- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

A Beginner’s Guide to Gold Futures Trading: What Is It and How to Get Started Trading Futures in 2020/2021

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 10th November 2021, 01:03 am

An ounce of gold costs 67.8% more today than it did five years ago, in November 2015. On January 1st, only ten months ago, gold prices closed at $1,519 per ounce. Today, an ounce sells for over $1,900 on the London bullion market.

No doubt, commodity prices are volatile. Especially gold and oil. Earlier this year, we saw the price of a barrel of crude oil crash from $63.27 (January 3) all the way down to $11.26 (April 21). A futures contract helps protect investors and producers from losing on expected price movements in the future by locking in prices beforehand.

A future is a contract to trade a commodity or financial instrument at terms decided now, but with a future settlement date. Buying a future means you don’t have to pay in full at the time you open the position, and the seller doesn’t have to deliver. You merely pledge to buy an asset in the future.

Trading futures are how investors speculate on the price of gold. But they’re also legitimate, binding legal agreements that protect both parties from price risk Below, I’ve provided a full, beginner-friendly crash course on gold futures. This way, you can bring yourself up to speed on the topic in case you’re interested in making money as a futures trader.

Table of Contents

Gold Futures 101: A Crash Course

Gold embodies a rare combination of qualities that makes it unique among metals. It’s dense, soft ductile, malleable, acid-resistant, and a conductor of both heat and electricity. For these reasons, gold is always in demand. But gold supply and demand fluctuate naturally with time in a way that cannot be reliably predicted. Gold futures provide a work-around of the unpredictability.

Why Futures? Rationale Explained

If you’re feeling a little sleepy at this point, let’s take the example of coffee. As a commodity, coffee beans are subject to price fluctuations like any other.

In the coffee industry, who benefits if the price of coffee beans rises? The coffee farmer wins, and the coffee shop loses. When the price of coffee beans drops, the farmer loses and the coffee shop wins. Price volatility is a zero-sum game. In a market economy, every price change creates a winning and losing party.

Coffee bean futures let both “producers” and “users” lock-in mutually beneficial prices for a predetermined time period. Futures exist specifically to hedge the risks that commodities produce. The contracts themselves can then be bought or sold in secondary markets.

Although futures contracts are often used as speculative instruments, their primary purpose is for businesses to hedge against unfavorable price movements of the underlying assets. It’s merely a byproduct that the futures market can be used as a conduit for investors to engage in speculation.

The Anatomy of a Gold Futures Contract

A gold future is an agreement to buy a certain quantity of physical gold at a certain price, by a certain date. When a gold future expires, you typically won’t receive an Amazon-style delivery of gold bars or coins to your front porch. If you don’t close the future position by its expiration date (i.e., find a third-party buyer), most brokerages will close it on your behalf and automatically sell it to a party interested in receiving the gold delivery.

There are 100 troy ounces in one standardized future contract. Although they’re increasingly less common, there are some micro-contracts that trade in 10 troy ounces. Each future on the NYMEX/COMEX is quoted in U.S. dollars and cents per ounce.

Speculative futures have two principal parties: the buyer, who is “long” and expects the commodity price to increase, and the seller, who is “short” and anticipates a price decline. To minimize counterparty risk, both parties deposit a cash sum worth a fraction of the contract’s value (called the “margin”) to the third-party brokerage. Thus, buyers have the power of leverage because they only pay for a small fraction of the contract’s value upfront.

At expiration, the deal is obligatory for both parties. If the seller loses money on the contract, it is still incumbent upon them to fulfill the buying party’s right to the gold at the agreed price. Most gold investors, however, never receive delivery of gold because they close their position before expiry.

If you don’t pass the contract on to an interested third-party by its expiration, then you’re on the hook for paying the total value of the contract. Closing the position involves risk because it can elicit either a profit or loss for either party.

Getting Familiar With the Lingo

Take a minute to familiarize yourself with some of the need-to-know jargon and technical language necessary for understanding gold futures.

