Top Alternative Investments to Make in 2022

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 17th January 2022, 02:51 pm

As 2022 gets started some analysts are predicting a slowdown in the economy for the first half-year. The WSJ reported in December Mark Zandi, chief economist at Moody’s Analytics, downgraded his forecast for GDP growth from 5.2% to 2.2% for the first quarter of 2022.

Aside from the possibility of a shrinking economy, the greatest threat for 2022 is possibly the return of high inflation. Investors are looking for ways to beat this ugly monster. Bonds almost certainly won't do it, and stocks are going to have a hard time.

It’s worth considering how to mix up your portfolio to gain exposure to different risks. It’s a simple matter of not putting all your eggs in one basket. So, adding alternative assets to your investments, that are not correlated to traditional investments, makes all the sense.

We are going to have a look at some options that we feel have great potential for growth or substantial returns in 2022 and beyond.

Cryptocurrencies

Cryptocurrencies continue to gain more traction as the years go by. Some of the coins are becoming household names, such as Bitcoin or Ethereum. More and more investors are investing in or trading this asset. This fact alone creates demand for digital assets.

However, that factor might not be enough by itself to spur the prices of a cryptocurrency higher. What we see is a wider acceptance of virtual coins. General recognition is leading to companies, and many online and offline stores, accepting payment in cryptocurrencies.

In January 2009, Bitcoin came onto the scene, and together with the blockchain technology behind it, started a revolution. The disruption has not only surfaced in finance, but it has also affected many fields. Basically, any activity that involves a digital process, or one that can be digitized.

As the concept of cryptocurrencies becomes more understood, so too does their acceptance. Various large corporations allow you to buy their products using virtual coins. Some companies even allow their employees to choose if they receive their salaries in digital coins or fiat money.

Cryptocurrency Applications

Bitcoin is leading the way in cryptocurrency usage. Companies that allow you to buy using Bitcoin include Microsoft Xbox, Overstock, Bed & Beyond, and Home Depot to name a few.

Some of these companies started accepting Bitcoin years ago. Microsoft first started accepting payments with the virtual currency in 2014. More recently Starbucks started accepting payments through the Bakkt app in 2021. But it doesn’t end with these big leading names.

Other organizations, like sports teams, also allow you to spend with Bitcoin. At the Dallas Mavericks’ stadium, you can buy anything they have using Bitcoin. In fact, it’s well known that Mark Cuban, the Mavericks owner, is also a committed fan of Bitcoin.

Another sports team, Miami Dolphins also allows its fans to buy tickets and food using cryptocurrency. This time, the football team chose a Bitcoin clone called Litecoin. Although less known than its bigger peer, Litecoin has a market capitalization of around $9.6 billion.

Online apps also allow users to buy their products using Bitcoin. Expedia, one of the largest online hotels and flights booking app, allows their clients to pay in Bitcoin. Usage of bitcoin also extends to the retail food industry. Some privately owned restaurants allow their patrons to pay their checks with Bitcoin.

How to Invest

Many online platforms allow you to buy and sell a variety of cryptocurrencies, there are currently over 9,000 of them as listed by coinmarketcap.com. The leading cryptocurrency exchanges include CoinBase, Crypto, and Binance.

You can open an account with any exchange completely online by following their instructions. You will need to upload a variety of documents, as most exchanges are obliged to follow Know Your Client rules.

Another way is to invest in cryptocurrencies through a Self-Directed IRA. Investing through these retirement accounts allows you to see your savings grow under a tax-enhanced environment. You can choose whether it’s a Traditional IRA or a Roth IRA.

Be aware, if you already own cryptocurrencies, you cannot transfer them directly into your IRA. You would have to first sell the digital currency you hold and contribute US dollars only to your IRA.

Managed Crypto Alternative

An alternative to self-investing in cryptocurrencies is through crypto funds. There are two main categories in the crypto management space: hedge funds and tracking funds. To invest in the former type of fund you will need to be an accredited investor. While requirements are much looser for passive investment type funds.

The total inflow into crypto funds for 2021 was $9.3 billion, greatly outpacing the number for 2020 which was $6.8 billion. There are currently 80 crypto tracking funds worldwide. However, the largest crypto fund is Grayscale Bitcoin Trust (GBTC: OTCQX). The fund has over $21.4 billion in assets under management.

One of the main benefits of a fund is that it will invest in a multitude of virtual coins. This diversification greatly reduces your overall risk. You can buy these funds through most brokers or banks. These funds are also eligible for inclusion in a Self-Directed IRA. You can find out more on how to buy Bitcoin in an IRA here.

Peer-to-Peer Lending

Peer-to-peer lending started catching the attention of many investors looking for an asset with an income stream. Traditionally, bonds were the security of choice for investors with such a requirement. However, in the past years of a low interest rate environment, these assets haven't offered attractive yields.

This type of lending allows investors to finance loans and earn interest rates in return that are not otherwise available. For example, personal loans carry a very high interest rate. Yet banks only pass on a small fraction of these earnings when you deposit your money.

The interest received on these loans varies greatly depending on the type of loan and the project you are funding. In personal loans, returns range from 3.5% to +20%, the rate depends on the riskiness of the loan. The riskier they are the more likely it is you may suffer a default by your borrower. The higher risk is compensated with higher interest rates.

