- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

12% of The American Population Owns Gold, While 14.7% Owns Silver, According to A New Survey

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th October 2019, 03:09 pm

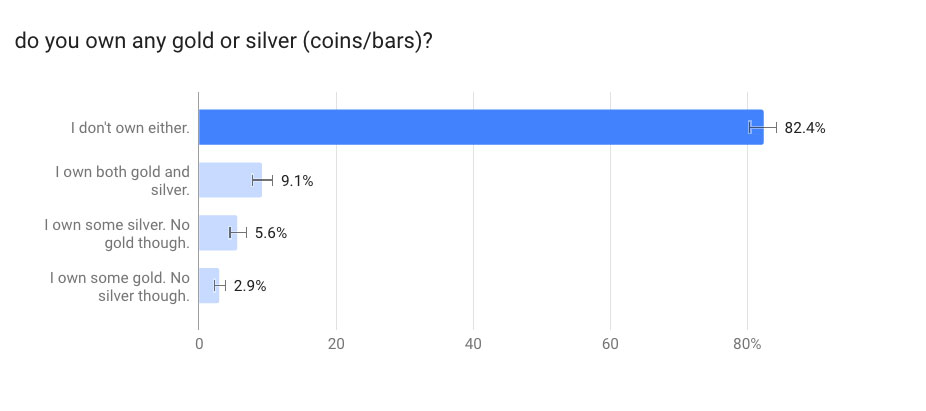

We conducted a survey asking 1,500 US respondents about precious metals ownership. We used Google Surveys and targeted males and females between the ages of 18 to 65+ from coast to coast. We asked the following question with several possible responses:

Do you own any gold or silver (coins/bars)?

- I don't own either.

- I own both gold and silver.

- I own some silver. No gold though.

- I own some gold. No silver though.

Table of Contents

- The Average American Does Not Own Any Gold Or Silver, Especially 18 To 24-Year-Olds

- Middle-Aged American Investors Own Both Gold And Silver, Especially Males Between 45 and 54

- Female Investors Between 35 And 44 Years Old Are Most Inclined to Own Silver

- Male Investors Between 35 To 44-Years-Old Are Most Inclined to Own Only Gold

- Conclusion

- Details About The Study And RMS Score

The Average American Does Not Own Any Gold Or Silver, Especially 18 To 24-Year-Olds

The overwhelming response of Americans who participated in the survey indicated that they owned neither gold or silver. Of the respondents, 82.4% indicated that they didn’t own either.

When demographic filters were applied to the survey results, specifically targeting young adults between 18 to 24 years old, that percentage increased to 87.6%. . When gender was specifically factored specifically to females of this age bracket, 88.4% stated that they owned neither of the precious metals. Considering that both gold and silver are volatile alternative assets, the survey results are unsurprising. Young Adults generally have the least disposable income to invest, and therefore, perhaps would be less inclined to put their hard-earned money into precious metals.

The present uncertainties regarding the turbulent state of the global economy have perhaps made American investors far more risk-averse than previously thought. – Even for an asset such as gold, which is often regarded as a safe haven during economic uncertainties.

Middle-Aged American Investors Own Both Gold And Silver, Especially Males Between 45 and 54

The next most popular response was 9.1% of participants who indicated that they owned both gold and silver.

Compelling insight was discovered when demographic filters were applied to the results factoring middle-aged respondents. 12.4% of survey participants between 45 and 54 years old, indicated that they owned both gold and silver. When males from this cohort were specifically targeted, the percentage leapt further to 14.3%. As a generalization, middle-aged investors are usually established within a respective career and have disposable income to invest in alternative assets such as gold and silver.

For those investors who choose to do so, precious metals such as gold and silver can be a good addition to a diversified portfolio.

Female Investors Between 35 And 44 Years Old Are Most Inclined to Own Silver

Of those who responded to the survey, 5.6% of participants indicated that they owned silver, but no gold.

Yet, when demographic filters were applied factoring specifically females between 35 and 44-years-old, 7.8% of this cohort stated this response. Younger female investors comfortably established within a career with disposable income to invest, seem the most inclined to place their money in silver. This demographic had the highest percentage of respondents who selected this survey option. In addition, female investors generally seemed more inclined to own only silver, with more women than men who participated indicating this response.