-

- Settlement Date: The date on which the exchange of the physical commodity takes place (usually within 3 months).

- Margin: The down payment held by a third-party clearer when you open a futures position (usually between 2% and 20% of the total commodity value).

- Topping Up The Margin: Until you sell, you are obligated to pay more margin if you bought a long position and the price of the asset falls.

- Tick Size: A tick is the minimum price fluctuation of a traded asset. They are determined by exchanges and vary widely by asset type and market behavior. COMEX Gold futures currently have a tick size of $0.10 per ounce.

- Notional Value: The total value of the contract’s underlying assets at its spot price. The notional value (not to be confused with market value) is calculated by multiplying the units by the spot price. A standard 100-ounce future contract multiplied by a spot price of $2,000 would, therefore, have a notional value of $200,000.

Gold Futures vs. Physical Gold Spread

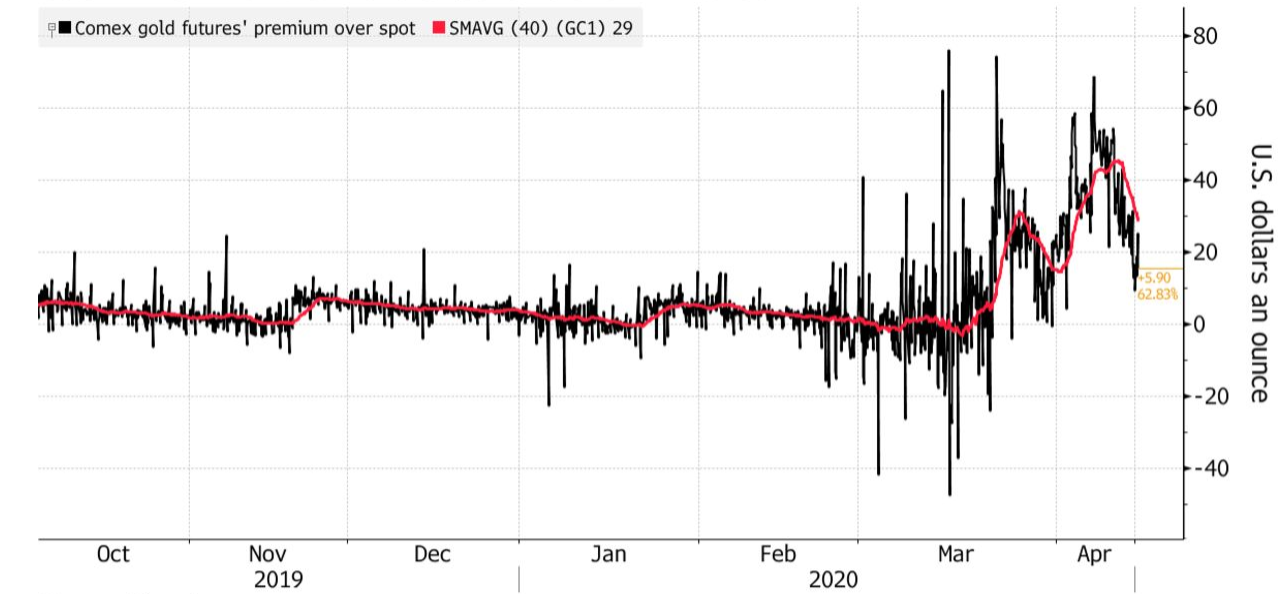

In a stable market, the price of gold futures and physical gold bullion is efficient. That is, they typically converge within +/- 5 U.S. dollars. When physical gold and gold futures diverge, like in March and April 2020, it signals an opportunity for arbitrage. Specifically, that there is potential to earn effectively risk-free profit by acquiring a lower-priced commodity and selling a higher-priced contract or vice-versa.

