used anymore on a large scale as a method of payment, but that stopped only a few decades ago. It would almost be impossible to imagine, but if the financial system of fiat money failed, society would most probably revert to gold as a method of payment again.

The characteristics mentioned above are what give gold the label of a safe-haven asset. Not only could you keep gold for centuries with little to no maintenance. If all else fails gold is still very likely to maintain its value and to function as a method of exchange.

How Has Gold Fared in Other Wars & Crises?

Let's have a closer look at how gold has performed in various periods of crisis or war. Thankfully, there haven't been many wars of a high profile in recent history, but we have seen some uncertain moments. Conflicts that remain contained, even if protracted in time, tend to not negatively impact securities. It's more a matter of the initial phase when we still don't know how far things can escalate.

The Afghanistan & Iraq Wars

The turn of the 21st century is a very interesting period for investors looking back and trying to understand how the market played out. In 2001, the stock markets were hit by the dot com bubble. The internet had taken off in a big way in the previous years. Many companies had started up in the online space and evaluations simply got out of hand.

Tech stocks came tumbling down, and the panic led to a selloff of traditional stocks also. But to add to the insecurity of the moment The United States led an allied attack to invade Afghanistan. The mission as we know was to rid Al-Qaeda operatives of a safe place to operate. But however noble the cause, this intervention created more insecurity.

With the Afghanistan conflict still in the background in March 2003, the US and its allies also invaded Iraq. More military intervention added more fuel to the fears of a protracted recession and stocks acted accordingly.

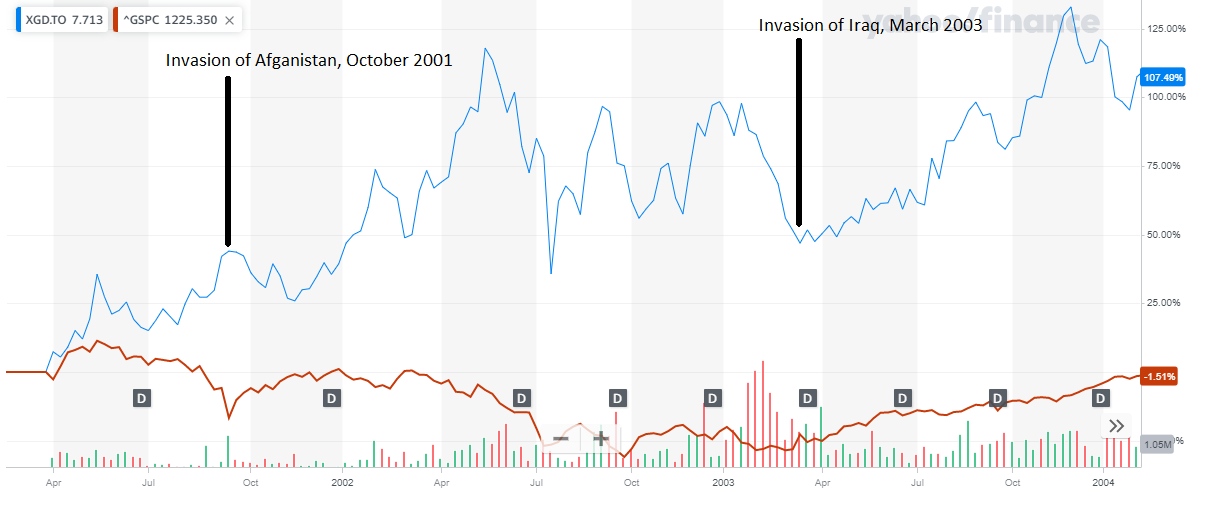

Source YahooFinance

The chart above shows the price of gold and the S&P 500 from 2001 to 2004. I used an index fund as a proxy for gold. While the brown line is the S&P 500 index. We can see that during the initial phase of the Afghanistan invasion in October 2001, stocks fell but gold advanced in price.

A similar pattern is visible with the invasion of Iraq in March 2003. Gold had been falling from recent highs. From March 2003, gold regained traction and outpaced the S&P 500 as it reached a gain of over 107% for the period that goes from March 2001 to February 2004.

