- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

When Will the Student Loan Bubble Burst?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 2nd September 2021, 06:05 pm

Did you know that American students both past and present are approximately in $1.5 trillion worth of student debt? Considering that number is so huge, it might leave you inclined to wonder when the student loan bubble might burst the way the housing market did more than 10 years ago.

As much as investing pundits can get on TV and talk about the inverse bond yield curve and the fact it is the precursor to a recession, the average person doesn’t understand it and by the time the world realizes what’s happening, we’re already knee deep in it.

The same thing is happening with student debt. More and more people are missing out on achieving other financial goals and living out certain dreams because they started their careers behind the proverbial eight ball. Being in student debt in this day and age means struggling to come up with the money to do things like buying a home, get married or retire.

Even with putting all of that on hold, it’s estimated that 40% of people in student debt will default on their loans by 2023. I guess it can be said that’s when the student loan bubble will burst, but that’s a simplified answer. A more detailed explanation might help to add context.

Table of Contents

The Beginning of the Student Loan Bubble

As noted above, the student loan bubble has Americans on the hook for $1.5 trillion. That’s more than all the car loan and credit card debt across the United States combined by the way. Considering the mind-blowing magnitude of that figure, it might be hard to imagine that just a year before the Global Economic Crisis that saw the financial world stop in 2008, that same figure was sitting at just $500 billion. The bubble is getting bigger and bigger for multiple reasons, including the fact that overqualified candidates struggle to find work despite going way past getting a four-year bachelor’s degree. It’s also because student loans are structured in a way that keeps the interest compounding and the balance getting larger rather than shrinking.

Further insight into how it all works will show how even the most well-meaning working professional who gets into their chosen field and works hard for decades to a good income and still end up paying off debt and yet find themselves in the hole years later.

The Math Behind Student Loans

Imagine that a student finishes school with $40,000 worth of debt has 25 years to repay that debt. The student makes payments on time for the first four years of that repayment then falls into default because other circumstances in life divert his income elsewhere. During all of the time that payments aren’t being made, even after the four years of paying every single month, interest would compound at a rate of at least $230 a month during any time he’s not making payments.

The United States offers something called loan rehabilitation programs. They allow those struggling to pay off their student loans to reorganize their debt, but there are fees involved. The borrower can pay as much is 16% in fees to enter a loan rehabilitation program which means with repayment and that interest, the value of the loan can quickly go up from $40,000 to $50,000. There you have it, the debt is now worth $10,000 more than when the borrower started paying it off four years ago.

More than 40% of borrowers who try to benefit from rehabilitation programs will end up defaulting on their loans again. Go through this process more than once over a 20 or 25 year period and all of a sudden, alone can do to twice the size that it was when you started paying it off. This is all because of something called forbearance, which is the ability to take a break from paying off a loan. It sounds like a good thing but that’s when all the interest accrues. The best thing to do is to pay off student debt as soon as possible. But with the rising cost of tuition fees and the shrinking of the economy as we head towards another recession in 2020 is making it harder for Americans to keep up.

The Student Loan Bubble Will Hit Women Harder

The $1.5 trillion in student debt our country is now in his thanks to 44 million people in the United States still struggling to pay off their loans.

The American Association of University Women states that the 56% of college students that are women today represent over $890 billion in debts. Women typically earn 27% less than men throughout their careers mean that it will take them longer to pay off those debts. This also means the average woman is going to pay more interest on her loans since it will take her longer to pay them off.

The compounding effect of being a woman increases even more when considering that a woman is more likely to have a family that a man and is more likely to have a higher degree of responsibility to support children in a man because of things like going on maternity leave, only being able to work part-time etc.

Women also typically graduate with about 30% more debt than men. With all these numbers being true, and might be surprising to know that while borrowing has declined since the 2008 recession, both men and women are taking on bigger loads of debt more frequently today.

Why The Bubble is About to Burst

The cost of going to school in America has gone up over 150% over the last 40 years, but household income has only gone up 20% over that same time. That means the cost of going to school is outpacing the income that the average graduate earns by more than 7 .5 times. It doesn’t take a math wizard to know that if we continue repeating this trend as a nation over the coming years, we will eventually get to a point that people just simply won’t be able to pay the government back, even with special programs that were supposed to be designed to keep those in debt from defaulting completely.

That’s why government intervention is certainly necessary. As this trend continues (or at least if it does) economists expect that this growing dad will eventually have a trickle-down effect on the entire economy. Student loans are certainly more reported by governments and private businesses were in 2008, but any institution responsible for handling money has its limits. People can’t pay back debt using income they don’t have and ultimately the cost for all of this has to be paid out in full eventually by everyone involved including students, working professionals, lending institutions and governments.

Is a Broader Recession Approaching?

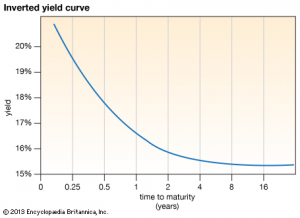

Many financial experts and economists believe that the next global recession is coming. They might be right. Consider that the stock market has been going higher and higher for the last 10 years, ever since the last economic crisis in 2008. Over the last year or so however, interest rates for short-term government bonds have been rising, but investors are putting more money into longer-term bonds. This is a signal that the investing community is losing faith in riskier investments like stocks, gold and other commodities, and even Bitcoin.

When the government continually has to jack up short-term rates in order to get people to invest in bonds and long-term rates are dropping, it usually means were about to go into a recession. In fact, every time that this trend has come to pass since 1975, a recession followed.

If an inverted bond yield curve once again takes shape, anybody struggling to pay off student loans over the last 10 years is going to find it even harder going forward. People lost their homes in 2008, so unless the government steps in to bail out well-educated professionals who are struggling, student loan market might just collapse.

The dark side of that is that student loans are more supported by governments than banks and private businesses are, so if this collapse happens it will definitely have a major impact on Americans and the broader economy at large.

Defensive Investing is the Best Antidote

Especially when times are lean financially, it’s important to adopt a defensive investing strategy that allows one to get through a recession. An individual’s strategy really comes down to their own financial situation. It may not be best to invest in certain kinds of businesses when the economy is in a downturn, things like gold, silver, other commodities and even more nascent investments like digital currencies might be a good hedge against more traditional investments like stocks and bonds.

Regardless of the chosen mix of assets or the investment vehicles that make up a portfolio, the important thing is to never stop fine-tuning that portfolio regardless of how well or poorly the economy is doing or how many well-meaning graduates are struggling to pay off their student loans.

Photo by Logan Isbell on Unsplash.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81