- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Baird & Co. Palladium Bars

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

The London-based Baird and Company is one of the finest precious metals refiners in the world. One of the company’s many offerings is the 99.95% fine palladium bar – one of the highest quality palladium products on the market today. Since palladium is often considered the “fourth” investment metal, many investors may be unfamiliar with the wonderful Baird Palladium Bar. Here you will learn everything you need to know about these bars, including how to add them to your investment portfolio.

Development, Introduction and History

Founded in 1967, Baird and Company has grown from a small English operation into one of the most trusted refineries in the world.

Many countries, including the UK, relaxed restrictions on both investing in bullion and minting of bullion products. Baird jumped in to fill this void and began large scale productions of gold, silver and platinum bars. The first Baird refinery was opened in 1979.

Palladium products did not enter the markets until later; however, Baird quickly established itself as a leader in palladium (and rhodium) refinement. The Baird Palladium Bars have been specifically designed for palladium investment and remain an excellent option for any precious metals buyer.

Baird Palladium Bars Physical Characteristics

Bar Design

The front (“obverse”) of Baird Palladium Bars is simply and elegantly designed. Each bar will have BAIRD & CO, BULLION MERCHANT, LONDON, 999.5 FINE PALLADIUM and the weight denomination (such as 250 GRAMS). In addition, each bar comes with its own unique serial code, which appears on the obverse side.

The rear (“reverse”) of Baird Palladium Bars are a little more diverse. Many feature the “Onion Dome” found on so many slavic and Russian buildings. Even though these bars are minted in England, nearly all of the palladium used in mined in Russia, and these bars pay tribute to that origin. The dome is located between the phrases MINTED IN LONDON and FROM PURE RUSSIAN PALLADIUM.

Other reverse designs are more simple, including only the BAIRD & CO name and logo. The Russian architecture design is considered more valuable and bars featuring this typically will sell for a greater premium.

Specifications

Baird and Company currently offers four different weight denominations for its Palladium Bars. Each size is guaranteed to have a palladium fineness of 0.9995 and are all sold in individual, tamper-proof casings.

| Weight Denomination | Width | Length | Total Weight | Fineness |

|---|---|---|---|---|

| 1 troy ounce | 24.1 mm | 41.2 mm | 31.104 g | 0.9995 |

| 50 grams | 27.2 mm | 47.2 mm | 50.000 g | 0.9995 |

| 100 grams | 27.2 mm | 47.2 mm | 100.000 g | 0.9995 |

| 250 grams | 40.2 mm | 79.2 mm | 250.000 g | 0.9995 |

Baird Palladium Bar Pricing

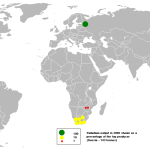

Much of Europe’s supply of palladium comes from deposits near Norilsk, Russia. This makes Baird Palladium Bar prices more sensitive to disruptions in supply. Investors have recently sought to acquire palladium while production is steady, hoping to avoid the huge price surges seen in the past.

Unlike many bullion coins, palladium bars are not used as legal tender, and therefore have no face value for use in exchange. Still, these bars contain certain advantages over palladium coins for those looking to invest in physical palladium.

The mintage of bullion bars – like Baird Palladium Bars – tends to be much lower than the minting cost of bullion coins. This means that the market price tends to be very close to the spot price of the underlying metal. In this way, palladium bars can be a very cost-effective way to own palladium.

Since palladium prices fluctuate daily, the value of Baird Palladium Bars will also fluctuate daily. You can check out our home page for live metals pricing.

It should be noted that, due to low levels of production and limited palladium alternatives, Baird Palladium Bars can, at times, trade at a significant premium over the value of the palladium content.

Adding Baird Palladium Bars to an IRA

The IRS allows Individual Retirement Accounts (IRAs) that meet specific requirements to carry precious metal bullion as an investment in a portfolio. Often referred to as a “precious metals IRA”, these accounts are self-directed, and only IRS-approved bars and coins are the metals eligible to be included.

Baird Palladium Bars are authorized to be included in a precious metals IRA. By placing real, physical palladium inside of an IRA, investors add diversification to their portfolio that is independent of fluctuations of stocks and bonds. Palladium is a more scarce metal than gold, silver or platinum; in fact, it is one of the 10 least occurring elements on the surface of the earth! This rarity helps provide real, sustainable value to investors everywhere.

Baird Palladium Bars can be added to an IRA because they meet the minimum purity requirements set forth in Internal Revenue Code section 408(b). To become an owner of a precious metals IRA you are required to make an initial metals purchase of at least $5,000. Each subsequent metals purchase must be at least $1,000.

When you make a purchase of Baird Palladium Bars (or any IRA-designated investment metals), the IRS further mandates that all coins and/or bars be held in a qualifying “depository.” The depository is responsible for the security and maintenance of the bullion.

Those with an existing IRA have the option of transferring or rolling over funds into a precious metals IRA.

You can purchase Baird Palladium Bars directly from the Baird and Company official website or from reputable dealers/exchanges around the world. Palladium is not as liquid an investment metal as gold, silver or platinum, and subsequently it may be more difficult to locate palladium bars in volume.

Sign up to learn more. It's free!

If you're worried about the economy and want to learn tips on how to protect your retirement savings in case of another systemic collapse, sign up to our monthly newsletter now for free! We cover topics such as: precious metals investing, inflation, currency devaluation, national debt, the Fed's financial policies, world politics, and much more. Join now and we'll send you a free PDF report entitled “5 scams to avoid when investing in bullion gold & silver”

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81