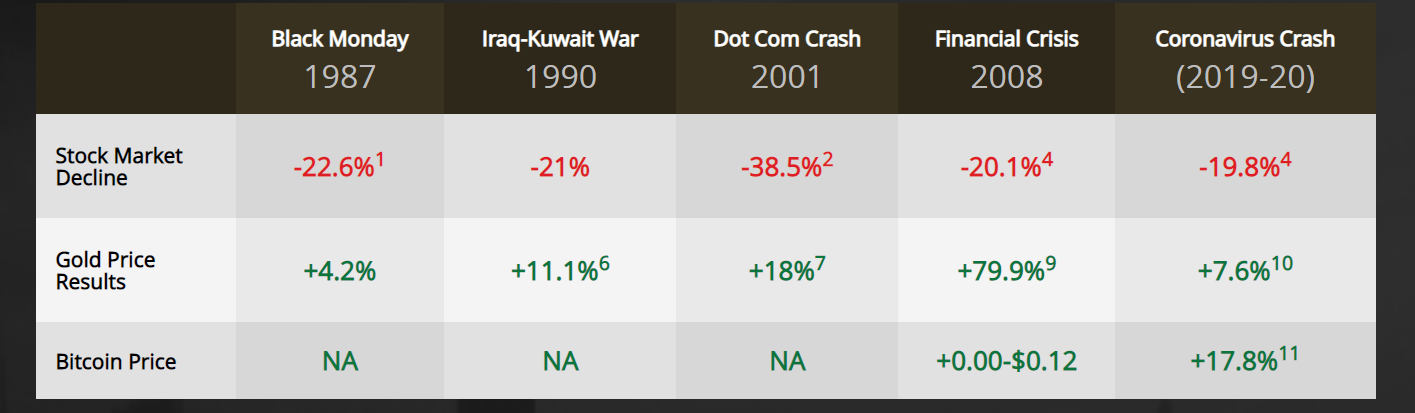

Past Crises & the First Iraq War

Over the past 5 crises for the stock market gold managed positive performances in all of them. Stocks lost an average of 24.4% over these 5 periods, while gold had positive returns for each of them. Investing a part of your savings in gold helps protect your wealth from the adverse effects in times of a calamity, whether it's war or a recession.

Gold also fares well in times of inflation. Inflation has started to gain momentum and with the latest bellicose events in Europe, looks like it may have an even more detrimental effect on prices. Gold isn’t the only asset that can protect wealth in times of prolonged inflation. You will find that there are various assets in which you can invest to protect against inflation.

Most Recent Performance Since the Ukraine Invasion

The conflict in Ukraine has only just begun. The invasion may continue for much longer than Russian forces initially hoped. The shortages and steepening prices of a variety of goods and commodities are likely to continue.

Crude oil is possibly the most worrying as it impacts many people and companies reliant on this fuel in many ways. But so too have other commodities increased in price, such as grain, aluminum, or natural gas.

Grain is needed not just to make bread, but also in the manufacture of many staples in our diet. Aluminum is necessary for the manufacture of a whole array of products, and its price has hit a 13-year high. Natural gas, which the west relies heavily on to produce electricity has risen by 60%.

Source YahooFinance

In the chart above we can see the price performance of gold, using the gold index fund as a proxy, compared to the performance of the S&P 500. This chart looks back to the beginning of 2022, and we can see how leading up to the day of the invasion of Ukraine the stock market continued to fall. On the other hand, gold continued to rise.

In the weeks leading up to the invasion on February 24, 2022, there was already a lot of talk of the possibility of war. The US intelligence services had already correctly advised that Russia was preparing to invade.

Of course, inflationary worries were already at play, and the likelihood of the Federal Reserve hiking interest rates was also at the forefront of stock investors' concerns. However, we can see that in the days leading up to the invasion gold surged while stocks continued to fall. Since the beginning of 2022 gold has risen 11.8%, while the broad stock index has declined 9.6%.

Wrapping Up

Gold has shown its capacity to resist inflation and stock market shocks time and time again. And this time around promises not to be any different. We are moving into an inflationary period, with greater uncertainty caused by the war in Ukraine.

So, adding gold to your investment portfolio or increasing your exposure to the timeless precious metal may be a good idea. This is especially true given that previous conflicts in Iraq, Kuwait, and Afghanistan oversaw periods of growth in the gold markets. You can learn more about how to include gold in an IRA to gain from the enhanced tax environment in our complete gold IRA guide 2022.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24