Complete Gold IRA Guide (2025 Update)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Table of Contents

What Is A Gold IRA?

A gold IRA is a type of individual retirement account (IRA) that is self-directed and contains physical gold assets such as bars or coins. Like regular IRAs and employer-sponsored retirement savings accounts, gold IRAs offer tax benefits to account holders—either tax-free (Roth IRA) or tax-deferred gains (Traditional IRA).

Gold IRAs are not limited to gold and may also contain other precious metals and alternative assets, like annuities or cryptocurrencies, or conventional assets like stocks and bonds. To qualify as a “gold IRA”, the account must allocate at least some of its holdings to physical gold.

Since gold IRAs aren’t offered by regular brokerage firms, these accounts are administered by accredited third-party providers that specialize in self-directed investments.

For many retirement investors, gold IRAs are a strategic tool for minimizing risk, hedging against stock market volatility, and preserving wealth over one's lifetime. Despite their popularity, gold IRAs still present some risks and drawbacks. In this exclusive guide, we’ll help you determine whether this retirement investment vehicle is right for you.

The Benefit of Gold IRAs: 3 Allocation Strategies

Thanks to the ingenuity of the Taxpayer Relief Act of 1997, American investors can invest in physical gold within a self-directed IRA. Since its passage, SIMPLE IRAs, SEPs, and IRAs can all hold gold investments through a third-party custodian.

Naturally, some investors are hesitant to pursue gold as an investment, especially given the limited contribution room available to IRA investors. That's why we looked at the data to gauge whether adding gold to one's retirement investing strategy is worth the cost.

The Gold Allocation Study (1972-2015)

To find out whether gold truly makes sense in an IRA, we conducted an independent research study to test whether gold holdings would improve or worsen the performance of retirement investment accounts, retrospectively, using real-world data.

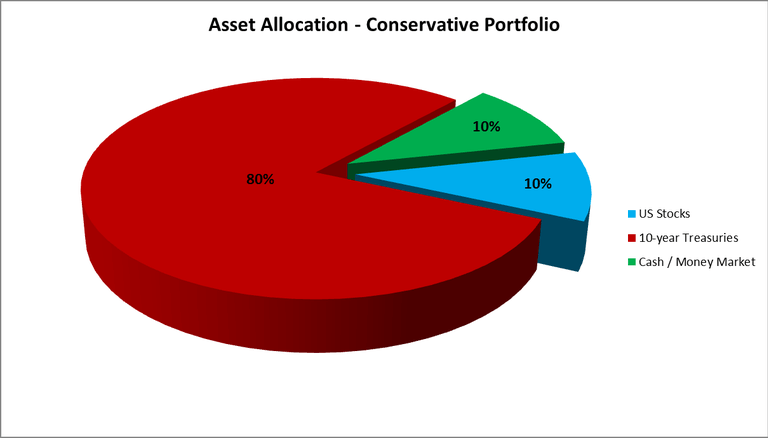

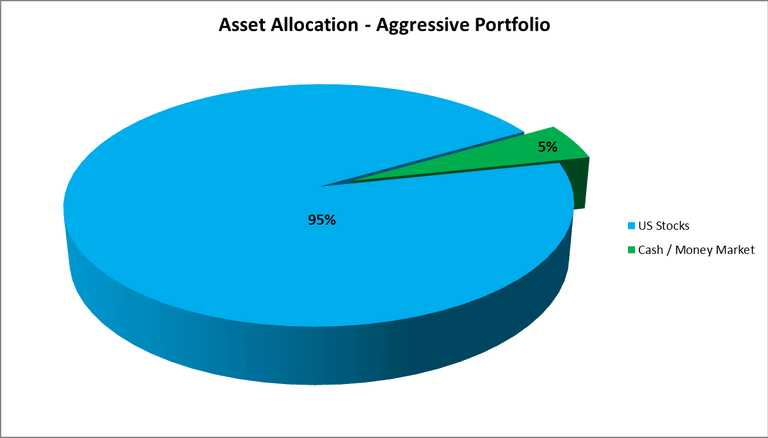

Our gold allocation study looked at three differing baseline IRA portfolios:

- Conservative (10% in U.S. stocks)

- Moderate (35% in U.S. stocks)

- Aggressive (95% in U.S. stocks)

The contents of each portfolio remained constant (i.e., the same stocks were selected for each portfolio, only scaled differently). The portfolios were analyzed using actual market data collected for the years 1972 to 2015 based on the following benchmarks:

- Vanguard Total Market Index Fund (VTSMX), 1993-2015

- CRSP Market Decile 1-10, 1972-1992

- Vanguard Intermediate-Term Treasury Fund (VFITX), 1992-2015

- Treasury Bills Risk-Free Return Benchmark, 1972-2015

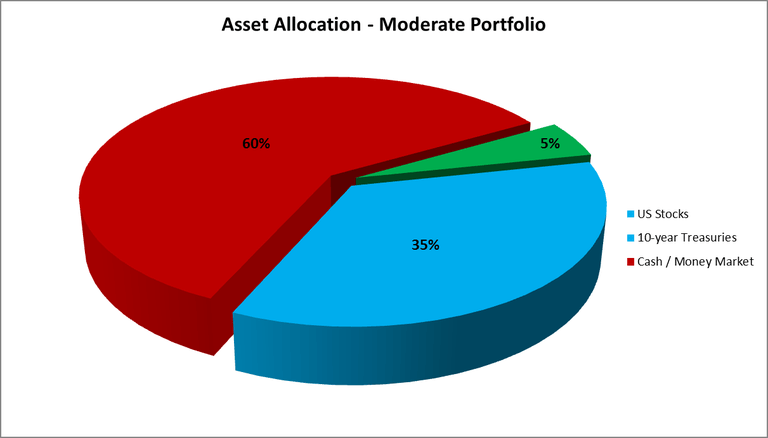

The baseline “moderate” portfolio consists of 35 percent American stocks, 60 percent American 10-year treasuries, and only five percent money market funds and cash.

