The Biggest Bond Bear Market in History: How Did It Happen, And Where Do We Go From Here?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 19th October 2023, 11:42 am

As fears mount that the Federal Reserve will hold interest rates at generational highs into 2024, 30-year Treasury bonds have surpassed 5% yields for the first time since 2007.

It’s been called the “worst bond bear market” in history. The magnitude of the current bond market resembles the crash we saw in the stock market during the dot-com bubble and the global financial crisis—we’re talking about prices falling by more than 50% over 800 trading days.

Despite the bloodbath in the bond market, investors and market watchers are oddly quiet. There is no sense of immediate panic as there would be in the case of a stock market downturn. Rather, Treasury funds are in their 34th straight week of net inflows.

Why is this, and what might the bond market tell us about the health of the U.S. economy and about whether it will impact future interest rate decisions?

To understand its implications and origins, it's crucial to delve into the intricacies of bond markets and analyze historical precedents.

Table of Contents

- Understanding Bond Bear Markets

- Historical Context of Comparable Bond Markets

- The 2023 Treasury Bond Bear Market: Causes & Implications

- How Do Bond Markets Relate to Interest Rates?

- Historical Outcomes of Down Bond Markets

- Pathways Out of the Bond Bear Market

- Amid An Unprecedented Bond Market, Consider Diversification

Understanding Bond Bear Markets

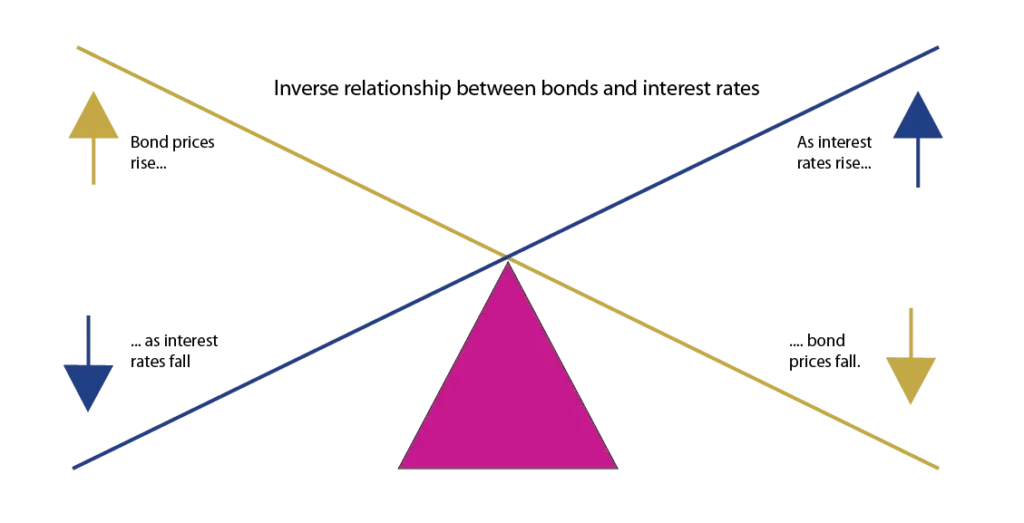

At its core, a bond bear market emerges when there is a prolonged period during which bond prices fall, causing yields (or interest rates) to rise.

This inversely proportional relationship is pivotal: as bond prices drop, the yields rise, reflecting a higher risk or a decreased demand for the bonds.

As of October 19, 2023, 10-year, 20-year, and 30-year Treasury bonds reached a yield of 4.9%, 5.24%, and 5.01%, respectively, the highest yield for these bond durations since 2007. Since the Federal Reserve began raising interest rates in March 2022, long-term bond yields have consistently risen in step.

Since bond yields and prices move inversely, the U.S. bond market has been in a prolonged bear market. To date, over 800 consecutive trading days have gone by in which long-term Treasury bond prices have fallen while yields have risen.

Historical Context of Comparable Bond Markets

Historically, bond bear markets have been less frequent than equity bear markets but can be just as impactful. Notable bond bear markets include:

1. The 1960s-1980s: Often termed the “Great Inflation,” this period saw bond yields rise steadily due to global oil shocks and aggressive fiscal policies. It culminated in 1981 when the 10-year Treasury yield surpassed a staggering 15%.