The chart below depicts the divergent relationship between the spot price of gold (i.e., for immediate delivery) and the price of active COMEX gold futures. Beginning in March, the COVID-19 pandemic created a market crisis which saw gold futures reach nearly $80 above its spot price.

Source: Bloomberg

An upward divergence is a bullish signal for gold because it implies that investors are confident that the price of gold will be significantly higher in the future. As of the time of writing, the spread is +6.10 USD for December 2020 gold futures, meaning the asset remains bullish but considerably less so than it was in the spring.

Much of the economics of commodities is rooted in geography. There are over 5,000 kilometers, or over 3,000 miles, that separate the spot price and the futures price of gold. No matter where you buy your physical gold, banks and financial institutions acquire their gold holdings from the London bullion market in the United Kingdom. The spot price of gold is determined by the London Bullion Market Association (LBMA) and the Bank of England and refers to the going rate for physical gold.

The dominant futures market, on the other hand, is COMEX (Commodities Exchange Inc.), a division of the New York Mercantile Exchange. Based in New York City, COMEX contracts are facilitated via delivery to New York—a standard gold future with a December expiration entails a physical gold delivery of 100 ounces to New York City in December.

Part of the discrepancy between gold futures and spot prices in March 2020 is due to reduced passenger flights between London (Heathrow) and New York City. The COVID-19 pandemic more than halved the number of transatlantic flights, which threatened logistics chains and jeopardized opportunities for arbitrage. This, of course, is on top of the fact that investors flooded the market with long futures in a speculative frenzy fueled by fears of an economic collapse.

What Moves Gold Future Prices?

The underlying factors that move gold futures are worthy of an article in themselves. At a glance, we’ll mention the top three driving forces:

- Correlation to inflation: Gold has been historically used as an inflation hedge. Since gold and gold futures are traded in U.S. dollars, a lower relative value of USD leads to a long-run appreciation in gold prices.

- Supply: Once gold is mined, it doesn’t go anywhere. It’s in your jewelry drawer, in a vault, inside your household electronics, or maybe even in your dental crowns.

- Central banks: Until 2019, monetary authorities and reserve banks held and sell gold in accordance with the Washington Agreement on Gold (1999). The Agreement held that no parties can introduce more than 400 tonnes of gold to the market in a given year. The agreement has since elapsed and annual gold sales by central banks are now near-zero.

- Logistics: As we touched on above, logistical disruptions, such as the widespread flight cancellations in response to the COVID-19 pandemic, can interfere with COMEX deliveries and affect the gold futures spread from the spot price.

Where Are Gold Futures Traded?

The Chicago Mercantile Exchange (CME) is the largest futures exchange in the world. CME Gold futures are only one of several commodities traded on the exchange, including silver futures trading, crude oil, soybeans, aluminum, and even live cattle. Gold is stockpiled in warehouses within the CME’s vetted “circle of integrity” that guarantees the fineness and purity of the bullion.

No matter which futures trading platform you use, they almost certainly work with the CME to facilitate the receipt and delivery of gold shipments. Popular futures trading platforms that charge low commissions include:

- TD Ameritrade

- E*Trade

- Charles Schwab

- Fidelity Investments

- TradeStation

- MetaTrader 4 / MT5

- IRESS

Disclosure: We have no affiliation with any of the platforms listed above. We selected these brokers and platforms based on their industry reputation, compliance with FCA/CySEC, and their low minimum deposits.

How To Get Started Trading Gold Futures

Futures trading isn’t a beginner’s game. Reputable brokers require new traders to prove they have sufficient capital and trading experience before opening a long position. Day trading platforms that deal in gold futures contracts usually require no less than $2,000 in a trading account on top of additional funds to offset potential margin losses.

Some futures brokers have less stringent requirements for novice investors. For instance, NinjaTrader lets investors get started with as little as $1,000 for trading E-Mini GCs—contracts a fraction of the size of a standard 100-ounce future. ATFX, on the other hand, requires a $500 minimum deposit.

