- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Why are Central Banks Repatriating Gold?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 28th December 2020, 10:59 pm

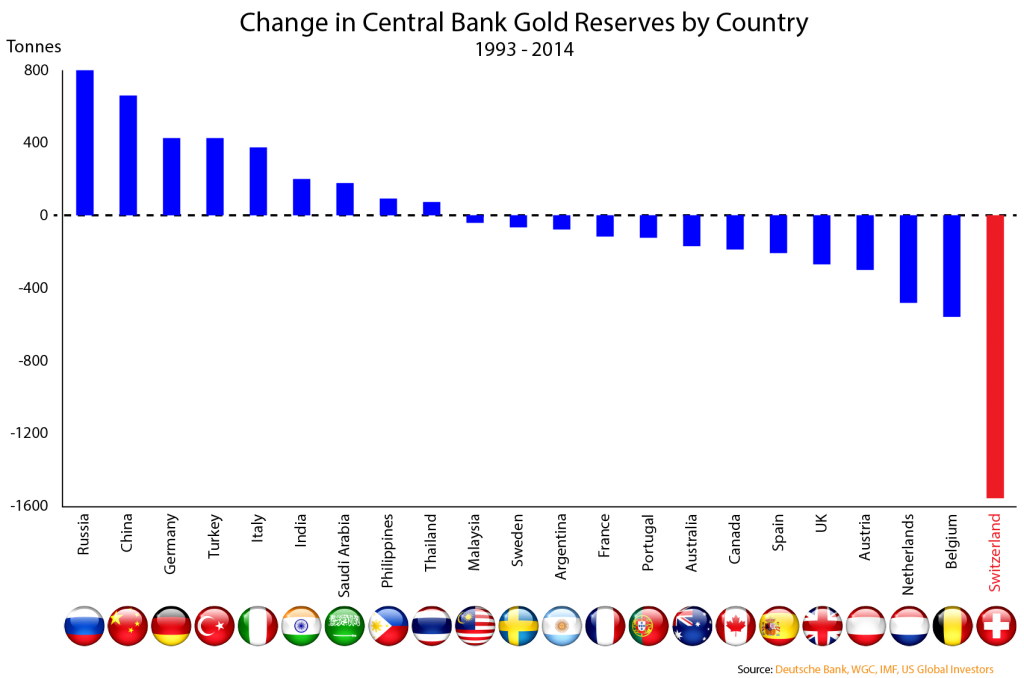

An interesting trend has been developing over the past few years which sends one of the clearest signals yet as to just how fragile the current financial and currency system has become. The gold community often pay close attention to the increased rate of gold accumulation by the central banks of China and Russia as signs of a new world financial order beginning to develop, but there is a far more interesting aspect in play here – namely the increased repatriation of existing gold by core European countries by their respective central banks.

Since 2009, Germany, Austria, The Netherlands, and Belgium have all publicly announced their intentions to repatriate gold held in offshore financial centers such as New York and London. The desire from these countries to secure their gold reserves under domestic control is a sharp break from tradition, and poses a worrying question. What are these countries witnessing on a local and global stage that has made them so fearful of holding their gold reserves offshore? Indeed given the disdain with which many of the world’s central banks and mainstream financial media view gold, why do they care about gold at all?

The answers are both glaringly obvious and worrying at the same time – there is a serious breakdown in trust within the modern financial system and a growing perception that the threads holding the fiat currency system together are looking increasingly frayed. The growing importance of Russia and China as an economic block also points to a growing need for Europe to align itself with this emerging order.

Stress within the Eurozone is Spurring Repatriation Demand

While there are several examples of countries repatriating their gold in recent years, it is the growing trend amongst the core European nations which sheds the most light on current and future economic trends. Germany, Austria, Belgium, and The Netherlands hold gold reserves of roughly 4,000 tons between them, or officially the second largest holders of gold reserves in the world. These four nations form the backbone of the Euro currency, command the highest credit ratings, and exert considerable political muscle on policy decisions within Europe as a whole. Operating from such a position of strength, it seems odd there would be such a clamor for gold repatriation, but these nations are facing potentially crippling relations with weaker members of the currency union, a problem which is only likely to worsen going forward. With the ongoing Greek crisis, and equally troublesome economic conditions in Portugal, Ireland, Italy and Spain, the “core” nations appear to be preparing themselves behind the scenes for a severe test of faith in the single currency looming on the horizon.

These central banks are aware that given a breakdown in the current system, gold will be the crucial asset required to backstop any phoenix currency which arises from the economic ashes should a full blown crisis take root within the Eurozone. Despite the public bashing of gold from many quarters of the financial community, these European central banks know that gold is the ultimate form of hard currency, and recognize the increasing importance of holding their gold reserves within their own borders. It seems possession after all, as the old saying goes, really is nine-tenths of the law.

The Traditional Economic and Political Order is Shifting

China and Russia’s growing importance on the world stage has been well documented over recent years, and both countries have shown an unprecedented appetite for increasing their gold reserves in attempt to gain leverage over the existing financial system. One of the most important aspects to emerge from this relationship has been the co-operation between the two countries in respect of energy and related infrastructure deals. Russia looks set to be the dominant energy player going forward into the next century and Europe will need to align its interests with Russia accordingly. This by and large will mean playing by the rules of the new emerging order. While a full gold backed currency in either China or Russia seems unlikely, gold will likely play a much more important role in the new system than it does in the current fiat based financial world.

Whether preparing themselves for the severe fallout from widespread debt defaults and deterioration of credit conditions in the Eurozone, or a more politically motivated maneuver to remain relevant in an increasingly multipolar world, it’s becoming increasingly clear that gold is becoming an increasingly important focal point in the world economy and political landscape. Central banks are falling over themselves to secure their gold supplies. Savers and investors should take note.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum