Silver Futures Trading Explained: Everything You Need to Know as a Beginner in 2021

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 06:46 pm

Volatility is often understood and perceived as a measure of risk. For this reason, silver too often gets a bad rep among investors looking to hedge against uncertainty.

It’s true, the price of silver is highly sensitive to price shocks. Between March and August of this year, silver prices doubled from $14.27 (March 1 close) to $28.59 (August 1). At the time of writing, the precious metal is up +37.96% YTD, following a -9.40% annual percentage change only two years prior.

The relative instability of silver is both a boon and bane to investors. If played strategically, handsome profits can be made on silver’s price movements. The key is to minimize one’s downside risk. Fortunately, silver futures contracts let us do just that.

In this article, I’ll explain everything you need to know before getting started with silver futures trading. To be sure, I’ll discuss the risks and benefits of trading silver futures so you can decide for yourself whether you want to add this asset class to your retirement investing strategy.

Table of Contents

- Silver Futures Trading 101: What You Need to Know

- Why Silver?

- Industrial Demand for Silver: 2020/2021 Outlook

- Silver Futures Explained: Concepts and Terms Defined

- The Risk of Silver Futures Trading

- Where Can You Invest in Silver Futures?

- Is Silver Futures Trading a Worthwhile Investment?

- Play It Safe, Invest in Silver Bullion

Silver Futures Trading 101: What You Need to Know

Financial markets are naturally volatile, and fluctuations in prices can pose an existential risk to businesses and indeed entire industries. Futures contracts are legal agreements that allow commodity producers and users to settle on a price for a predetermined period of time in an effort to mitigate such risks.

“It’s not sensible,” wrote John Maynard Keynes, “to pay 25 for an investment of which you believe the prospective yield to justify a value of 30 if you also believe that the market will value it at 20 three months hence.”

Keyne’s quote speaks to our inherent preference for immediacy in financial transactions which, if unchecked, can come back to bite us. Fortunately, futures exist to curb our bias for the immediate and minimize excess volatility risks in commodities markets.

Silver futures contracts are entered into by producers (i.e., miners) and users (manufacturers) to standardize the quantity, quality, and time of delivery at an invariable price for the duration of the contract. In the secondary market, futures contracts are traded by investors speculating on the future price of the underlying asset.

The Value Proposition of Silver Futures

Because futures are traded on secondary markets, investors repurpose them as instruments for price speculation. However, their speculative potential is simply a byproduct of their primary purpose which is to hedge against the natural price risk of commodities.

An economist would call commodity pricing a “zero-sum” game, a situation in which one party’s gain necessarily incurs a loss for the opposing party. In other words, when the price of an asset changes, there’s a “winning” and “losing” party as a result.

Let’s say you’re in the jewelry business. You need 120 tonnes of silver per year to produce silver necklaces at full capacity. Therefore, you order 10 tonnes every month from a silver mining company at the going spot price to meet your production quotas.

What happens if the spot price of silver increases by 5% from one month to the next? In this scenario, the producer “wins” and you, the jewelry-maker, gets burned.

To prevent either party from winning or losing due to price fluctuations, futures contracts lock in prices that are beneficial to both parties in the long-run. A standardized silver futures contract is for 5,000 troy ounces, which is to be delivered to the buyer by the contract’s expiration date. Micro-contracts (“micro silvers”) are less common and trade in increments of 1,000 ounces, and have a tick size of about $1 on the Chicago Mercantile Exchange.

Why Silver?

Silver enjoys enormous industrial application. The metal is used widely in soldering alloys, medicine and dentistry, nuclear energy production, battery technology, jewelry, photovoltaic (PV) solar panels, computer semiconductors, and more.

There is a unique combination of qualities that makes silver, unlike other electrical conductors. Given silver’s one-of-a-kind slate of properties, the metal is highly sought after by industrialists and manufacturers. The main distinguishing qualities of silver include:

- Durability: Silver is a non-perishable metal that resists corrosion, which explains why 19th-century silver coinage can still be found in circulation in the United States.