To get started, contact your preferred brokerage and inquire about opening a gold futures position. Before doing so, we suggest using a trading simulator, such as CME Group simulator, to ensure that your trading strategy works.

Advantages and Disadvantages of Gold Futures

Gold futures plays are a classic case of high-risk, high-reward trading. Below, we’ve put together a list of some of the most commonly cited advantages of opting for gold futures trading rather than investing in gold bullion or paper-backed gold.

- No need for storage or securing a third-party vault or depository

- Capital constrained investors can utilize leverage to make large trades

- High amount of liquidity available

- Provisions available for short selling

An ancillary benefit of futures contracts is that they allow investors to offload risk in macro commodity prices. Trading futures on an exchange transfers risk from the businesses or investors to the investment banks who are, at least in theory, better equipped to manage the risk.

The Risks of Gold Futures Trading

Whereas physical gold is a passive investment, gold futures entail active trading that should only be ventured by sophisticated investors. It’s a fact that the majority of investors who trade gold futures end up losing money. This is because unseasoned traders exploit leverage to take on more risk than they can afford.

Let’s take the example of a novice investor who has $10,000 with which to trade. They can choose to purchase about five (5) ounces of gold bullion at the current spot price, or put up $10,000 as margin on a $100,000 gold futures contract.

If the value of the underlying asset increases by 5%, the investor would earn $500 from holding bullion. But if the investor had put their money in gold futures, they would earn $5,000 on the trade—that’s the power of leverage in investing.

This might sound tempting, but don’t forget what happens if prices move the opposite way. Those holding gold bullion only lose $500 on the value of their gold, and they can wait until spot prices inevitably correct and resume their upward trajectory. In time, nothing is lost. In the case of a losing gold future, you’re forced to close your position at a $5,000 loss and thereby lose half your margin.

