Gold Rallies Above $2,000 as Fears of Market Contagion from Israel-Hamas War Spread

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 31st October 2023, 06:40 pm

Key Insights

- Gold prices are up +8.7% since Hamas’ deadly terrorist attack in Israel, breaking through the $2,000 mark for the first time in 5 months

- Capital flight into safe-haven risk hedges, such as gold, oil futures, and U.S. dollars, have been observed over the past few weeks

- Geopolitical analysts have not ruled out the possibility of regional conflict expansion if Hezbollah and Iran join combat operations

- Oil futures are speculated to reach upwards of $150 per barrel if the war spirals into a wider conflict

- Shocks in the oil market have been shown to correlate with shocks in the gold market

On October 27, 2023, the price of gold soared above $2,000 per gram for the first time since May. Amid rising tensions in the Middle East and international concerns of a regional spillover outside of Israel and Gaza, investors have flocked to safe-haven assets—as a result, gold closed at $2,006 on Friday.

Although long-term bond yields are at a 16-year high (5.24%), amid the biggest bond bear market in history, capital inflows into gold have shown that the yellow metal is currently a more desirable risk hedge for some investors.

In the immediate aftermath of the Hamas’ October 7 terror attack on Israeli settlements, markets had a relatively muted response. However, within the first days, safe-haven assets such as oil futures, gold futures, U.S. dollars, and Swiss francs, all saw significant capital inflows. Oil futures jumped +4% within 48 hours amid speculation of a protracted regional conflict spiking crude prices to over $150 per barrel.

Over three weeks after Hamas’ invasion of Israel, gold prices are up +8.7% and rising. As the situation develops, what is the ceiling for gold prices, and what geopolitical factors might influence gold prices in the weeks and months ahead?

Table of Contents

- Hamas-Israel War & The Price of Gold

- Historical Milestones: When Gold Surpassed $2,000 Per Ounce

- 1. The Global Financial Crisis (2008)

- 2. COVID-19 Pandemic (2020)

- 3. Geopolitical Tensions and Trade Wars (2019-2020)

- 4. Inflation Concerns (2021-2022)

- Gold’s Price Ceiling Amid Israel-Hamas War

- How to Invest in Gold During Times of Geopolitical Uncertainty

Hamas-Israel War & The Price of Gold

The price of gold is heavily influenced by geopolitical events such as armed conflict and economic warfare. When international conflicts cast doubt and uncertainty into global markets, investors often react by seeking out less volatile stores of wealth such as gold and silver.

Armed conflict has tended to stimulate investor interest in gold. At the outset of the Russian invasion of Ukraine, gold prices hit $2,068 per ounce—only a hair shy of its all-time high set in 2020. Similarly, Hamas’ invasion of Israel has seen gold prices rise from $1,845 on October 6 to $2,006 as of October 30.

Figure 1: Rising gold prices depicted shortly after the Russian invasion of Ukraine (Source: ABM AMRO Group Economics)

Armed conflict in the Middle East can be disruptive to global financial markets and spark interest in gold as an investment for several reasons. First, the Middle East is a major oil-producing region, and any conflict in the area can disrupt oil production and supply. Second, geopolitical tensions and uncertainty resulting from armed conflict can make investors seek safe-haven assets like gold and crude oil, which are often viewed as stores of value during times of crisis.

Historical Milestones: When Gold Surpassed $2,000 Per Ounce

The price of gold has long been a barometer of economic and political uncertainty. It is a precious metal that has been coveted for its intrinsic value and perceived stability for centuries and has been sought after as a store of value for millennia.

In recent history, we have witnessed significant milestones where the price of gold surged past the $2,000 per ounce mark. Let’s take a look at these key moments, examining the price movements leading up to these surges and the underlying economic and political factors driving them.

1. The Global Financial Crisis (2008)

- Price Movement: Before the financial crisis of 2008, the price of gold had been steadily rising from around $600 per ounce in 2006. As the crisis unfolded, investors sought refuge in safe-haven assets, causing gold to surge past $1,000 per ounce by early 2008 and eventually reaching over $2,000 per ounce in August 2011.

- Economic Factors: The collapse of major financial institutions and the subsequent recession led to a loss of confidence in traditional financial markets. Investors turned to gold as a hedge against economic instability and a devaluing U.S. dollar.

2. COVID-19 Pandemic (2020)

- Price Movement: Gold experienced another significant surge in 2020 as the COVID-19 pandemic roiled global markets. The price, which had been trading around $1,500 per ounce in early 2020, surpassed $2,000 per ounce in August of the same year.

- Economic Factors: The pandemic brought about widespread uncertainty, leading to central banks worldwide implementing unprecedented monetary stimulus measures. Investors turned to gold as a store of value amid concerns about inflation and currency devaluation.

3. Geopolitical Tensions and Trade Wars (2019-2020)

- Price Movement: The trade tensions between the United States and China, along with various geopolitical conflicts, contributed to gold's steady rise. It crossed the $2,000 per ounce mark during this period.

- Political Factors: Trade disputes and geopolitical uncertainties eroded investor confidence, driving them towards safe-haven assets like gold. The ongoing tensions fueled gold's ascent.