- Density: The density of silver is 10.49 grams per centimeter cubed. Silver’s high density makes it difficult to counterfeit and fake silver coins can be easily detected by its weight.

- Malleability: Silver can be molded into thin sheets without cracking or degrading, which has led to its widespread use in silverware production, PV panels, and other consumer and industrial goods.

- Anti-Bacterial: The precious metal is used widely in the medical supply industry for its natural anti-bacterial properties that prevent bacteria from spreading from site to site.

- Ductile: Silver is the second-most ductile metal, which means it can be hammered into long, thin wires several meters in length.

- Thermal Conductivity: More than any other precious metal, silver is the most efficient conductor of thermal energy and electricity. Silver’s status as a thermal conductor has led to a spike in demand for its use in the solar energy industry, which alone accounts for 81 million ounces of silver consumption per year.

- Vital Catalyst: Silver is unique for its ability as a noble metal to convert ethylene to ethylene oxide, which is a useful metal in the synthesis of many industrial chemicals.

Industrial Demand for Silver: 2020/2021 Outlook

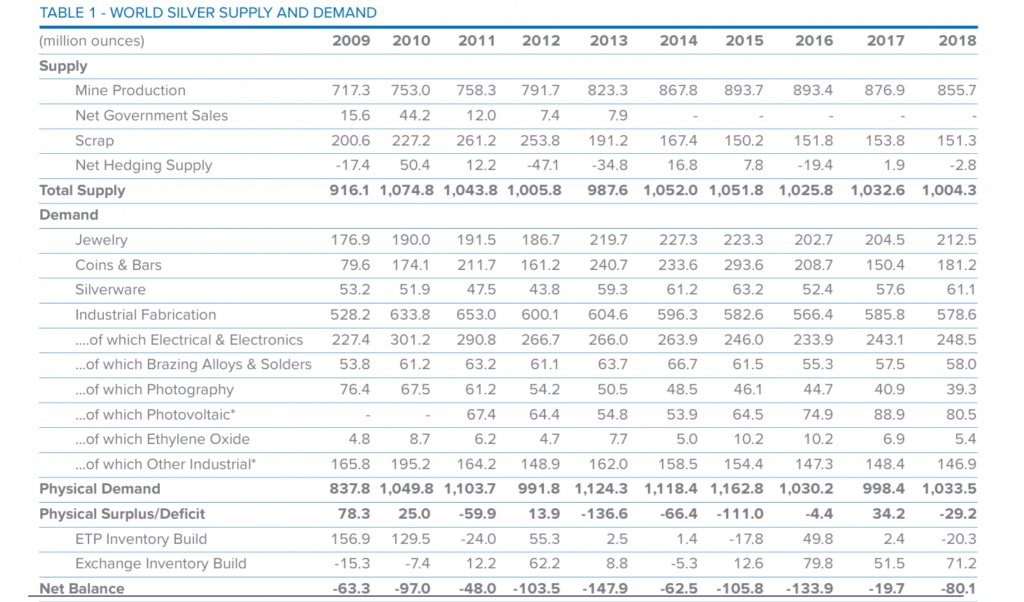

In 2019, less-than-expected silver demand from jewelry and silverware manufacturers led to subdued growth for the precious metal. The year saw only a modest 0.4% increase in global demand due, in part, to the ongoing U.S.-China trade war. Concurrently, the supply of silver mines worldwide fell by 1% in 2019, for the fourth consecutive year.

As an investment, silver demand is undergoing a renaissance of sorts. In 2019, investments in silver increased to over 186 million ounces, an increase of 12%, which is the largest growth year for silver investment demand since 2015. Driving last year’s growth was strong demand sentiment in India, which catalyzed a 20% year-over-year increase in investment demand in silver bullion and coinage.

