- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Potential Minsky Moment Collapse Facing Markets and Economy

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week several prominent analysts and a Federal Reserve regional president warned of threats to the lofty stock market valuations and recent highs that investors have seen. In particular, Market Strategist Ron William of the RW Advisory firm warned that a potentially painful market collapse called a “Minsky moment” threatens stock exchanges. William stated that a retest of the lows not seen since March is looming over stock prices.

Despite Recent Stock Market Highs, Dangers of Minsky Moment Collapse Are Growing

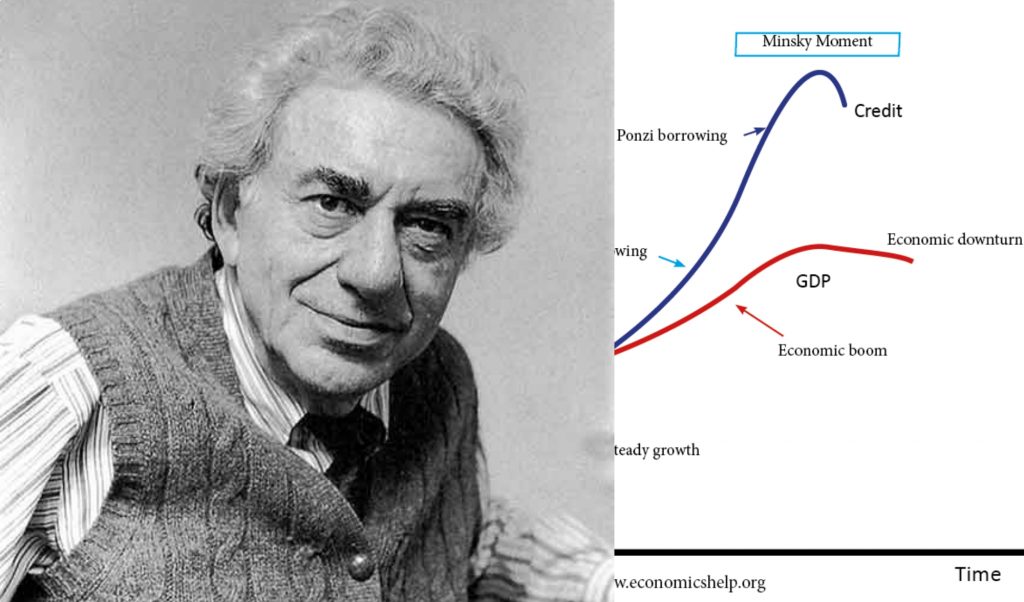

Hyman Minsky the economist coined the phrase “Minsky moment” when he explained about dramatic and unexpected collapses in the markets that followed bull runs which were unsustainable. In today's terms, the environment of easy and cheap credit is the back story of why markets have run so much higher from their recent more realistic lows. Thanks to the historically unrivalled monetary and fiscal stimulus programs enacted by major government policymakers in the U.S., Britain, Europe, and other leading developed countries, the Nasdaq and S&P 500 have each set new record highs this past Wednesday with the DJIA (Dow Jones) having closed higher than 29,000 level in its first record performance dating back to February.

William gave an interview to the “Squawk Box Europe” program on CNBC Thursday in which he went through the many different themes that threaten the potential Minsky crash. The first of these causes is the recent gains in the market that have only been narrowly spread around while tech giants are enjoying the majority of the price gains. He cautioned that:

“This is the ongoing story of tech street, Wall Street and Main Street all diverging. If we look at the equal weighted index of the S&P 500, it has barely broken above its June peak and has actually been flatlining ever since, so we can see there the FAANG-tastic divergence, as I call it.”

