What Causes Gold and Silver Prices to Fluctuate?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 27th May 2021, 04:53 pm

Precious metals such as gold and silver aren't known for their market volatility. In fact, they’re usually sought out for exactly the opposite: their resistance to price shocks and knee-jerk investor reactions. Unlike more volatile assets, such as stocks and ETFs, precious metals are relatively resistant to sudden price movements.

In today's unpredictable market environment, precious metals play a crucial stabilizing role in investor's portfolios. In 2019, the global precious metals market was valued at $182 billion and is expected to grow by 9.0% annually until 2027. Every year, an increasing number of investors are turning to precious metals to protect their wealth from excess volatility.

Nonetheless, gold and precious metals do experience volatility of their own. In August 2020, the spot price of gold went over $2,063 per troy ounce for the first time ever before cooling off to $1,893 on December 31, representing a loss of about 8.1%.

In this article, I'll examine the causes of gold and silver price fluctuations to help precious metals investors better understand the market. This way, you can invest for your retirement with greater confidence in this asset class.

Table of Contents

Gold Price Fluctuations: Causes and Effects

Let's start with gold, which has been used as both money and a store of value for millennia. Historically, many European and English-speaking countries tethered their sovereign currency to the price of gold in a process known as the gold standard.

Since gold was seen as a stable and sound asset, every economic unit of account (i.e., each U.S. dollar) was based on a certain quantity of gold for which it could be converted. In the early 1970s, the Nixon Administration suddenly revoked this system for an entirely fiat monetary system that is no longer based on gold.

Today, gold price fluctuations are driven by the following market factors:

- Central Banks & Monetary Authorities: Sovereign monetary institutions hold large amounts of gold as a reserve asset; during expansionary periods when the economy is growing, central banks often sell a portion of their reserve assets and thus increase the supply of gold—the inverse is true of contractionary periods.

- Interest Rates: When returns from bond yields and cash savings are low (i.e., in low federal interest rate environments), commodities such as gold typically attract more demand from investors looking for comparatively better performance.

- Industrial Demand: Gold metal has rare chemical properties that make it very useful as a manufaturing alloy. The jewelry, electronics, medical equipment, and consumer goods industries can drive the price of gold depending on expected industrial output.

- Speculation: Like any asset, gold isn't immune from speculation. Retail and institutional investors alike often speculate on future spot prices based on macroeconomic forecasts which, in turn, drive real-time price movements.

There is no one individual factor that influences the price of gold more than any other. They all work in concert to exert upward or downward price action depending on market conditions.

Liquidity in the Precious Metals Market

It should also be noted that physical gold and silver aren't nearly as liquid as exchange-listed stocks or ETFs. Unlike a publicly traded security, gold or silver bullion cannot be instantaneously sold on open markets. Indeed, it can take weeks or even months to close a precious metals sale at scale.

The illiquidity of precious metals is a feature, not a bug. Since investment-grade gold bars cannot be bought and sold instantaneously, these assets are much more resistant to hasty investor reactions and panic selling. This partially explains why gold and silver are more resilient assets than stocks when it comes to volatility and intra-day price swings.

State Gold Reserves in the 21st Century

Although most countries abandoned the gold standard in the aftermath of World War 2 and the subsequent financial crises, gold is still held in reserve by sovereign states. These gold reserves are held in order to guarantee repayment to depositors, to store value, or to support the value of a sovereign currency.

At present, the following countries hold the most gold (measured in metric tons) in reserve as of early 2021:

- United States: 8,133

- Germany: 3,362

- Italy: 2,451

- France: 2,436

- Russia: 2,298

As you might imagine, if sovereign gold reserves were to be gold in bulk or leased to foreign buyers, that too would affect the price of gold. When ascertaining what causes gold and silver prices to fluctuate, you must account for the possibility of foreign states flooding the market with the commodity or intentionally withholding it to artificially inflate the price.

Stock Market Uncertainty and Gold Prices

Gold has long been considered a safe-haven asset. When traditional financial markets are in disarray, gold and other illiquid assets are seen as volatility-resistant alternatives.

Take, for example, the coronavirus crash between December 2019 and March 2020. During this period, the spot price of gold rose +7.6% while the S&P 500 lost 19% of its value. The same is true of the late-2000s global financial crisis, when the price of gold rocketed +78% between October 2007 and October 2010 while the stock market fell by 20.1%.

From this, we can infer that gold, at least historically, has performed well when the stock market experiences high levels of volatility. Although gold prices and the stock market have shared an inverse relationship during previous recessionary events, it's important to keep in mind that past performance does not guarantee future results.