Source: World Silver Survey 2019

Looking forward, the silver landscape is optimistic. At the time of writing, the YTD price change is about +37% ($24.69), up from its $18.03 open on January 2. Of the three major silver investment firms surveyed this year regarding their 5-year outlook on the metal (First Majestic Silver, Gov Capital, and CPM Group), all three indicate a “dramatically” bullish rise in silver prices. When asked, their long-term price forecasts boil down to a few key factors.

1. Investment Demand vs. Industrial Demand

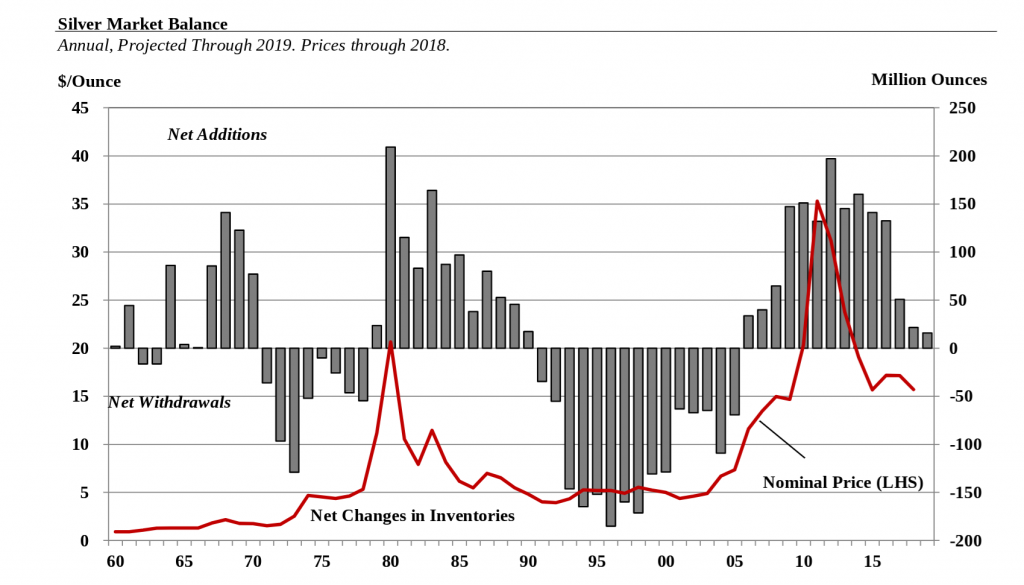

Investment demand has a major influence on the price of silver. Whereas industrial demand remains relatively stable year over year, demand from investors for the precious metal is much more volatile. As depicted below, the per-ounce price of silver is highly responsive to the market balance for the asset—that is, when investment demand increases for silver in a given year, so too does its price and vice versa.

Source: CPM Group Silver Yearbook 2019

When investment demand switches from a net-selling to a net-buying period, the nominal price of silver spikes. This is most evident in the periods from 1975-1980 and 2005-2015. You’ll notice that the market equilibrium for silver has been steadily decreasing since 2015. However, the price of silver has reliably surged in the years immediately following a net-buying shift. As physical demand is projected to grow ~5% through 2020/2021, coupled with diminished silver mine production, we should expect to see a corresponding upside trend in the asset’s price.