Between the study years of 1972 and 2015, the average annualized growth rate for the “moderate” baseline portfolios was +8.53%.

If we assume a $1,000,000 starting investment, over the 43-year study period the portfolio would grow to $36,713,972.

Indeed, this is an impressive return. Yet it only gets better when gold is included in the asset allocation mixture, as demonstrated below (Fig. 1).

Let's look below to see how our “conservative” investor fared, on average, over the 43 year study period after adding gold, as well as during the worst and best-performing five years of the stock market throughout this period.

Conservative Investor Portfolio (25% Gold Allocation)

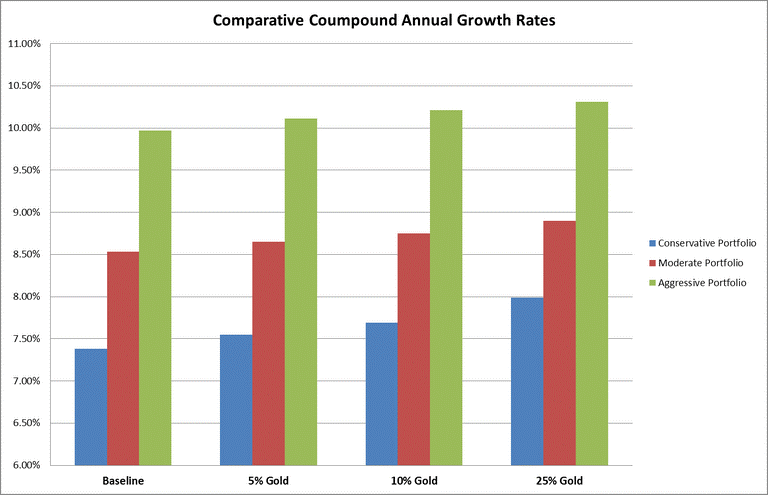

Here are the overall average returns with and without gold for all three investor profiles:

| Baseline | 5% Gold | 10% Gold | 25% Gold | |

|---|---|---|---|---|

| Conservative Portfolio: | 7.38% | 7.55% | 7.69% | 7.99% |

| Moderate Portfolio: | 8.53% | 8.65% | 8.75% | 8.90% |

| Aggressive Portfolio: | 9.97% | 10.11% | 10.21% | 10.31% |

The inclusion of a 25 percent gold allocation to the conservative portfolio improves the overall returns from 7.38 percent to 7.99 percent, a boost of two-thirds of a percentage point per year.

Although this gain may not seem significant, an additional +0.61% return compounded year after year can make a huge difference in the long term. Over 40 years, an additional +0.61% return would generate an additional $439,000 on a $100,000 initial investment compounding annually.

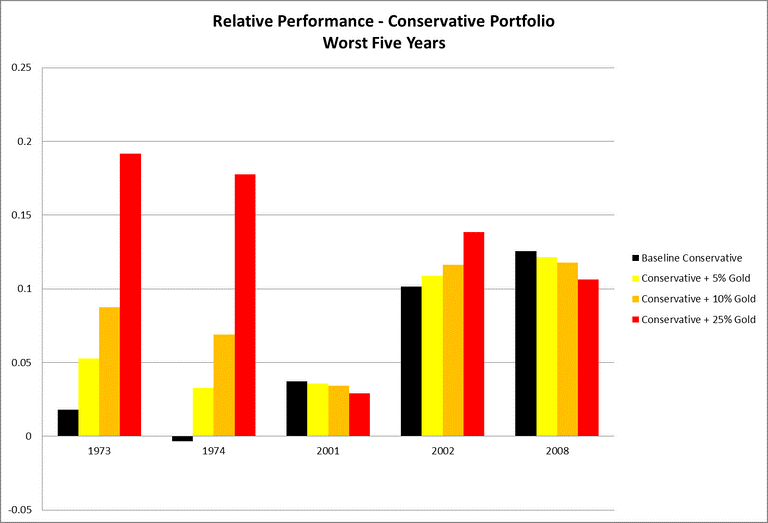

But we can't judge a portfolio by how well it performs during the good times—we also need to evaluate how it fares during market downturns. Let’s consider the worst-performing five stock market years with a gold allocation of 25% within a conservative portfolio (Fig. 2).

In three of the five years shown, our aggregate returns have somewhat improved. Note that this portfolio again has minor exposure to the stock market and major exposure to inversely moving bond markets, so its returns were positive in four out of the five years even without the additional diversification in gold.

In short, we can conclude that gold-heavy IRAs have historically outperformed those who do not hold gold. Gold tends to improve returns during bull markets and lessens the negative impacts of falling stock prices during a recession or down market.

For a more in-depth look at the data, and the original study conducted by Nevada-based hedge fund Beta Capital LLC, read our report here.

