The Big Short Squeeze: Why Reddit Isn’t to Blame for the Silver ($SLV) Short Squeeze That Never Was, and Why Stable Silver Is Here to Stay

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 06:50 pm

The price of silver surged to 8-year highs ($29.59) over the weekend. But despite reports in Bloomberg, CNN, and Barron's that Reddit was to blame, there's no evidence of a coordinated push among Redditors to go long on the white metal. The recent price movement appears to be the cause of a media frenzy that has no origin in /r/WallStreetBets, the subreddit responsible for last week's short squeeze on GameStop ($GME) and AMC Theatres ($AMC).

Futures for silver jumped 11% on Monday (Feb 1) morning, representing the highest price level for the precious metal since 2013. The next day, the price of silver fell to $25 per share, less than its mean spot price the previous Friday.

The chaotic activity we've seen this week in stocks like $GME and $AMC has proven that organized retail investing is a force in the market that won't soon go away. But the volley in $SLV and the silver futures market (COMEX) is evidence that media misinformation can influence collective retail capital to serve institutional interests.

Nonetheless, silver remains—as it has for centuries—a legitimate store of wealth designed to minimize risk and hedge against inflation and financial market volatility. What it isn't is a tool for political advocacy or financial takedowns. Investors should get into silver for the right reasons, and, for reasons I'll explain, not as a get-rich-quick scheme or as a form of activism.

Table of Contents

The Silver Squeeze Conspiracy

The theory goes like this: silver equities like $AG and $SLV are to banks what $GME is to hedge funds. Silver squeeze theorists correctly point out that silver prices have a history of being artificially suppressed by multinational institutions. Sometimes, they're even caught. For example, JPMorgan Chase had to pay a $920 million settlement after admitting to manipulating silver futures between 2008 and 2016.

Proponents of the silver squeeze allege that all of the world's most potent silver mines have been depleted, and that a supply shortage is looming. Concurrently, the demand-side is booming, with industrial demand for physical silver at all-time highs.

Meanwhile, these same theorists maintain that the world's biggest silver funds ($SLV, in particular) are heavily shorted by institutional price manipulators. Therefore, if retail investors band together and corner the market by going all-in on $SLV or $AG, they can squeeze the banks and force them to cover their calls at bankruptcy-inducing prices.

Silver Squeeze Debunked: A Closer Look

The London OTC market trades about half a billion ounces of silver every day. Currently, the white metal has a supply surplus to the tune of 14.7 million ounces. There is little hope for retail investors to make much of a dent in the COMEX even if all seven million members of /r/WSB purchased an ounce of silver bullion.

In reality, it's extremely difficult to squeeze silver in a meaningful way. The vast majority of hedge funds, including market makers like Citadel Investment Group LLC, hold long positions in paper silver like $SLV.

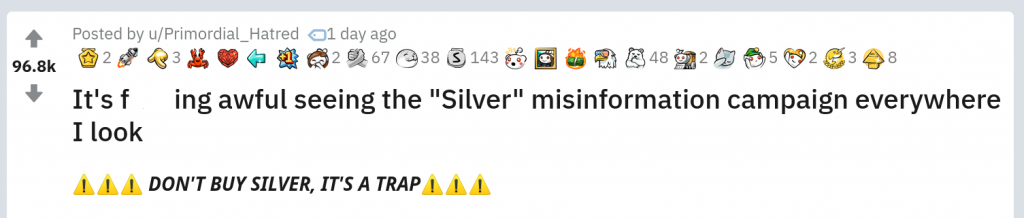

A 30-second scroll through the top investing subreddits will prove that the overwhelming majority of Redditors are strongly opposed to a silver short squeeze. Below is a post characterizing the mainstream media's coverage of the story as a “misinformation campaign”, which has received 96,800 upvotes.

Source: Reddit.com/r/Stocks

Many of the accounts currently posting in /r/SLVTakeOver, the leading silver short subreddit, are either less than a week old or are posting from previously inactive accounts. It seems that the general consensus among /r/Stocks, /r/Investing, and /r/WSB is that the “silver squeezers” represent a minuscule splinter group of the three dominant investing subreddits or is a charade orchestrated by institutions with a financial interest in paper silver funds.

The point is that there may be a coordinated effort to manipulate unsophisticated retail traders into buying paper silver under the pretext of an upcoming squeeze.

The Hypothetical Silver Squeeze: What Would Happen?

A short squeeze is a practice of driving the price of a security higher, thereby forcing those betting on a price drop (i.e., short-sellers) to buy-back their positions at a higher price. When a short seller is forced to cover their calls at a higher price, they take a loss. In the case of Melvin Capital, the hedge fund lost 53% of its AUM in January 2021 on a $GME short play gone awry.

A retail investor flash mob—like what we saw with $GME—would eventually run out of steam. In a commodities market in which billions of ounces are traded every day, the collective capital of retail traders can assert little influence. The price surge we've seen to date is more so the fruits of a media campaign designed to distract from the ongoing stock market squeeze and promotion orchestrated by institutions long on silver.

It bears repeating: Reddit traders are not responsible for the weekend spike in silver futures trading. Rather, institutional capital pushed silver to an all-time high over the weekend of January 30 on the news that Redditors might be gunning for a short squeeze.