2. Gold/Silver Ratio

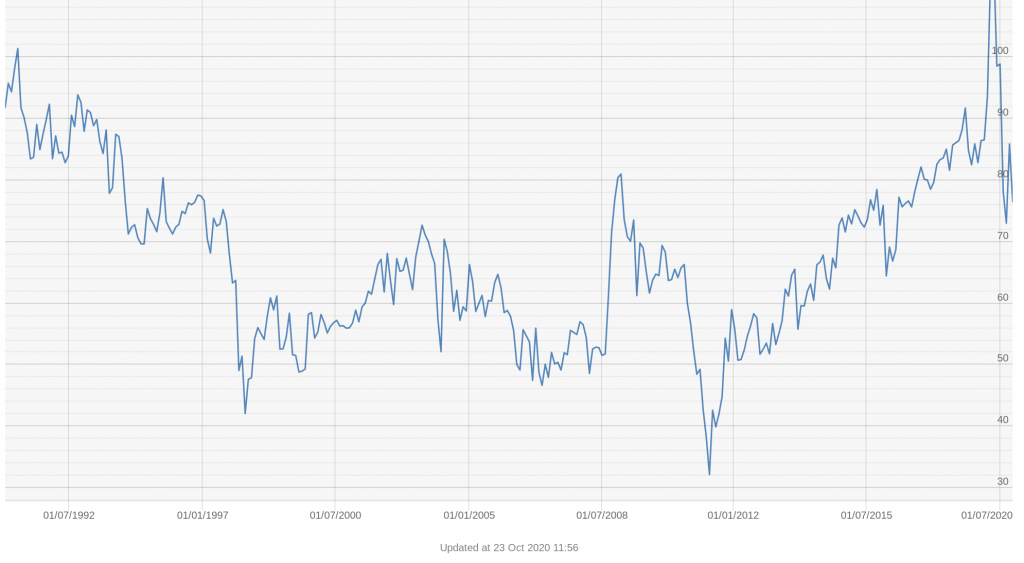

There’s strong evidence that the price of silver is undervalued. The current gold-silver ratio (i.e., the price of gold divided by the price of silver) is the highest it’s been since the early 1990s. Currently, the gold-silver ratio is about 76.96:1, meaning you would need nearly 77 ounces of silver to purchase a single ounce of gold.

Since the coronavirus crash of March 2020, the gold-silver ratio has trended higher than any other period in recent history, including during the 2008 global financial crisis. If historical precedent is to be trusted, such an extreme reading means silver will outrun gold when the ratio inevitably reverses, as it did between 1995-1998, 2003-2007, 2009-2011, and 2016.

Source: BullionByPost

3. Market Size

There are roughly 3.5 billion ounces of physical, investment-grade silver available on the market. Multiplied by the current spot price ($24.80/ounce), that leaves us with a total market size of about $86 billion—a drop in the bucket of the total wealth circulating in the world’s financial markets ($360 trillion).

As a relatively small market, the price of silver is highly sensitive to new investments. An influx of new institutional money in the market would create an outsized impact on silver prices compared to the equivalent amount of cash introduced to the gold market.

If institutional investors take long positions in precious metals in 2020/2021, the price of silver will rise in step. With so much uncertainty in the global equities market, it stands to reason that institutional players will look to gold and silver as safe haven assets that hedge against volatility.

Silver Futures Explained: Concepts and Terms Defined

Before getting started with silver futures, it’s important that you first become acquainted with the technical terms necessary for understanding this asset class.

- Margin: A futures margin is a financial deposit owed to the futures broker or clearing house when you open a futures position. Margins represent a small percentage of the notional (full) value of the contract, typically between 3 and 12%.

- Maintenance Margin: The minimum amount that must be held in one’s account at any given time to maintain one’s futures position.

- Margin Call: A demand for more funds to be added to one’s account to bring their position back to their original margin level. Failing that, one’s position may be automatically liquidated by the broker.

- Notional Value: The full value of the futures contract as determined by the quantity of the underlying asset multiplied by its spot price.

- Tick Size: The minimum price fluctuated of the contract’s underlying asset and are determined by exchanges. For silver futures listed on the COMEX Division of the New York Mercantile Exchange, the silver tick size is currently $0.005 (i.e., half a cent) per ounce.

- Expiration Date: The specified date on which the contract expires and traders are obliged to close out the position or extend their open position. If the trader fails to extend or close their position, the contract goes to settlement which entails the physical delivery of the underlying commodity.