Gold IRA Pros and Cons

Although IRAs can benefit all investors, gold IRAs are not ideally suited for everyone. There are many reasons why this is the case, and in this section, we’ll take a look at what those reasons are. Specifically, we’ll weigh the pros and cons of precious metals IRAs and, more specifically, gold IRA pros and cons, by evaluating their fees, storage limitations, counterparty risks, opportunity costs, and their impact on your expected returns.

Gold IRA Pros

- They provide greater control over your financial future

- They deliver a powerful hedge against market risks that can jeopardize or delay your retirement

- They offer disaster insurance for your retirement portfolio in cash of market crashes, hyperinflation, or geopolitical conflict

- Gold and other assets appreciate in value on a tax-free or tax-deferred basis

- Offer greater diversity of assets to invest in than brokerage accounts

Gold IRAs Provide Greater Control Over Your Future

Perhaps the most important benefit of a gold IRA is that it provides you with the ability to sleep soundly knowing that you're in control of your financial future. This results from the greater control you gain over the assets in which you invest for retirement.

Everyone wants more control of their own life, and more freedom to do as they please. The good news is that a physical gold IRA offers exactly that. You gain this control by no longer having to concern yourself with the financial “what ifs”, such as:

- What will I do if the stock market crashes?

- What will I do if inflation erodes my cash savings?

- What will I do if my investments don't pan out?

- What will I do if the housing market corrects?

With gold, these questions aren’t as grave as they would be otherwise. As investors, gold is our most reliable hedge when it comes to offsetting losses from inflation, stock market adjustments, and other adverse economic events that can delay your retirement.

The yellow metal has always kept pace with (or outperformed) the rate of inflation in the long term. The classic example is to take a $20 gold piece from one hundred years ago. In 1917, a $20 gold bar could be used to purchase a custom-made suit in New York City. Today, the same $20 gold piece is worth about $1,500 per ounce, and it will still buy you a tailored suit.

The point is that gold has held its value exceptionally well over time. Whereas a $20 banknote could buy you a designer suit in 1917, that same banknote won't even buy you dinner today.

Gold IRAs Provide Your Retirement Portfolio With A Powerful Hedge

Most financial advisors recommend that you keep all your retirement assets in some combination of stocks, bonds, or mutual funds.

They may adjust the percentages, but whether they are talking about 60 percent stocks and 40 percent bonds, or 40 percent stocks and 60 percent bonds, the end result is largely the same. In both cases, you’re exposed to two asset classes that are highly correlated to one another.

Gold is a strategically uncorrelated alternative asset class that typically does not decline in value alongside stocks and bonds. Instead, its beta is completely unlike these other assets—so much so that it provides a true counterweight against the volatility of stocks.

Economic research has found that gold is a “zero-beta asset”, meaning it bears little to no market risk. Remember that stocks may crash and burn even by 50 to 60 percent in hours. Gold has never crashed to such an extent, since it is a relatively illiquid and rare physical asset with intrinsic value.

Gold IRAs Are the Ultimate Disaster Insurance for Your Portfolio

You pay for health insurance, life insurance, homeowners insurance, and car insurance to protect yourself from disease, premature death, fire, theft, or a car accident. These are all prudent investments made in order to preserve your or your family’s integrity in the event of disaster.

In the same vein, why would you not protect your retirement savings? Financial markets are rife with risk, and adverse economic events have crushed the retirement hopes of many investors who didn't adequately safeguard their savings.

Gold IRAs provide the “portfolio insurance” you need to shield your wealth from financial market risks that could cripple your life savings.

Today, portfolio insurance is needed more than ever. We’re living in an era of historically unparalleled government spending levels, all-time-high public debt, growing distrust in an irrational stock market, political instability and polarization, a once-in-a-lifetime public health situation and, more recently, the ravages of inflation.

All of these factors threaten systemic collapse in our financial system. Fortunately, gold IRAs hedge against these threats by providing a sound store of value when dollars, stocks and bonds lose their worth.

Gold IRA Cons

Now let's take a look at some of the various drawbacks of investing in a gold IRA:

- They will not allow you to view your gold holdings in-person

- They are not meant to be short term, quick profit investments

- They do not provide dividends, interest payments, or any yield

- They carry an opportunity cost given IRA contribution limits

The Majority of Account Administrators Will Not Let You Physically Store Your Gold Holdings

Gold IRA holdings are stored in trusted, third-party depositories. As an account holder, you have access to the address, website, and phone number of the custodian that vaults your assets.

However, you cannot view your physical inventory—rather, you're given an official certificate that signifies your ownership of the metals. Ultimately, the assets are held in trust by precious metals IRA administrators.

This is why you must work with a reputable and well-respected IRA administrator. This way, you won't one day find out that your administrator or depository has gone bankrupt or have been forced to liquidate their assets. This is called “counterparty risk”, and it's inherent to all investments held by a third party (including the assets held by your bank or brokerage).

If viewing your metal holdings is very important to you, we recommend contacting a self-directed IRA administrator and asking if they allow their account holders to make an appointment with their depositories to view their physical gold holdings. Although this isn't the industry standard, some companies may offer such services for a fee.

Gold IRAs Are Long Term Holds, Not For People Looking for A Quick Profit

Investors who want a quick return or want to profit from intra-day gold price movements would be better served by one of the major gold ETFs. For long-term retirement investors, physical gold bullion or coins are by far the better investment. However, they need to be held for years to benefit from their hedging properties.