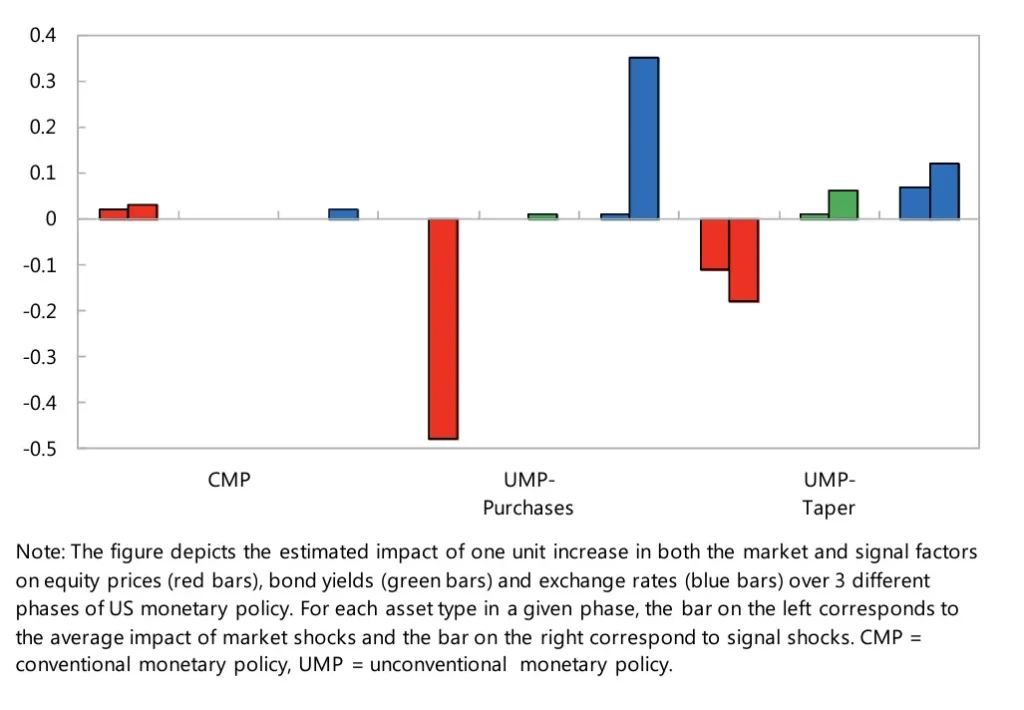

2. The Taper Tantrum of 2013: Triggered by the Federal Reserve's announcement of its plans to taper its bond-buying program, yields on 10-year Treasury bonds surged by approximately 1% over a few months. This set off a chain reaction in emerging markets, with multiple developing economies, such as Turkey, South Africa, India, and Brazil, seeing a surge of 2.5% in 10-year bond yields over the same period.

Figure 1: Effects of U.S. monetary policy announcements on equities, bonds, and exchange rates in 2013 (Source: International Monetary Fund)

Both periods were marked by a combination of external shocks, aggressive fiscal policies, and, most importantly, changing perceptions about the future direction of inflation and central bank policy.

The 2023 Treasury Bond Bear Market: Causes & Implications

Several factors have coalesced to give rise to this unparalleled bear market:

1. Global Economic Recovery: Post the economic stagnation of the early 2020s, the global economy has been on a rapid recovery trajectory. This rebound, while promising, has stoked fears of rising inflation, pushing bond yields higher, especially amid rising interest rates.

2. Debt Levels: National debt levels, exacerbated by pandemic relief efforts, have soared. With increased borrowing, the supply of bonds has risen, placing downward pressure on bond prices. At present, the U.S. national debt stands at $33.17 trillion, up from approximately $405 billion (inflation-adjusted) in 1923.

3. Shift in Monetary Policy: Central banks worldwide have begun to shift from ultra-accommodative monetary policies. Higher interest rates has made current bonds, with their lower yields, less attractive. Interest rates are currently higher than they have been in over 15 years, with the federal funds rate standing at 5.25 percent.

How Do Bond Markets Relate to Interest Rates?