Hedge funds are long silver, not short. In fact, Citadel Advisors has $13 million worth of silver calls and about 6 million shares (0.93% stake) of the iShares Silver Trust as of September 30. For this reason, Reddit has little interest in attempting anything seen last week with heavily-shorted stocks like $NOK, $GME, and $AMC.

Source: Reddit.com/r/WallStreetBets

The Hunt Brothers Silver Squeeze: A Repeat in 2021?

When the Hunt brothers cornered the silver futures market in the early 1980s, they held an estimated one-third of the world's non-reserve supply of silver. The ensuing squeeze caused their fortunes to balloon to about $4.5 billion before the U.S. federal commodities regulators stepped in and created new rules to block the addition of new long contracts.

The price of silver fell dramatically following the issuance of the new regulations, which led to panic in the market. Since they were highly leveraged, federal regulators feared that the Hunt brothers wouldn't be able to meet their debts to brokerage firms and banks. Eventually, a consortium of private banks and corporations provided a bailout package to the Hunt brothers which allowed them to satisfy creditors before filing for bankruptcy.

The point is that irrational exuberance in the silver market cannot be sustained without external intervention. Despite what your former high school classmate is posting on Facebook, buying silver won't take down the Fed. A silver short squeeze would face a swift intervention from regulators much like the most recent event catalyzed by the Hunt brothers in 1980.

Unintended Consequences of a Silver Squeeze

Traders aim for asymmetric bets. These are plays where the upside probability (i.e., likelihood of winning) or upside magnitude (the payoff of winning) far exceeds the downside. For an asymmetric investor, silver bullion is the ultimate safe-play asset because it follows a typically predictable supply output and a steady industrial demand.

Artificially raising the price of silver would have major downstream negative social consequences. For one, the accelerated adoption of solar energy requires a readily available supply of photovoltaic (PV) panels. As of 2019, the PV sector accounted for 10% of global silver demand, or nearly 28 hundred metric tonnes.

Under the nascent Biden Administration, the PV industry is set for significant growth as the U.S. transitions to a low-carbon economy. A rapid increase in the price of silver would present a roadblock to a cost-effective transition.

The second unintended consequence of a silver squeeze is that it would benefit the myriad entities that are net-long on the white metal. These include:

- JP Morgan Chase (95 million oz.)

- Citadel LLC ($100M in silver equities)

- Credit Suisse Securities (USA) LLC

- Citigroup Global Markets, Inc.

- Merrill Lynch Professional Clearing Corp.

By squeezing silver, retail investors would certainly not stick it to Wall Street the same way they did during the $GME squeeze. In fact, a silver price surge would benefit many of the countries’ largest financial institutions that hold silver for its legitimate hedging and diversification benefits.

Paper Silver (SLV) or Physical Silver?

Physical silver bullion is often seen as a safer investment due to its supply scarcity and invulnerability to confiscation. However, if a coordinated effort to squeeze silver was to take place, it's unlikely it would be achievable with physical silver alone.

On the other hand, paper silver has a liquid options chain. Therefore, a large-scale /r/WSB play, at least in theory, could have the power to effectively squeeze the price. Unlike physical bullion, $SLV trades affect the spot price of the metal. Sophisticated traders, with a bit of luck, can cash out $SLV options and then reload their calls on price dips. Then, they can buy physical silver bullion with the price difference.

But, to date, there is no coordinated short squeeze on silver. And unlike paper silver, real silver bullion is supported by strong fundamentals and is less susceptible to price manipulation than synthetic paper trading.

If you're going to buy silver, consider buying the physical asset. Doing otherwise would play into the hands of large multinational investment banks, hedge funds, and market makers that have long positions in $SLV. For the best deal on physical silver, check out our list of IRA-approved silver bullion eligible for inclusion in tax-advantaged retirement accounts.

The Takeaway: Stable Silver's Here to Stay

The conditions that led to the historic $GME squeeze, such as over 100% of the available float being shorted, are not present with physical or paper silver. In fact, nothing about the silver market resembles the conditions that led to the $GME/$AMC short squeeze.

Unfortunately, a media frenzy has largely misreported the situation on the ground. Reddit isn't conspiring to squeeze silver, and hasn't had an active discussion on silver-buying since January 28. Redditors realize that buying paper silver won't crash large multinational hedge funds, because those same institutional investors own an outsized portion of the available silver shares.

If you're interested in silver, get into it for the right reasons. It's not a get-rich-quick scheme, nor is it a play to stick it to the hedge funds. It's a real, prudent investment used to manage risk in one's portfolio and to hedge against inflation and stock market volatility.

Buy silver as a commodity, not to mess with anyone's short positions. If you're interested in taking a position in silver, first read our list of the best silver coins for IRAs and 401(k)s. These are an excellent low-cost starting point for investors looking for exposure to silver metal in a tax-sheltered environment.

This does not constitute investment, tax, or financial advice. Always consult with a licensed investment professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,307.17

Gold: $3,307.17

Silver: $36.09

Silver: $36.09

Platinum: $1,351.02

Platinum: $1,351.02

Palladium: $1,110.25

Palladium: $1,110.25

Bitcoin: $107,626.91

Bitcoin: $107,626.91

Ethereum: $2,483.54

Ethereum: $2,483.54