Gold IRAs Do Not Pay Dividends, Interest, or Yields

Income investors seek out dividends from stocks or interest payments from bonds. You will never receive either of these with physically held gold in a precious metals IRA. Instead, gold undergoes capital appreciation as the price of gold increases over time. Those looking to generate passive income from their assets are better off investing elsewhere.

Gold IRA Storage Options

A substantial amount of wealth is stored in U.S. investors’ precious metals IRAs and vaulted in physical safes and depositories. For security reasons, the IRS determined that only certain pre-approved facilities would be allowed to vault such large amounts of physical bullion.

Only six depository vaults in the entire United States of America are approved to hold the valuable contents of these extremely resource-rich retirement accounts.

These six IRS-sanctioned vaults are responsible for nearly all of the gold, silver, platinum, and palladium contained in the precious metals retirement accounts in America. Recently, the IRS amended this rule to allow for gold IRA physical offshore storage in approved international vaults and countries. Below, we’ll look at all of your options for gold IRA storage.

IRS-Approved Precious Metals Depositories in the U.S.

IRA precious metals are still usually held in one of six IRS approved depository company vaults. These include the following institutions:

- Delaware Depository

- Brinks Security

- HSBC Bank USA

- JPMorgan Chase Bank North America

- Scotia Mocatta

- CNT Depository

These storage firms have U.S.-based locations which the IRS formerly requires for all precious metals IRAs. Some of them also offer international, or “offshore” storage options in various market centers known for global commodities trading, such as:

- London (United Kingdom)

- Singapore

- Dubai (United Arab Emirates)

- Zurich (Switzerland)

- Toronto (Canada)

- Hong Kong

Offshore Storage Versus Local Storage Options

Certain IRS-approved gold IRA companies offer offshore storage for account holders. Offshore storage only needs to be that which is located outside of the United States in order to qualify for this designation. Common offshore storage sites for gold IRAs include:

- Brinks Security (London vault)

- HSBC with storage offered in London, Zurich, Singapore, and Hong Kong

- JP Morgan Chase with vaults offshore in London and Singapore

- ScotiaMocatta with international storage options in Toronto, Canada

When choosing offshore storage, it’s crucially important to select a provider that vaults their assets in a legally and politically stable jurisdiction.

If you're a gold IRA investor, offshore vaulting and storage are worth considering. This is because U.S. jurisdictions are not as immune to political instability as you might assume.

Recall that the United States federal government confiscated all non-rare and non-collectible gold holdings in the early 1930s under then-President Franklin D. Roosevelt. Under Executive Order 6102, all Americans were required to hand over their gold assets to the Federal Reserve in exchange for about $20 per troy ounce.

When they were first introduced in the 1970s, IRA retirement accounts often contained physical gold, silver, platinum, and palladium holdings. In response, the IRS effectively nipped that thorny problem of storage jurisdiction in the bud by simply requiring that all self-directed IRAs containing metals be stored in an approved vault found within the United States.

The Taxpayer Relief Act of 1997, however, modified the rules imposed on IRA investors to allow for offshore storage. Today, more investors opt for storage facilities in safe foreign countries that are more resistant to confiscation or unrest.

Co-mingled Storage Versus Segregated Storage

“Co-mingled storage” is another trick you should watch out for when you are selecting a depository and vaulting storage options for your precious metals holdings within a gold IRA. Co-mingled storage refers to the concept of a giant vault in which the depository firm simply lumps all of their clients’ precious metals bullion together.

Storing clients’ metals in the same vault is simpler and less expensive for the depository. It requires only an inventory sheet to track what metals belong to which client. For the vaulting companies, co-mingling is the preferred method of storing clients' precious metals assets.

Unfortunately, it also means that you do not have any fully allocated precious metals inventory with such depositories.

The way around this troubling fact is to insist on using a depository firm that gives you allocated, segregated precious metals storage in writing. This way there will be a small room or safe deposit box where your particular precious metals are individually inventoried and segregated away from the general clientele's precious metals supply.

Segregated storage is the only way to keep your metals safe from potential disappearance in the event of bankruptcy or other adverse events at the depository.

You should be prepared for the depository to attempt to charge you a higher storage percentage fee when you request segregated storage. In any event, gold IRA providers are required by law to plainly disclose exactly what form of storage they utilize and at what price.

Unallowed Home Storage

It is illegal under federal law to store precious metals in an IRA within one's home. Make no mistake, there is no “grey area” or legal loophole that you can exploit: precious metals IRA home storage is against the law, and will disqualify your IRA.

Unfortunately, certain scam artists have been known to suggest a “controversial new storage method” in which you install a safe at home, create your own limited liability company, and vault your own metals while serving as your own trustee. Although this may sound appealing, it is false and fraudulent.

The IRS specifies that only approved and accredited financial organizations such as banks or non-bank trustees can act as IRA administrators. To become designated as such, an institution must undergo an extensive application process, proving your:

- Fiduciary experience

- Financial responsibility

- Fitness to handle funds

- Written fidelity bonds

- Net worth of at least $250,000

- Legal counsel retained

An individual investor with a safe and an LLC does not qualify for such designations. Always abide by the IRS' guidelines and directives to the letter to avoid any costly consequences or penalties.

IRA-Approved Precious Metals

You cannot simply invest in any type of gold or silver coin or collectible through an IRA. The IRS has established well-defined rules regarding which types of metals are permitted and under which conditions.

For example, any collector’s coin or “rare” precious metals coin is strictly forbidden from IRA inclusion per IRC Section 401(a). Coins or bars that don't meet purity standards are also prohibited.

Many popular bullion coins and bars are not eligible for IRA investing simply because they do not meet the IRS’ purity requirements. The IRA purity grades are as follows for precious metals investments:

- Gold: 0.995 or higher

- Silver: 0.999 or higher

- Platinum: 0.9995 or higher

- Palladium: 0.9995 or higher

Some of the most popular gold bullion assets that can be included in a tax-advantaged retirement account include the following:

American Gold Eagle Coins |  Credit Suisse Gold Bars |  Johnson Matthey Gold Bars |  Valcambi Gold Combibars |  Canadian Gold Maple Leaf Coins |

As of Q4 2021, an exhaustive list of gold, silver, platinum and palladium investment products that can be included in an IRA or tax-advantaged retirement account include:

IRA-Approved Gold Coins and Bars

.995%+ Purity Level Required

IRA-Approved Silver Coins and Bars

.999%+ Purity Level Required

IRA-Approved Platinum Coins and Bars

.9995%+ Purity Level Required

IRA-Approved Palladium Coins and Bars

.9995%+ Purity Level Required

Collectibles & Metals Not Eligible for IRAs

To reiterate, no collectible items nor coins originating from non-sovereign mint sources (i.e., collectible coin producers) can be included in an IRA. Although they may be popular among numismatics and collectors, coins such as the Chinese Panda or the Israeli Tower of David are unapproved for IRA inclusion, as well as:

- French Napoleon coins

- South African Krugerrand coins

- Switzerland Vreneli coins

- Mexican Gold Pesos

- Chilean Peso

For a full list of which metals are eligible and ineligible for an IRA, read our full-length article on IRA-approved metals.

Note that there are three criteria that allow for certain gold coins to be eligible for gold IRA inclusion. All three of these criteria must be met for a gold coin to qualify for an IRA:

- Certain gold coins listed under 31 USC Section 5112

- Coins minted and issued by a sovereign state

- Coins vaulted by a bank or approved non-bank trustee

Funding Your Account: Gold IRA Rollovers vs. Transfers

There are two main funding options when opening a gold IRA: a rollover or a transfer. Below, we’ve listed their core distinctions.

Gold IRA Transfer Rules | Gold IRA Rollover Rules |

|---|---|

| No 60-day transfer rule in effect | 60-day transfer rule applies, in which the account holder must transfer the deposited funds from their account into the new gold IRA |

| No early withdrawal penalties | distributed funds are subject to a 10% early withdrawal penalty if the account holder is under the minimum withdrawal age of 59.5 |

| Not taxable | If the 60-day rule is violated, the distributed funds are then deemed taxable as ordinary income |

| No annual limits | IRA holders are strictly limited to one rollover per 365-day calendar year |

| No withholding taxes | There is no tax withholding if a rollover is made from a personal IRA to another IRA |

Fewer rules apply to transfers than rollovers. Funds distributed via transfers never touch the account holder’s bank account, which presents fewer opportunities for accidentally violating regulations and triggering a tax event.

For this reason, we generally recommend transfers over rollovers to minimize risk and move assets more safely between retirement savings accounts.

To learn more about how the federal government regulates rollovers, and the penalties for violating such regulations, read the official IRS guide to Rollovers of Retirement Plan Distributions or the IRS-authored IRA FAQ document.

Rollovers and Transfers: A Closer Look

Gold IRA rollovers and transfers entail converting wealth from a pre-existing IRA, 401(k), 403(b), or any other tax-advantaged retirement account, and transferring a portion of it to a new precious metals IRA.

The difficulty in trying to add precious metals to your existing IRA is that most brokerage plans do not permit diversifying into physical gold, silver, platinum, or palladium. This is because they entail additional costs and risks for the brokerage, including long-term storage, custodial responsibilities, insurance, and safeguarding of the metals.

To purchase precious metals within your retirement accounts you have to set up a new account with a trustee that specializes in self-directed retirement vehicles. You will then have two choices as to how to move your funds from your current brokerage account to the new trustee:

- A rollover (employer-sponsored plan to IRA)

- A direct transfer (IRA-to-IRA)

The Mechanics of a Gold IRA Rollover

The easiest way to understand a gold IRA rollover is to think of it as an automatic transfer from your old IRA administrator to your new one. You simply fund the new self-directed IRA account by rolling over (i.e., transferring) money out of your current retirement account into a new one.

Your financial institution or existing account administrator will simply initiate an electronic transfer of your current funds and/or assets to the administrator of the new IRA plan. You can roll over funds from old IRAs or any other type of qualified retirement plan, such as a:

- Traditional IRA

- Roth IRA

- Self-directed 401(k)

- Employer-sponsored 401(k)

- SEP IRA

- 403(b)

- 457(b)

- Thrift Savings Plan (TSP)

Under federal law, gold IRA rollovers are only permitted once per 365-day period.

Moving funds from an existing account to a new gold IRA is simply a matter of registering for a new self-directed IRA through a gold IRA company. Then, fill out a transfer request form to initiate the process of rolling over the funds. Usually, it takes no longer than 14 working days for funds to successfully be credited to the new IRA.

Once the funds are confirmed and credited by your new IRA account administrator, you can speak with them to select the specific precious metals and coins you wish to invest in.