The Risk of Silver Futures Trading

It’s a fact that the majority of investors who trade precious metals futures end up losing money in the long-run. Above all, this is due to the prevalence of overleveraged novice investors who treat silver futures as a low-risk, get-rich-quick scheme. The truth, however, is that silver futures carry significant risks that scale up depending on the amount of leverage you assume.

Let’s say you’re a new investor with $5,000 in capital to invest in the silver market. At the current spot price (24 USD), you can purchase over 200 troy ounces of physical silver bullion. Alternatively, you could put the money down as a margin on $50,000 worth of silver futures contracts. If you take the latter option, your money is suddenly stretched further as you’re exposed to higher risks and rewards.

Take, for example, the price of silver increasing by 10%. If you hold physical silver coinage, your investment will have appreciated by $500 ($5,000*.10). Those invested in silver futures, however, would see their investment grow by $5,000 ($50,000*.10)—the potential for high growth is a testament to the power of leverage and is one of the main reasons why investors prefer trading futures over physical bullion.

Remember that leverage works both ways. If the price of silver were to fall by the same margin by the contract’s expiration date, then the buyer will have no choice but to make the sale at $5,000, thereby losing their entire initial investment.

Where Can You Invest in Silver Futures?

Like gold futures trading, the silver futures market is facilitated through the Chicago Mercantile Exchange (CME). The CME vets stockpiled silver such that each contract guarantees a delivery of silver that meets the exchange’s fineness and purity standards.

You can initiate trades for silver futures by using any of the popular asset trading platforms or consulting with a brokerage. A few of the most popular trading platforms commonly used by options and futures traders include:

- TradeStation

- IRESS

- Meta Trader 4 and 5

Likewise, some of the most popular brokerages for opening a silver futures position in the United States include the following vendors:

- Charles Schwab

- Fidelity

- TD Ameritrade

- Self-directed IRA or 401(k) administrators

Is Silver Futures Trading a Worthwhile Investment?

There are several distinct advantages to investing in silver futures as opposed to bullion. For one, you don’t have to worry about securing and storing the physical metal with a third-party custodian. Therefore, the degree of counterparty risk you assume when trading silver futures is significantly lower than investing in the physical assets themselves.

Plus, as we’ve already explained, silver futures trading gives investors the benefit of leverage. Buying a large supply of silver on margin, however, is a riskier play than simply buying and holding coins or bullion. If you’ve opened a highly leveraged position on silver futures and the price of the commodity declines, you can lose your entire margin and have your position automatically closed.

For some, precious metals futures are speculative plays that have higher upsides than traditional equities and fixed-income securities. But the risks are proportionate to the rewards. If you want safer exposure to silver, consider investing in physical silver bullion or coinage as a hedge against inflation and volatility in the stock market. If you’re determined to invest in silver futures, make sure you aren’t over-leveraged and that you haven’t put up a margin you can’t afford to lose.

Play It Safe, Invest in Silver Bullion

Risk-conscious investors should err on the side of caution and consider investing in physical precious metals if they want exposure to the asset class. Before taking a position on a new type of asset, always consult with your financial advisor to determine whether they have a justified place in your portfolio.

Investing in silver bullion carries the same benefits as silver futures when it comes to providing a hedge against inflation and financial risk. However, only physical silver bullion protects against leverage risk and provides a safe haven store of wealth in the event of a disruption to the monetary system.

If you do decide to trade silver futures, consider doing so within a tax-advantaged retirement savings account, such as a self-directed Roth IRA or self-directed 401(k) plan. This way, you can grow your investments within a tax-deferred environment and won’t pay a dime to Uncle Sam until you take your first distribution during retirement.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,307.17

Gold: $3,307.17

Silver: $36.09

Silver: $36.09

Platinum: $1,351.02

Platinum: $1,351.02

Palladium: $1,110.25

Palladium: $1,110.25

Bitcoin: $107,626.91

Bitcoin: $107,626.91

Ethereum: $2,483.54

Ethereum: $2,483.54