What Drives Silver Prices?

We're often asked what drives silver prices, and the answer is largely the same as gold's. However, one key difference is that physical silver is significantly more light-sensitive than gold. Therefore, silver prices can be impacted by the demand for photographic film and photovoltaic panels used in solar energy production.

Indeed, there are myriad potential use cases for silver in the industrial world. Consumer electronics, such as the manufacturing of smartphones, rely heavily on silver. However, there is no market that demands more silver than the photovoltaic market, which is driven by the solar energy industry to produce panels that convert sunlight into electricity.

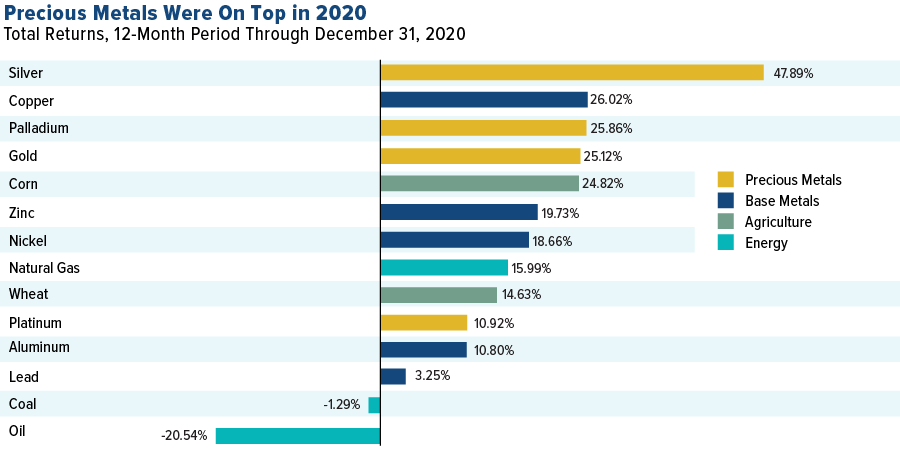

Source: U.S. Global Investors

As displayed in the chart above, silver was the top performer in 2020 among precious metals and other commodities (+47.89% on the year). That's to say nothing of the short-lived silver short squeeze that occurred in February 2021. Rather, a primary driver of silver's success during 2020 was the rising demand for silver metal in the solar industry.

In 2021, President Joe Biden's multi-trillion dollar infrastructure plan is poised to create even more long-term demand for solar energy and thus silver will likely continue to be in high demand in the years ahead. Therefore, market watchers should closely observe the state of the solar energy industry when speculating on the future value of silver.

If you're wondering “How are silver prices determined,” you should consider many of the same factors as gold, including state reserves, inflation, and stock market volatility. However, the renewable energy market—in particular, solar energy—is an additional key driver that needs to be considered when evaluating silver prices.

Precious Metals: Speculators vs. Fundamentals

Analysts in the precious metals market often debate whether the price of silver and gold are driven primarily by speculative investors betting on future price movements, or the fundamental realities of supply and demand. The answer, as it often is, lies somewhere in the middle.

Recent research has found that speculation on the value of the U.S. dollar, the rate of inflation, and the federal funds rate creates bubble-like formations in the gold futures market. This is because gold is viewed as a hedge against inflation and a weakening U.S. dollar. Although there is evidence to the contrary, many speculators drive up the future value of gold if they expect inflation to devalue the U.S. dollar.

As of May 2021, the U.S. inflation rate sits at a 13-year high (4.2%). It shouldn't come as a shock, then, that many leading analysts, including European bank UBS, have set their gold price targets as high as $3,100 per ounce by the end of September.

We’re often asked, “Why do gold prices fluctuate?” The only honest answer is that there is a medley of fundamental and speculative forces that tilt the market. Although the fundamentals of supply and demand dictate precious metals prices, so too does macroeconomic speculation.

Should You Buy Gold and Silver?

There's nothing unique about what causes gold and silver prices to fluctuate. Ultimately, it's the power of supply and demand that determine the value of precious metals. However, the buyers and sellers are highly diversified, consisting of sovereign states, financial institutions, manufacturers, speculators, and even regular retirement investors like us.

Knowing what affects gold prices can help you invest safely in the asset. The same goes for silver, platinum, palladium, and other precious metals that hold value. But to invest with confidence, you need to know how to protect yourself against the most common scams and pitfalls that first-time gold and silver buyers often fall for. If you want to learn how you can avoid these common traps, download our free gold IRA guide today, in it you'll find everything you need to invest in gold worry-free.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24