In the case of employer-sponsored accounts, such as a 401(k) or 457(b), you may need to facilitate the rollover after you have terminated employment at the company. In some cases, you may be able to do a partial rollover while still employed after you’ve reached 59.5 years of age. Inquire with your employer to determine your eligibility for rolling over or transferring funds.

Want to learn more? Read our step-by-step guide to gold IRA rollovers to find out how you can get started funding a gold IRA today.

The Mechanics of a Gold IRA Transfer

The second way of moving funds over to the new IRA custodian is by manually transferring the funds on your own. This is known by the IRS as a “60-Day rollover”, and is more commonly called an IRA transfer.

This process requires the account holder to take a distribution from their existing retirement plan in the form of a check. Once the distribution is received, you have a maximum of 60 days to deposit it into the new self-directed IRA. The clock starts ticking from the day you actually receive the distribution.

There are certain specific cases where the IRS may be willing to waive this otherwise strict 60-day rollover limitation in the event that you miss this critical deadline because of a scenario outside of your control.

There are essentially three ways to have this requirement waived:

- You could simply qualify for an automatic waiver (usually triggered by an error committed by the financial institution, see below).

- You might self-certify that you meet all the requirements for a waiver. The IRS will then audit your income tax return to ensure that you qualify for such a waiver.

- You can obtain a private letter ruling that grants you a waiver if you satisfy Revenue Procedures 2003-16 and 2020-4 ($10,000 application fee applies).

Qualifying for an automatic waiver requires that all of the following criteria apply to your situation:

- The funds are not deposited properly into your account at the new IRA custodian within the 60 day deadline simply because there is an error at the bank.

- You did in fact make sure the funds were received by the financial institution for the account on your behalf before the 60-day rollover time limit expired. You must have correctly followed all relevant procedures which the bank set for properly depositing said funds into the IRA account on time.

- The rollover would have been done on time and correctly if the bank had properly credited the funds to the appropriate account as you instructed them to do.

- The funds do become deposited into the IRA in a year or less from the start of the 60-day period.

Should you not complete the transfer to the new IRA account in time, or otherwise obtain a waiver for missing the 60-day deadline, then you will be penalized financially.

First, the funds will become fully taxable (unless they were taken out of a Roth IRA and therefore were previously taxed). Second, the funds will be subject to a 10% early distribution penalty if the account holder is under 59.5 years of age.

Warning About the Potential Tax Implications of a Transfer

There are some potentially significant tax implications to consider when you choose to do a transfer instead of an automatic rollover.

When you personally receive a distribution from your existing retirement account provider, the estimated taxes due will be withheld.

If these funds are not supposed to be taxed (and they wouldn’t if you complete the 60-day rollover process on time), then you will have to utilize other funds to complete the full transfer yourself.

The differences would later be reconciled on your yearly tax return via a tax refund or credit against other taxes owed. The easiest way to avoid these complications is to have your new IRA account administrator handle the rollover automatically on your behalf.

How to Build a Gold IRA Investment Strategy

Your gold IRA investing strategy should be tailored to your specific financial circumstances and time horizon. Additionally, the extent to which you’re willing to tolerate risk will also play into your investment strategy.

There's simply no black-or-white answer to the question: “What percentage of my portfolio should be dedicated to precious metals?”

Ultimately, one's gold allocation should be determined by the personal factors mentioned above, as well as one’s proximity to retirement. Generally, those closer to retirement can afford to take on less risk and, therefore, may want to invest a higher percentage of their wealth in gold or other precious metals (e.g., 18-20%).

Finding The Right Gold Allocation for Your IRA

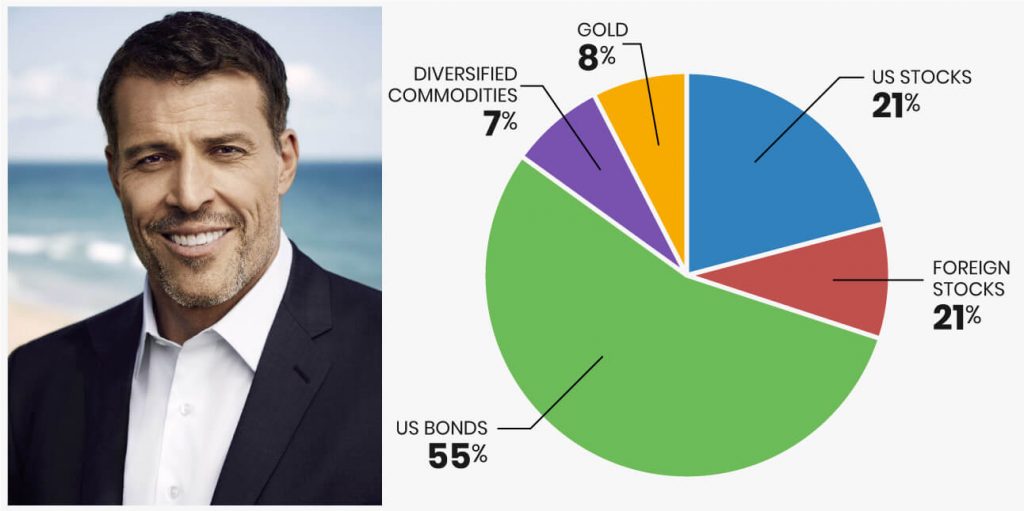

As a rule, a limited allocation of 5-10% of one’s portfolio value in gold offers ample protection against market losses and has the potential to capture significant upside growth. This allocation has been endorsed by such investors as Kevin O’Leary of ABC’s Shark Tank, Tony Robbins, and Ray Dalio.

