- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Student Loan Bubble Continues Rapidly Expanding, Threatening Financial Solvency

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:00 am

This last week there was more bad news out of the student loan market bubble. For the fourth quarter of 2018 ending December 31st, the total American household debt reached an all-time high amount of $13.54 trillion. A large percentage of this comes from student loan debt. Today in fact, only mortgage debt is higher than student loan debt totals in the U.S. consumer debt categories.

This skyrocketing debt category threatens economic growth and government financial solvency since the Federal government issued or backed so much of it. This is only the latest reason why gold makes sense in an IRA. While you can not control when the financial bubbles pop, you can safeguard your investment and retirement portfolios with IRA-approved gold. You should start by buying gold in monthly installments. If you prefer, you can even store your hoard in top offshore storage locations for your IRA gold.

Dangerous Statistics on American Student Debt Levels

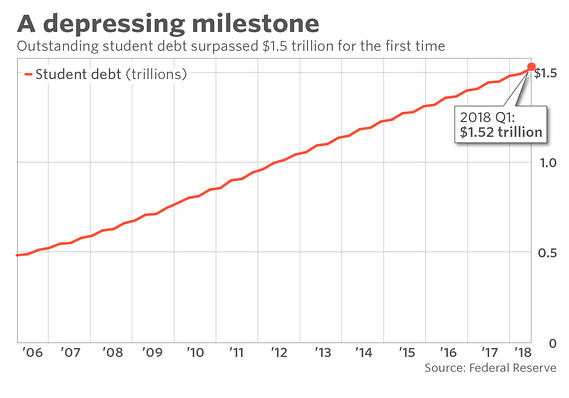

Today, over 44 million individual Americans who are also student loan recipients hold a combined record high debt of almost $1.5 trillion, per the Forbes article and Zack Friedman statistics. Forbes magazine calling this a “$1.5 Trillion Crisis” is no exaggeration either, as the grim chart below shows:

Student loan debts have mushroomed into the second biggest category of consumer debt, and are just behind mortgage debt while ahead of car loans and credit card debt today. Those borrowers from the Class of 2017 as an example have a typical $28,650 in student debt on average, per the Institute for College Access and Success.

And while the overwhelming majority of student loan borrowers in America today may owe under $100,000, a surprising 2.5 million Americans actually owe in excess of $100,000. An incredible 610,000 of them are now on the hook for more than $200,000 worth of crushing student loan debt. It explains how the category has become the fastest growing household debt in the U.S. economy, as the chart below reveals:

American University Graduates Are Sinking Deep in the Financial Hole

What does it matter that millions of American graduates are saddled with significant long-term student loan debt? These devastating millstones around their necks translate to millions of otherwise productive Americans starting their working careers already severely underwater. They spend the next decade or even two attempting to dig themselves out of a deep hole financially.

More dangerous to the all around U.S. economy is the fact that defaults are gradually and steadily rising, particularly in the category of student loan debt. The problem is severe enough to be among the greatest single factors causing the millennial trend of Americans to not be able to start their own households. With an average student loan borrower having to pay $351 each month just servicing these loans, it is no wonder they are afraid (or unable) to take on monthly rent and mortgage commitments.

It combines into a significant financial drag on the national economy. The fact remains that each dollar millennial individuals have to spend on paying down their loans is a dollar lost for purchasing cars, homes, investments, or savings for retirement. These effects often spill over onto the indebted graduates' parents too.

Consider how many of these hopelessly indebted borrowers are struggling to cover their own bills too. An incredible 11.4 percent of total student debt stood in the over 90 days delinquent category or in outright default by fourth quarter of 2018. This amounts to a sobering $101 billion worth of student loans that have fallen into default (meaning more than 360 days delinquent). A scary 5.1 million borrowers are hopelessly mired in this default category now.

Still another 2.6 million student loan borrowers received a temporary grant of forbearance during the quarter, meaning that they are not even making current payments on their student loans as of now.

American Taxpayers Backstop These Massive Student Loans

The default statistics become more dangerous when you consider who stands behind these loans. The federal government backstopped most of them in recent decades, putting the American taxpayers on the line for the overwhelming majority of them. U.S. Education Secretary Betsy DeVos shared how substantial the student debt totals had grown in her speech from the end of 2018, calling this a “significant risk” to the economy:

“At 1.5 trillion dollars, FSA's loan portfolio is now one-third of the Federal government's balance sheet. Last year, uncollateralized student loans — which are all of them, by the way — accounted for over 30 percent of all federal assets. One-third of the balance sheet. Only through government accounting is this student loan portfolio counted as anything but an asset embedded with significant risk. In the commercial world, no bank regulator would allow this portfolio to be valued at full, face value. Federal Student Aid has a consumer loan portfolio larger than any private bank. Behemoths like Bank of America or J.P. Morgan pale in comparison. FSA also is the largest direct loan portfolio in the whole Federal government — by far — surpassing all other federal direct loans combined by 1.1 trillion dollars.”

Keep in mind this revelation came from the American government's own Education Secretary. Consider yourself fairly warned.

Spiraling Student Debt Poses A Grave Economic Threat to America

Education Secretary DeVos capped it all off by freely admitting that this out of control surge in student debt now poses in her own words:

“very real implications for our economy and our future. The student loan program is not only burying students in debt, it is also burying taxpayers and it's stealing from future generations.”

The government has no one but itself to blame for creating this latest, dangerous bubble. One thing is sure, all financial bubbles like these will pop in the end.

U.S. Government Already Over $22 Trillion in Debt Not Counting Student Loans

This student debt news was made worse in the last few weeks by the revelation that the American Federal government debt has finally surged past the $22 trillion mark for the first time in history. It means that the Federal government has no room on its debt balance sheet to absorb the rapidly growing defaults from student loans. Already the government struggled under the heavy debt service burden that now amounts to a significant portion of the debt the country pays.

The Congressional Budget Office has already reported that the debt service will grow in the next decade to being greater than many massive government programs including Social Security and Medicaid. Rising interest rates have already made these interest payments worse, and they will continue to rise into the future, making the debt even costlier to attempt to pay down. This means that the accumulated debt will continue to rise even as the servicing amount to cover it also rises exponentially. It means in the near future, the monthly totals to service the debt are going to grow substantially bigger.

Gold will hedge your retirement portfolio against these rising dangers of student loan defaults and the danger they pose to the finances of the Federal government backstopping them. Now is the time to consider the Top Five Gold Coins for Investors before the crisis grows any worse. You should also consider who are the Top Gold IRA Companies and Bullion Dealers with whom to work.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68