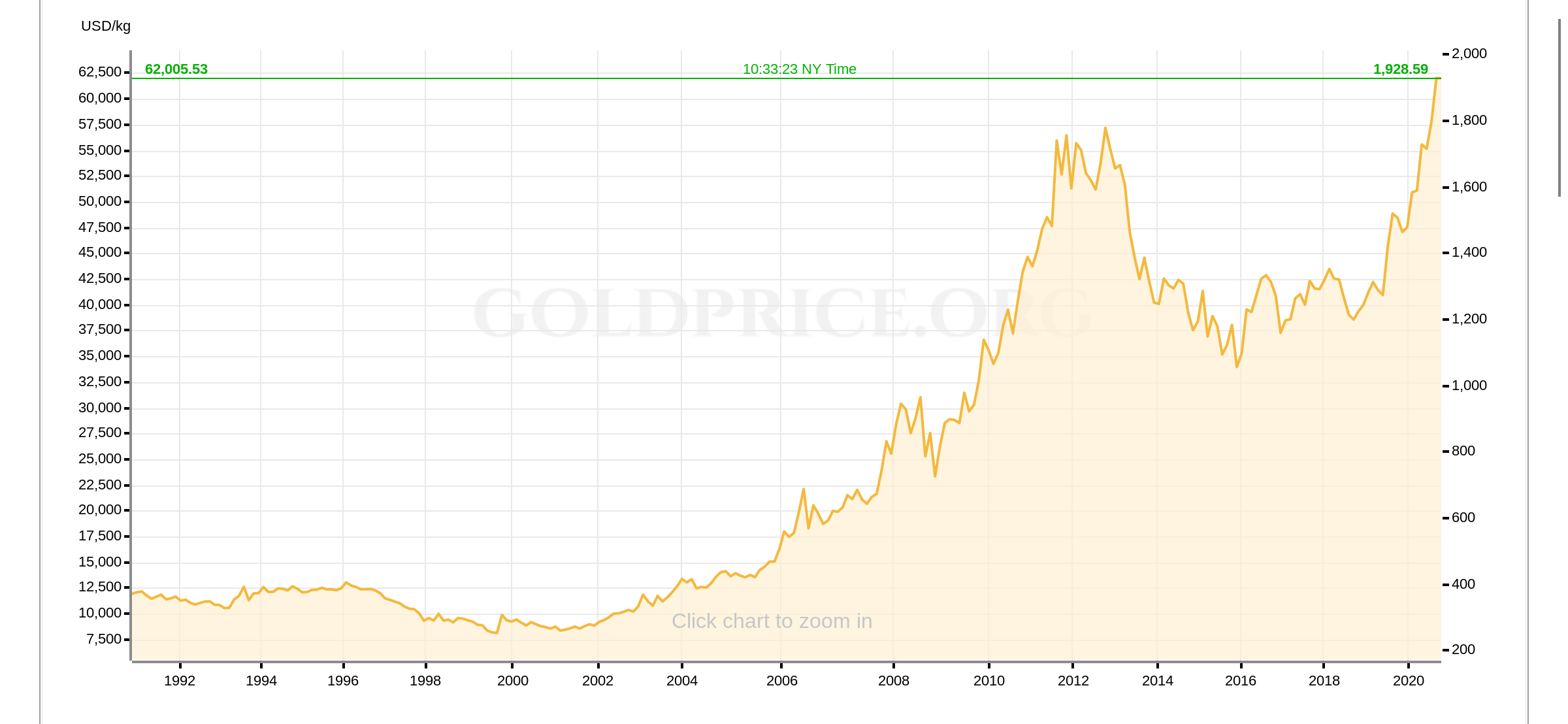

The pain of a $5,000 loss on a gold future is made all the worse by the fact that, as depicted below, gold prices have trended upward over the last 30 years. Losing thousands on a small intra-day price adjustment on a commodity that will likely resume its pre-sale trajectory is a tough pill to swallow even for the most hardened investors.

Source: GoldPrice

With gold futures, it’s too easy for investors to get carried away by their own confidence. Even investors who make rational, conservative gold futures forecasts can have their savings decimated by an unpredictable blip in the price of the commodity. For this reason, I caution beginners away from gold futures and to consider gaining exposure to gold by other means until they’ve accumulated risk capital that they can afford to lose.

Want Safer Exposure to Gold?

Futures enable industry players—the miners, refiners, retails, and manufacturers—to protect their interests from market risk by entering into contracts with predetermined values. For speculators playing with leverage, futures can burn you and find you on the hook for more money than you originally invested. For this reason, they’re not suited for novice investors or traders.

There are many ways for investors to gain exposure to gold. There’s paper-backed gold, such as gold mining stocks and gold ETFs, as well as gold futures and, of course, physical gold bullion. If you want true portfolio diversification, considering opening a gold IRA or 401(k).

Buying physical gold is the best hedge against broad systemic risks in the market. The metal is uncorrelated to the stock market, and historically performs well during recessions and financial crises. You can choose from a variety of fully-insured gold IRA storage options to vault your gold in offshore or domestic depositories that will keep your assets safe.

Trading futures is a dangerous game with a high-risk, high-reward profile. To play it safe, consider adding IRS-approved gold bullion to your retirement portfolio. Opening a gold 401(k) or precious metals IRA allows you to safeguard your wealth in the event of an economic downturn or collapse. Investing in physical gold lets you reap many of the rewards of gold futures without the risk.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

CITATIONS:

https://www.cmegroup.com/trading/why-futures/welcome-to-comex-gold-futures.html

https://www.barchart.com/futures/quotes/GC*0/futures-spreads

https://goldiraguide.org/potential-minsky-moment-collapse-facing-markets-and-economy/

https://pureportal.strath.ac.uk/files/64981641/strathprints007215.pdf

https://pubs.iied.org/pdfs/G00537.pdf

https://hercules.finance/what-is-different-cysec-and-fca-cyprus-and-england/

https://www.cmegroup.com/trading/metals/precious/e-mini-gold.html

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68