In the financial ecosystem, both the 30-year Treasury bond yields and the federal funds rate play crucial roles. While they are distinct metrics, they are interrelated and influence one another in multiple ways.

The Direct Influence

The federal funds rate serves as a benchmark for short-term interest rates throughout the economy. Although the 30-year Treasury yield is more directly influenced by long-term economic expectations, changes in the federal funds rate can still influence its direction.

- Short-Term Rate Changes: When the Federal Reserve changes the federal funds rate, it often leads to immediate shifts in short-term borrowing costs throughout the economy. This can influence the broader interest rate environment, including the yields on long-term bonds like the 30-year Treasury.

- Economic Outlook: The Fed adjusts the federal funds rate based on its economic outlook. A rate hike might be implemented to curb inflation or cool down an overheated economy, while a rate cut could aim to stimulate economic growth. These policy decisions, and the economic outlooks that drive them, influence investor expectations and can thus impact long-term bond yields.

Figure 2: A graph demonstrating how interest rates and bond prices interact (Source: AMFIE Academy)

Indirect Impacts Through Inflation Expectations

One of the primary concerns for long-term bond investors is inflation, as it erodes the real value of fixed-interest payments. When the Federal Reserve adjusts the federal funds rate, it can shape inflation expectations.

If the Federal Reserve raises rates to combat high inflation, and the market believes in the effectiveness of this intervention, it can lead to reduced inflation expectations. This, in turn, can make long-term bonds more attractive, pushing up their prices and lowering their yields.

This has been the case in recent months. The Federal Reserve hiked the federal funds rate to 5.25 to 5.5 percent in July 2023—this is the rate at which commercial banks borrow funds and lend out their reserves overnight that, in turn, impacts interest rates for the general population.

Yield Curve Dynamics and Bonds Markets

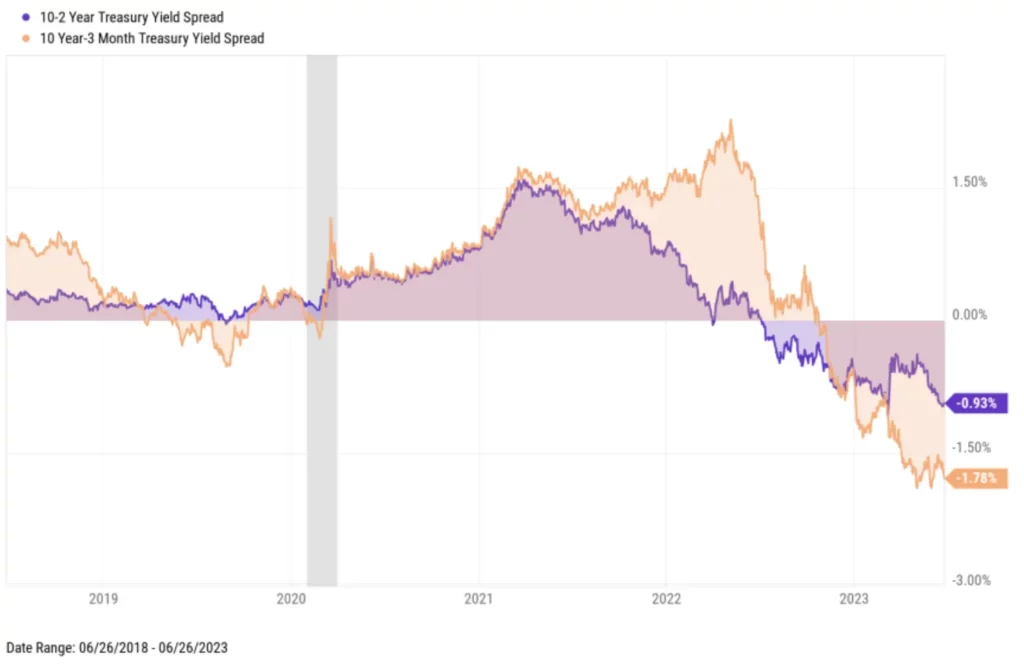

The yield curve plots the yields of bonds of similar quality but different maturity dates. Typically, long-term bonds have higher yields than short-term bonds, reflecting the risks associated with time. However, Federal Reserve actions can influence the shape of this curve.