Interestingly, when the males from the 35 to 44-age bracket were targeted, only 1.8% indicated that they owned silver, but no gold. Rather, males between 35 and 44 who participated in the survey were more inclined to own only gold.

Male Investors Between 35 To 44-Years-Old Are Most Inclined to Own Only Gold

The final group of respondents, at 2.9%, indicated that they owned some gold, but no silver.

However, compelling insight was discovered when demographic filters were applied focusing specifically on males between 35 to 44-Years-Old – 5.1% of survey participants from this cohort indicated that they owned only gold. Not only was this the demographic with the highest percentage that selected this option, but also it was the third most popular response amongst them.

Curiously, in a recent survey conducted about Bitcoin ownership in the US, 6.2% of Americans surveyed indicated that they owned the cryptocurrency. Conversely, a combined 12% of participants in this survey stated that they own gold. Therefore, based upon both surveys of American investors, Bitcoin ownership is half that of gold ownership. Suffice to say, American investors seem more inclined to invest in an asset with a history spanning millennia, rather than a highly volatile asset a mere decade old. This especially rings true, given concerns surrounding the turbulent global economy and which trajectory it will ultimately take in the coming months.

Conclusion

Precious metals such as gold and silver can prove to be good additions to a diversified portfolio. Yet, it is crucial to remember that these metals are volatile assets. Careful consideration and due diligence are essential before adding either to an investment portfolio. It is advisable to allot only a small percentage of your portfolio to gold and silver.

Based upon this survey, the combined total of American investors who own gold and silver is 12% and 14.7%, respectively. Middle-aged investors appear to be the demographic that chooses to invest in both of the precious metals. Young female investors between 35 and 44 seem most inclined at present, to invest only in silver. Conversely, males from the same 35 to 44-year-old cohort prefer gold as an investment.

Details About The Study And RMS Score

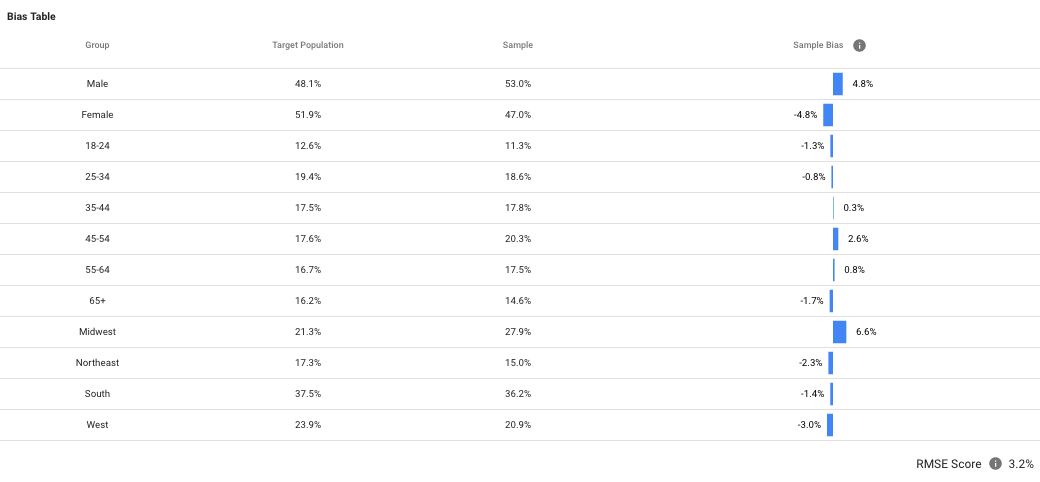

Audience: Users on websites in the Google Surveys Publisher Network

Method: Representative

Age: All Ages

Gender: All Genders

Location: United States

Language: English

Frequency: Once

Root mean square error (RMSE) is a weighted average of the difference between the predicted population sample (CPS) and the actual sample (Google). The lower the number, the smaller the overall sample bias.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum