The Gold/Silver Ratio: What It Is And What It Isn’t

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 24th November 2020, 02:30 pm

The present quandary instigated by the global COVID-19 has surged the price of gold and silver over the past year. Thus, the returns on both these precious metals have soared to new levels. In an unprecedented period such as this, investors have flocked to gold and silver cognizant that both make an excellent hedge against economic turmoil. Additionally, precious metals will provide protection against potentially staggering inflation that could be imminent. That said, the average investor may find it difficult to decide which of the precious metals to actually invest in. Thus, an indispensable tool for precious metals investors is the gold/silver ratio. In this article, we will delve into the particulars of the gold/silver ratio.

Table of Contents

What is the Gold/Silver Ratio

Concisely put, the gold/silver ratio denotes how many ounces of silver are needed to buy one ounce of gold. Additionally, it can also be regarded as the number of ounces of silver needed to purchase one ounce of gold. To ascertain the actual gold/silver ratio, investors need only divide the market price of gold by the market price of silver. As an example, if the price of gold is $1,839 and silver is $23, then the gold/silver ratio is 79 times, meaning it takes 79 times the price of silver to equal one ounce of gold.

The gold/silver ratio can be an indispensable tool for investors to decide when to actually invest in precious metals. The ratio can be used as a trading strategy for deciding the optimum time to invest in gold or silver.

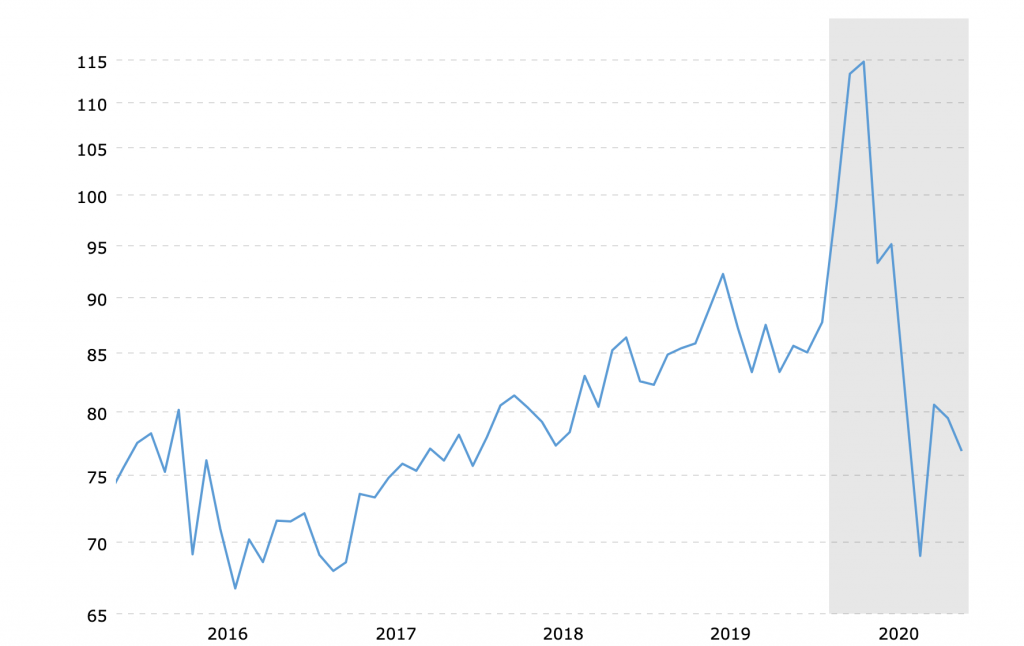

Below is a chart tracking the ratio of gold prices to silver prices from November 2010 to November 2020.

Factors Driving the Price of Gold

There are a number of fundamentals that drive the price of gold. The World Gold Council estimates that approximately 190,000 tonnes of the glittering metal have been mined, with two-thirds of that being mined in the last 70 years. Almost the entirety of the mined gold supply is still in circulation to this day. Therefore, this consistent supply fuels the demand for the yellow metal. The four primary components that comprise the demand for gold are jewelry, investment, central banks, and technology.

Recently, the World Gold Council released its Gold Demand Trends Q3 2020 report. The findings highlighted the repercussions of the global pandemic on the demand for the precious metal, specifically with each of the four components.

“Demand for gold dropped to 892.3t in Q3 – its lowest quarterly total since Q3 2009 – as consumers and investors continued to battle the effects of the global pandemic. At 2,972.1 tonnes year-to-date (y-t-d) demand is 10% below the same period of 2019.

Although jewelry demand improved from the Q2 record low, the combination of continued social restrictions, economic slowdown, and a strong gold price proved onerous for many jewelry buyers: demand of 333 tonnes was 29% below an already relatively anaemic Q3 2019.

By contrast, bar and coin demand strengthened, gaining 49% y-o-y to 222.1 tonnes. Much of the growth was in official coins, due to continued strong safe-haven demand in Western markets and Turkey, where coins are the more prevalent form of gold investment. Q3 also saw continued inflows into gold-backed ETFs, although at a slower pace than in the first half. Investors globally added 272.5 tonnes to their holdings of these products, taking y-t-d flows to a record 1,003.3 tonnes.