To help you arrive at an allocation percentage that works for you, consider the following questions:

- Am I optimistic about the economy as a whole over the next 5-10 years?

- Has my portfolio been generating satisfactory returns over the past 5 years?

- What ends would my gold investments serve? (e.g., diversification, risk management, profit)

- Do I plan to retire within the next 10 years?

Those who are pessimistic about the future of the economy, have an underperforming portfolio, or plan to retire within 10 years have all the more reason to increase their allocation in gold. In the same vein, those most interested in using gold to manage or mitigate risk are likely better off devoting more of their wealth to gold than strictly profit-oriented investors.

The Three Gold Investor Orientations

Most gold investors fall into one of three broad categories based on their investment goals.

Diversifiers (5-10%)

Investors most concerned with protecting their wealth from stock market overexposure and limiting risk from downturns in the business cycle fall into this category.

At this level of exposure (i.e., 5-10%), investors benefit from investing in an asset that is inversely correlated with the stock market, while still allowing their significant holdings in equities to capture upside potential. Most gold IRA investors fall into the “Diversifiers” category.

Inflation Protection (10-20%)

Investors looking to minimize the effects of inflation and currency debasement may want to dedicate more of their portfolio to gold.

Gold is a strategic hedge against inflation. Therefore, the more one invests in gold, the more protection they have against rises in the consumer pric index (CPI). As of November 2021, the CPI sits at +6.2%, the highest inflation rate since 1990.

When the purchasing power of the dollar diminishes, the value of gold has historically tended to hold its value. Consequently, investors concerned by today’s inflation levels would do well to dedicate more of their wealth to gold than those merely managing risk through diversification.

Systemic Collapse Protection (20-30%)

Gold is renowned as a disaster hedge that traditionally performs well during times of crisis or radical instability. For instance, the geopolitical events of 2020 saw gold prices hit a 7-year high, including a +1.4% overnight jump in the gold spot price following a U.S.-Iran airstrike. In late 2023, the price of gold reached all-time highs following the outbreak of various geopolitical conflicts in the Middle East.

Those most concerned with the threat of war, geopolitical tensions, or the outright systemic collapse of the financial system should dedicate much more of their wealth to precious metals (e.g., 20% or more).

Physical Gold IRA vs. “Paper Gold” IRA

IRAs invested in “paper gold” (e.g., gold ETFs or mining stocks) without investing in bullion or coins are not gold IRAs.

Gold-based securities, while offering some exposure to the gold market, do not offer the same benefits as genuine gold products. As exchange-traded securities, paper gold is highly liquid and therefore prone to erratic price movements especially as compared to the gold spot price.

In the event of an economic disaster, paper gold would be worth little more than the paper it's printed on. Only gold bullion that can be vaulted and physically possessed offers the full range of hedging benefits and advantages inherent to this asset class.

Below, we’ve listed some of the key advantages of investing in physical gold over paper gold such as mining stocks or ETFs.

- Counterparty Risk: Unlike a stock, a gold bar cannot declare bankruptcy or fail to honor its contractual obligations—therefore, physical gold investors are free from the same counterparty risks as securities investors.

- Safe Haven Store of Value: During times of crisis, physical gold acts as a last resort store of value if cash and paper assets are rendered worthless.

- Physical Ownership: Physical assets are far more difficult to confiscate or seize as opposed to electronic assets.

- Portability: Gold bars are portable and can be transferred from your IRA into your own hands or home storage facility (thereby losing IRA benefits).

How to Find the Best Gold IRA Custodian

Opening a conventional Roth IRA is as simple as calling your local investment brokerage and applying on the spot for a new account.

However, gold IRA rollovers are a bit more complicated than that because regular brokerages like Vanguard, Fidelity and Charles Schwab don’t support gold IRAs.

To open a gold IRA, you have to choose a dedicated gold IRA custodian. These are companies that facilitate your gold IRA rollover with your existing IRA or 401(k) provider, or help you fund your new account from scratch.

To help you avoid non-reputable gold IRA companies, we’ve listed some basic ground rules for finding a legitimate service provider below.

1. Reputation

It should go without saying that a company with an impeccable reputation and customer satisfaction profile should take priority when shopping for a gold IRA provider.

Avoid precious metals companies that aren’t well-reviewed online. Always read the customer-generated testimonials on social platforms and consumer review sites such as:

- YouTube

- Google My Business

- Trustpilot

- Yelp

- Better Business Bureau (BBB)

2. Segregated and Offshore Store Options

Reputable precious metals IRA companies offer versatile storage options.

First, an IRA provider worthy of your business is one that offers both domestic and offshore vaults in order to meet your security preferences.

Additionally, an ideal provider should offer segregated storage protocols so that your holdings are kept separate from other customer's metals.

3. Years in Business

In the self-directed IRA industry, many contenders come and go in an effort to capture market share. However, these are often short-lived.

If a company has lasted over a decade in the precious metals IRA space, you can rest assured that they have proven themselves as a worthy candidate for your business.

4. Be Mindful of Rollover Limitations

It bears repeating that the IRS allows only one penalty-free rollover per 365-day period. Therefore, if you complete a rollover on January 1, 2025, you won’t be able to initiate another rollover tax-free until January 1, 2026. As such, it’s crucial that you choose a custodian carefully.