When the Federal Reserve hikes the federal funds rate aggressively, and long-term yields don’t rise as quickly or even decline due to subdued inflation expectations, the yield curve can flatten or even invert (where short-term rates are higher than long-term rates). An inverted yield curve is often seen as a predictor of economic recessions.

As of October 2023, the yields for 10-year and 2-year Treasury bonds are as follows:

- 10-Year Treasury: 4.9%

- 2-Year Treasury: 5.24%

This indicates an “inversion” of the yield curve as, under normal economic conditions, the yield for a 10-year Treasury bond is higher than the 2-year Treasury yield.

Inversions in the 10 and 2-year Treasury yields have preceded economic recessions in various instances, including the 2001 dot-com bubble burst, the late-2000s global financial crisis, and again in 2019 before the coronavirus economic crash.

Figure 3: 2-year and 10-year Treasury yields, denoting an inversion in 2023 (Source: Nasdaq)

While the 30-year Treasury yield and the federal funds rate are influenced by various factors, their relationship is undeniable. The Federal Reserve's policy decisions, directly and indirectly, shape the broader interest rate environment, including the yields on long-term bonds.

Historical Outcomes of Down Bond Markets

The following events have historically transpired during past bond bear markets:

1. Capital Reallocation: Investors often shifted their capital from bonds to equities or other assets, such as precious metals or real estate investing, leading to rallies in other parts of the market.

2. Economic Restructuring: High yields can lead to tighter credit conditions, potentially slowing down economic growth or leading to recessions.

3. Increased Volatility: Financial markets experienced heightened volatility due to uncertainties related to interest rates and inflation.

Pathways Out of the Bond Bear Market

While no solution guarantees an immediate exit from a bond bear market, historically and theoretically, a few policy tools and strategies have been employed:

1. Central Bank Intervention: Central banks can restart bond-buying programs or reinstate lower interest rates, thereby increasing demand for bonds and supporting bond prices.

2. Fiscal Responsibility: Governments can commit to long-term fiscal responsibility, addressing national debt levels and restoring investor confidence.

3. Innovation in Bond Issuance: Issuing bonds with novel structures or terms that appeal to a broader investor base can help stabilize or increase demand.

4. Enhanced Global Cooperation: Coordinated monetary policies among major economies can stabilize global financial markets and reduce extreme capital flow movements.

At present, there is no indication that the bond market is set to rebound.

The current macroeconomic policy environment is focused on inflation reduction, for which the primary monetary policy tool is to hike interest rates. Some institutional analysts foresee interest rates rising potentially as high as 7 percent. It remains uncertain how or when the bond bear market might bottom out.

Amid An Unprecedented Bond Market, Consider Diversification

Treasury bonds have always been a cornerstone of risk-conscious investing and retirement planning, often viewed as a risk-free bedrock around which other investments fluctuate. As of October 2023, however, we find ourselves in the middle of what can be termed the greatest Treasury bond bear market of all time.

While the 2023 bond bear market presents significant challenges, understanding its underpinnings and historical contexts can guide policymakers and investors alike. As history has shown, financial markets are cyclical, and with the right interventions, equilibrium can be restored—however, there are no indicators to suggest when this may take place.

With an inverted yield curve, generationally high interest rates, and a bond market locked in a continual, multi-year decline, some investors may want to consider making adjustments to their portfolios.

Such economic uncertainty may call for some investors to diversify with assets uncorrelated to bond and equity markets, such as real estate, precious metals, and other alternative assets. Historically, alternative assets have tended to perform well during recessions and periods of economic upheaval—such as in 2009 and 2020.

To get started diversifying with precious metals, consider opening an alternative asset account with one of America’s best gold IRA companies.

(For more information about how to invest in gold and other precious metals within an IRA, consider reading this helpful article on the subject published in the Salt Lake Tribune.)

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,329.45

Gold: $3,329.45

Silver: $36.82

Silver: $36.82

Platinum: $1,388.07

Platinum: $1,388.07

Palladium: $1,153.30

Palladium: $1,153.30

Bitcoin: $109,622.77

Bitcoin: $109,622.77

Ethereum: $2,590.46

Ethereum: $2,590.46