Central banks generated small net sales of gold in Q3, the first quarter of net sales since Q4 2010. Sales were generated primarily by just two central banks – Uzbekistan and Turkey – while a handful of banks continued steady albeit small purchases.

Demand for gold used in technology remained weak in Q3, down 6% y-o-y at 76.7 tonnes. But the sector saw a decent quarterly improvement as some key markets emerged from lockdown.

The total supply of gold fell 3% y-o-y in Q3 to 1,223.6 tonnes, despite 6% growth in gold recycling, with mine production still feeling the effects of the H1 COVID-19 restrictions.”

Based upon the findings of the World Gold Council, amid the Coronavirus crisis, it is investor sentiment that has propelled the price of gold upward.

Factors Driving the Price of Silver

Tantamount to gold, the supply of silver has proven to be very consistent. Yet, the principal factor that drives the demand for this precious metal is industrial and medical applications. For decades, silver has been utilized across a number of industries and sectors, including the auto industry, in solar panels, and now for various nanotechnologies in the medical sector. Therefore, investing in silver can be a good diversification strategy. Moreover, the general consensus is that silver has been an undervalued asset.

How Much Gold and Silver Should be Allotted in a Portfolio?

A diversified portfolio is essential, especially during periods of uncertainty and economic tumult. Utilizing the gold/silver ratio enables investors to decide when to invest in the precious metals. Yet, what percentage allocation is safest, especially during periods of unpredictability? Below, two experts provide insight into what percentage of the precious metals should be allotted within one’s portfolio.

“Let's start by getting one thing straight: When folks ‘invest' in something, there's normally an expectation of earning a profit. However, buying precious metals for one's portfolio isn't *primarily* about making a profit! Owning precious metals is a hedge against a future financial collapse (such as we experienced in 2007-2008), and it can also stave off the ravages of high inflation (which periodically occurs in some countries but is less common in the United States). Further, for folks who live in countries that have unstable governments, owning some easily-sold precious metals could also make good sense. Thus, while it's entirely *possible* to earn some profits while owning precious metals, that's really not the point; and relatively few folks who own precious metals get rich by doing so.

However, allocating a small portion of one's portfolio to (easily-sold) precious metals can be a wise way to prepare for emergencies. And thus, I've collected silver coins for many decades.

I have a large collection of high-quality Morgan Silver Dollars (90% silver content), a similar-sized collection of even higher quality U.S. Silver Eagle Dollars (99.93% silver content), and a number of Commemorative Silver Dollars (e.g., from various Olympic Games). I also have a large bag of old, heavily-circulated U.S. silver coins (mostly dimes and quarters with a 90% silver content) that I accumulated over several decades. Few of those worn (pre-1965) silver dimes and quarters would be of any interest to coin collectors, but they still have quite a bit of worth in terms of their ‘melt-values': $1.23 for an old silver dime and $3.08 for an old silver quarter. (BTW, all of my silver dollars are *considerably* more valuable to collectors than their melt values would indicate.)

As a senior citizen, a bit less than 4% of my retirement nest-egg is invested in silver coins. Is that too little or too much? Who knows! But investment allocation experts generally advise against keeping more than

10% of one's portfolio invested in precious metals, so I'm likely taking a conservative approach in my portfolio allocation.”

Dr. Timothy G. Wiedman, Associate Prof. of Management & Human Resources (Retired), Doane University

In addition, during periods of tremendous economic uncertainty, an even higher percentage allocation may be warranted.

“Allocating 5% of one's investment portfolio to precious metals is a generally accepted standard for any diversified strategy, especially—but not limited to—a portfolio with a long-term time horizon. During times of heightened risk (i.e. turmoil in equity and bond markets, war and geopolitical tensions, or an economic downturn more generally), perhaps a more aggressive allocation of 10%–15% is warranted. This is because gold and silver have historically tended to behave as safe-haven assets during periods characterized by volatility and uncertainty. The price appreciation of bullion during such scenarios helps offset some of the depreciation elsewhere in the portfolio. It can be compared to buying insurance for your portfolio. Gold also provides added stability because it is highly liquid in the event that funds need to be withdrawn quickly.

Investors can choose any distribution of the different metals within that 5%–15%. Virtually all of these options are quite reasonable. For instance, you could simply split the weighting 50-50 between gold and silver (2.5% allocation each), or you could choose to more heavily weight one metal if you anticipate it will outperform its counterpart. Similarly, some investment portfolios include a small allocation (<1%) of the lesser-known precious metals, platinum, and palladium, for added diversification. In our experience, however, more than half of the portfolios that allocate any exposure to precious metals are strictly focused on gold.”

Everett Millman, Precious Metals Specialist, Gainesville Coins

Suffice it to say, factoring the bull market and economic turmoil, there never has been a better time to invest in gold and silver. Including these precious metals is an excellent diversification strategy. Ultimately, the percentage allocation is dependent upon the investor, but the gold/silver ratio can prove to be an indispensable investing tool. A simple way of gaining exposure to precious metals is investing in gold through an IRA. Have a look at our top Gold IRA company reviews for more information on your options. Likewise, if you prefer to simply invest in collins and bullion, here is our list of the top 5 silver coins for investors. Lastly, always do your due diligence and consult a financial professional prior to making investment decisions.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24