Divergence Between FAANG Technology Stocks and Other Markets Dangerously Rising

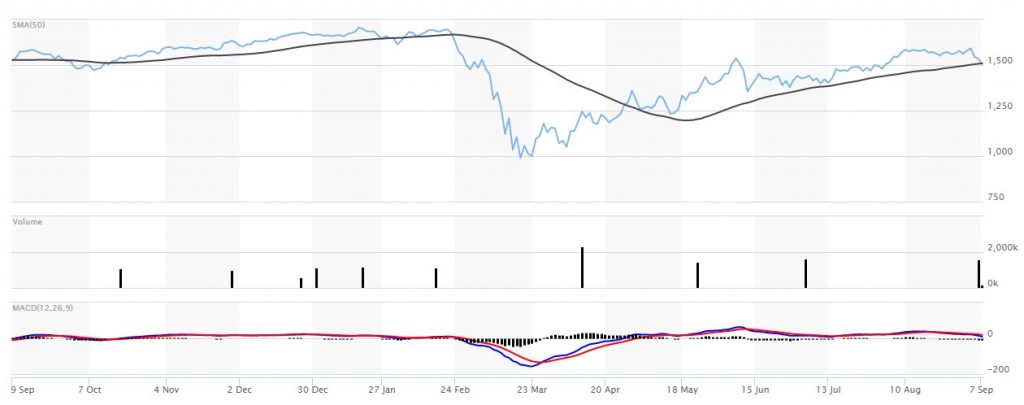

The U.S. technology mega caps called the FAANGS (Facebook, Apple, Amazon, Netflix, Google) are the center of the ongoing U.S. markets' momentum even with the continued steady drip of bad news coming from widespread civil disorder and a coronavirus pandemic that is still afflicting large parts of the nation. William also noted that the more representative Russell 2000 index of small cap stocks is lower than its June highs (according to an equal weighting) as the chart below reveals:

Many of the issues in the Russell index are classified as “zombie companies.” Williams continued with:

“Particularly if we look outside of the U.S. at the rest of the world, the U.K. here in this home base is actually quite negative and we've had a new range breakout to the downside. ETF flows on the S&P 500 is at a new record low, and if we take a look at the VIX, that has also been in an interesting atypical spike up as markets go up, suggesting potential hedging for downside risk.”

Minsky Moment Market Idea Predicts Twenty to Thirty Percent Stock Market Collapse

William is predicting a Minsky moment market move that potentially witnesses a substantial fall of “20 to 30 percent or more.” This would cause the presently hailed V-shaped recovery to turn into a “rolling W retest of the March crash low.” William thinks the markets are seeking pockets of correction thanks to the traditionally negative seasonal period of from late August through early September, lofty stock market valuations, and a presidential election cycle. While the analyst believes that this might be healthier for markets over the long term, it would meanwhile lead to a “multi-year repair period before that long term bull reappears again.”

Famed Investing Guru Mohamed El-Erian Joins Chorus of Warnings About Markets

William is not alone in his warnings of a potential stock market pullback. Legendary Chief Economist Mohamed El-Erian of Allianz recently cautioned that Wall Street is possibly moving towards correction territory again following the largest stock market drop to occur in months. El-Erian has warned that a shift in investor sentiment may be on the way, with:

“We could have another 10 percent fall, easily… if people start thinking fundamentals.”

El-Erian has pointed out that the American stock market has decoupled from the United States' economy, high yield markets, Treasury markets, and VIX levels. Just a month ago, El-Erian was warning that massive scale bankruptcies could crush the stock market rally with many corporate firm bankruptcies still hanging over the future:

“If you are in a liquidity based paradigm, you will be dominated by relative thinking, and that's where we've been. If you're in a fundamentally based paradigm, the answer is: no, you are not paying for an economy that faces not just moderation in the way of improvement, but a rising level of bankruptcies.”

Fed Member Rosengren Warns About A Prolonged Economic Recovery

Boston Regional Federal Reserve President Eric Rosengren joined the chorus of warning economists by declaring that a full U.S. economic recovery will not occur until the Covid-19 pandemic gets completely under control. The Boston regional president said that there had been improvement in the labor markets but that the overall economy is still experiencing significant headwinds, with:

“We have a long way to go before we are fully recovered, but I will say this employment report was a very positive one.”

Rosengren observed that a lot of the recent gains had occurred in hospitality and retail industries, two sectors that had been devastated by the virus pandemic with diners and shoppers having to remain home because of the state governments' enforced restrictions that served as a form of national lockdown. Rosengren added that:

“At 8.4 percent unemployment, that is a very significant recession and I do think that it's going to take quite a while to bring all those people back, particularly if it takes us a long time not only to get the pandemic resolved but also to get a workable and safe vaccine that is widely distributed. I think it really is going to take that before we see a completely normalized market.”

The Federal Reserve has attempted to speed along a recovery by fixing the national short term benchmark interest levels at close to zero percent along with starting up a range of liquidity and lending programs. Besides this, the central banking officials have expressed a different inflation approach that will de facto fix interest rates at low levels up to the point that the current unemployment levels decline substantially below the present levels. Rosengren added that:

“We already are doing quite a lot in terms of stimulating the economy. I think that we'll have to consider what's appropriate forward guidance, but I think at this point the market understands that we're not planning on raising rates anytime soon.”

Unfortunately the news from this past week regarding a potentially severe bear market correction in stocks from noted international analysts and economists is not good. It does explain why gold makes sense in an IRA though. While you can not steer the direction of the markets, it is possible to consider ways to protect your investment and retirement portfolios. One of these is by looking at IRA-approved gold like Top five gold coins for investors. You can learn more by reading all about the Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81