4. Inflation Concerns (2021-2022)

- Price Movement: In 2021, gold experienced renewed interest as concerns about rising inflation took center stage. After surpassing $2,000 per ounce in August 2020, the price remained above this threshold through 2021 and into 2022. On August 7, 2020, gold prices hit $2,072 per ounce, their highest point in history.

- Economic Factors: As central banks maintained loose monetary policies and governments implemented massive stimulus packages, there were growing concerns about inflationary pressures. Investors turned to gold as an inflation hedge.

The historical moments when gold surpassed the $2,000 per ounce mark are closely tied to economic and political factors that undermine confidence in traditional financial markets. These global events share a resemblance to, in terms of shock and severity, the Hamas-Israel war.

These milestones listed above remind us of gold's enduring role as a safe-haven asset during times of crisis and uncertainty. Investors and experts continue to monitor these price movements and the associated geopolitical and economic developments to navigate the changing landscape of global finance.

Gold’s Price Ceiling Amid Israel-Hamas War

Estimates vary widely regarding gold’s price ceiling in the short-to-medium term. One analyst quotes a figure as high as $4,000 per troy ounce, while others are much more conservative.

While gold prices spiked only 7.2% after the launch of the Russo-Ukrainian war (less than the currently observed gold price increase of 8.7% following Hamas’ attack), it is important to note that this conflict was generally considered to be contained. The prospects of a wider ground campaign outside of the borders of Ukraine were never considered a likely outcome.

By contrast, there are various regional powers in the Middle East that could see material involvement in the Hamas-Israel war. For instance, the U.S. government currently assesses an “elevated risk” of a regional spillover involving Iran or Iranian-backed proxies.

Given the large-scale economic and humanitarian consequences of a wider Middle Eastern ground war, it stands to reason that the precedent set by the Russo-Ukrainian war—a locally contained conflict—does not apply to the ongoing Israel-Hamas conflict. In the event of a regional spillover, gold prices could exceed 7.2% several times over.

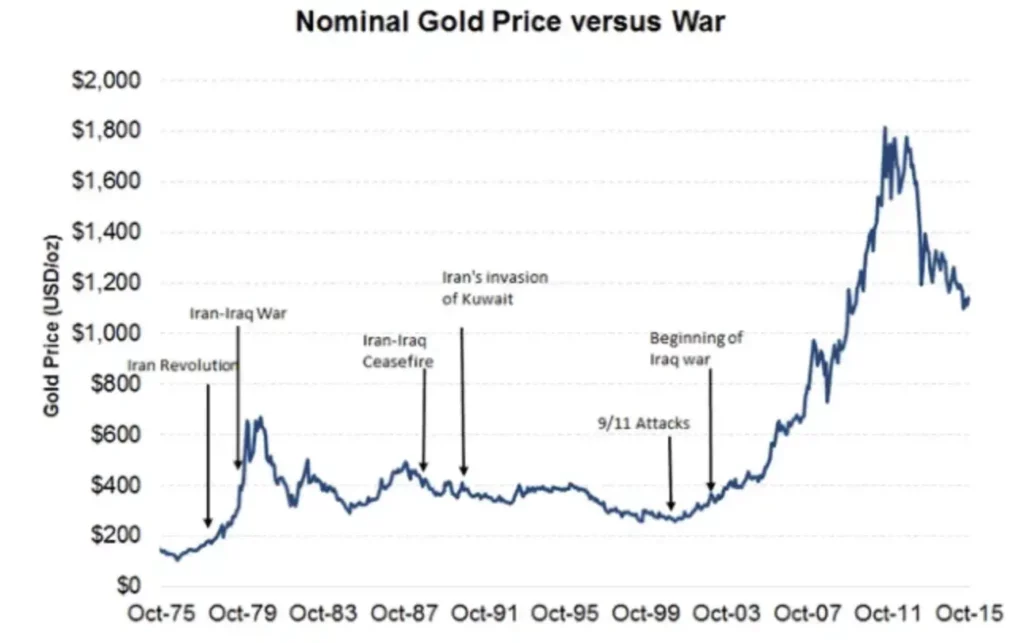

Figure 2: The relationship between gold prices and geopolitical risk events (Source: Medium)

As depicted in the chart above, armed conflict and geopolitical flashpoints—including 9/11 and various Middle Eastern wars since the Iranian Revolution—have often seen gold prices increase in their aftermath. The same is true of economic uncertainty, as seen during the late-2000s financial crisis, as well as the 2020 coronavirus pandemic.

How to Invest in Gold During Times of Geopolitical Uncertainty

Amid geopolitical tensions, war, and global uncertainty, some investors may want to capitalize on the upside potential of safe-haven assets. Diversifying with gold, silver, and other precious metals may prove to be a prudent decision while conventional asset markets experience prolonged volatility.

To invest in gold and other alternative assets uncorrelated with the stock market, consider opening a gold IRA with one of America’s best gold IRA providers. For more information about investing in gold in a tax-advantaged retirement account, read our exclusive guide to investing via gold IRAs today.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,328.02

Gold: $3,328.02

Silver: $37.77

Silver: $37.77

Platinum: $1,404.65

Platinum: $1,404.65

Palladium: $1,226.98

Palladium: $1,226.98

Bitcoin: $117,368.41

Bitcoin: $117,368.41

Ethereum: $3,090.52

Ethereum: $3,090.52