If you decide to change custodians before the 12-month period has elapsed, you’ll be on the hook for an early distribution penalty and applicable taxes if you roll the funds over again.

For more information about how to find a reputable service provider, read our exclusive report on America’s most reputable gold IRA rollover companies.

Gold IRA Rules and Regulations

It shouldn’t come as a surprise that the IRS enforces a number of stringent and specific rules for gold IRAs. Below, we’ve listed the various rules that apply to precious metals IRAs.

IRS Account Administrator Rules

To have a gold IRA, you will have to first open it with an IRS-approved administrator. It is most critical to note that you never buy gold or other precious metals with your IRA account funds personally. The IRS requires that your IRA account administrator facilitate the actual transactions on your behalf.

Account holders simply give directions to their custodian in order for them to purchase the precious metals on their behalf. They will make all arrangements for shipping and insurance once they finalize the transaction.

IRS Storage Rules

The account holder is never allowed to have their IRA-included coins or precious metals in their personal possession at any point. You also can not buy the gold with the intention of handing it off to your administrator or custodian.

If you have possession of the assets at any moment, the IRS will then treat your metals as distributed and start levying the appropriate penalties and taxes.

The custodian of your new gold IRA will receive your precious metals and then hand them over to an IRS-sanctioned third party, off-site depository. If you elect to have your metal holdings withdrawn, distributions would be sent by insured delivery to your home address.

Your precious metals will not leave their vaults until you sell them or request a distribution. Many of these vaults will, by default, store your metals via an “aggregated” system where they are held side-by-side with the metals of other clients.

For a more secure vaulting process, you should request segregated storage of your holdings. Under this protocol, all holdings are vaulted separately in individualized safes. However, beware that they may charge you higher fees for this convenience.

IRA Tax Regulations and Contribution Limits

When you begin to make your contributions, you should check the annual contribution limit of your self-directed IRA. By default, it is set to $7,000 yearly for 2025 (same as 2024), with an increase to $8,000 yearly when you reach 50 years of age in the form of a “catch-up contribution”. However, you may have additional contribution room from previous years.

If you decide to take a distribution from your account, there will be tax consequences. Once you assume physical possession of it, you will have to pay the full income tax on the metals' values at the moment you withdraw them. If you're younger than 59.5 years of age, there will also be a 10 percent penalty assessed on the value of the withdrawal.

Besides this, the IRS will assess a 28 percent capital gains tax on any profits realized from the original cost basis of the holdings.

IRA Retirement Age Limits

The IRS also has age limits on when you are able to access your gold IRA funds. They can not be touched until you reach age 59½ without incurring a penalty. By age 70, you must begin to receive regular distributions and withdrawals from your account.

IRA Early Withdrawal Penalties and Penalty Exceptions

While the IRS does levy a 10 percent penalty (plus applicable income taxes) for early distributions, they are not completely heartless in their enforcement of this rule. The IRS allows for a number of early withdrawal penalty exceptions under the following circumstances:

- The IRA owner becomes permanently disabled.

- The IRA holder becomes hospitalized and has neither insurance nor money for the medical bills.

- The IRA owner dies and the beneficiary needs to access funds via withdrawals.

- The IRA holder becomes unemployed and cannot pay for insurance as a result.

- The IRA possessor engages in identical amount equity withdrawals known as “substantially equal periodic payments” throughout their expected life.

- The IRA owner or immediate family member (spouse, son, or daughter) requires funds to pay for education considered to be qualified. This does not only allow for tuition, but also for books, room and board, and other reasonably related expenses.

- The IRA holder wishes to utilize up to $10,000 out of the account in order to purchase a first-time home.

List of Top-Rated Gold IRA Companies

With so many precious metals IRA companies in the market, it can be hard to decide on the best one for your needs. That’s why we’ve put together a quick list of the bestselling and most trusted companies in the industry, each of which has been in operation for a decade or longer:

Generally, you should expect to pay between $100 and $325 for gold storage fees from a reputable provider. Some companies, such as Augusta Precious Metals, charge $0 in rollover or transfer fees, and also waive all administrative and storage fees for the first year.

For a more in-depth analysis of the best custodians on the market, read our reviews of the top gold IRA providers today. There you’ll find a full breakdown of the best-reviewed gold IRA rollover companies, as well as a list of five essential considerations you need to keep in mind when shopping for a gold rollover.

Our 10 Top-Rated Gold IRA Companies

If you’ve decided that a gold IRA is right for you, your next step is to find an investment company that offers the services you need.

This decision should be taken seriously because, unfortunately, some IRA companies have poor track records when it comes to customer satisfaction. At worst, some shady companies are downright predatory.

To help you steer clear of bad actors, we put together a list of the ten top-rated gold IRA companies that we've worked with over the years. Not only can we vouch for any of the companies listed below, but so can thousands of our readers who’ve relied on their services for over a decade.

In order to get the best deal possible, we recommend contacting several companies for a quote before opening an account with any one provider. As always, speak to your financial advisor before making any investment decision and never invest more money than you can afford to lose.

Disclaimer: The content provided on this page and throughout this website is for informational purposes only. It does not constitute financial advice and should not be taken as such.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,337.61

Gold: $3,337.61

Silver: $37.99

Silver: $37.99

Platinum: $1,341.58

Platinum: $1,341.58

Palladium: $1,116.78

Palladium: $1,116.78

Bitcoin: $117,645.06

Bitcoin: $117,645.06

Ethereum: $4,436.18

Ethereum: $4,436.18