This field has a large variety of platforms that allow you to lend money for various projects through them. Lending can be targeted towards personal loans, business loans, real estate projects, or start-up funding. You can pick more than one type of lending by opening various accounts to spread your risk.

Types of lending

P2P companies offer 2 different types of marketplaces, which determine how the money you lend reaches the borrower. One way is the direct marketplace. In this scenario, the platform puts borrowers and lenders in touch.

Companies act as an online gathering point for borrowers to apply for loans, and for investors to fund these projects. To meet the lender’s required amount, platforms use the crowdfunding method. So, you can pick and choose which projects you want to invest in.

Another way is the balance sheet lending method. Here the company acts as an intermediary between borrowers and lenders. Where the platform gathers the funds for the loan from the investor and sends them to the borrower.

Here your money is commingled with the funds of others to match the required amount by the borrower. A sub-version of this type of marketplace is when another company originates the loans. In this case, a third company, usually the owner of the platform, selects and does the vetting of borrowers. While the platform finds and manages the accounts of the lenders.

Minimum investment size depends on a few factors. Firstly, the type of field the loans are directed to. Real estate funding usually has a relatively higher minimum investment amount, such as $5,000. Whereas personal loans platforms can request as little as $25 as a minimum investment.

Where to Lend

Here is a list of 3 platforms that are renowned for their service, accountability, and attractive returns.

Prosper:

This online P2P platform focusing on personal loans was the first to launch in 2005. Since then, it has helped over 1.1 million clients reach their goals. The company has lent $20 billion so far. Investments start from $25 and have had an average historical return of 5.6%.

Funding Circle:

This company operates in the field of small business loans. It has served over 118,000 businesses and made loans for more than $17.5 billion. The P2P platform has a worldwide outreach and is quoted on the London Stock Exchange, under ticker FCH.

Peerform:

This platform operates in personal loans and started lending in 2016. The company boasts a state-of-the-art fraud prevention system. Thanks to following strict procedures they maintain a zero-tolerance policy on borrower fraud.

Precious Metals

Society has used precious metals as a store of value for millennia. Gold and silver have always been considered the noblest as people have known them for the longest time. They have been used as a method of payment and to make valuable jewelry.

More recently, meaning in the past centuries, other precious metals have also been discovered. Platinum, palladium, and rhodium are now well-known precious metals with many uses from jewelry to various applications in industrial production.

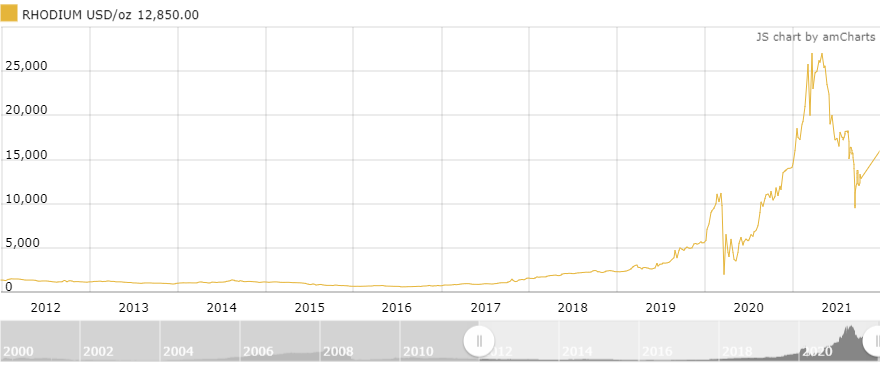

Although we may not consider Rhodium as much as the other precious metals it has had a stellar performance over the past 10 years. Most of the demand for rhodium comes from catalytic productions for cars. However, rhodium is also used in electronics, because of its low resistance to electricity.

Source: KITCO

The chart above shows the price performance of rhodium since 2012. In 2018 the price of this shiny metal broke its sideways trend and rallied to $11,200 by March 2020. The precious metal then pulled back, but it then staged an even greater rally by hitting its all-time high of $27,000 in March 2021.

Past performance is no guarantee of future performance. However, electronics are becoming an ever-greater part of all aspects of our lives. Therefore the demand for rhodium, in my opinion, may continue to increase.

Inflation Beater

Most investors already know the inflation-beating quality of precious metals. These metals can keep up with and at times exceed inflation. Precious metals in general are so rare and have such high demand factors that people will keep paying higher prices as and when needed.

2022 looks set to see inflation to continue the path it started in April 2021. From that month, inflation grew steadily till December when it reached 7%. With inflation on the rise, we already know stocks may not perform particularly well. And we know for sure bonds will be hard hit by rising inflation.

Conclusion

The returns of these investments are not correlated to stocks and bonds in a big way. So, adding one or all these alternative investments could help protect your portfolio. Not only from the inflationary period that is already looming but also from possible future market shocks.

Setting up an IRA for Gold or Bitcoin investing can be more intensive than most people have time for. We have made it easier for you to get the knowledge you need to understand every aspect of investing in these assets. Download our free guide here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,338.16

Gold: $3,338.16

Silver: $36.06

Silver: $36.06

Platinum: $1,357.42

Platinum: $1,357.42

Palladium: $1,110.47

Palladium: $1,110.47

Bitcoin: $105,607.89

Bitcoin: $105,607.89

Ethereum: $2,404.72

Ethereum: $2,404.72